| Ralph Vince* |

| Corresponding Author: 405 Lexington Ave - The Chrysler Building, 26th Floor, New York NY 10174, USA. |

| Received: 22 May 2020; Revised: June 28, 2020; Accepted: 25 May 2020 |

| Share : |

2749

Views & Citations1749

Likes & Shares

Often,

geometric growth maximization techniques as presented by (Kelly, 1956; Thorp,

1962; Vince et. al., 2019 & Vince, 1990) have looked only at such ambits

where the implementor was concerned with maximizing growth, or more generally,

situations where growth was beneficial to the implementor (Vince, 2013; Vince,

2015).

In

this paper we examine using these techniques on geometric growth functions

where the implementor benefits from diminished growth. Certain geometric growth

functions accruing against the public, often characterized as “growing out of

control,” typically meet this criterion. These often include medical costs, the

growth of populations (e.g., bacteria) or pathogenic infections in a

population, infected cells in an organism, or even the growth of cumulative

national debt.

Finally,

we demonstrate the technique upon this notion of the growth rate of a nation’s

cumulative debt. Heretofore, debt reduction has been considered along the

one-dimensional tug-of-war between reducing government services or increasing

taxes. The technique presented, albeit very simple, provides a

politically-agnostic means of debt-reduction. We provide further examples of

potential applications in terms of mitigating malevolent cellular growth and

concerns for applying the material in the spread of pathogenic outbreaks.

Interaction

with stochastic, time-series data is implicitly an exercise in geometric growth

maximization. If we consider a random stream of outcomes over time, in almost

every case, resources available to allocate to the immediate outcome is an

unavoidable result of the cumulative trail of outcomes to that point in time.

The results compound. There exists not-so-common exceptions to this compounding

effect (consider a retiree who receives a pension he does not need in order to

meet his expenses, which he chooses to wager on a particular gamble with each pension

distribution), but in most cases compounding is implicit, and we restrict our

discussion to such ever-prevalent cases.

Maximization of results from stochastic, time-series data has a long history, beginning with (Bernoulli, 1738) who, in 1738, provides the first known reference to “geometric mean maximization”.

This

1738 paper, written in Latin containing the first known reference to geometric

mean maximization, is translated into English in 1954 (Bernoulli, 1738).

In

his 1956 paper, (Kelly, 1956) showed how Shannon's “Information Theory”

(Shannon, 1948) could be applied to the problem of a gambler who has inside

information in determining his growth-optimal bet size.

Six

years later, (Thorp, 1962) applies the concept to the actual gambling situation

presented in the game of Blackjack. Thorp would later provide closed-form

solutions.

In

1990, (Vince, 1990) provides a solution for capital market applications, and by

2019 in (Vince & Optimal, 2019) provides the full (non-asymptotic,

non-instantaneous) solution for geometric mean maximization for all conditions.

Other

avenues where other variants of geometric growth amplification are shown to be

“optimal”, for criteria other than outright maximization appear in (Lopez,

Vince & Zhu, 2019; Vince & Zhu, 2013; Vince & Zhu, 2015).

Yet everything up to such a point refers to geometric growth as something that is desired, beneficial, and seeks ways to maximize the benefit derived from such streams of stochastically-generated outcomes.From (Vince & Optimal, 2019) we find, in simplest form, geometric growth is maximized for a single stream (as opposed to multiple, simultaneous streams) of Q stochastic outcomes[1], x, asymptotically (i.e., as the number of trials approach infinity), by that fraction of the total cumulative pool at any i, by that value for f (0…1) which maximizes the geometric mean outcome, G:

G

(f) = Q √( ∏i=1Q1 + f (-xi

⁄ min (x1…xQ

))) (1)

As mentioned, the value for f which maximizes G(f) in (1) is asymptotic with respect to ever-greater Q. When Q=1, if the probability weighted mean value for x is positive, then G will be maximized at a value of 1, and this will approach the value given in (1) asymptotically with ever-higher Q. If the probability-weighted mean value for x is zero or less, then the function for G is maximized at f=0, and remains for all possible values of Q.

Where:

G =the

probability-weighted geometric mean outcome of the stream of outcomes.

Q = the number of

outcome events in the stream of outcomes.

f =the constant

fraction of the total pool of resources allocated on each outcome in the

stream.

xi =an

individual result of the i’th

outcome event.

n.b. min (x1…xQ) must be a

negative number, otherwise the value for f

which maximizes G(f)is 1

for all possible values of Q.

