Research Article

MODELLING IMPACT OF TAX BURDEN ON STATE FINANCIAL STABILITY

4305

Views & Citations3305

Likes & Shares

Scientific attempts to assess the relationship between the tax burden and financial stability face many challenges and scientific deadlocks. Research in this area has particularly intensified since the 2007-2008 global financial crisis, which demonstrated a close correlation between financial systems and macroeconomic factors. Various scholars studying the impact of tax burden focus on different aspects and generate controversial conclusions therefore a comprehensive methodology for assessing all types of factors and testing this methodology in the European Union (EU) context is lacking. Based on the analysis of scientific sources this paper presents a theoretical model that causally combines the components of tax burden and state financial stability. The newly constructed Index was used to assess state financial stability and the applicability of the index was verified by assessing the impact in the 28 EU countries during the 2005–2017 period. A clustering of the EU countries according to the differing tax rate policies and financial stability level was performed using the Ward method of hierarchical clustering. According to the results of the empirical study (regression analysis) the increase in tax burden strengthened state financial stability in three country groups (High Tax Burden / High Financial Stability; Low Tax Burden / High Financial Stability; Low Tax Burden / Low Financial Stability), while decreased in the High Tax burden/ Low Financial stability country group.

Keywords: Financial Stability, Tax Burden, Impact, Index Calculation Methodology

JEL Classifications: E6

INTRODUCTION

The prevailing view in the economic literature is that ensuring financial stability is “an important condition for maintaining macroeconomic and monetary stability, as well as a significant factor in sustainable economic growth” (Schinasi, 2006). In order to ensure state financial stability, it is important to form a publicly available, statistically transparent and research-based opinion analysing the shape of the financial system in terms of internal and external threats and the system's ability to withstand them. The international scientific community is actively researching the factors influencing state financial stability and agrees that an evaluation should be based on a macroeconomic and systemic approach. Assessing the impact of the tax burden on the state financial stability is particularly relevant in shaping a country's tax policy, and its significance has become apparent in the context of the recent financial crisis. The European Union’s ambitious goals for economic and social development are closely linked to the process of reforming the tax system. EU is made up of countries in different stages of economic development that calculate taxes on the basis of differing principles. This provides real opportunities for researchers to study the interrelations between tax burden parameters and national economic development trends. The optimal tax burden is seen as an important condition for social development, the quality of public welfare, business growth, while the efficiency of the tax system is one of the most important factors determining the potential of the national economy (Abuselidze, 2012). Modern economists argue that reducing tax burden effectively influences state financial stability and stimulates the economy (Alstadsaeter et al., 2017; Tamai, Myles, 2019; Celikay, 2020), but there is no consensus among scholars on how tax cuts affect economic development in the long run (Vasiliauskaitė, Stankevicius, 2014). Various scholars studying the impact of tax burden on state financial stability assess the impact of different factors, focus on different aspects and generate controversial conclusions therefore a comprehensive methodology for assessing all types of factors and testing this methodology in the European Union context is lacking.

The context of theoretical and empirical research allows us to conclude that the content and manifestations of the interaction between tax burden and state financial stability are a relevant object of research from both a theoretical and empirical point of view. This paper presents a developed and verified model of the impact of a tax burden on the state financial stability, which not only comprehensively assesses the impact of the tax burden on the individual components of the state financial stability, but on the state financial stability as a whole. To achieve this goal, the assumptions that create the conditions for the state financial stability were analysed and identified, the analysis of the tax burden and the components and indicators of the state financial stability was performed, and an index assessing the impact of the tax burden was constructed and tested. The applicability of the index was verified by assessing the impact of the tax burden on state financial stability in the EU countries during the 2005–2017 period. The index will have practical applicability in assessing and comparing the interactions between individual states' tax burdens and financial stability, as well as adding scientific value by contributing to the research on tax burdens and financial stability.

THEORETICAL ASPECTS OF FINANCIAL STABILITY AND ITS’ CONCEPTUAL MODEL

Financial stability is widely studied in the scientific literature and the concept differs depending on the scientist's approach. The international scientific community is actively researching the factors influencing state financial stability (Ada, et al, 2015; Roosma, et al, 2015; Cural, Cevik, 2015; Flood, Jagadish and Raschid, 2016; Bischof, Laux ir Leuz, 2019). However, as Schinasi (2006) points out, “the analysis of financial stability is still in its infant stage of development and practice, as compared with the analysis of monetary and/or macroeconomic stability, meaning there is a lack of a commonly used model or an analytical system to assess financial stability”. After summarizing various theories of financial stability and the factors influencing it, the following features of the concept of financial stability were singled out:

- Financial stability is perceived as the absence of fluctuations (Gadanetz et al., 2012; Das et al., 2019); as the absence of crises and tensions (Haldane et al., 2017);

- An emphasis is placed on the impact financial stability has on macroeconomic processes (ECB, 2019, IMF, 2020);

- A broader approach to financial stability is promoted (Houben, Kakes, 2004; Schinasi, 2006; Fell, Schinasi, 2005) and it is argued that financial stability is an extensive concept encompassing various aspects of finance and financial systems. Financial stability manifests itself through the ability to reallocate resources, manage risk and overcome financial imbalances. According to these authors, financial stability can be assessed in terms of the consequences to the real sector of the economy and is perceived as a continuum.

