1496

Views & Citations496

Likes & Shares

The relationship between DMBs and the federal government budget takes several forms, with each influencing the other in a dynamic interplay between the dynamics of the financial markets and fiscal policy. This introduction seeks to clarify the complex link that exists between DMBs and the federal government budget, examining how these relationships affect the transmission of monetary policy, the generation of credit, and the overall performance of the economy.

Since DMBs do not operate in isolation and are impacted by the happening in the economy being highly sensitive to government spending patterns and fiscal policies, this study, therefore examines the relationship between the national budget and the performance of DMBs in terms of their profit before tax (profitability performance) and total asset size (growth performance). Therefore, to achieve the main objective of this study, the following specific objectives were set:

To assess the effect of the national budget on the profit before tax of deposit money banks in Nigeria;

To evaluate the effect of the national budget on the total asset size of deposit money banks in Nigeria.

To meet the specific objectives, research questions were framed with the aim of the questions being answered in this study. The research questions are:

How does the national budget affect the profit before tax of deposit money banks in Nigeria?

To what extent does the national budget affect the total asset size of deposit money banks in Nigeria?

Finally, the research questions are posed as research hypotheses such that they can be tested and answered in this study. The research hypotheses are posed in their null form below:

H01: National budget does not have a significant effect on the profit before tax of deposit money banks in Nigeria.

H02: National budget does not have a significant effect on the total asset size of deposit money banks in Nigeria.

The remaining part of this study will cover the conceptual review of the main variable, the theoretical framework, the methodology section to show the methods and design followed in this study, the result of the data analysis, the discussion of findings, as well as conclusion and recommendations.

CONCEPTUAL REVIEW

National Budget

Budget has been described by various authors (Olayiwola et al., 2021; Onyema, 2019; Phuc, 2018; Danladi et al., 2015; Efobi & Osabuohien, 2012) as an estimate of revenue and expense over a specific period. It details how an enterprise whether government establishment or private business determines to raise revenue and what expenditures to make within a precise period usually one year (Olayiwola,2021). The national budget according to Onyema, (2019) is the federal government's documented revenue and expenditure plan for a particular year? The national budget is managed by the Budget Office of the Federation domiciled under the Ministry of Budget and Economic Planning (Budget Office, 2024). The national budget is the fiscal tool that governments all over the world use to drive economic policies. This is because taxes are critical sources of government revenue and tools used to manage inflation and drive spending patterns in any economy (Danladi, 2015). According to CBN (2017), fiscal policy can be used to correct economic imbalances in periods of recession and depression, as such, proper planning of the national budget and adequate implementation is a vital roadmap to economic stability.

Capital Expenditure & Recurrent Expenditure

The national budget is broken into capital expenditure and recurrent expenditure. Although both components measure government spending in a particular year, while the capital expenditure relates to spending on infrastructural development like construction of roads, bridges, markets, hospitals, dams and others, the recurrent expenditure relates to spending on operational activities such as workers’ salaries, interest repayment on loans, operational overheads and others (Ron, 2002). Capital and recurrent expenditures are veritable tools used in stabilizing the economy when there are imbalances. However, Onyema, 2019 opine that although capital and recurrent expenditures have served as a vital tool in economic stability in other climes, this has not been the case in the Nigeria context as the fiscal policy framework of the government remains unproductive and negative over time. The argument about the effectiveness of Nigeria's government fiscal policy is outside the scope of this work as other works of literature like Adegboyo, (2021); Ogbonna, (2019); Agu, (2015) & Audu, (2012) abound about the effectiveness of fiscal policy on economic stability.

Bank Performance

Different indicators have been used to assess bank performance over the years. Havryliuk, (2017) opines that any technique used in analyzing bank financial performance must commence with an analysis of cost and income and end with returns on equity. This invariably means that operating cost, profit (before and after tax) and return on equity are key measures of bank financial performance.