Let us examine a simple stream of outcomes which are binomially-distributed, such as the results of a coin toss. We will assign a value of 2 if the coin lands favorably to us, and a value of -1 if it lands the opposite way, unfavorable to us.

Thus,

if one seeks to find that value for f which maximizes G(f),

equation (1) is properly expressed as:

limQ→∞ G (f) = Q √ (∏i=1Q 1+ f (-xi ⁄ min x1…xQ )) (1)

The non-asymptotic

formulation, that is, the determination of the growth-optimal value for f

for a finite-length stream of stochastic outcomes (Q <∞) is given in

(Vince, 1995).

It

is important to note that growth gets ever greater as f increases from 0

to its asymptotically growth-optimal value between 0 and 1, as given in

equation (1) and then decreases. That is, asymptotically, as Q gets

ever-greater, growth is reduced with ever-greater values for f beyond

that given in equation (1).

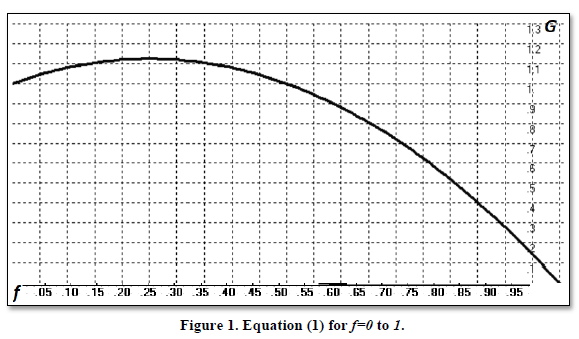

Thus,

we find for our 2: -1-coin toss, by Equation (1), we see that geometric growth

of our pool is achieved as Q, the number of trials, gets ever-greater,

at f=.25 as we see in Figure 1.

If

we took this stream of outcomes, 2, -1, where Q=2, and applied

the values to (1), we would find that G(f) is maximized at f=.25

where G (.25) =1.06066. Thus, if

we were to wager .25 of our entire pool on each coin toss in sequence,

regardless of sequence, we would maximize our gains as Q got ever

greater.

G (.25) = Q √ (1+.25(-2 ⁄ -1) x (1+.25 (- -1 ⁄ -1)

G (.25) = Q√ (1.5 x .75)

G (.25) = 1.06066

This value, 1.06066, the geometric mean return outcome, represents the multiple we would make on our pool, on average, with each coin toss, with each event, since we are “reinvesting” after each toss (i.e., our pool, from which we take a fraction, f, of to wager on the next toss, is the cumulative result of the outcomes of all subsequent tosses). This number is necessarily less than the “average” (the arithmetic mean return per event): A(f) = ∑i=1Q1 + f (-xi ⁄ min (x1…xQ)) / Q (2)

Just

as there is a geometric mean outcome, G, for any value for f, so

too is there an arithmetic mean outcome, we shall designate as A, and

for our 2:-1 coin toss, where f=.25, we find G=1.06066 and, from

(2), A = 1.125.

SEEKING GEOMETRIC GROWTH ATTENUATION OR

DIMINISHMENT

We

shall now play devil’s advocate, where our goal, when faced with the growth of

such streams which appear with a geometric growth amplifier innate to them, is

to attenuate rather than amplify such growth rates. Typically, the literature

on the matter has previously been focused on maximizing growth in a stream of

stochastic outcomes. Now, we shall examine ways, first introduced in (Vince,

1995), to use the ideas to reduce geometric growth in stochastic outcomes. The

real-world is rife in systems where we would desire this. Among these types of phenomena are things

like the growth of bacteria in a petri dish, the spread of infectious disease

in a population of organisms, the spread of pathogenic cells within an

individual organism, or even, say, the growth rate of a nation’s cumulative

debt. The same mathematical formulations are at work as when we desire growth.

The

problem is, in looking for diminishment in these aforementioned types of

geometric growth situations where we seek diminishment, what is the f

value? Clearly, there is no such governing value of the growth rate of a

nation’s aggregate debt’s rate of growth or in other situations where we desire

geometric growth attenuation or diminishment. Where do we obtain an available

parameter to affect the formulation which belies the geometric growth function

here?

Just

as there is a geometric mean outcome, G, for any value for f, so

too is there an arithmetic mean outcome, we shall designate as A, and a

variance, we shall designate as V, to the stochastic stream of outcomes.

For our 2: -1-coin toss, we thus

have corresponding values of 1.06066 for G, 1.125 for A, and

.140625 for V, the population variance. Since standard deviation,

SD, is simply the square root of variance, we can express this SD = 0.375.