- Financial stability is perceived through the interplay between financial system stability and sustainable economic growth (Corboe, Levine, 2018; Akins, Li, Rusticus, 2016; Ozili, Thankom, 2018; Jiang, Levine, 2019).

- An emphasis is placed on the impact the financial system, economic development and fiscal policy has on financial stability (Boyd et al. 2005; Kroszner et al., 2007; Dell’Ariccia et al., 2008)

- Financial stability is perceived through the stability of public finances and the financial system, which influence economic development (Amadeo, 2013; Caner, Grennes and Koehler-Geib, 2010; Staniuliene, 2015)

- Financial stability is assessed through sets of macro indicators covering the various sectors of business, household, financial and finance markets (Schakeldorf et al, 2011; Hawkins, Klau, 2000; Nelson and Perli, 2005; Gray, Merton, Bodie, 2007).

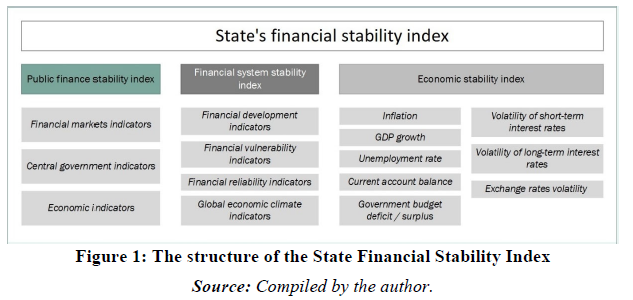

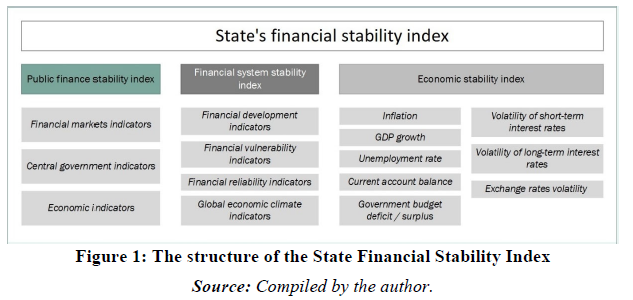

Although narrower approaches to financial stability are characterized by simplicity such as the absence of certain phenomena (Gadanetz et al., 2012; Haldane et al., 2017; Das et al., 2019) a broader assessment, encompassing public finance, financial systems, economic growth and fiscal policy, provides an opportunity to reveal the essence of this phenomenon more accurately and is in line with the objectives of this paper. By focusing on the broader concept of financial stability (Fell, Schinasi, 2005; Houben, Kakes, Schinasi, 2005; Levine, Corboe, 2018; Akins, Li, Rusticus, 2016; Ozili, Thankom, 2018; Jiang, Levine, 2019), the state financial stability in this paper is defined as the interaction between the stability of public finances, the stability of the financial system and a balanced economic growth. Such a perception of state financial stability was chosen as a theoretical starting point for theoretical and empirical research as it creates preconditions for a complex assessment of this phenomenon, with a special focus given to the complex interrelations between these areas (Figure 1).

Commenting on Figure 1, the stability of public finances in this paper is treated as the totality of the stability of financial markets and economic indicators, which is decisively influenced by the actions of the central government. After analysing the valuation methods for the evaluation of public finances (Blommestein, Turner, 2012; İlgün, 2016; Janda, Kravtsov, 2017; Birškytė, 2019; Alshubiri, 2019), the Trading Economics Index was chosen as, in the author's opinion, it corresponds the closest to the concept of public finance stability formed in this paper. The structure of the Public Financial Stability Index is based on the classification proposed by Trading Economics (2009), which consists of (1) financial market indicators, (2) central government indicators, and (3) economic indicators. The structure of the Financial System Stability Index was chosen based on the analysis of scientific sources (Skaržauskas, 2016) and theoretical models of such authors as Gersl and Hermanek (2006), Van den End (2006), Albulescu (2010; 2012), as well as the empirical studies evaluating the financial systems of Czech Republic, Romania, Turkey and other countries. The set of indicators proposed by Albulescu (2010) illustrates the spectrum of financial stability dimensions, which consists of 4 sub-indices such as 1) the developmental stage of the financial system; (2) financial vulnerability; (3) financial reliability; and (4) the global economic climate. Each sub-index in the structure is reflected with a range of indicators. The structure of the Economic Stability Index is based on Daugėlienė (2012), Riley (2009, 2014), Sharuddin, Rama (2017) and others’ theoretical insights, which the author has aggregated into seven key indicators (see Figure 1) reflecting the macroeconomic situation. The weight of the indicators was determined according to the analysed scientific sources and based on the factors that have the greatest impact on economic stability. This number of indicators is relatively optimal compared to other high-volume indices and the combination of indicators includes key influencing factors. Structure of indices and weights assigned to indicators are provided in appendices (Table A4).

