Research Article

INVESTIGATING THE EXISTENCE OF NON-LINEARITY IN THE DEBT-GROWTH NEXUS IN NIGERIA

3911

Views & Citations2911

Likes & Shares

This study employed the threshold regression analysis to assess the non-linear effects of aggregate public debt on economic growth in Nigeria using the stock of debt and institutional quality as the threshold variable. The analysis was based on quarterly time series data from 1984:Q1 to 2017:Q1 and an augmented standard neoclassical growth model. The threshold results revealed that the growth effect of public debt was more sensitive to institutional quality than the stock of debt. Specifically, when the stock of debt was used as the threshold variable, the study found that public debt exerted positive effect on growth below the threshold level, while its effect was insignificant above the threshold level. When institutional quality was used, however, results showed that public debt was growth promoting and growth inhibiting below and above the threshold level of corruption, respectively. The threshold findings using institutional quality as the threshold variable agreed with the conventional belief that the growth effects of public debt would tend to be positive at low levels of corruption, but negative at very high levels of corruption. Based on these findings, the study concluded that the Nigerian economy may suffer unsustainable debt accumulation and hence, long-term growth and stability problems if the level of corruption in the country is not kept at the barest minimum.

Keywords: Public debt, Economic growth, Nigeria, Non-linearity, Threshold regression

INTRODUCTION

The growing debt profiles in many countries, including those in Africa, have given rise to concerns that such debts could be unsustainable, thereby putting long-term growth and stability under threat. What makes the case of Africa critical is the argument by Devarajan, Gill and Karakülah (2019) that all that is needed is for the generality of African countries to experience debt crisis is for any of the continent’s large economies to find itself in debt distress. This implies that how well a country like Nigeria, which has one of the largest economies in Africa, is able to avoid debt crisis has far reaching implications. The history of public debt in Nigeria can be traced to the 1920s when the government secured loans from external sources for the purpose of creating and expanding infrastructure facilities, which include roads, railways as well as telegraph services (Ogunyemi, 2011). Since then, successive governments have continued to borrow not only externally but also internal lyin order to take care of the shortfall between revenue and expenditure.

The prevalence of budget deficits over the years has been occasioned largely by the dwindling revenue generated from oil which is the nation’s major export. As a matter of fact, the mobilization of resources from the domestic economy by government began in 1959 following the establishment of the Central Bank of Nigeria (CBN) a year earlier. One of the responsibilities of the CBN was the floating of treasury bills to enable the government to borrow from domestic investors. It was also the task of the apex bank to manage the country’s debts which had become substantial without commensurate results to show for them in terms of growth and development (Udeh, Ugwu & Onwuka, 2016). However, the step did not help much in improving the management of the country’s debt and this led to the establishment of the Debt Management Office (DMO) in 2000.The principal objective of the agency is to maintain reliable database of the country’s loans. It is also saddled with the responsibility of preparing and implementing a plan form an aging the country’s domestic and external domestic loan obligations efficiently (Sharkdam & Agbalajobi, 2012).

The country’s debts continued to increase as the years went by so much so that in 2005, the government of President Olusegun Obasanjo pleaded with the Paris Club for part of the nation’sdebt to be forgiven. As at that time, the country’s indebtedness to the Paris Club of creditors stood at US$30 billion. That step led to the writing off of 60% of Nigeria’s debt which amounted toUS$18 billion. Following this development, public financial management experts argued for the need for the government to come up with economic reforms targeted at consolidating the gains from the debt deal. This was with a view to ensuring that the country’s debt become sustainable and that the population share in the benefits from debt relief. However, the country did not achieve much in the area of sustainable debt management. Instead, successive governments continued to borrow to the extent that by September 2017, the country’s total indebtedness had risen toN17,189.697 trillion with little to show for it (Rafindadi & Musa, 2019).

The present administration, under the leadership of President Muhammadu Buhari, which is in its second tenure, has had its own share of loan acquisition. When the President took over power in 2015, the country’s external indebtedness was $10.32 billion (Okwunodu &Daniel, 2020). After approving the President’s request of $22.7 billion foreign loan in 2019, the Nigerian Senate put the country’s indebtedness at N33 trillion. The interesting part of it is that the administration is still proposing to take more loans as one of the response measures in overcoming the challenges posed by the COVID-19 pandemic and position the country on the path towards economic sustainability. However, many stakeholders, which include some section of the National Assembly, have continued to express their reservations about such loan requests. For example, Mr. Godwin Eohoi, who is the Registrar of the Institute of Finance and Control of Nigeria, argued in the April 16, 2019 edition of the Punch Newspaper that the concern is not about borrowing since debt is a leverage, but what the loans are used for. He stressed further that the loans should be acquired in such a way that it will engender exponential benefits for the economy and that where such is not in place, the debt will become a burden.