Similarly, the European Central Bank (2010) indicates that profitability is a key indicator of measuring bank performance since it is the first line of defense against unexpected losses and strengthens capital position by ploughing back retained earnings. European Central Bank, (2010) also stated that adjusted shareholders’ funds, total assets, and non-performing loans are other indicators used to measure bank performance.

Using a more distinct approach, Antoun, (2018) maintained that the combined course of capital adequacy, asset quality, management capability, earnings strength, liquidity, and sensitivity to market risk (CAMELS) is a better indicator of measuring bank performance.

Theoretical Framework Keynesian Theory

The dominant classical economic doctrine, which minimized the need for government involvement in managing economic downturns and promoted market self-regulation, gave rise to the economic revolution known as the Keynesian revolution Jonathan, (2013) & Dutt, (2010) highlighted that in 1936, John Maynard Keynes published "The General Theory of Employment, Interest, and Money," a significant study that questioned these established beliefs. Keynes contended that market mechanisms might not be enough to restore full employment and economic equilibrium during periods of economic crisis or depression. Rather, he promoted aggressive government involvement to boost demand and stabilize the economy through monetary policy (interest rates and money supply) and fiscal policy (government spending and taxation).

Keynesian economics has been criticized from several angles, ranging from methodological issues to real-world difficulties, despite its broad acceptance and impact (Edmund, 2022). One well-known critique according to Dutt, (2010) originates from the monetarist movement, which is headed by economists such as Milton Friedman. Keynesian policies, especially expansionary fiscal measures, are criticized by monetarists for having the potential to cause inflationary pressures and jeopardize long-term economic stability. They stress the need to regulate the money supply to preserve price stability and push for a more rule-based approach to monetary policy.

By linking the federal government budget and deposit money banks (DMBs), the Keynesian theory highlights the interdependence of monetary and fiscal policy in shaping economic results. Keynesian economics offers a framework for comprehending how government budgetary decisions affect DMBs. Keynesian theory states that economic production and employment levels are largely determined by aggregate demand. A government's changes in taxation and spending, in particular, can have a direct impact on aggregate demand. The federal budget injects funds into the economy by increasing government spending on social programs, infrastructure projects, and other expenses that boost demand for products and services. Demand growth can boost economic activity, which might help DMBs by expanding lending options and deposit levels as consumers and businesses spend more money.

The Keynesian theory is still very functional in today’s economic interplay as major actors in the private sector wait for the fiscal budget before they conclude their organization plans. However, it is not clear to what extent the fiscal budget effects output. More so, there appears to be a dearth of studies on how this interplay affects the financial sector, especially deposit money banks, therefore, this study is designed to examine the effect of the national budget on the financial performance of deposit money banks in Nigeria.

Review of Extant Literature

Studies have been carried out to determine the effect of government expenditure on private businesses. For instance, Olaifa & Benjamin, (2020) examined the impact of government expenditure on private-sector investment in Nigeria. Secondary data was collected over a period from 1981 to 2016. Co-integration regression was used to analyze the effect of capital expenditure on private-sector investment. The study revealed that capital expenditure on human development and debt servicing has a positive effect on private-sector investment. Similarly, Amire, (2020) assessed the impact of government expenditure on private investment in Nigeria. They used secondary data which covered a period from 1981 to 2018. The Granger causality test was used to analyze the data. They concluded that capital expenditure has a positive effect on private investment, but recurrent expenditure has an inverse effect on private investment in Nigeria.

In the same vein, Ihori, (1987) examined the effect of government spending on the evaluation of the private sector in Japan. Secondary data was gathered ranging from 1970 to 1983. The study showed that the government has increased its spending over time. Hymer & Resnick, (1968) evaluated the interaction between government expenditure and the private sector in the US. Qualitative research design was used with the derivation of models. The study revealed how government spending affects the private sector's performance.

On the other hand, in a bid to determine the effect of government policies on private-sector business performance in Tanzania & Mwakalila, (2020) discovered that government expenditure and domestic borrowing have a crowding-out effect on the private sector. The study employed the use of secondary data that covered a period of 2004 to 2018 and the autoregressive distributed lag (ARDL) was used to analyze the data.