We can thus summarize as

follows for this simple, binomial case:

f

= 0.25

G

= 1.06066

A

= 1.125

SD = 0.375

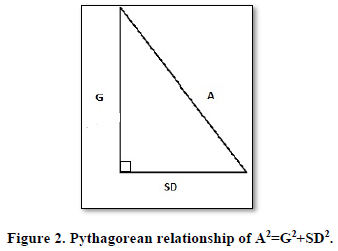

Serendipitously, as demonstrated in (Henry, 1959), these values comport perfectly to the Theorem of Pythagoras as:

A2 = G2 + SD2 (3)

Our

goal here, as the advocate of the devil, is to seek geometric growth

diminishment. Thus, we seek to make the value for G be as small as possible, as

it can be said that the growth of the pool after Qevents is GQ.

With Q as a given, any reduction in

SD that can exceed an offsetting increase in A will reduce G,

and, geometrically, the size of the pool after Q events, GQ.

From

this, we can state the following:

With respect to

growth multiples, any increase in their variance, V, affects the geometric growth

rate, G, by an amount equal to an equivalent decrease in the arithmetic average

- squared!

In

most human endeavors, when confronted with a malevolent geometric growth

function, man’s first reaction is to seek to minimize the (arithmetic) average

growth rate, A, when equally as much beneficial fruit can be derived

merely by increasing the period-on-period variance, V.

Variance,

V, or it’s square root standard deviation, SD, depending on the

function, often tend to move with respect to A in a non-linear manner; i.e.,

often, as A increases, so too does SD, with the latter increasing

at a faster rate. This leads to the familiar peak in G (0...1) such as

we see in Figure 1.

However,

in many malevolent, naturally occurring growth functions, we are able to effect

SD, to increase SD, without a corresponding increase in A.

If, in Figure 2, one increases SD without a corresponding

increase in A of the same increase as being applied to SD, then G

is necessarily smaller.

Any increase in the base of a right-angled triangle without any

equivalent or greater increase in the hypotenuse will reduce the vertical leg,

will achieve our goal, will diminish growth.

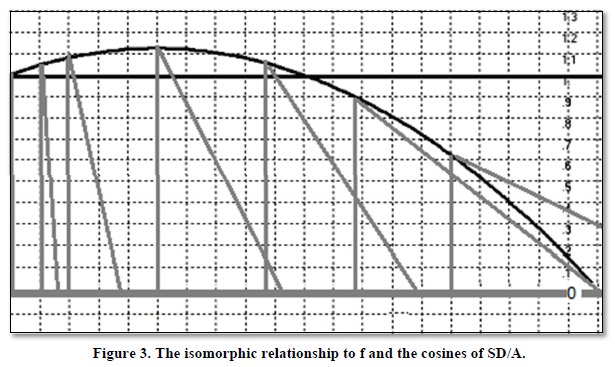

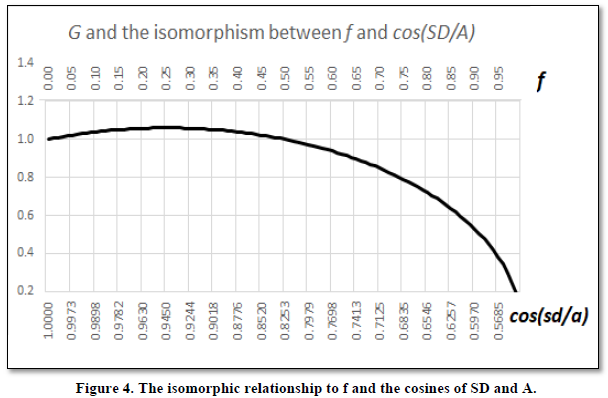

We thus find there exists an isomorphism

between the f value illuminated in Section 1 and the cosine of the standard

deviation and mean of the period-on-period growth in a stream of malevolent

stochastic events. Graphically, this is depicted in Figure 3.

In

the simplest case, if we disregard A varying with respect to V,

we can unequivocally then state that for constant A, that is if we can

hold A constant, any increase in V reduces G. If A

increases with respect to V, we witness a curve with a peak in the

horizontal range of values beyond which geometric growth begins to diminish.