The foregoing shows that all the controversies surrounding public debt as well as its management and consequently its growth effects in Nigeria have not been resolved. It is against this backdrop that this study was undertaken with a view to contributing to the empirical analysis of the growth effects of public debt in Nigeria. The study followed recent works on the debt-growth link by focusing on the existence of non-linear effects. The decision to focus on the non-linear effects of public debt on growth was informed by theoretical as well as empirical considerations. It has been discovered that the behaviour of most economic and financial time series is non-linear over time and that their interaction with each other often follows a non-linear pattern (Atil, Lahiani & Nguyen, 2014). Some of the factors that have been suggested to be likely causesof the non-linear behaviour of time series aresuccessive episodes of economic and financial crises (such as the global financial crisis of 2008-2009) andgeopolitical tensions. Other factors include sudden changes in the business cycle and the complex nature of financial markets. These factors have the tendencies of causing public debt and economic growth, not only to behave in a non-linear manner, but also to interact in a non-linear pattern. Previous studies in this area in the context of Nigeria concentrated on panel analysis which included both developed and developing countries. The problem with such studies is that they may not yield results which are necessarily true for each of the countries that make up the panel, hence the need for a country-specific analysis.

EMPIRICAL REVIEW

Various studies have investigated the link between economic growth and aggregate public debt and/or its components in Nigeria. These studies can be divided into two broad categories based on their specification of the nature of the relationship between the two main variables. The first category of studies assumed a linear impact of public debt on economic growth. Some of these studies adopted the ordinary least squares (OLS) method of estimation and arrived at mixed results. For instance, (Akinwunmi & Adekoya, 2018) found that the growth effect of external debt was inverse and significant (Alagba & Eferakeya2019) obtained evidence in support of positive effects of both domestic and external debts, although the coefficient on the latter was insignificant (Laosebikan, Alao, Ajani, Alabi, & David 2018) found that the effects of the two components were positive and significant. (Ndidi 2020) as well as (Ogege & Ekpudu 2010) found negative and significant effects of the two components of public debt on economic growth. The results of the study by (Obisesan, Akosile & Ogunsanwo2019) revealed a negative and statistical impact of external debt on economic growth. (Umaru, Hamidu & Musa2013) arrived at results which showed that while the coefficient on domestic debt was positive and significant, that of external debt was negative but insignificant.

Another approach that has been used in this category is the error correction model (ECM). The evidence obtained by the studies which employed this approach is also mixed. For example, the results of the study by (Abula & Ben2016) revealed that while the impact of domestic debt on growth was positive and significant, that of external debt was negative but insignificant. (Elom-Obed, Odo, Elom-Obed & Anoke, 2017) found that the effects of both external and domestic debts were negative and significant, just as (Ezeabasili, Isu, & Mojekwu, 2011) found similar results for external debt. (Ebi, Abu & Clement, 2013) obtained evidence in support of a positive and insignificant effect of domestic debt, while that of external debt was positive and significant. The findings by (Ijirshar, Joseph & Godoo, 2016) on external debt were consistent with those reported by (Ebi, et al., 2013). The results obtained by (Ogbebor & Aigheyisi, 2019) for domestic debt in the short- and long-run were similar to the ones obtained by (Elom-Obed, Odo, Elom, & Anoke, 2017). The findings of both studies on external debt in the short and long run were similar to the ones obtained by (Abula & Ben, 2016), and (Ebi, Abu & Clement, 2013), respectively. For (Udeh, et al., 2016), the effects of external debt on economic growth were positive and negative in the short and long run, respectively.

Moreover, studies such as (Anderu, Omolade & Oguntuase, 2019) as well as Eze, Nweke & Atuma (2019), used the autoregressive distributed lag (ARDL) model in their analysis. They both found that the effect of external debt on growth was negative and significant. The results of Eze, et al., (2019) also showed that the impact of domestic debt was insignificant, although positive.

One major limitation of all the studies in the first category is their assumption of a linear relationship between debt and economic growth. This assumption has been faulted on the ground of being too restrictive as there is no basis for such. Specifically, these studies ignored the possibility of non-linearity in the link between the two variables. The possible existence of non-linear effects is a more plausible assumption since the effects of debt should not be expected to be the same at very moderate and at very high levels. Efforts to address this limitation, therefore, has led to the emergence of another category of studies. Thesestudies, most of which focused on advanced countries, anchored their analysis on the existence of non-linearity in the relationshipbetween debt and economic growth. The emergence of this category is also partly as a result of efforts to subject the results obtained in a widely acclaimed study by Reinhart and Rogoff (2010) to more formal econometric testing. Using data on 44 countries between 1946 and 2009 as well as simple descriptive statistics, (Reinhart & Rogoff, 2010) showed that economic growth slowed down considerably if the ratio of public debt to GDP exceeded 90%.

This second category comprises two strands in view of the non-linear specification adopted. The first strand modeled non-linearity by including a quadratic term in the growth regression. Studies in this strand include (Checherita- Westphal & Rother, 2012) whose study of 12 European countries showed that the effect of debt on growth became negative when debt-to-GDP ratio was above 90–100%. Also, (Kumar & Woo, 2010) found the turning point of public debt-to-GDP ratio to be 90% using a spline regression analysis for a sample consisting of advanced and developing countries.