It is important to note that the factors listed are closely linked, therefore the stability of the financial system can only be ensured by the stability of all these components together. For these reasons, financial stability analysis is a particularly difficult and a complex task.

THE PROBLEMATIC ASPECTS OF TAX BURDEN ASSESSMENT

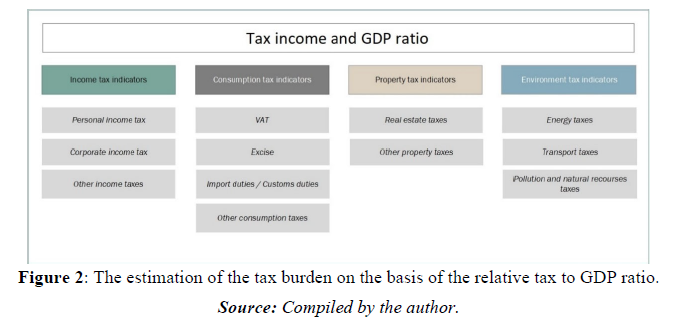

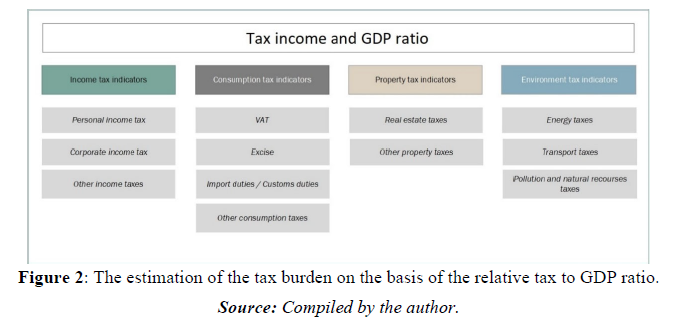

Research shows that international tax burden comparisons are possible, but the impact of tax burdens on a country's financial stability remains problematic primarily due to the multifaceted nature of tax burden assessments. The most commonly used method in research for tax burden calculation is the ratio of tax revenue to GDP (OECD, 2019; Liu et al, 2013; Celikay, 2020; Vasileva, 2020; Paientko and Oparin, 2020). The popularity of this method is based on the simplicity of the calculation and the availability of data through national statistical agencies and departments. The indicator of tax revenue to GDP can also be based on qualitative studies assessing the dependence of this indicator and GDP through economic activity. Although scientific literature lists many shortcomings of this approach, the ratio of tax to GDP remains the most widely used indicator for assessing tax burden as it covers all state taxes and their types, assesses the impact of tax exemptions and progressivity, and it can be used to compare different economic sectors or States. As the tax burden in this paper is assessed in the context of the EU Member States, and they use the same methodology for calculating GDP, the adoption of this indicator avoids any potential distortions in the values of the tax burden. Due to the mentioned advantages in comparison with other indicators and indices described in this chapter, it was decided to assess tax burden in relation to the ratio of tax revenue to GDP.

According to the OECD classification of tax types (OECD, 2019) four categories of tax indicators are used to assess the relative indicator: (1) income tax, (2) consumption tax, (3) property tax, and (4) environmental tax. Each of the indicators has subcategories, which are calculated as the ratio of tax to GDP. The calculation considers tax exemptions, standard and reduced tax rates, tax administration and progressivity as well as other factors. The chosen valuation methodology is multicriteria and reflects the burden of different tax groups based on the EU’s classification (Figure 2).