Figures

1, 3, and 4

show where A varies with changing V. This is not necessarily the

case however, as often variance can be increased without increasing the

arithmetic average in a sequence, particularly those of “malevolent” character

where our directed efforts can be used to increase variance. When A does

not increase with increasing V, the peak of the curve is at its

left-most point, that point where f=0 and cos(SD/A) = 1 (i.e.,

the “base” of the triangle is zero-- is it no longer a triangle at this point

but merely a vertical line).

Thus,

there exists two important points in the range of values of “directed effort,”

either with respect to percentage of a resource we allocate to the multiples of

a stream of stochastic outcomes or the cosines of the standard deviation to

means of these outcomes.

The

two points are portrayed in Figure 5. Working from the left, the first

of these points is that point where the curve begins descending, where the

slope of the first derivative turns negative. This represents that point where

as f (the “fraction allocated”) increases further, or the size of

the base (V) relative to the hypotenuse (A) increases further, geometric

growth becomes less.

Of note, if A does not increase

with increasing V, the peak of the curve is at the leftmost bound, and

hence this first geometrically significant point is immediately to the right of

the leftmost bound by an infinitesimally small amount; i.e., as soon as f

or V increases, G decreases.

The

second important point is that point where the value for G crosses 1 to the downside, and we

refer to this point as ψ. Any

given number multiplied by a number less than 1 will have a lower product than

the given number. Repeatedly multiplying the resultant product by a number less

than 1 will cause the resultant products to get ever-closer to zero. A value

for G

less than unity will cannibalize itself as more periods accrue.

From this, we can see that Sir Ronald Fisher’s

fundamental theorem of natural selection (Ronald, 1930), which states:

“The rate of increase in fitness of any organism at

any time is equal to its genetic variance in fitness at that time.”

Provides

only a partial explanation; it consists of looking at the natural world as it

exists in nature, to the “left” of the peak where A increases with

increasing V. However, by increasing this variance beyond the peak, we

can see that such fitness diminishes with further increases in variance, and at

the point ψ extinction is ultimately assured.

In

the natural world, the point to the right of the peak is obscured; too much

variance in fitness, and the organism no longer exists.

The

Pythagorean relationship in (3), expressed between the arithmetic mean of

growth multiples and the geometric mean and standard deviation of these

multiples, is exact if the stream of multiples is binomially distributed.

Other

measures for estimating geometric growth have been proposed and can sometimes

be more accurate and deserve discussion.

In (de La Grandville, 1989) speaks of misconceptions in estimating long-term returns and refers to the popularity of one widely held formula for estimating geometric returns as being “approximately equal to the arithmetic average minus half of the variance,” or:

G = A – V / 2 (4)

Another formula, common in quantitative finance for estimating the geometric mean return which provides an exact estimate when the returns are lognormally-distributed is:

G = A ⁄ √1+V x A-2 (5)

Generally

(3) will be less than (5). Typically, (3) is not greater than the actual G for

most real-world, non-binomially-distributed data sets.

All

examples for estimating the geometric return, Equations (3), (4), and (5),

generally work for any return sample, and establish approximate relationships

between the geometric and arithmetic averages and the variance. These formulas

are all based on Taylor series expansions up to the second degree.

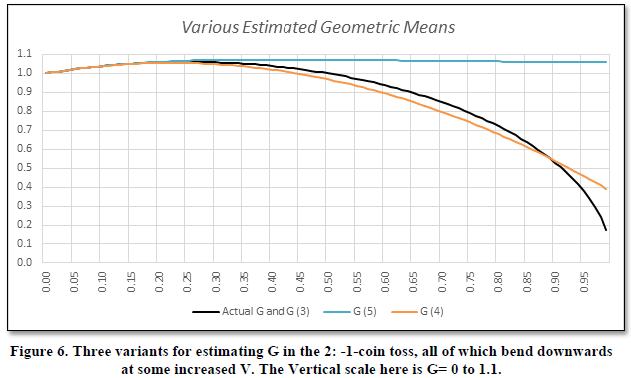

The

question as to “Which is best?” is a debate for another paper as all three of

these approximations provide values for G which begin decreasing at some

level of V in the domain of values for V. All three

approximations see the curve for G bend downwards at some point as V

increases.

For

various, real-world data sets of various distributions, we find that the value

for Equation (3), though for some data sets not the best estimation for G

of the three, is never the worst estimation for G of the three

equations. For this reason alone, in the real-world where often, the

distribution of a priori data is unknown, Equation (3) is in fact, the

best estimator for G.

Finally, when we get into the

lower values for the cosine of SD over A, that is, when V

begins to get larger with respect to A, when the points of geometrical

significance are encountered, particularly by the time V is at a

critical enough value to encounter the point ψ, Equations (4) and (5)

are unable to keep pace. For the 2: -1-coin toss, this becomes evident in Figure

6 and 7.

