Research Article

STRATEGIC GROWTH CASE STUDY: STARBUCKS

18835

Views & Citations17835

Likes & Shares

In the strategy of this article on Starbucks, we will first present a PESTEL analysis to identify the external factors that affect them, an analysis of Porter's five forces as well as a competitor analysis. Then we will analyze the strategic capabilities of Starbucks, which will be identified through resource control, by analyzing the value system, by identifying its potential key features and by identifying key stakeholders. A Starbucks SWOT analysis will then be presented as well as three possible one’s strategic development options that the company has.

The following is a critical comment on the international Starbucks chain. For this purpose, a brief presentation will be made of the company, its market position and its activities. Then the industry framework in which it operates will be analyzed, analyzing both its internal and external elements.

The purpose of this article is to explore the appropriate growth and competitiveness strategies and its survival in today's tough competitiveness.

Finally, based on the data that will be analyzed and the general knowledge, some suggestions are presented regarding the future of Starbucks and their development.

Keywords: Development strategy, Penetration, Cafeteria, Competitiveness

INTRODUCTION

The concept of business strategy is a complex concept and includes the long-term goals of a business, its overall vision and mission. of its long-term goals. The acceptance of a strategy has other positive dimensions for the company, as it coordinates the decision-making processes, the actions and the positions of the company in its internal and external market and towards its competitors".

At the same time, the links between businesses and governments around the world have become clearer and more important, and it is widely accepted that we are in a new internationalized environment.

Businesses need to be able to constantly look for new markets in order to identify new market segments and changes in customer profile and behavior in order to create new products or services that will match those changes.

The standard approach cannot bring value, and executives try to create market-leading brands only by differentiating themselves from the competition.

Thus, in the present case, Starbucks is considering the possibility of greater market growth worldwide and to focus its strategy on the development of more countries.

Starbucks through its expansion, not only has created a strong image for its brand but also an exclusive image since no competing company seems to have done something similar in terms of its growth strategies.

COMPANY BACKGROUND

The Early Years

The first store located across the street from Seattle's historic Pike Place Market. The three Starbucks founders shared two traits: they all came from a background in academics, and they all liked coffee and tea. They borrowed money and spent to open the first Starbucks in Seattle, which they called after the first partner in Herman Melville's classic novel Moby Dick.

Alfred Peet, a coffee roasting entrepreneur, was a significant influence on the Starbucks founders. During the 1950s, Peet, a Dutch refugee, began smuggling fine arabica coffees into the United States. He founded Peet's Coffee and Tea in Berkeley, California, in 1966, specializing in sourcing high-quality coffees and teas. Starbucks' designers were inspired by Peet's popularity to focus their business strategy on supplying high-quality coffee beans and supplies, and Peet's became Starbucks' first green coffee bean supplier. Baldwin and Bowker then bought a used roaster in Holland and worked with Alfred Peet's roasting techniques to develop their own blends and flavors. Starbucks had opened four stores in Seattle by the early 1980s, one of which stood out from the market for its high-quality fresh-roasted coffee. In 1980, Siegel left the corporation to seek other interests, leaving the two remaining partners with Baldwin as president.

The Howard Schultz Era

Howard Schultz, a sales agent for Hammarplast, a Swedish firm that manufactured kitchen appliances and house wares from which Starbucks ordered drip coffee makers, observed the company's huge orders and wanted to pay it a visit in 1981. Schultz was so intrigued that he agreed to work for Starbucks, and in 1982 he was appointed as the company's head of communications. Since first-time shoppers were often uneasy in the shops due to their lack of information about fine coffees, Schultz collaborated with store staff to improve customer-friendly sales skills and created brochures that made learning about the company's goods simple for customers.

When the organization sent Schultz to Milan to attend an international house wares fair in the spring of 1983, he had his biggest vision for the future of Starbucks. He was fascinated by the country's cafés while in Italy, and he considered doing something similar in Starbucks. Baldwin and Bowker, on the other hand, were not optimistic about Schultz's proposal because they did not want Starbucks to stray too far from its conventional business model. They did not want Starbucks to become a café selling espressos and cappuccinos, but rather a coffee and supplies store.

Schultz quit Starbucks in 1985 after discovering he would not be able to convince Baldwin and Bowker to accept the café model. He launched his own coffee chain, Il Giornale, which was an instant success, rapidly spreading into several locations. When Baldwin and Bowker agreed to sell Starbucks in March 1987, Schultz jumped at the opportunity. He consolidated all of his activities under the Starbucks banner and devoted himself to the café model, with additional sales of beans, supplies, and other products in Starbucks outlets. The company embarked on a rapid growth phase, which began after it went public in 1992. Starbucks quickly rose to become the world's biggest coffeehouse chain. Starbucks had a footprint in hundreds of countries and controlled over 20,000 outlets by the early twenty-first century.