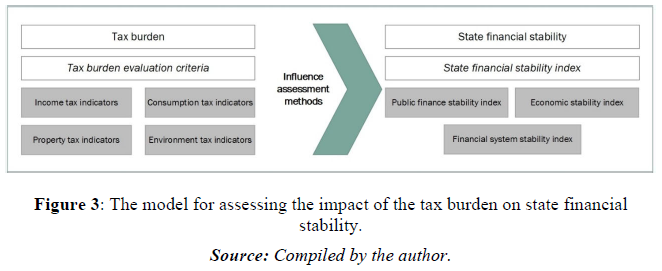

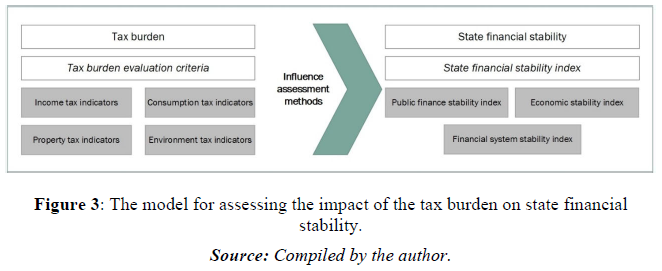

After building the basics and methods for assessing the state financial stability and tax burden, a theoretical model of the impact of the tax burden on the state financial stability was constructed as presented in the next section.

THE METHODOLOGY FOR ASSESSING THE IMPACT OF TAX BURDEN ON STATE FINANCIAL STABILITY

The complexity of the model is revealed through different levels of state financial stability and tax burden assessment. The model has been designed for applicability in an international environment and is therefore suitable for research in individual regions or groups of countries. The impact assessment methodology uses a linear multivariate regression equation, hierarchical clustering and other econometric / statistical methods. These research methods have been chosen as reliable instruments for the purpose and scope of this paper and are generally recommended by the scientific literature for the investigation of the effects and causal relationships between variables.

The interaction between the tax burden and financial stability in the 28 European Union member states was chosen as the main object of this paper. This group was chosen due to the relevance of the problem to the European Union, whose member states have differing tax systems and varying levels of financial market and economic development. In order to determine the level of financial stability of the EU member states during the period of 2005-2017 the values of the indices assessing the stability of public finances, the stability of the financial system and the stability of the economy and their indicators were calculated. The tax burden has been determined according to the values of the tax burden assessment criteria for each member state. According to the following index values and using the hierarchical Ward connection method the countries have been divided into 4 groups according to the hierarchical clustering analysis:

- High tax burden and high financial stability (HTBHFS cluster)

- Low tax burden and high financial stability (LTBHFS cluster)

- High tax burden and low financial stability (HTBLFS cluster)

- Low tax burden and low financial stability (LTBLFS cluster)