This is central

to our argument, that at some point of higher V, G is decreased. All three values

for estimating G support this contention. However, we find that using the

Pythagorean estimate of Equation (3) to be the best fit for our purposes and

can be certain, regardless of the distribution of outcomes we will be applying

it to, it will never be the worst estimate, and most importantly, that by

increasing variance, at some increased value (perhaps immediately) we will

begin to see reductions in G.

Examples

Example

1 – A politically agnostic means of deficit reduction

For the sake of illustration, we

demonstrate the method in a simplified example using a binary stream of

stochastic outcomes. As pointed out, this stream need not necessarily be binary-distributed,

we merely use it for simplicity’s sake to illustrate the method.

We

examine the period-on-period percentage changes in growth and re-express these

as a Multiple on the aggregate of the prior period as 1 plus the

period’s percentage growth.

We

further introduce in this example the notion of Constant

Dollars Forward, which represents the

amount of cumulative debt (it's initial principal plus its service) represented

by an individual silo of one million going forward, as of a given start

date. Thus, each period forward will see new, non-debt-service borrowing that

is not addressed here. Rather, this addresses the debt-service cost of one million

in debt into the future.

Our first example sequence shows a constant increase of 99.5% per

period in debt service, which appears as follows for ten periods (Table 1).

Since the stream is the same 99.5% from one period to the next,

the arithmetic average, A, and the geometric average, G, of the

period-on period multiples is identical at 1.995. Thus, for this constant

growth sequence, we have:

A=1.995;

V=0

SD=0

G=1.995

There is no variance in this first sequence. In this example, we

are able to keep A constant while increasing variance, V, and so

the introduction of any variance – that is, increasing the base of a

right-angled triangle while holding the length of the hypotenuse constant, must

result in a shorter vertical leg, G.

We see this when we amend the sequence to be simply the

alternating binary distribution of 100% and 99% increases (Table 2).

The introduction of variance,

even as small as .000025 in the period-on-period growth multiples, shows a

growth rate diminished from 1.995 when variance, V, was 0 to 1.994993734

even though the (arithmetic) average period-on-period growth multiple remains

at 1.995, or an average gain of 99.5% per period. The cumulative growth at the

end of the period is reduced simply by the introduction of variance.

Unlike Figures 1, 3, and 4, where the arithmetic average

growth rate, A, increased with respect to variance, V, and hence

the geometric average growth rate, G, had a peak farther down range than

the leftmost values on the horizontal axis of f=0 or cos(SD/A)=1,

when A does not increase with increased V (as may be the case in

real-world applications of directed efforts to increase period-on-period

variance) we find G achieves its peak at the leftmost values and

decreases from there with increased directed effort.

To continue to increase this period-on-period variance we find,

still holding the (arithmetic) average growth per period at 99.5%, represented

as the binary sequence 200, -1 (Table 3).

The period-on-period growth rate, G, is further reduced to

1.723368794, and the total growth of the starting amount of $1,000,000 is now

cut to less than 1/4th over ten periods of what it was at no

period-on-period variance.

Assuming we can increase variance without bound, we examine the

sequence 272, -73, which shows a period-on-period average growth rate, A, of

1.995 and variance, V, increased to 2.975625 (Table 4).

Notice the Constant Dollars

Forward has barely increased over this sequence of 10 periods. We increase the

variance by one more degree at the sequence 273, -74, which still has an

arithmetic average growth rate, A, of 1.995 (Table 5).

We now see our geometric average growth rate, G, to be less than 1

at 0.98478424 for this sequence. We are now past the point ψ in terms of the

size of the base, SD, with respect to the hypotenuse, A, and the sequence has

now thus become terminal. This is so even though this sequence with an A of

1.995 thus grows at an (arithmetic) average growth of 99.5% per period. It is

still, by virtue of increased variance, terminal.

Thus, an initial silo of the growth of $1,000,000 in debt service

has been broken, and at the current average growth rate and variance will

diminish to nothing in time. Even if the average growth rate, A,

increased with respect to time, there still exists a value for V which

will cause the process to self-cannibalize.

Variance in a

nation’s cumulative debt is affected by tax policy, sporadic principal

paydowns, and rates of borrowing which are, at the shorter maturities at least,

influenced by the policies of central banks.