PESTEL ANALYSIS

Political factors

Starbucks is the world's leading specialty coffee roaster and retailer. It has over 32,000 sites in more than 80 countries (Starbucks,2020). Since this is a huge undertaking, it can open the organization to certain difficult political activities and decisions.

Starbucks has benefited from political prosperity in the United States, the United Kingdom, the European Union, and several other nations. Trading in a variety of countries (in addition to the ones mentioned above), such as Bahrain, Belgium, Brazil, China, Colombia, Costa Rica, Egypt, India, Luxembourg, Malaysia, Mexico, Monaco, Morocco, Qatar, Romania, Russia, Saudi Arabia, Singapore, Slovakia, Trinidad and Tobago, Turkey, and several others, necessitates adjusting to diverse political and legal structures. Similarly, global upheavals in some countries influence the company's day-to-day activities and raw material procurement (Sholihah, Ahmed & Prabandari, 2016).

Economic factors

Starbucks is marketed as a high-end, specialty coffee shop. This placement influences the company's pricing strategy. Owing to the high prices of its goods, many people in both developed and developing countries may find it difficult to drink a cup of quality coffee every day due to financial constraints. Many of the countries where Starbucks works will face major obstacles in 2020. Starbucks is reported to have lost $3.1 billion in sales. It is, however, positive about its second-largest market, China. (Lucas, 2020).

Starbucks is dealing with rising labor and maintenance costs. However, though wages in the United States, the United Kingdom, and the European Union are comparatively high, this is not the case in many other nations. Another thing to remember is that there are many cheaper options available, making Starbucks' competition incredibly competitive.

Social factors

The social climate is an important topic to explore in the PESTEL study of Starbucks. Coffee culture is undeniably well-established in most developing countries. Many people drink several cups of coffee a day. Coffee intake has risen in developed countries as well. This is, in effect, what is fueling Starbucks' rapid expansion in many countries. The firm, however, has suffered a significant setback as a result of social distancing laws. In the coming years, these rules may require the organization to limit the number of seats available in its restaurants.

Starbucks has poured millions of dollars into projects to help urban cities boost their social conditions. It offered career openings for many unemployed and out-of-school young people aged 6 to 24. Ses programs, along with a slew of others, continue to improve the company's corporate profile (Haskova, 2015).

Technological factors

Starbucks has done an excellent job of incorporating emerging technology. Customers, for example, receive personalized order recommendations created by a learning framework designed and hosted in Microsoft Azure (Sokolowski, 2019). Similarly, the corporation uses AI to collect large volumes of data from millions of purchases every week.

In 2014, Starbucks launched its Smartphone Order & Pay service, which helps consumers to request orders ahead of time and pay for them when they pick up their orders at the store (SBUX, 2016). It is still on the lookout for new technological breakthroughs. Starbucks is, without a doubt, a technology leader in the coffee industry.

Environmental factors

Starbucks has been accused by many of polluting the climate. Starbucks uses tens of thousands of cups per minute, the majority of which are not recyclable. Plastic pollution has a massive effect on water, fisheries, and human wellbeing. However, the firm has taken a series of steps to reduce the environmental footprint of its activities. For eg,in August 2020, it announced the launch of Circular Cup (a reusable cup) in UK shops. Reusable cups are being launched in Europe, the Middle East, and Africa as well. It has also set a 2030 goal for biomass, power, and waste reduction.

Legal factors

Starbucks has been fined in several countries in recent years on a variety of topics. For example, the Westminster Magistrates Court in London fined it in 2016 for leaving trash bags on the street outside of collection hours. Similarly, the National Anti-Profiteering Authority of India fined it Rs 1.04 crore in 2020. As a result, it is important for Starbucks to ensure that it complies with all applicable laws and regulations in the countries where it operates.

FIVE FORCES OF PORTER

Competitive Rivalry or Competition with Starbucks Coffee Company (Strong Force)

In the food service and coffeehouse markets, Starbucks is up against a heavy force of economic rivalry or competitiveness. This influence is linked to the effect of companies on each other and the industry climate in the Five Forces analysis model. The following external conditions lead to the intense force of rivalry in the case of Starbucks Coffee Company:

- Large number of firms (strong force)

- Moderate variety of firms (moderate force)

- Low switching costs (strong force)

The vast number of companies is an external force that heightens competition. Starbucks Corporation is up against a slew of smaller rivals. In this respect, the competitor population is moderately complex in terms of specialization and technique. Such moderate range, according to this Starbucks Five Forces review, increases the degree of competitiveness in the sector. Furthermore, because of the low conversion costs, which are the drawbacks that customers face when switching from one service to another, rivalry is bolstered. Consumers who move from the business to other coffeehouses, for example, face minor drawbacks in this situation. Competition is one of the company's top-priority obstacles, according to this portion of the Five Powers review. The general approach and intensive growth plans of Starbucks Company are competitive approaches to rivalry (Geereddy, 2013).