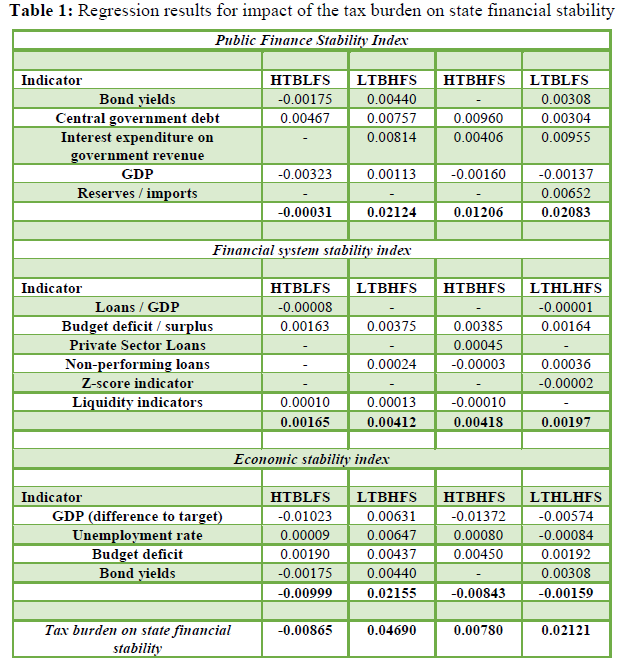

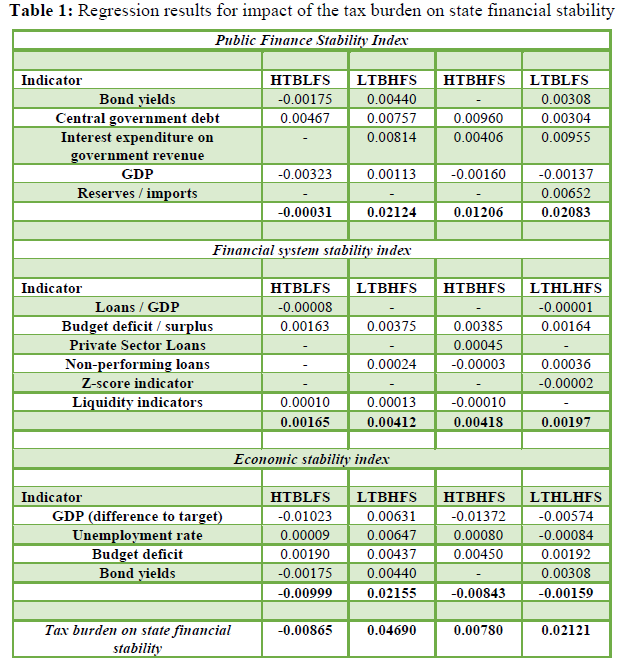

Indices of the total tax burden and the constituting indices of the different types of taxes were calculated for these clusters of countries. Indices of the tax burden, the public finance stability, the financial system stability and the economic stability were used in the correlation analysis to examine the interaction and interrelation between the overall tax burden and state financial stability. The impact of the tax burden on the state financial stability has been examined using multiple linear regression analysis. During analysis regression models were formed for each indicator of public finance stability index, financial system stability index and economic stability index using time series data. Regression models are provided in appendices (Table A1, Table A2, Table A3). Tax burden was used as one of the independent variables, therefore coefficients of tax burden variables in the regression models were selected as measure of impact. In cases when statistically significant models were formed only without independent variable of tax burden, it was considered that tax burden has no impact to the dependent variable, e.g., indicator, which is used in calculation of public finance stability, financial system stability or economic stability indexes. Using coefficients assigned to independent variables of tax burden impact to public finance stability, financial system stability and economic stability was calculated according to weights of indicators in the indices (Table A4). Finally, using data of impact to indices, tax burden impact to state financial stability was calculated (Table 1).

Publicly available data from the World Bank, the Organization for Economic Co-operation and Development (OECD), the European Central Bank (ECB), Eurostat, CESIF and other internationally recognized organizations were used in the study. Data was processed with MS Excel and IBM SPSS 24.

THE GENERALISED RESULTS OF THE REGRESSION MODELS

The regression equations for the indicators of the indices of the stability of the public sector, the financial system and the economy allowed to calculate the overall impact of the change in the tax burden on the state financial stability. Table 1 shows the changes in the state stability indices after the increase of the tax burden by a normalized value of 0.01 (or 0.374% of the tax to GDP ratio during the analyzed period). It can be observed that the increase in the tax burden would have a positive impact on the stability of public finance in all groups of countries except the one with high tax burdens and low financial stability, where the negative impact would be relatively weak and would have little effect on the stability of public finance. The strongest positive impact was due to the positive developments of the central government debt and interest expenditure on government revenue, while the negative impact was strongest in conjunction with growth of GDP.