The

technique is politically agnostic, and there is no reason why the

period-on-period variance should not be among the primary considerations of

policymakers in such matters. These are economic gains to the population at

large that are heretofore being foregone, and would be acceptable to all

regardless of politics. Further, the matter is rife in potential fruit for

medical and pharmacological researchers.

However,

lawmakers and central bank policy makers - practitioners working to diminish a

nation’s cumulative debt, may rightfully object that such an example disregards

a plethora of real-world constraints they are up against. Similarly,

applications in the biological sciences – epidemiology, pharmacological dosing,

etc., may make similar

arguments against the technique (e.g.,

the human body could not survive the higher doses of a drug necessary in

certain periods required to increase period-on-period variance).

These are all

valid arguments. The purpose of this paper is to introduce the technique in

pure, theoretical form, that actual application left to the practitioners where

the technique might be applied. Nevertheless, with these caveats in mind

we examine a naïve, hypothetical epidemiological example of how this principle

can be useful.

Example

2 – Applications involving malevolent cellular growth

In the following example, we consider a bacterial culture in a

petri dish which we wish to diminish via an antibiotic. Let us assume the

growth rate of this culture is 1.08 per unit time. That is, it is increasing in

size by a multiple of 1.08 as each unit of time transpires. In other words, it

grows 9% in size for every unit of time.

If left untreated after ten units time, we find it has therefore

grown to:

G = 1.0810=2.158925 times its original size

Further, since it is left untreated, we determine its variance, V,

in period-on-period growth to be 0, hence, the arithmetic average growth

rate, A, is equal to 1.08 and the geometric average growth rate, G,

is per Equation (3).

Generally, antibiotics are prescribed in a manner so as to induce

a constant blood level of the antibiotic. The effect, in terms of this perspective

is that we have reduced G while leaving V still 0, and hence have obtained this

resultant lower geometric average growth rate (the only factor in this

perspective we observe directly in this example), G, solely by reducing A,

the arithmetic average growth rate.

Mathematically, we know two things:

1.

Any increase in standard deviation, SD, in period-on-period

growth (which is the square root of V) is akin to a decrease in A,

the arithmetic average period-on-period growth rate. Thus, if we can increase V

at a faster rate than A increases, we gain by this action in terms of

diminishing the average growth rate per period, G.

However, since usually

in increasing variance, the average arithmetic growth rate, A, also increases

2.

At that point where A2 – V<

1, we have reached point ψ where growth diminishment is assured by virtue of

this increase variance as shown in Figure 8.

To invoke variance, we must now administer the antibiotic in a

manner which is counter-intuitive and administer it in a manner where we do not

induce a constant blood level.

We shall assume in this hypothetical example that the prescribed

dosage for this type of bacterial culture at this level would be to apply 100

mcg of the particular antibiotic per unit time.

In maintaining a “constant blood-level” of antibiotic, by applying

the prescribed amount per unit time consistently, we have minimized

variance. This is the common manner in

which antibiotics are used.

As time elapses, we can measure the amount of culture in the petri

dish to determine the growth rate per unit time. Let us suppose we find that

after 10 units of time, our culture has shrunk to 60% of its original size from

when we began applying 100 mcg of antibiotic per unit time.

Thus, the growth rate, G, can be determined to be:

G = 0.6(1/10) = 0.6.1=.9502

Thus, applying 100 mcg per unit time sees the culture grow as the

size of the culture for the previous time unit times 0.9502.

Looking at this then, since our Variance, V, is 0, then our

arithmetic growth rate per unit time, determined from Equation (3) is:

A2 = G2 + SD2 = G2

+ V

Since

V=0, then A=G in this case, and thus A=.9502 also.

We see then that without 100mcg per unit time applied to the

culture, the culture will grow at a rate of 1.08 per unit time, and with the

100mcg constant-level antibiotic treatment, it will grow at a rate of .9502 per

unit of time (i.e., since it grows by its multiple per unit time, it

“shrinks” per unit time when the multiple is less than 1).

Given the nature of this example, we do not see the arithmetic

average growth rate directly but rather the geometric average growth rate.

Hence, we must calculate the arithmetic average growth rate from the geometric

average and the variance in period-on-period growth.

Furthermore, since we also cannot examine the variance directly

either (because the variance we witness is in period-on-period geometric

growth, not the arithmetic data underlying it from which the variance must be

determined) we are, in effect, blind to the inputs of A and V (or SD) in the

critical Equation 3 from which we determine that A2-V will give us

that growth-diminishment critical point of ψ where growth-diminishment is

mathematically assured.