Bargaining Power of Starbucks’s Customers/Buyers (Strong Force)

The powerful force or purchasing power of consumers or clients is sensed by Starbucks Coffee Corporation. This power is focused on the impact of individual customers and groups of customers on the international market climate in Porter's Five Forces analysis model. In the case of Starbucks Corporation, the following external conditions lead to consumers' high bargaining power:

- Low switching costs (strong force)

- High substitute availability (strong force)

- Small size of individual buyers (weak force)

The purchasing power of customers is one of the most important factors impacting the company in this aspect of the Five Forces analysis model of industry. Customers can quickly migrate from Starbucks to other brands due to the low switching costs. Furthermore, the abundance of substitutes means that customers can avoid Starbucks if they so desire, as there are numerous alternatives, such as instant beverages from vending machines. The assumption that individual purchases are limited in contrast to the company's overall profits is overwhelmed by these influential forces. Individual sales are minimal, implying that individual customers have little impact on the company. Despite this vulnerability, the other two external influences raise consumers' purchasing power. As a result, this aspect of the Five Forces review demonstrates that consumer bargaining power is a high-priority strategic concern. Starbucks Corporation's campaign blend, or 4Ps, promote brand strengthening by addressing customer purchasing power in part (Haskova, 2015).

Bargaining Power of Starbucks Coffee’s Suppliers (Weak Force)

Starbucks Coffee faces the weak force or bargaining power of suppliers. Porter’s Five Forces analysis model considers this force as the influence that suppliers have on the company and its industry environment. The following external factors contribute to the weak bargaining power of suppliers on Starbucks Corporation:

- Moderate size of individual suppliers (moderate force)

- High variety of suppliers (weak force)

- Large overall supply (weak force)

An external consideration that exerts a moderate impact on Starbucks is the moderate scale of individual suppliers. The vast number of vendors, on the other hand, limits their bargaining power. Suppliers, for example, employ a variety of tactics and competencies to compete against one another to increase sales by selling more products, such as coffee beans, to Starbucks Corporation. Because of the broad total stock, producers' negotiating power is further reduced. For eg, there are various coffee and tea suppliers all over the world. Individual suppliers' impact is limited by this external cause. The poor force or bargaining power of vendors on the business is the overall impact of external conditions in this aspect of the Five Forces study. Another factor to remember is Starbucks Coffee Company's approach of diversifying the supply chain in order to counter the patterns found in the PESTEL/PESTLE report. Suppliers' influence is weakened as a result of such policies. Therefore, the purchasing power of vendors is a small competitive concern in company administration (Roby,2011).

Threat of Substitution or Substitutes to Starbucks Products (Strong Force)

Starbucks Corporation experiences the strong force or threat of substitution. In the Five Forces analysis model, this force pertains to the impact of substitute goods or services on the business and its external environment. The following external factors contribute to the strong threat of substitution against Starbucks:

- High substitute availability (strong force)

- Low switching costs (strong force)

- High affordability of substitute products (strong force)

Substitutes have a high potential to damage Starbucks Coffee's business, according to this portion of the Five Forces review. Since replacements are widely available, customers can easily purchase them instead of Starbucks goods. Substitutes such as ready-to-drink foods, instant soda powders and purees, food and other drinks, and vending machines, supermarkets and grocery stores, and small convenience stores, for example, are widely accessible from different retailers such as fast food and fine-dining establishments, vending machines, supermarkets and grocery stores, and small convenience stores. Furthermore, the low switching costs intensify the threat of replacements since it is simple for customers to purchase alternatives to Starbucks goods. Furthermore, all of these alternatives are less expensive than the company's goods. Thus, the challenge of alternatives is a high-priority strategic management issue, according to this Porter's Five Forces review of Starbucks Coffee Company (Roby, 2011).

Threat of New Entrants or New Entry (Moderate Force)

Starbucks Corporation faces the moderate force or threat of new entry. In Porter’s Five Forces analysis model, this force refers to the effect of new players or new entrants in the industry. In this business case, the following external factors contribute to the moderate threat of new entrants against Starbucks:

- Moderate cost of doing business (moderate force)

- Moderate supply chain cost (moderate force)

- High cost of brand development (weak force)

The uncertainty of the real expense of building and managing activities in the coffeehouse industry is linked to the moderate cost of doing business. The cost of running a small coffeehouse, for example, is cheaper than the cost of running a coffeehouse chain. Smaller cafés, on the other hand, have fewer production demands and, as a result, lower supply chain prices. These external factors make it easier for smaller companies to negotiate with Starbucks Corporation. Brand growth, on the other hand, is an expensive endeavor. This state eliminates the danger of substitution in the sense of the Five Forces analysis model. Small coffeehouses, for example, do not have the capital to grow their products. Furthermore, brand creation takes years to achieve the power of the Starbucks brand. The corporation is subjected to moderate force or the possibility of alternatives as a result of the convergence of these external influences. Thus, the threat of replacement is a major but confined concern in Starbucks Corporation's strategic management, according to this Five Powers review (Roby, 2011).