Kengara & Makina, (2020) examined the government budgeting process on organizational performance in Kenya. Primary data was collected from selected respondents through the use of a questionnaire. They concluded that government budgetary spending has a positive effect on organizational performance.

On the contrary, Furceri & Sousa, (2009) evaluated the impact of government spending on the private sector in 145 selected countries. Secondary data was collected over a period spanning from 1960 to 2007. The study revealed that government spending negatively affects the private sector. In supporting the assertion that government spending does not impact private sector businesses, Omitogun, (2018) concluded that government expenditure has varying effects on the component of private investment. Although secondary data that span from 1981 to 2015 was used in the study and data analyzed using the auto-regressive distributed lag, the result negates that government spending has a positive significant effect on private investment.

From the review of existing literature, there appears to be a paucity of studies on the theme as it relates to how government expenditure specifically affects the DMBs, hence, this study is designed to examine the effect of the national budget on the financial performance of DMBs in Nigeria.

METHODOLOGY

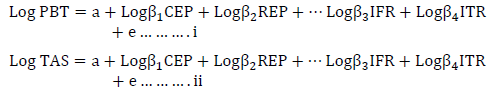

The quantitative research method was used in this study, this involves the manipulation and interpretation of data using numerical analysis. The ex-post facto research design is adopted as the study is designed to examine past events to draw meaning from their occurrence. Secondary data was collected from the Nigerian Deposit Insurance Commission annual report, the Budget Office of the Federation and the Central Bank of Nigeria annual statistical bulletin over a time frame of ten years which covers a period of (2012 to 2021). The data collected for the deposit money banks were retrieved in aggregate form. Descriptive analysis such as mean, median, mode, maximum and minimum were carried out on the data to better describe the attribute of the data to draw more insightful meaning from it. In addition, a diagnostic test (heteroskedasticity) was carried out on the data to confirm the suitability of the data. In addition, inferential analysis was carried out through the use of multiple regression which was used to analyze the effect of the national budget (proxy by capital expenditure and recurrent expenditure) on the financial performance (profit before tax and total asset) of deposit money banks in Nigeria. The multiple regression model used in this study is depicted below:

Where;

a: Intercept where PBT and NPL are zero; PBT: Profit Before Tax (Dependent Variable); TAS: Total Asset Size (Dependent Variable); β1CEP: Capital Expenditure (Independent Variable); β2REP: Recurrent Expenditure (Independent Variable); β3IFR: Inflation Rate (Moderating Variable); β4ITR: Interest Rate (Moderating Variable); e: Error Term

DATA ANALYSIS AND DISCUSSION OF FINDINGS

Both the diagnostic and inferential results of the analyses are presented below:

Diagnostic Result

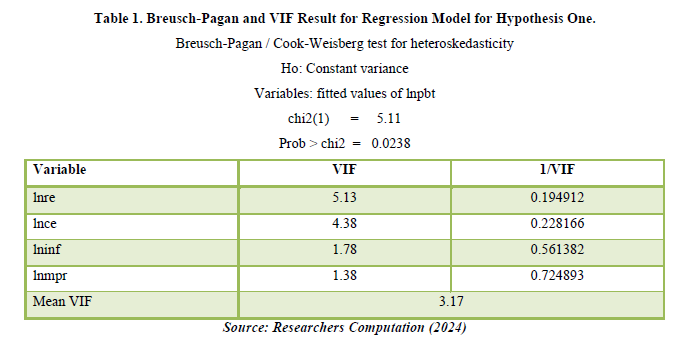

The Breusch-Pagan/ Cook-Weisberg test and the Variance inflation factor are carried out to test the suitability of the model and variables. The results are discussed below Table 1.

The Breusch-Pagan / Cook-Weisberg test for heteroscedasticity was carried out with a result of 0.0238 which confirms the presence of heteroscedasticity. However, the robust regression was initiated to correct and normalize the model. Therefore, the research model can give a good result on the effect of the national budget on the profit before tax. The VIF also confirms this as the result which is less than ten confirms the suitability of the model (Table 2).