However, this first approach to modeling non-linearity in the debt-growth link has been faulted based on its exogenous determination of the threshold. In view of this, scholars argued for the need to find an alternative approach that would be able to determine the threshold level of debt rather than fix the thresholds at arbitrary values. This led to the second strand of studies whose analysis was based on the use of the modeling approach known as threshold regression, with public or government debt as the threshold variable. Two variants of the threshold regression methodology has been used in the literature on the debt-growth nexus. The first one is the Panel Threshold Regression methodology developed by Hansen (1999). Studies which used this variant in their analysis include Cecchetti, (Mohanty & Zampolli, 2011) with the results indicating a threshold level of 95% for debt-to-GDP ratio for a sample of 18 Organisation for Economic Construction and Development (OECD) countries.

Also, using a panel data set of 25 developed and 74 developing economies which included Nigeria, Caner, (Grennes & Köhler-Geib, 2010) found a threshold level of 77% for all the countries beyond which public debt hampers growth. They also showed that this non-linear impact was more pronounced for developing countries and that their threshold was lower (64%). Égert (2015) failed to find a robust non-linear relationship between public debt and growth using (Reinhart & Rogoff, 2010)'s dataset, but found negative non-linear correlation at very low levels of public debt (between 20% and 60% of GDP). Focusing on 12 Euro area countries, Baum, (Checherita-Westphal, & Rother, 2013) showed that the short-run impact of public debt on growth was significantly positive, while the impact declined to zero and became insignificant beyond public debt-to GDP ratios of around 67%. Their results also revealed that for higher debt ratios above (95%), the effect turned to negative.

(Kourtellos, Stengos, & Tan, 2013) employed a structural threshold regression methodology. They found that public debt led to lower growth if a country's institutions fell below a particular quality level, while public debt was growth neutral for countries with highly qualified institutions. In addition, (Chudik, Mohaddes, Pesaran & Raissi, 2017) used data on a sample of 19 advanced and 21 developing countries including Nigeria between 1965 and 2010. They found a threshold effect in the range of 60 to 80% for the whole sample of 40 countries. Their results also revealed that the threshold was significantly lower for the developing countries with the value ranging between 30 and 60% as opposed to 80% for their advanced counterparts.

The second variant of the threshold regression methodology is the Panel Smooth Transition Regression (PSTR) model developed by Gonzales, (Terasvirta & Dijk, 2005). The few studies which employed this approach include Chang and Chiang (2009) while investigating the non-linear relationship between government debt ratio and growth for a sample of 15 OECD countries. They used yearly observations for the period 1990–2004 and found two debt-to-GDP threshold values, 32.3%and 66.25%, for which the impact of debt was significantly positive in all three extreme regimes, been higher in the middle but lower in the two outer regimes. Also, Minea and Parent (2012) used Reinhart and Rogoff (2010) dataset and found that public debt negatively affected growth when debt-to-GDP ratio was above 90% and below 115%. In addition, Karadam (2018) used a large panel datasetcovering 23 advanced and 113 developing economies which included Nigeria over the period 1970–2012. They found a debt threshold of 88% for the developing countries while it was 106.6% for the whole sample. This implied that public debt could hurt growth at lower levels of debt for developing economies relative to their advanced counterparts.

One thing that is common to all the studies which employed the two variants of the threshold regression approach is that they were based on panel data analysis. Hence, they did not capture country-specific differences since what holds true for a panel of countries may not necessarily hold true for each of the countries that make up the panel. Consequently, the aim of this study was to complement the existing ones by examining the threshold effects of public debt on economic growth in Nigeria using quarterly time series data. Two important growth determinants were used as the threshold variables, namely, public debt itself as well as institutional quality. The inclusion of the latter was informed by the finding of the study by Kourtellos et al. (2013) that the growth effect of public debt was shaped by the quality level of institutions.

METHODOLOGY

This section focuses mainly on the theoretical framework, model specification, technique of estimation, source of data, description and measurement of variables as well as contribution to knowledge.

Theoretical Framework

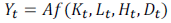

In analysing the impact of public debt on economic growth in Nigeria, this study employed the Debt Laffer Curve theory. The theory establishes a non-linear relationship between debt and growth and states that there is an optimal level of debt that promotes growth while further debt accumulation beyond that threshold impedes growth. While following the dictate of the theory, the debt–growth nexus was explored using an aggregate production function augmented with a debt variable. This allowed for testing the impact of debt after controlling for the basic drivers of growth, namely, the stock of physical capital, the labour input and a measure of human capital. In doing this, the study followed the approach by (Gómez-Puig & Sosvilla-Rivero, 2017) which is an extension of the standard neoclassical growth model of Eberhardt and Presbitero (2015). Hence, the paper considered the following aggregate production function, in which public debt was included as a separate factor of production:

(1)

(1)where Y is economic growth or the level of output, A is an index of technological progress, K is the stock of physical capital, L is the labour input, H is the human capital, and D is the stock of public debt.