SWOT ANALYSIS OF STARBUCK

Starbucks Strengths – Internal Strategic Factors

- High brand awareness–In the food and beverage industry, Starbucks Company is the most successful and strongest brand. It has grown in complexity, volume, and number of loyal customers over time. According to the 2019 Inter brand index, it has a brand worth of $11.7 billion.

- High financial success–Starbucks has a strong financial presence in the industry, with annual turnover of $26.5 billion and profit of $3.6 billion in fiscal year 2019.

- Retail expansion- Between 1998 and 2019, it expanded the store count from 1,886 to 31,256.

- Global supply chain–Starbucks is well-known for maintaining a wide global network of vendors. Starbucks receives its coffee beans from Latin America, Africa, and Asia-Pacific, which are the three main coffee-producing countries.

- Acquisitions–Seattle's Finest Chocolate, Teavana, Tazo, Evolution Fresh, Torrefazione Italia Coffee, and Ethos Water are among the top six firms the company has purchased. Starbucks has had a lot of traction with these acquisitions.

- Moderate diversification–Starbucks has broadened its product and service offerings by adding new products and food goods. One example is the use of coffee-flavored ice cubes, which results in a better coffee taste.

- Consistency, Flavor, and Standardization–Starbucks has expanded internationally as a result of its luxury blends and tasty coffees. It delivers reliably high-quality and uniform goods in all of its locations.

- Profitability, Strategic Planning, and Reinvestment Strategy–Starbucks reinvests its revenues in extending its market around the globe. The corporation has benefited from its successful practices and well-planned business decisions.

- Employee treatment–It manages its workers properly, which leads to healthier employees who provide excellent service to consumers. Starbucks has regularly numbered in Fortune's Top 100 Businesses to Work With.

- Strong Loyalty Program–Starbucks has a fantastic loyalty program that keeps consumers coming back for more. You get 3 stars for every $1 you spend ($1 = 3 stars). You get a free drink when you earn 150 stars (150 stars = 1 free drink). Furthermore, incentive holders enjoy the ease of mobile payment, pre-ordering, and receiving free birthday cocktails, among other benefits.

- Gender-Neutral Bathrooms–To protect the Lesbian, Gay, Bisexual, and Transgender (LGBT) population from bigotry, Starbucks has launched gender-neutral restrooms. That is in response to anti-LGBTQ laws that discriminates against transgender people.

Starbucks Weaknesses – Internal Strategic Factors

- Expensive–For many middleclass and working-class customers, Starbucks is more expensive than McDonald's and other coffee shops. Its high costs make it unaffordable for customers.

- Product Imitability–Starbucks does not have the most innovative brands on the market. This makes product imitability reasonably straightforward for other businesses. Other coffee shops and restaurant stores, such as McDonald's McCafe and Dunkin Donuts, have similar services.

- Many goods have generalized standards–Any of the merchandise ranges aren't in line with most markets' cultural norms. In certain regions, for example, the formulated drinks do not adhere to customer tastes.

- European Tax Evasion–It has been the subject of many scandals and attacks as a result of the tax avoidance in the United Kingdom. According to a Reuters investigation, it failed to pay tax on £1.3 billion in revenue in the three years before 2012.

- Procurement Policies–The organization has been chastised by many civil and environmental advocates for its immoral procurement practices. According to them, it buys coffee beans from poor third-world producers. It has also been accused of breaking the rules of the "Fair Coffee Trade."

- Product Recalls–Starbucks has had to recall a number of popular items over the years. This will have a negative impact on the company's public reputation and contribute to a lack of customers.

Starbucks issued two product recalls in March 2016. The ham, bacon, and cheddar breakfast sandwich were one, and the cheese and fruit bistro box was the other. The possibility of pollution and allergens prompted the recall of these drugs. The presence of Listeria Monocytogenes on the touch surface of the facility that produced the breakfast sandwiches was discovered during routine monitoring. These sandwiches had to be recalled from 250 locations in Arkansas, Texas, and Oklahoma. The almonds found in the cheese and fruit bistro package showed evidence of undeclared cashew nuts, triggering the recall. This could be potentially life-threatening for people with cashew allergies (Geereddy, 2013).

Starbucks Opportunities – External Strategic Factors

- Penetration into new markets–Starbucks largely runs coffeehouses in the United States. Global expansion in developing economies such as India, China, and a few African regions will provide the business with significant opportunities.

- Product Requirements and Market Diversification–It will extend its business activities to maximize total sales growth potential. Developing brands based on the tastes of customers in a particular target market is often a lucrative prospect.

- Launching new items–With the company's success, introducing new products and holiday flavors (Peppermint Mocha, Eggnog Latte, Gingerbread Loaf) under the company's brand will be lucrative and well-received in the markets.