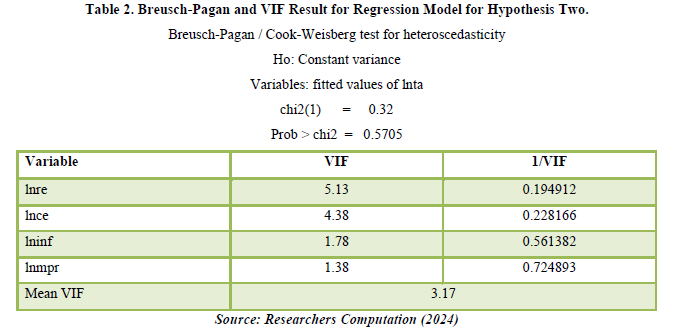

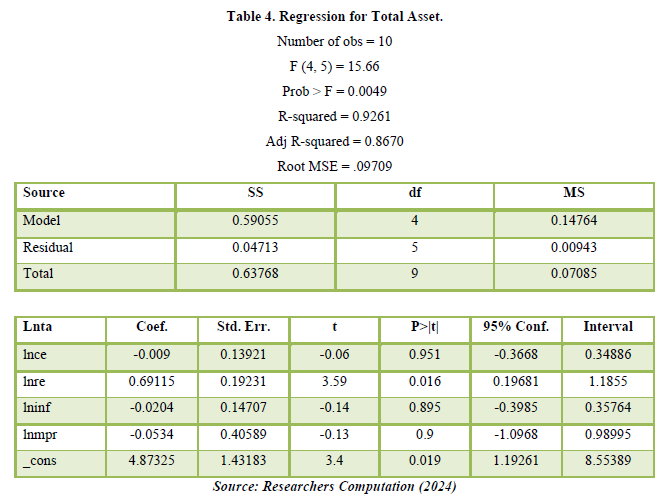

The Breusch-Pagan / Cook-Weisberg test for heteroscedasticity was carried out with a result of 0.5705 to confirm the correctness of the research model and its predictive power. The result shows that there is no significant presence of heteroscedasticity, therefore the research model can give a good result on the effect of the national budget on the total asset size of deposit money banks. The VIF also confirms this as the result which is less than ten confirms the suitability of the model.

Test of Hypotheses

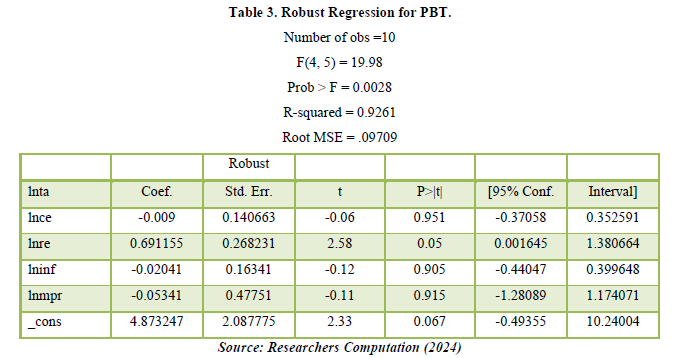

H01: National budget does not affect the profit before tax of Deposit money banks in Nigeria.

Table 3 shows that recurrent expenditure has a positive effect on the profit before tax of deposit money banks in Nigeria. Individually, the recurrent expenditure has a significant effect on the profit before tax of deposit money banks in Nigeria. However, capital expenditure, inflation rate and interest rate on the other hand have an inverse effect on the profit before tax of deposit money banks in Nigeria which is also not significant.

The result shows that the variables together explain about 93% of the variability in profit before tax while 7% is affected by other variables not contained in this study. Furthermore, the result shows that the national budget has a significant effect on profit before tax of deposit money banks in Nigeria.

The result shows that the variables together explain about 93% of the variability in profit before tax while 7% is affected by other variables not contained in this study. Furthermore, the result shows that the national budget has a significant effect on profit before tax of deposit money banks in Nigeria.