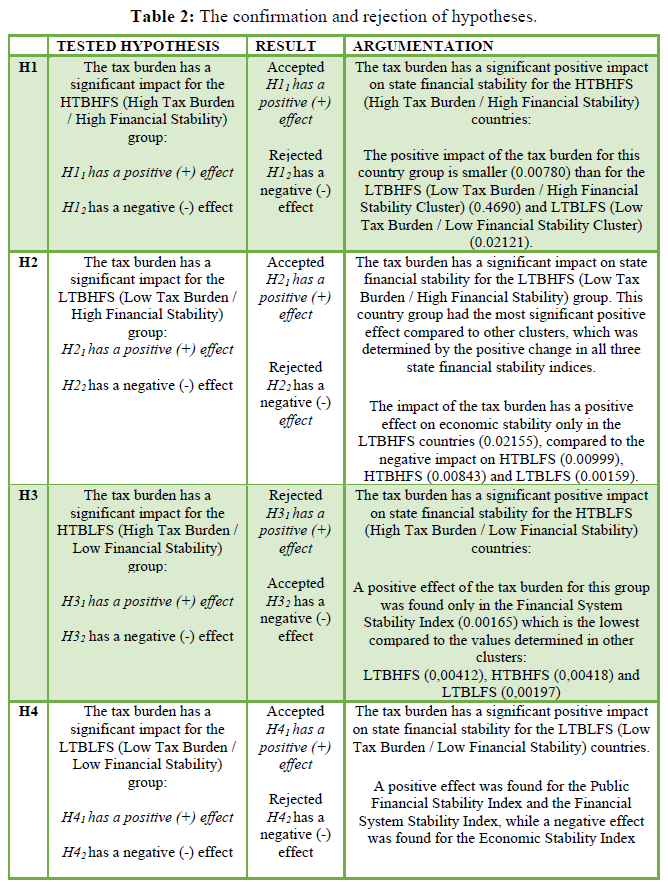

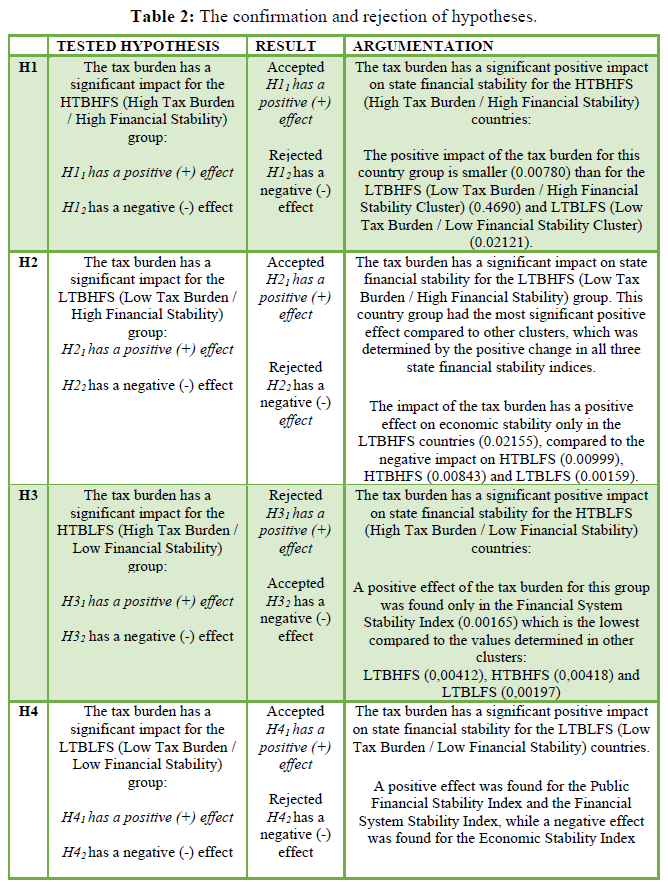

The results of testing the hypotheses. The results of the empirical study allowed to confirm 4 and reject 4 hypotheses (Table 2).

Meanwhile, the increase in tax burden has a positive effect on the stability of the financial system in all country groups. The biggest positive impact of the tax burden on the stability of the financial system is made through the reduction of the budget deficit ratio. Studies show that economic stability indicators would be negatively affected by an increase in the tax burden in three groups and only positively in a group of a low tax burden and high financial stability. The tax burden would also have the strongest impact on economic stability in a group of countries with high financial stability. The strongest negative value could be observed in conjunction with the difference to the nominal GDP, the change of which with the increase of the tax burden would have a negative impact on the stability of the economy. After assessing the impact of the tax burden on individual components of the state financial stability the total impact of the increase in the tax burden on the state financial stability could be calculated. According to the results of the empirical study the increase in tax burden strengthened state financial stability in three country groups, while decreased in the high tax stability/ low financial stability country group.

CONCLUSION

After testing the theoretical model in 28 EU countries several mixed conclusions were drawn regarding the peculiarities of the tax burden assessment. In general, when the tax burden is measured in relative terms, an increase in tax burden would have a positive impact on the stability of public finance in all country groups except the one of high tax burden / low financial stability, where a negative impact would be relatively weak and have little impact on public finance stability. The strongest positive impact would be due to a positive development of the central government debt and interest expenditure on government revenue, while the negative impact would be strongest in conjunction to the growth of GDP. Meanwhile, an increase in the tax burden would have a positive effect on the stability of the financial system in all country groups. The biggest positive impact of the tax burden on the stability of the financial system would be made through the reduction of the budget deficit. The study showed that economic stability would be negatively affected by the increase of the tax burden in three country groups and only positively in the group of low tax burden / high financial stability. The tax burden would also have the strongest impact on economic stability in the group of countries with high financial stability. The strongest negative value could be observed in conjunction with the difference to the nominal GDP, the change of which with the increase of a tax burden would have a negative impact on the stability of the economy. According to the results of the empirical study, as the tax burden increased (in relative terms) state financial stability increased in three country groups, while it decreased in the group of a high tax burden / low financial stability.

In terms of the composite index an increase in tax burden would have a positive impact on the stability of public finances in all groups except the one with a high tax burden / high financial stability, where a negative effect of the increase in tax burden was identified. The positive impact was strongest on positive developments in bond yields and interest expenditure on government revenue, while the negative impact was strongest on the reserve-import ratio. The study also showed that the indicators of the financial system stability would be positively affected by the increase in tax burden in three country groups and negatively impact only the one with low tax burden / low financial stability. The strongest positive values were found in conjunction with the budget deficit, while the strongest negative impact of the increase in the tax burden was found within the liquidity of the financial system’s ratio. Meanwhile, the increase in tax burden has a positive effect on economic stability in all country groups. The biggest positive impact of the tax burden on the stability of the financial system was observed in parallel with the decline in the bond yield volatility. The results of the empirical study show that as the tax burden increases (measured by composite index values) state financial stability decreases in the countries with a high tax burden and high financial stability, but increases in the remaining three country groups. In summary it can be stated that different methods of estimating the tax burden have yielded different results of its effect in countries with high levels of tax burdens, but a positive trajectory can be identified in countries with low levels of tax burdens.