- Partnerships or associations with other companies Co-branding is often helpful. Starbucks can form strategic alliances and collaborations with large companies. This would increase its market share and influence.

- Take advantage of the most recent coffee trends and technologies–While Starbucks is at the forefront of cutting-edge coffee technology, there is still space for development. There are countless possibilities provided by the new coffee trends and inventions, from best foam technology to snap-chilling, back to black, and RSI-reducing gizmos.

- Use Price Differentiation–Some coffee shops are increasingly expanding their customer base by selling daily and luxury coffee to appeal to various income levels. Starbucks can appeal to the middle class by offering standard coffee at a cheaper price point while serving the more costly version as luxury.

- Improve Internet Outlets–The pandemic has made in-store eating less enticing, with more coffee consumers opting for take-out. Starbucks should boost its online distribution platforms and entice more people to pick up their coffee at the curb or at one of its delivery sites.

- Coffee Delivery Service–Now, consumers can order Starbucks coffee from Uber Eats, Grubhub, or Postmates. For a great consumer experience, Starbucks might launch its own coffee delivery program.

- Coffee Subscriptions–Panera Bread has also begun selling coffee subscriptions. Starbucks may also experiment with a new coffee delivery business model in order to broaden its client base.

Starbucks Threats – External Strategic Factors

- Competition from low-cost coffee vendors – Many coffee shops market items at a low cost. This might jeopardize the long-term viability of Starbucks, which charges higher costs.

- Rivalry from major outlets – The company's business share can be jeopardized by direct competition from global firms such as Dunkin' Donuts and McDonald's.

- Imitation – Both modern and old entrants will mimic items.

- Strike by Third-Party Distribution Vendors (union)– Starbucks' supply chain involves a vast number of third-party providers and customers, making it impossible to efficiently control the whole chain. Since staff of a large supplier went on strike, Starbucks coffee shops in the Midwest saw shortages in 2019.

- Independent coffeehouse protests – Starbucks faces various socio-cultural challenges. Small independent and local coffeehouses are favored by these socio-cultural groups, which reject the proliferation of big corporate chains.

- California warning law controversy – In March 2018, a California judge ordered Starbucks and other firms to have warning warnings on all of their coffee products. This was about avoiding a possible cancer-causing chemical breach.

- Starbucks arrests in Philadelphia – In April 2018, two African American men were arrested at Starbucks, sparking a social media backlash against the company. Since they had not ordered anything, Starbucks workers declined to let them use the bathroom. Kevin Johnson, the CEO, ultimately apologized to both men.

- Corona virus – Owing to a corona virus epidemic, Starbucks has temporarily reopened about 2000 stores in China. Provided that Starbucks has 4123 outlets in China, almost half of which are closed, the company's financials will struggle in 2020.

- Global Recession – Experts expect that the current economic crisis will be stronger than past downturns. Starbucks has also seen a fall in sales. Thanks to the pandemic, sales in the second quarter of fiscal year 2020 is down 5%, and revenue in the third quarter is down 38% compared to last year.

- The Prices of Raw Coffee Beans – The price of raw coffee beans has risen dramatically during the pandemic due to concerns about availability, hoarding, and supply chain disruption. Arabica, the world's most-produced coffee (representing over 60% of global production), has increased dramatically during the pandemic due to concerns about its availability, hoarding, and supply chain disruption. Starbucks' sustainability is harmed for any extra dollar spent on fresh coffee beans at a higher price.

Recommendations

Starbucks needs to bring some improvements and advancements in the company to keep its market position stable and strong. For this, few recommendations are given below:

- Introduce diversification in products and services offerings. This will help strengthen their position.

- Bring innovation and technological advancements in the company to deal with the rising competition and imitation.

- Resolve the issues with the social activists that oppose international market players.

- Reduce prices of the products to attract more customers and increase the affordability for all classes of consumers.

- Implement creative marketing campaigns, promotional activities, and branding strategies.

- Contribute to community development, participate in Corporate Social Responsibility (CSR), and sustainability practices.

EXTERNAL ENVIRONMENT OF THE RETAIL MARKET

Industry Overview and Analysis

Starbucks mainly works in the specialty coffee and snack shop market, where it competes. Thanks to the economic downturn and shifting market preferences, this sector saw a significant slowdown in 2009, with sales falling 6.6 percent to $25.9 billion in the United States. Prior to this, the industry had a decade of steady expansion. Owing to the economic crisis, shoppers spend less on luxuries such as dining out, opting to buy low-cost goods rather than high-priced coffee drinks. 3 From 2008 to 2013, the sector expanded at a low annualized average growth rate of 0.9 percent, with current industry sales of $29 billion in the United States. The sector is now expected to expand at a 3.9 percent annualized pace over the next seven years, from 2013 to 2020, with sales of $35.1 billion in the United States. An improving economy, improved customer confidence, and expanding menu offerings within the industry will all contribute to this development. Starbucks has a 36.7 percent market share, Dunkin Products has 24.6 percent, and other rivals such as McDonalds, Costa Coffee, Tim Horton's, and others hold the remainder.