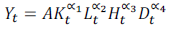

A Cobb-Douglas specification of the production function in equation (1) was employed for the sake of simplicity as follows:

(2)

(2)A logarithmic transformation of both sides of equation (2) as well as the addition of the error term yieldedthe econometric model estimated in the study as follows:

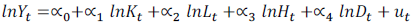

(3)

(3)where denotes natural logarithm, and

Model Specification

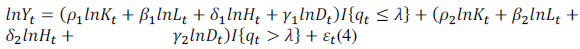

To arrive at the estimating model for this study in the light of the Debt Laffer Curve theory, the linear model in equation (3) was transformed into a threshold framework in order to capture the existence of non-linearity as follows:

where all the variables are as earlier defined and is the threshold variable. is an indicator function, denotes the threshold parameter or value which divides the observations into two regimes, while and are the slope parameters associated with the two regimes, respectively. The error term, is a zero mean idiosyncratic random disturbance.

Estimation Technique

Equation (4), which was the model used for the empirical analysis of the study, was estimated using Stata 15's threshold command which fits threshold models. When applied to time-series datasets such as the one employed in this study, thresholds delineate one regime or state from another. There is one effect (one set of coefficients) up to the threshold and another effect (another set of coefficients) beyond it. The confirmation of the existence or otherwise of threshold effects was done by using the Wald test developed by Judge, Griffiths, Hill, Lutkepohl and Lee (1985). Under the test, the null hypothesis of linear effects, was tested against the alternative of threshold effects for each of the two threshold variables, where is the difference between the coefficients of the two regimes. The test is available as a standard post estimation command after implementing Stata 15’s threshold command. Acceptance of the null hypothesis would reduce the threshold regression in equation (4) to the linear model in equation (3).

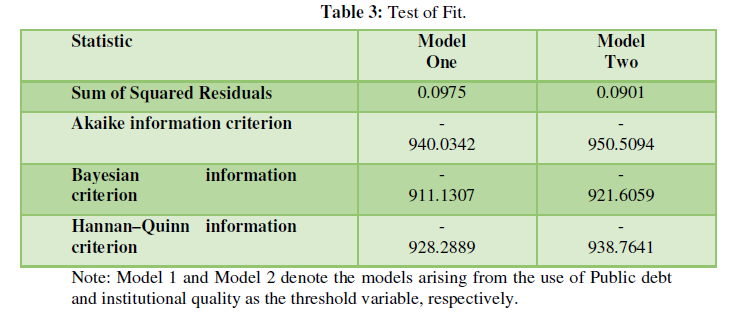

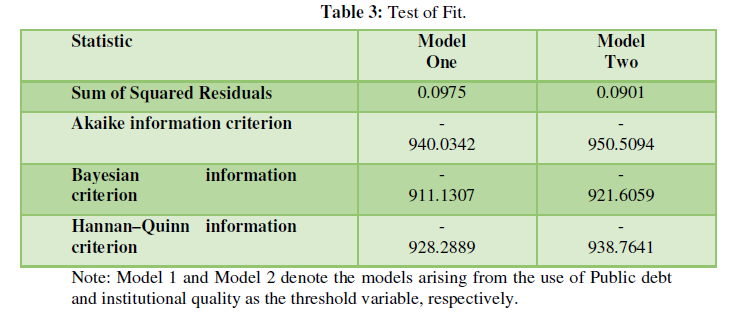

Two variables were used as the threshold variable one after the other and this yielded two threshold regression models. The first variable was public debt since it was the main explanatory variable of the study. The second one was institutional quality and this was done in the light of Kourtellos et al. (2013)’s finding that the threshold effect of public debt on economic growth was shaped by the quality level of institutions rather than debt itself. In order to determine which of the two threshold regression models provided the better fit, the study compared the Sum of Squared Residuals (SSR) as well as the three information criteria obtained from the two fitted models. The decision rule was to select the model that contributed more in minimising the SSR and the information criteria.

Measurement of Variables and Sources of Data

This study employed annual time-series data over the period 1984-2017 due to data availability. Economic growth was measured using GDP (constant 2010 US$). The stock of physical capital was measured using gross fixed capital formation (percentage of GDP). To measure human capital, the study used life expectancy at birth (total) in years. Data on the three variables were obtained from World Bank’s World Development Indicators (WDI) database, 2019 version. Labour input was measured using the total labour force obtained from the WDI database augmented with number of persons engaged as obtained from the Penn World Table (PWT) database, 9.0 version (see Feenstra, Inklaar & Timmer, 2015 for details on PWT). Gross government debt-to-GDP ratios were used as proxy for the stock of public debt. These ratios were obtained from the Historical Public Debt database published by International Monetary Fund’s Fiscal Affairs Department (see Abbas, Belhocine, El-Ganainy & Horton, 2011 for details). Lastly, institutional quality, which was used as an alternative threshold variable in the light of the study by Kourtellos et al. (2013), was measured using the Bayesian Corruption Indicator (BCI) developed by the Sherppa Ghent University. The BCI index is a composite index of the perceived overall level of corruption and lies between 0 and 100, with zero corresponding to absolutely no corruption. The collected data were converted into quarterly data using the linear interpolation method in order to have sufficient data points for the threshold estimation.

EMPIRICAL RESULTS

This section presents the results obtained by the study in terms of the non-linear effects of public debt on economic growth as well as the interpretation of these findings.