- Abuselidze, G. (2012). The Influence of Optimal Tax burden on Economic Activity and Production Capacity. Intellectual Economics 6(4), 16.

- Adam, A., Kammas, P. & Lapatinas, A. (2015). Income inequality and the tax structure: evidence from developed and developing countries. Journal of Comparative Economics 43(1), 138-154.

- Albulescu C. (2010). Forecasting the Romanian Financial system stability using a stochastic simulation Model. Romanian Journal of Economic Forecasting 13(1), 81-98.

- Albulescu, C. (2012). Financial stability, monetary policy and budgetary coordination in EMU. Theoretical &Applied Economics 19(8), 85-96.

- Alstadsaeter, A., Johannesen, N., & Zucman, G. (2017). Tax Evasion and Inequality. National Bureau of Economic Research, Working Paper, No 23772

- Akins, B., Li, L., Ng, J., & Rusticus, T.O. (2016). Bank competition and financial stability: Evidence from the financial crisis. Journal of Financial and Quantitative Analysis 51, 1-28.

- Alshubiri, F. (2019). Public finance indicators and the value of investment project development: a comparative study of GCC countries. Journal of Business Economics and Management 20(6), 1143-1167.

- Amadeo K. (2013). Budget Deficit. How Deficits Affect the Economy. Available online at: http://useconomy.about.com/od/glossary/g/Budget_Deficit.htm

- Bischof, J., Laux, C. & Leuz, C. (2019). Accounting for financial stability: Lessons from the financial crisis and future challenges. SAFE Working Paper Series 283, Leibniz Institute for Financial Research SAFE.

- Birškytė, L. (2019). The impact of government debt on public finance stability in Lithuania. Contemporary issues in business, management and economics engineering’ 2019, VGTU.

- Blommestein, H. J., & Turner, P. (2012). Interactions between sovereign debt management and monetary policy under fiscal dominance and financial instability. OECD Working Papers on Sovereign Borrowing and Public Debt Management No. 3. OECD Publishing. Available online at: https://doi.org/10.1787/5k9fdwrnd1g3-en

- Boyd J, Kwak S. ir Smith B. (2005). The Real Output Losses Associated with Modern Banking Crises. Journal of Money, Credit and Banking 37(6), 977-999.

- Caner M., Grennes T. & Koehler-Geib F. (2010). Finding the Tipping Point – When Sovereign Debt Turns Bad. Policy Research Working Paper 5391, The World Bank.

- Celikay, F. (2020). Dimensions of tax burden: a review on OECD countries. Journal of Economics, Finance and Administrative Science 25(49), 27-43.

- Cural, M. & Cevik, N.K. (2015). Ekonomik kalkınmanın vergi yapısı üzerindeki etkisi: 1924-2013 dönemi Türkiye örnegi. Amme Idaresi Dergisi 48(3), 127-158.

- Das, U.S., Xu, T. & Hu, K. (2019). Bank Profitability and Financial Stability. International monetary fund, project: Systemic risk and financial stability, Working papers 19(5).

- Daugelienė R. (2012). Hypothetical of Macroeconomic Stability Surveillance Indicators and European Union ‘s Initiatives for Maintenance of Financial Stability. European Integration Studies No. 6.

- Dell‘Ariccia G. Detragiache E., Rajan R. (2008). The real effect of banking crises. Journal of Financial Intermediation 17(1), 89-112.

- ECB-European Central Bank. (2019). Financial Stability Review. Available online at:

- https://www.ecb.europa.eu/pub/financialstability/fsr/html/ecb.fsr201911~facad0251f.en.html

- Fell, J., Schinasi, G. (2005). Assessing financial stability: exploring the boundaries of analysis. National Institute Economic Review 192(1), 102-117.

- Flood, M.D., Jagadish, H.V. & Raschid, L. (2016). Big data challenges and opportunities in financial stability monitoring. Banque de France, Financial Stability Review 20, 129-142.

- Gadanetz, B.K., Tsatsaronis, K., Altunbas, Y. (2012). Spoilt and Lazy: he Impact of State Support on Bank Behavior in the International Loan Market. International Journal of Central Banking 8(4), 121-173.