Industry Life Cycle and Market Share Concentration:

This is an established business with a modest degree of focus. Starbucks and Dunkin Brands control more than 60% of the market, giving them significant clout when it comes to deciding industry trends.

Industry Demand Determinants and Profitability Drivers

The demand for quality coffee and snack goods in the industry is primarily influenced by a variety of variables, including disposable income, per capita coffee intake, health attitudes, global coffee pricing, and demographics. This sector is extremely vulnerable to macroeconomic conditions that influence household disposable income. The fall in household disposable income caused by rising unemployment and low wages during the recession put downward pressure on the industry's sales and profit margins. Another important element to consider when assessing market demand is per capita coffee intake, as increased coffee consumption raises sales for coffee and snack shops. If the economy improves and consumers continue to relax their budgets, the primary cause of this spending growth would be an increase in disposable income. This factor has a favorable impact on market sales. In 2020, per capita coffee intake is projected to rise.

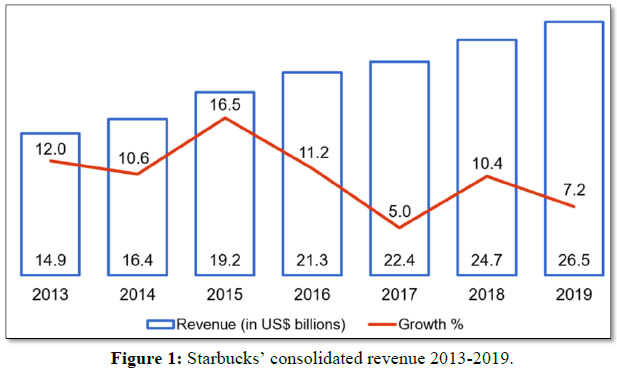

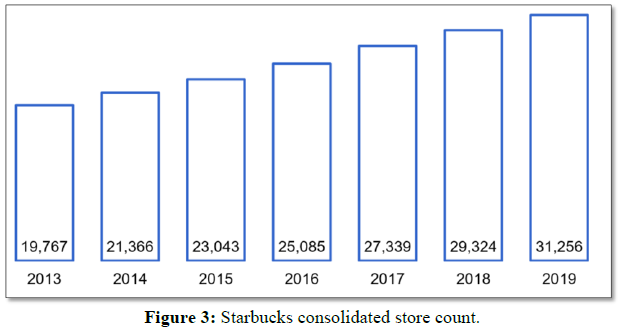

Since coffee beans are the main input in the supply chain of industry players, market costs and profit margins are determined by current volatile coffee bean prices. Coffee prices have risen significantly in recent years as a result of rising demand in other countries and subsequent supply shortages. Coffee bean rates are expected to fall in the seven years leading up to 2020, resulting in lower market costs and greater profitability. Attitudes toward wellbeing often play a significant role in evaluating market demand (Geereddy, 2013) (Figure 1).