Nevertheless,

we can extrapolate, for dosages and schedules of sporadic administration what

the curve for G, the period-on-period growth rate as depicted in Figure 8

may be.

We induce variance through such a

seemingly heterodox schedule of administration. Any heterodox schedule can be

attempted, plotted and the critical points discerned. In addition to the point ψ,

since increasing variance initially increases A at a rate such that G

increases (as depicted in Figure 8), the peak of the curve for G with

respect to the cosine(SD/A) is too, a geometrically-critical point representing

that point where increases in variance, V, now begin to decrease the

growth rate, G.

We demonstrate here by a very simple, hypothetical schedule with

naïve assumptions (so as to sketch out the principle). Rather than administer

our recommended dosage of 100mcg for every period, we shall administer twice

that (with the naïve assumption that it will give us twice the shrinkage in

growth as with 100 mcg), and administering this only every other period (and

thus the assumption that the growth for these intervening periods is the growth

rate, if left entirely untreated, of 1.08).

We sketch this hypothetical for illustrative purposes (Table 6).

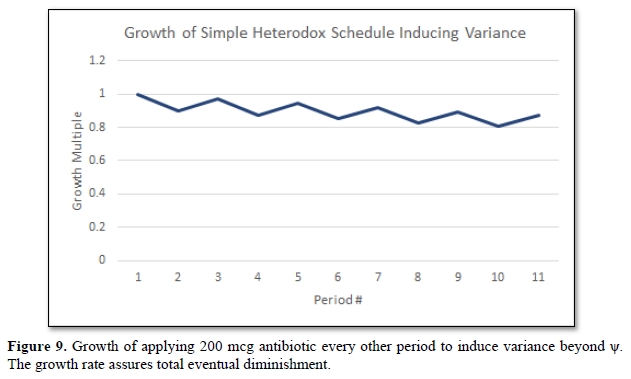

And after 10 periods of

such alternating double-treatments, we find growth has been reduced by nearly

13%, depicted in Figure 9.

This simple, hypothetical schedule is but one schedule – an

infinite number are available and if

the host can sustain the schedule, then there exists a schedule of

administration more effective

than the accepted, outright, constant-blood level recommend dosages.

Mathematically, therefore, there exists many schedules that are more beneficial

provided the host can sustain the schedule.

We have been discussing the growth of bacteria in a petri dish,

but the same notion can be extended to a bacterial infection in a human being, e.g., an upper-respiratory infection

and antibiotic treatment. Again, the critical caveat is if the host can sustain the schedule being the limiting factor.

Different antibiotic treatments can be handled in varying doses differently,

and thus the principle of increasing the variance also affects which antibiotic

to invoke.

Further, not only is the principle applied with this

caveat to bacterial infections but other malevolent cell function conscriptions

as well, such as cancer and potential chemotherapy dosages and abilities to

sustain higher dosages, with some chemotherapies and doublets thereof more

easily sustained at the varying dosages than others, thus becoming of possibly

greater concern, ceteris paribus.

Example 3 – Pathogenic spread through a

population

Thus far we have looked at an example of an out of control

national debt, as well as certain infections and malevolent cellular

conscriptions within an organism. We can also apply these simple properties to

the growth function innate in a pathogenic outbreak between organisms

themselves. This too is a geometric growth function, and the effect of

increasing the period-on-period variance in growth to tame the function applies

as well.

Let us consider a population of organisms, human beings in the

immediate case, where a viral outbreak occurs. The problem in application of

these properties in all cases – not just the examples cited here in is

two-fold:

1. 1. How

can we induce greater period-on-period variance (i.e.,what actions can

we take to migrate rightward on the horizontal axis of Figures1,3,4,5,6,7, and

8)?

-and-

2.

Can we induce variance safely enough that we can achieve the

growth-terminal critical point ψ?

Inducing period-on-period variance can be achieved through various

possible measures with the one(s) best suited determined by qualified

epidemiologists. These, below, are a suggested sampling of possibilities:

1. Quarantine, much like an antibiotic or chemotherapy in

the malevolent cellular growth example, a sporadic period between serious, hard

lock-down and none-at-all.

2. Prophylactic measures (usually pharmacological) even if

only to segments of the population sporadically, to induce variance.

3. Vaccination - which, when applied to the entire

population, liberates the population from that pathogenic event, but even if to

only part of the population will induce variance.

These measures can provide a viable stop-gap for situations

involving limited resources if they induce enough variance in the

period-on-period growth rate of infected individuals within a population.