H02: National budget does not affect the total asset size of Deposit money banks in Nigeria.

Table 4 reveals that recurrent expenditure has a positive effect on the total asset size of deposit money banks in Nigeria. Individually, recurrent expenditure also has a significant effect on the total asset size of deposit money banks in Nigeria. However, capital expenditure, inflation and interest rates have a negative effect on the total asset size of deposit money banks in Nigeria. The trio (capital expenditure, inflation and interest rate) also does not have a significant effect on the total asset size of deposit money banks in Nigeria.

The overall result reveals that 93% variation in total asset size of DMBs in Nigeria can be explained by the combined proxies of the independent variables (capital expenditure, recurrent expenditure, inflation and interest rate). In addition, the result reveals that the national budget does have a significant effect on the total asset size of deposit money banks in Nigeria.

DISCUSSION AND POLICY IMPLICATION OF FINDINGS

Based on the results of this study, it is revealed that recurrent expenditure has a positive effect on the profit before tax and total assets of deposit money banks in Nigeria. Capital expenditure, inflation rate and interest rate on the other hand have an inverse effect on the profit before tax and total assets of deposit money banks in Nigeria. This means that the deposit money banks will experience an increase in profit before tax and total assets when recurrent expenditure is increased but will experience a decline when capital expenditure, interest rate and inflation are increased. This position is similar to the position of Olaifa & Benjamin, (2020) & Amire, 2020 who opined that government expenditure has a positive effect on private investment. However, the result summarily shows that the national budget has a significant effect on both the profit before tax and total assets of deposit money banks. This invariably means that if the recurrent expenditure is increased and capital expenditure, interest rate and inflation are held constant, the profit before tax and total assets of DMBs will increase with an attendant increase in tax accruing to the government and dividend payment to shareholders. It will also stimulate the bank to expand its operations as the additional increase in total assets will be deployed to generate additional revenue. This aligns with the position of Keynes's theory which expects an increase in government expenditure to effect increased performances in the economy.

CONCLUSION

The main focus of this study is to show how the national budget affects the performance of deposit money banks in Nigeria. The result shows that recurrent expenditure has a positive effect on the profit before tax and total assets of deposit money banks in Nigeria. While capital expenditure, inflation rate and interest rate on the other hand have an inverse effect on the profit before tax and total assets of deposit money banks in Nigeria.

It is concluded from this study that the national budget does have a significant effect on the performance (profitability and total assets) of deposit money banks in Nigeria.

POLICY IMPLICATION AND RECOMMENDATION

Based on the result of this study, it is recommended that the management of deposit money banks should devise strategies to effectively deploy their assets in generating more businesses when the government's recurrent expenditure increases as this will increase their PBT and total assets. Assets could be strategically deployed into digital transformation, product innovation, and market expansion to enhance competitiveness and profitability.

Similarly, the Board of DMBs should enhance their risk management frameworks to mitigate the adverse effects of capital expenditure, interest rate fluctuations, and inflation on profitability. DMBs should adopt prudent lending practices and diversify their investment portfolios to minimize risk exposure.

The CBN should foster an effective collaboration between sister agencies (NDIC, Ministry of Finance) and financial institutions to ensure coherence and effectiveness of economic policies. Coordination between fiscal and monetary authorities is essential for achieving macroeconomic stability and sustainable growth.

The government in order to drive economic growth and development should put measures in place to effectively hold down interest rates and inflation and increase recurrent expenditures as this will help stimulate growth in the financial sector with attendant positive growth in the economy.

The federal government should engage stakeholders, including policymakers, industry experts, and representatives from the banking sector, in policy formulation and decision-making processes. Dialogue and collaboration are crucial for identifying challenges, exploring opportunities, and designing effective policy interventions.- Adegboyo, O. S., Keji, S. A., & Fasina, O. T. (2021). The impact of government policies on Nigeria economic growth case of fiscal, monetary and trade policies. Future Business Journal, 7, 59.