Descriptive Statistics

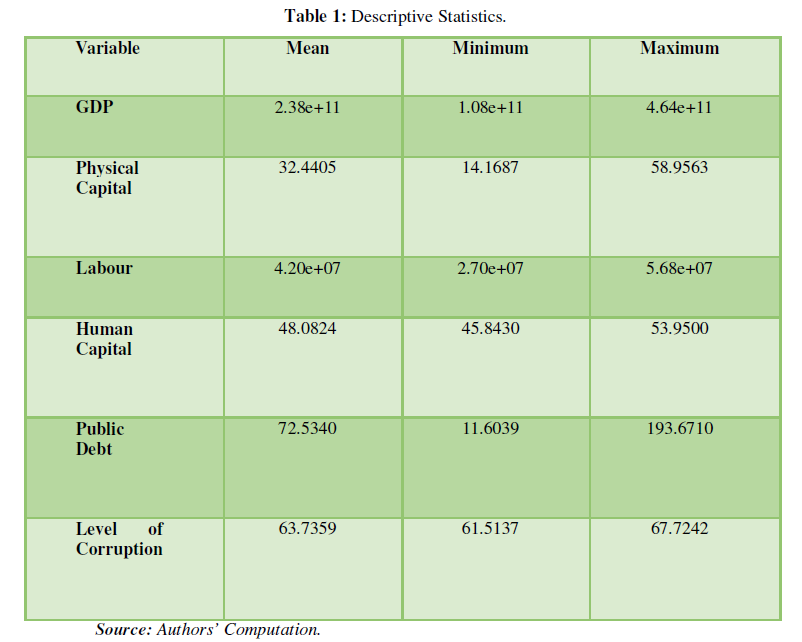

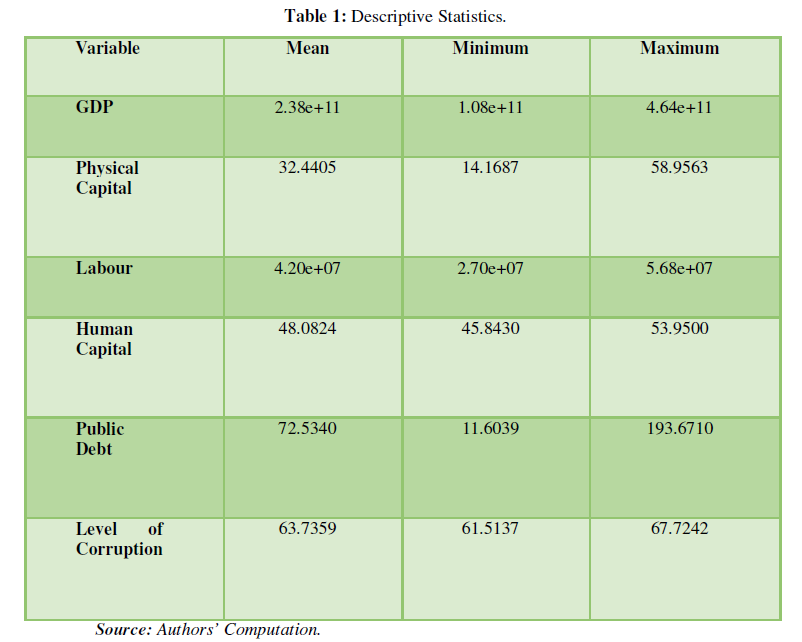

Before delving into formal empirical analysis, the summary statistics for all the variables in the dataset for the study were calculated. Results of the calculation are shown in Table 1.

The statistics in Table 1 showed a wide margin between minimum and maximum government gross debt-to-GDP ratios (11.6039 and 193.6710, respectively). This margin should be expected to increase over time if debt accumulation trajectory is maintained. The Table also revealed that both minimum and maximum corruption indices were above the half mark (on a scale of 0 to 100), which might be interpreted as fairly poor institutional quality for Nigeria.