If we can induce variance in the spread of a pathogen within a

population and do so safely such that the invoked variance is of degree

sufficient to achieve the growth-terminal critical point ψ, the

growth curve is broken.

In the particular case of

attempting to invoke variance in period-on-period growth to mitigate the spread

of a pathogenic outbreak, it is vital to avoid entropic outcomes. That is to

say, if one measure is being used to induce variance, other measures must not

interfere in such. In inducing variance, a wave function is created on what

otherwise is a simple curved function of increasing spread. If multiple wave

functions are overlaid such that peaks and troughs cancel, which, conceivably

could occur if multiple avenues of inducing variance are invoked, especially in

uncoordinated fashion, the campaign to reduce the spread, to break the growth

function through increased period-on-period variance in growth, will fail.

CONCLUSION

We have demonstrated how increasing

variance in geometric growth rates can diminish geometric growth. We find here

the aspects in the underlying data that are related to the geometric growth

rate by a Pythagorean or closely-Pythagorean relationship, depending on the

distribution of outcomes. These three components are the arithmetic mean growth

rate, A, the geometric mean growth rate, and the variance (or standard

deviation in growth rates). When the arithmetic growth rate squared less the

resultant variance is 1 or less, the growth will ultimately cease (as

multiplying any product repeatedly by a number less than 1 yields a new product

approaching zero).

We

examined growth rates with respect to a fraction of resources to allocate to

risk, or in proxy of that, growth rates with respect to the cosine of the

standard deviation in period-on-period outcomes and their arithmetic average.

Often we only have the geometric average period-on-period growth rate, and must

sketch out what the variance or standard deviation is, as well as the

arithmetic average growth rate, and where this is not feasible, we must seek a

schedule of increasing variance until the growth-terminal

critical point ψ is arrived at.

We

have looked at examples which are either politically agnostic, or uses less

resources, or heterodox approaches than conventionally used for “bending the

curve” of malevolent geometric growth. We have examined simple, hypothetical

examples where this might be applied in terms of a nation’s aggregate debt, in

terms of malevolent cellular growth, and in terms pathological spread through a

population. Each example also is riddled with specific concerns, such as “can

the host survive increased, sporadic doses,” as well as avoiding entropic

outcomes in more social applications such as pathological spread in a

population.

The examples provided, though hypothetical and naïve to their field of application, are provided as trail heads, as a means of sketching out how one might go about attempting to find a means to apply the principle of increased variance and to highlight potential pitfalls to be avoided for the particular application.

Bernoulli, D.

(1738). Specimen theoriae novae de mensura sortis (Exposition of a new theory

on the measurement of risk). In Commentarii academiae scientiarum imperialis

Petropolitanae 5: 175-192. Translated into English: L. Sommer. Econometrica 22:

23-36.

Fisher, R.A.

(1930). The Genetical Theory of Natural Selection, Clarendon Press, Oxford.

de La Grandville.,

O. (1998). The Long-Term Expected Rate of Return: Setting It Right, Financial

Analysts Journal, November/December.

Latané, H.A.

(1959). Criteria for Choice among Risky Ventures. Journal of Political Economy 67(2).

Kelly, J. L.

(1956). A new interpretation of information rate. Bell System Technical Journal

35: 917-926.

Lopez de Prado,

M., Vince, R. & Zhu, Q. (2019). Optimal Risk Budgeting Under a Finite

Investment Horizon. Risks 7(3): 86.

Shannon., C.E.

(1948). A Mathematical Theory of Communication. Bell System Technical Journal

27: 379-423 & 623-656.

Thorp., E.O.

(1962). Beat the Dealer. Random House, New York,

Vince, R., (1990).

Portfolio Management Formulas. John Wiley and Sons, New York,

Vince, R. (1992).

The Mathematics of Money Management. John Wiley and Sons, Hoboken, NJ.

Vince, R. (1995).

The New Money Management: A Framework for Asset Allocation. John Wiley and

Sons, Hoboken, NJ.

Vince, R., (2012).

Risk-Opportunity Analysis. Kindle Publishing Division of Amazon,

Vince, R.

Expectation., & Optimal f., (2019). Far East Journal of Theoretical

Statistics 56(1), 69-91.

Vince, R &

Zhu, Q.J. (2013). Inflection point significance for the investment size. SSRN,

2230874.

Vince, R &

Zhu, Q.J. (2015). Optimal Betting Sizes for the Game of Blackjack. Journal of

Investment Strategies 4(4), 53-75.