- Agu, S. U., Okwo, M. I., Ugwunta, D. O., & Idike, A. (2015). Fiscal policy and economic growth in Nigeria Emphasis on various components of public expenditure. Sage Journals Home.

- Amire, C. M., Okufuwa, M. O., & Amire, C. O. (2020). Government expenditure and private investment in Nigeria. Journal of Accounting, 6, 71-79.

- Antoun, R., Coskun, A., & Georgievski, B. (2018). Determinants of financial performance of banks in Central and Eastern Europe. Business and Economic Horizons, 14, 513-529.

- Audu, N. P. (2012). The impact of fiscal policy on the Nigerian economy. International Review of Social Sciences and Humanities, 4, 142-150.

- Budget Office. (2024). Budget Office. Retrieved from: https://www.budgetoffice.gov.ng/

- CBN. (2017). Fiscal policy at a glance. Retrieved from: https://www.cbn.gov.ng/out/2017/ccd/fiscal%20policy%20at%20a%20glance.pdf

- Danladi, J. D., Akomolafe, K. J., Olarinde, O. S., & Anyadiegwu, N. L. (2015). Government Expenditure and Its Implication for Economic Growth: Evidence from Nigeria. Journal of Economics and Sustainable Development, 6, 142-150.

- Dutt, A. K. (2010). Keynesian Growth Theory in the 21st Century. London: Palgrave Macmillan.

- Edmund, P. (2022). Public Debt My Dissent from Keynesian Theories. Journal of Government and Economics.

- Efobi, U., & Osabuohien , E. S. (2012). Government expenditure in Nigeria an examination of tri-Theoretical mantras. Journal of Economic and Social Research, 14, 27-52.

- European Central Bank. (2010). Beyond ROE how to measures Bank performance. Eurosystem, 5-35.

- Furceri, D., & Sousa, R. M. (2009). The impact of government spending on the private sector Crowding out versus crowding in effects. Working Paper Series, 1-38.

- Havryliuk, A. (2017). Indicators of effective bank. Technology Audit and Production Reserves, 5, 39-44.

- Hymer, S., & Resnick, S. (1968). Interactions between the government and the private sector: An analysis of government expenditure policy and the reflection ratio. Yale University Discussion Paper, 1-48.

- Ihori, T. (1987). The size of government spending and the private sectors evaluation. Journal of the Japanese and International Economies, 82-96.

- Jonathan, M. H. (2013). Green Keynesianism Beyond standard growth paradigms. Global Development and Environmental Institute, 1-17.

- Kengara, R., & Makina, I. (2020). Effect of budgetary processes on organizational performance A case of Marine state agencies Kenya. Universal. Journal of Accounting and Finance, 8, 115-130.

- Mwakalila, E. (2020). Crowding out of private sector in Tanzania Government expenditure, domestic borrowing and lending rates. Emerging Economy Studies.

- Ogbonna, B., Uba, C., & Odionye, J. (2019). The Effectiveness of Fiscal Policy on Economic Stabilization in Nigeria.

- Olaifa, F. G., & Benjamin, O. O. (2020). Government capital expenditure and private sector investment in Nigeria Co integration regression and Toda Yamamoto causality analysis. Advanced Journal of Social Science, 6, 71-82.

- Olayiwola, S., Kazeem, B., & Olusanya, S. (2021). Public expenditure and income growth in Nigeria: A vector autoregressive analysis. Journal of Management and Social Sciences, 10, 1061-1076.

- Omitogun, O. (2018). Investigating the crowding effect of government expenditure on private investment. Investment Journal of Competitiveness, 10, 136-150.

- Onyema, J. J. (2019). Fiscal Policy and Economic Growth in Nigeria. KIU Journal of Social Sciences, 5, 25- 34.

- Phuc, C. (2018). The effectiveness of fiscal policy: Contributions from institutions and external debts. Journal of Asian Business and Economic Studies, 25, 50-66.

- Ron, H., David, H., & Fei, Y. (2002). Recurrent Expenditure Requirements of Capital Projects. World Bank Policy Research Working Paper.