Threshold Regression Results

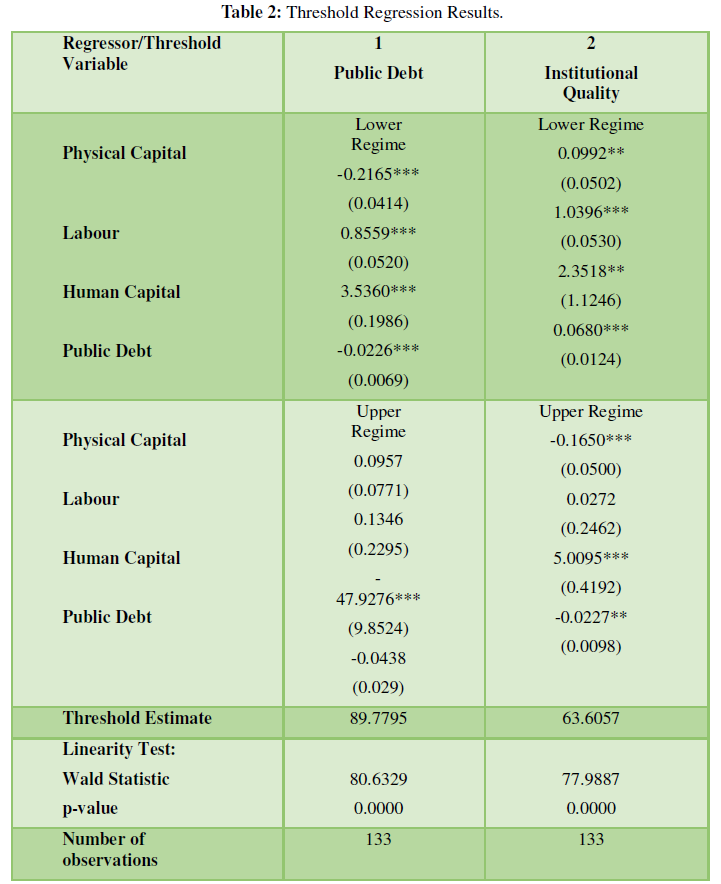

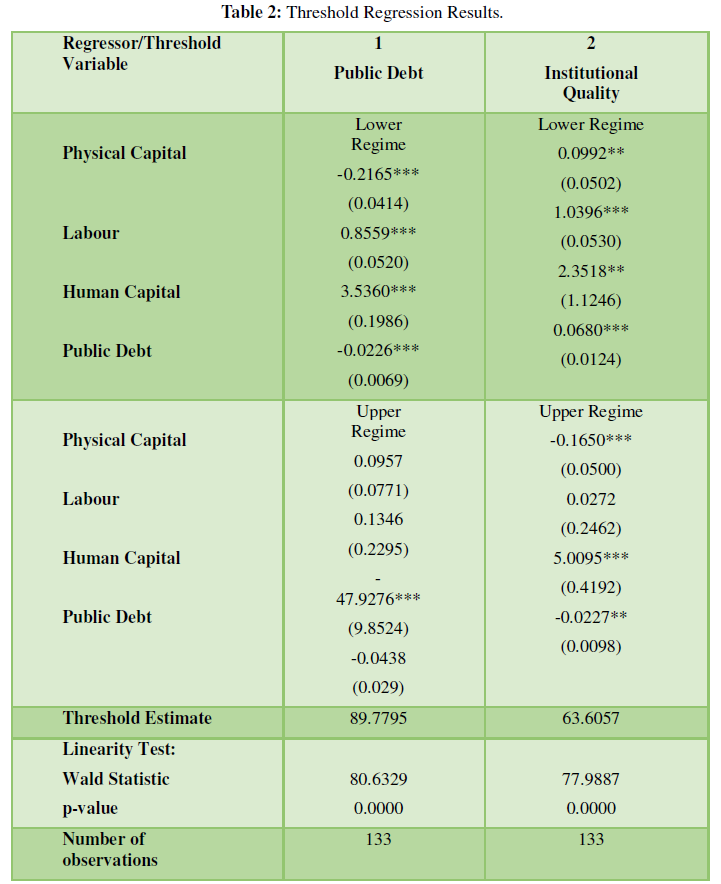

The results obtained from estimating equation (4) with Stata 15’s threshold command using debt as the threshold variable are presented in column 1 of Table 2.

significance at 1%, 5% and 10% levels, respectivelyThe null hypothesis of the linearity test was that there is no threshold effect.

Source: Authors’ computations.

The results showed that the threshold level of debt-to-GDP ratio was about 90%, and that based on the Wald statistic of 80.6329 (p-value , the null of no threshold cannot be accepted at 1% level of significance. The findings also revealed that while the coefficients on labour and human capital in the low-debt regime were positive and significant at 1%, those on physical capital and public debt were negative and significant at 1%. As for the parameter estimates obtained for the high-debt regime, the results showed that while the coefficient on human capital was negative and significant, those on physical capital, labour and public debt were insignificant. This implies that while increase in public debt below the threshold value of debt-to-GDP ratio promoted growth, the growth effect of public debt above the threshold value was insignificant.

These findings contradicted the postulation of the Debt Laffer Curve theory that debt accumulation, particularly at any debt level above a certain threshold, can retard growth. The results, however, supported the finding by Kourtellos et al. (2013) that the use of public debt as the threshold variable when investigating the non-linear effects of debt on growth would yield inconsistent estimates. The authors found that what was responsible for the existence of threshold effects in the debt-growth link was actually the quality of institutions rather than the level of debt itself. In the light of this, this study re-estimated equation (4) using institutional quality as the threshold variable in order to ascertain the extent to which the finding was true for Nigeria. The results of this second threshold regression model are presented in Column 2 of Table 2.

The results revealed that the threshold index of institutional quality was about 64, and that based on the Wald statistic of 77.9887 (p-value , the null of no threshold cannot be accepted at 1% level of significance. The findings also revealed that the coefficients on all the explanatory variables in the low-corruption regime were positive and significant at 5%. This implied that at low level of corruption, each of physical capital, labour, human capital and public debt would promote economic growth in Nigeria. Furthermore, the results showed that while the coefficients on labour and human capital were positive in the high-corruption regime although that of labour was insignificant, those on physical capital and public debt were negative and significant. This implies that further accumulation of debt above the threshold value of corruption index would retard growth. This finding is, therefore, in line with the the evidence obtained by Kourtellos et al. (2013).