GROWTH STRATEGIES

Operating efficiency and strong growth leading to superior financial performance

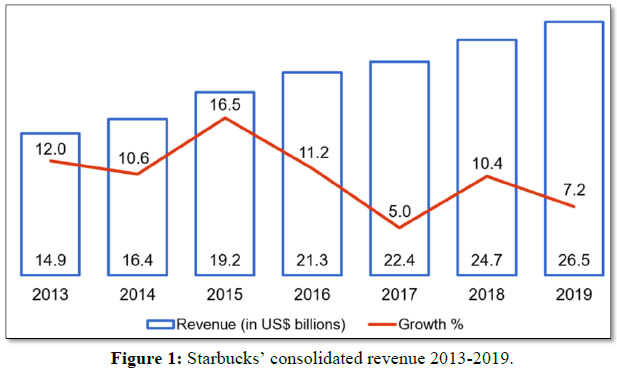

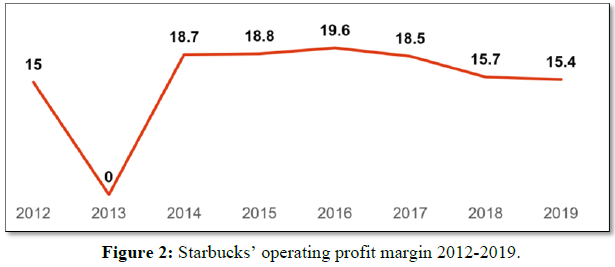

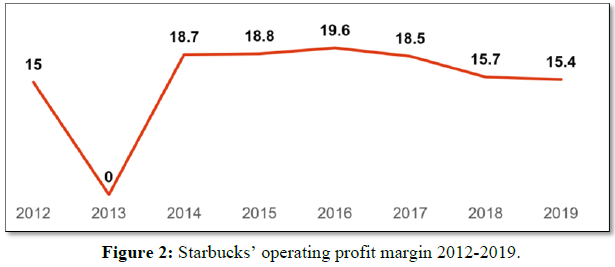

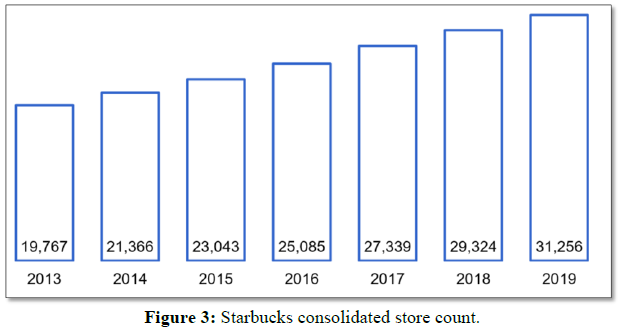

2019 marked continuing Starbucks growth both financially and physically. The company had yet another great financial year. The company’s revenue grew by 7.2% and 1,932 new stores were opened. Starbucks’ operating profit margin remained above 15% and its cash flow generated US$5.047 billion, despite the company’s enormous expansion (Figure 2 & 3).

The company's net profit stood high at $3.594 billion, which was actually higher than in 2018 if not for a one-time profit rise of US$1.4 billion due to the purchase of the East China joint venture the previous year.

Starbucks, on the other hand, saw the balance sheet deteriorate in 2018 and 2019. The company's assets shrank, as long-term debt grew, increasing the debt-to-asset ratio. Even if the balance sheet can be scrutinized with care, the company's financial situation remains strong.

What does this imply for the business? Starbucks is handling its activities very well, including its rapid expansion, as shown by the company's significant sales growth, solid operational and net income. Investors are encouraged by the company's strong financial figures, which enable it to make speculative acquisitions that would otherwise be impossible.

Fast growing store network in China

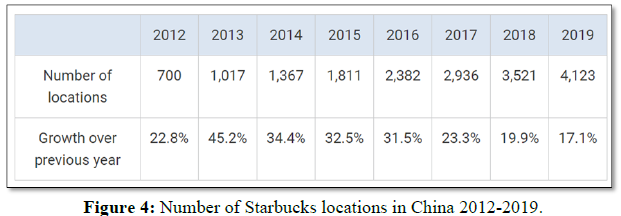

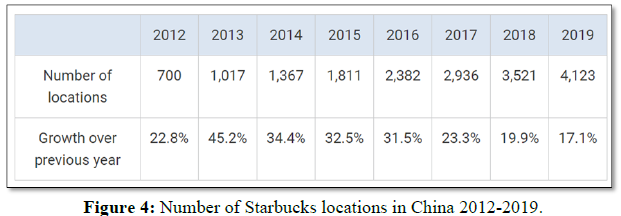

Currently, Starbucks has 4,123 restaurants in China, which is more than Costa Coffee’s 449 restaurants (data only from 2020), McDonald’s 3,300 restaurants and Luckin Coffee’s 3,680 restaurants (Figure 4).

The number of Starbucks locations has grown significantly over the past few years. In 2011, the company had only 570 coffeehouses in China. Since then, it grew its presence to 4,123 locations or 723% in just 9 years (Sholihah, Ahmed & Prabandari, 2016).

As a result, Starbucks, unlike its competitors, is well positioned China will surpass the United States as the second-largest Starbucks market in the future, and it is currently the second-fastest-growing Starbucks market behind the United States. Starbucks is, above all, well-positioned to compete in China.

Starbucks has been beefing up its tea options for years, as tea is a common Chinese beverage. Teavana is the company's tea brand, and it offers brewed tea, single-serve tea, packed tea, and other tea-related items.

To appeal to Chinese preferences and draw Chinese consumers to its coffee shops. In addition to tea, coffee consumption is increasing in China, and Starbucks, with its extensive coffeehouse network, is well placed to capitalize on this trend (Sholihah, Ahmed & Prabandari, 2016).

The combination of a premium menu, huge range of coffee and quality customer service provides the best customer experience in the industry.

Starbucks, unlike most coffee shops, is recognized for its high quality and outstanding customer service. As a result, the brand will charge higher rates while also being the world's biggest coffeehouse chain. Starbucks must excel at multiple aspects in order to have the optimal customer service, including:

- quality of its coffee and tea

- menu choices

- quality of its customer service

- location and quality of its stores

Starbucks has always put a premium on its coffee's consistency. When it comes to coffee buying, roasting, packing, and shipping, the company meets stringent protocols. It only purchases Arabica beans cultivated at high altitudes. Before accepting a shipment of coffee beans, the company tastes it at least three times. None of the company's competitors put their coffee ingredients into such rigorous quality assurance tests.