- Gersl A., Hermanek J. (2006). Financial Stability Indicators: advantages and disadvantages of their use in the Assessment of the Financial System Stability. Financial Stability Report, Czech National Bank.

- Gray D., Merton R. & Bodie Z. (2007). New framework for measuring and managing macro financial risk and financial stability No. 13607, National Bureau of Economic Research.

- Haldane A., Aukman D., Kapadia S., & Hinterschweiger M. (2017). Rethinking Financial Stability. Rethinking Macroeconomic Policy IV Conference, Washington.

- Hawkins J., & Klau M. (2000). Measuring potential vulnerabilities in emerging market economies, Bank for International Settlements. Monetary and Economic Department.

- Houben A. ir Kakes J. (2004). Toward a Framework for Safeguarding Financial Stability. IMF Working paper no. WP/04/101.

- Houben, A., Kakes J., & Schinasi, G. (2005). A practical approach to financial stability. The Financial Regulator 9(4).

- International Monetary Fund. (2020). How the IMF Promotes Global Economic Stability. Available online at: https://www.imf.org/en/About/Factsheets/Sheets/2016/07/27/15/22/How-the-IMF-Promotes-Global-Economic-Stability

- İlgün, M F. (2016). Financial development and domestic public debt in emerging economies: a panel cointegration analysis. Journal of Applied Economics and Business Research 6(4), 284-296.

- Janda, K., & Kravtsov, O. (2017). Time-varying effects of public debt on the financial and banking development in central and Eastern Europe. Munich Personal RePEc Archive 77325, 1-17.

- Jiang, L., Levine, R. 2019. Does competition affect bank risk? Available online at: https://faculty.haas.berkeley.edu/ross_levine/Papers/Bank%20Risk_02_2019.pdf

- Kroszner R., Laeven L., Klingebiel D. (2007). Banking crises, financial dependence, and growth. Journal of Financial Economics 84(1), 17-228.

- Levine, R., & Corbae, D. (2018). Competition, Stability, and Efficiency in the Banking Industry Available online at: https://faculty.haas.berkeley.edu/ross_levine/Papers/CorbaeLevine102118.pdf

- Liu, L. & Altshuler, R. (2013). Measuring the burden of the corporate income tax under imperfect competition. National Tax Journal 66(1).

- Nelson, W.R., & Perli, R. (2007). Selected indicators of financial stability. Risk Measurement and Systemic Risk 4, 343-372.

- OECD. (2019). Tax revenue trends in the OECD. Revenue Statistics 2019.

- Ozili P.K., and Thankom. A.G. 2018. Income smoothing among European systemic and non-systemic banks. The British Accounting Review.

- Paientko, T., & Oparin V. (2020). Reducing the Tax Burden in Ukraine: Changing Priorities. Central European Management Journal 28(3), 98-126.

- Riley G. (2009). Macroeconomic stability. Available online at: http://www.tutor2u.net/blog/index.php/economics/print/macroeconomic-stability

- Riley G. (2014). Macroeconomics.Tutor2ru

- Roosma, F., Oorschot, W. & Gelissen, J. (2015). A just distribution of burdens? Attitudes toward the social distribution of taxes in 26 welfare states, International Journal of Public Opinion Research 28(3), 376-400.

- Sharuddin, D., & Rama, A. (2017). Currency system and its impact on economic stability. Journal Ilmu Ekonomi Syariah (Journal of Islamic Economics 9(2), 289-310.

- Schinasi, G.J. (2006). Safeguarding Financial Stability: Theory and Practice. Washington, D.C., International Monetary Fund.

- Schakeldorf D.A., Slemrod, J., & Sallee, J.M. (2011). Financial reporting, tax, and real decisions: Toward a unifying framework. International Tax and Public Finance 18, 461-492.

- Tamai, T., & Myles, G. (2019). Unemployment, Tax Competition and Tax Transfer Policy. Economic research center 1-25.

- Skaržauskas, S. (2016). Influence of Tax Burden on Countries Financial Stability. Proccedings of 4th International Symposium of Business System Laboratory, Vilnius 189-192

- Staniuliene, G. (2015). Fiskalinių kintamųjų poveikio finansiniam stabilumui vertinimas. Doctoral Thesis, Vilnius.

- Van den End J. (2006). Indicator and boundaries of financial stability. No. 097, Netherlands Central Bank, Research Department.

- Vasiliauskaitė A., & Stankevičius E. (2009). Tax Burden Management and GDP growth: Case of EU. Ekonomika ir vadyba: 2009. 14.

- Vasileva, T. (2020). Tax Burden as an Indicator of Assessing the Impact of Taxation System on Region’s Economy. Advances in Social Science, Education and Humanities Research 392.