The study compared the SSR and the three information criteria obtained from the two fitted regression models in order to determine the one that provided the better fit. As shown in Table 3, the model involving the use of institutional quality contributed more to minimising the SSR and the information criteria than the model involving the use of debt itself. In view of this, the former was considered as providing the better fit. This, therefore, confirmed the position that the use of institutional quality as the threshold variable in the analysis of the growth effects of public debt would yield more reliable estimates than debt itself.

DISCUSSION OF FINDINGS

The study found that the positive growth effect of public debt changes to negative above the threshold level of corruption index. This is not surprising as good institutions would ensure that borrowed funds are channeled into productive uses for the benefits of the vast majority which would generate high returns. Part of the generated returns constitute what would be used in servicing the debts as well as pay back the principal as and when due. In such a setting, increase in public debt would lead to more growth which would ensure that the debts are sustainable. Conversely, poor institutional quality would allow for the borrowed funds to be allocated for the benefits of just the privileged few who hold political positions. Hence, there is no concern about whether the funds are committed to projects that would generate enough benefits to service the debt and pay back the principal. In such a setting, therefore, increase in debt accumulation would likely retard growth, thereby making such debts unsustainable.

CONCLUSION AND RECOMMENDATIONS

This study complemented the existing studies on the debt-growth nexus in Nigeria by investigating the existence of non-linear effects in the relationship. This was with a view to investigating whether the concern that some developing countries stand the risk of unsustainable debt accumulation, and hence, long-term growth and stability problems, was true in the case of Nigeria. Findings showed that it was the quality of institutions rather than the absolute size of debt that matters. Specifically, the study found that while increase in public debt below the threshold value of debt-to-GDP ratio promoted growth, the growth effect of public debt above the threshold value was insignificant. Results also showed that while public debt would promote economic growth at low level of corruption (below the threshold value), further accumulation of debt above the threshold value of corruption index would retard growth. Based on these findings, the Nigerian economy may face the problem of unsustainable debts which has the potentials of hampering long-term growth and stability if the level of corruption in the country is not kept at the barest minimum. It is therefore recommended that the government needs to show more sincerity and commitment to its anti-graft crusade. All anti-corruption agencies in the country need to be strengthened and allowed to carry out their duties without any interference from the government. The anti-graft institutions on their part should not be selective in their handling of corruption cases and must ensure that justice is served at all times.

- Abbas, S.A., Belhocine, N., El-Ganainy, A., & Horton, M. (2011). Historical patterns and dynamics of public debt—evidence from a new database. IMF Economic Review 59(4), 717-742.

- Abula, M., & Ben, D.M. (2016). The impact of public debt on economic development of Nigeria. Asian Research Journal of Arts & Social Sciences 1(1), 1-16.

- Akinwunmi, A.A., & Adekoya, R.B. (2018). Assessment of the impact of external borrowing on the economic growth of the developing countries-Nigerian Experience. Asian Business Research 3(1), 29-40.

- Alagba, O.S., & Idowu, E. (2019). Effect of public debt on economic growth in Nigeria: An empirical analysis. International Journal of Business and Economic Development 7(2), 10-18.

- Anderu, K.S., Omolade, A., & Oguntuase, A. (2019). External debt and economic growth in Nigeria. Journal of African Union Studies 8(3), 157-171.

- Atil, A., Lahiani, A., &Nguyen, D.K. (2014). Asymmetric and non-linear pass-through of crude oil prices to gasoline and natural gas prices. Energy Policy 65, 567-573.

- Baum, A., Westphal, C.C., & Rother, P. (2013). Debt and growth: New evidence for the euro area. Journal of International Money and Finance 32, 809-821.

- Caner, M., Grennes, T.J., & Geib, F.K. (2010). Finding the Tipping Point - When Sovereign Debt Turns Bad. SSRN Electronic Journal.

- Cecchetti, S.G., Mohanty, M., & Zampolli, F. (2011). Achieving growth amid fiscal imbalances: the real effects of debt. In Economic Symposium Conference Proceedings 352, 145-96. Federal Reserve Bank of Kansas City.

- Chang, T., & Chiang, G. (2009). The Behaviour of OECD public debt: A panel smooth transition regression approach. The Empirical Economics Letters, 8(1).

- Westphal, C.C., & Rother, P. (2012). The impact of high government debt on economic growth and its channels: An empirical investigation for the euro area. European Economic Review 56(7), 1392-1405.

- Chudik, A., Mohaddes, K., Pesaran, M.H., & Raissi, M. (2017). Is there a debt-threshold effect on output growth? Review of Economics and Statistics 99(1), 135-150.

- Devarajan, S., Gill, I.S., & Karakulah, K. (2019). Africa’s Debt: Three Concerns, Three Remedies.Duke Global Working Paper Series No. 2019/09. Available online at: http://dx.doi.org/10.2139/ssrn.3422880

- Eberhardt, M., & Presbitero, A.F. (2015). Public debt and growth: Heterogeneity and non-linearity. Journal of International Economics 97(1), 45-58.

- Ebi, B.O., Abu, M., & Clement, O.D. (2013). The relative potency of external and domestic debts on economic performance in Nigeria. European Journal of Humanities and Social Sciences 27(1), 1414-1429.

- Égert, B. (2015). Public debt, economic growth and nonlinear effects: Myth or reality? Journal of Macroeconomics 43, 226-238.

- Elom-Obed, F.O., Odo, S.I., Elom-Obed, O., & Anoke, C.I. (2017). Public debt and economic growth in Nigeria. Asian Research Journal of Arts & Social Sciences 4(3), 1-16.

- Eze, O.M., Nweke, A.M., & Atuma, E. (2019). Public debts and Nigeria’s economic growth. IOSR Journal of Economics and Finance 10(3), 24-40.

- Ezeabasili, V.N., Isu, H.O., & Mojekwu, J.N. (2011). Nigeria’s external debt and economic growth: An error correction approach. International Journal of Business and Management 6(5), 156-170.

- Feenstra, R.C., Inklaar, R., & Timmer, M.P. (2015). The next generation of the Penn World Table. American economic review 105(10), 3150-3182.

- Gómez-Puig, M., & Sosvilla-Rivero, S. (2017). Public debt and economic growth: Further evidence for the euro area. IREA Working Papers 201715, University of Barcelona, Research Institute of Applied Economics.

- Gonzalez, A., Teräsvirta, T., Van Dijk, D., & Yang, Y. (2005). Panel smooth transition regression models.Working Paper Series in Economics and Finance No. 604. Stockholm School of Economics,Sweden.

- Hansen, B.E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of econometrics 93(2), 345-368.

- Ijirshar, V.U., Joseph, F., & Godoo, M. (2016). The relationship between external debt and economic growth in Nigeria. International Journal of Economics & Management Sciences 6(1), 1-5.

- Judge, G.G., Griffiths, W.E., Hill, R.C., Lutkepohl, H., & Lee, T.C. (1985). The Theory and Practice of Econometrics.2nd ed. New York: Wiley.

- Karadam, D.Y. (2018). An investigation of nonlinear effects of debt on growth. The Journal of Economic Asymmetries 18.

- Kourtellos, A., Stengos, T., & Tan, C.M. (2013). The effect of public debt on growth in multiple regimes. Journal of Macroeconomics 38, 35-43.

- Kumar, M., & Woo, J. (2010). Public debt and growth. IMF Working PapersWP/10/174 International Monetary Fund.

- Laosebikan, J.O., Alao, J.A., Ajani, J.O., Alabi, F.A., & David, J.O. (2018). Federal Government Domestic and External Debt: Implications on Nigeria’s Economic Growth. International Journal of Innovative Finance and Economics Research 6(4), 95-106.

- Minea, A., & Parent, A. (2012). Is high public debt always harmful to economic growth? Reinhart and Rogoff and some complex nonlinearities. CERDI Working Papers No. 201218, University of Auvergne, Clermont-Ferrand.

- Ndidi, D.A. (2020). Public Debt and Economic Growth in Nigeria. Salem Journal of Business and Economy 6(2), 111-117.

- Obisesan, O.G., Akosile, M.O., & Ogunsanwo, O.F. (2019). Effect of External Debt on Economic Growth in Nigeria. African Journal of Economics and Sustainable Development 2(1), 39-50.

- Ogbebor, O., & Aigheyisi, O. (2019). Public Debt, Foreign Direct Investment and Economic Growth in Nigeria. Finance& Economics Review 1(1), 1-23.

- Ogege, S., & Ekpudu, J.E. (2010). The effects of debt burden on the Nigerian economy. Journal of research in national development 8(2).

- Ogunyemi, A.O. (2011). Rethinking the origin of Nigeria's debt burden: A historical reconstruction. Journal of the Historical Society of Nigeria 20, 26-44.

- Okwunodu, J.N., & Daniel, C.O. (2020). Loan-Dependent Budget and Debt Crisis in Nigeria: An Assessment of the Buhari’s Regime. International Journal of Scientific and Engineering Research 11(4), 1202-1205.

- Rafindadi, A.A., & Musa, A. (2019). An empirical analysis of the impact of public debt management strategies on Nigeria’s debt profile. International Journal of Economics and Financial Issues 9(2), 125-137.

- Reinhart, C.M., &Rogoff, K.S. (2010). Growth in a Time of Debt. The American Economic Review 100(2), 573-78.

- Sharkdam, W., & Agbalajobi, D.T. (2012). The Administration and the Campaign for External Debt Relief for Nigeria. Journal of Social Science and Policy Review 4, 30-44.

- Udeh, S.N., Ugwu, J.I., & Onwuka, I.O. (2016). External debt and economic growth: The Nigeria experience. European Journal of Accounting Auditing and Finance Research 4(2), 33-48.

- Umaru, A., Hamidu, A., & Musa, S. (2013). External debt and domestic debt impact on the growth of the Nigerian economy. International Journal of Educational Research 1(2), 70-85.