Starbucks also has the industry's most comprehensive coffee menu. Each coffeehouse serves more than 50 drinks, bringing the total number of drinks available to over 230. [number six] McDonald's McCafé, Dunkin' Donuts, and Costa Coffee, on the other hand, each sell less than 20 different drinks.

The high level of customer support provided by Starbucks, as well as the consistency of its stores and sites, all contribute to a strategic edge in terms of customer engagement. Starbucks is ranked 61st by the Customer Service Commission, based on constructive customer comments, while McDonald's is still ranked 603rd.

Customers will also benefit from Starbucks' easy shop locations, as there seems to be a Starbucks on nearly every corner. In 2019, the brand had 15,049 outlets in the United States and 16,207 stores globally, making it the world's largest coffee chain.

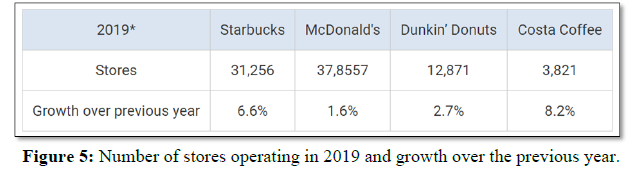

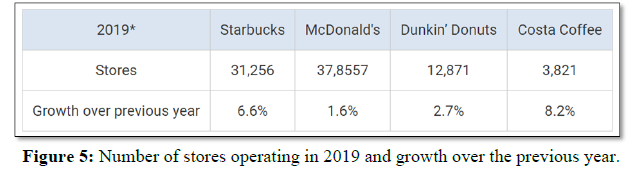

McDonald's, Dunkin' Donuts, and Costa Coffee, Starbucks' biggest rivals, each had 37,855, 12,871, and 3,821 stores in 2018. As a result, with the exception of McDonald's, which is more of a fast-food chain than a coffee retailer, all of the other big rivals are much smaller supermarket networks (Figure 5).

RECOMMENDATIONS

-

Starbucks' international segment has seen the most growth. With an increasing middle-class demographic, the developing markets of Brazil, India, China, South Africa, and Mexico continue to offer major opportunities to open new stores and serve more clients. Starbucks has also made substantial inroads into the Chinese market, but these markets still have a lot of space for expansion. Starbucks should win locally in these developing markets to expand. Starbucks' management teams should have the flexibility to function within their overarching structure to adapt shop format, add local product mix, and price points to the wants, lifestyles, and tastes of each market/community to expand in these markets.

-

Starbucks' international approach calls for it to move its key competencies and skills from country to country, then steadily create value generators in many countries as it begins its organic global expansion.

-

Starbucks' Tea and Fresh Juice product mix provides considerable growth opportunity.

-

Additionally, as customer preferences and lifestyles turn toward more food and beverage choices, Starbucks can tailor its menus and broaden to include more balanced food items in its mix.

-

Coffee beans are an important part of Starbucks' supply chain, and retail values for high-quality coffee beans have fluctuated greatly. Starbucks may reduce the possibility of market fluctuations by using a successful hedging technique such as forward contracts to lock in their expected quantity inputs at a low swing price, allowing them to better control future costs.

-

Starbucks' expansion plan in the oversaturated US market should concentrate on expanding into underserved rural areas.

-

Its bundled coffee packets and iced beverage items are another area of development. Starbucks should strengthen its links with big-box stores in order to secure quality shelf space and improve the performance of this sales route.

-

Starbucks spends relatively little in ads and promotion campaigns, as shown by their 10-K filings. In the face of intensified market competition, it is proposed that Starbucks invest greatly in advertisement and marketing campaigns.

-

Improve on the beta model of on-the-go home delivery to enhance and maintain customer satisfaction.

-

Their mobile applications company accounted for 10% of revenue in the United States, so it will be advised that they aim to enhance the ease of use and payment process, which will help them gain more buyers, minimize store wait times, and maximize productivity. Integrating the Starbucks loyalty scheme for the mobile app is also a smart idea.

- About Us. (2020). Available online at: https://www.starbucks.com/about-us.

- Basset, M.A., Mohamed, M., & Smarandache, F. (2018). An extension of neutrosophic AHP–SWOT analysis for strategic planning and decision-making. Symmetry 10(4), 116.

- Burke, A., van Stel, A., & Thurik, R. (2010). Blue ocean vs. five forces. Harvard Business Review 88(5), 28-29.

- Dobbs, M. (2014). Guidelines for applying Porter’s five forces framework: A set of industry analysis templates. Competitiveness Review 24(1), 32-45.

- Geereddy, N. (2013). Strategic analysis of Starbucks corporation. Available online at: https://scholar.harvard.edu/files/nithingeereddy/files/starbucks_case_analysis.pdf

- Grundy, T. (2006). Rethinking and reinventing Michael Porter’s five forces model. Strategic Change 15(5), 213-229.

- Haskova, K. (2015). Starbucks marketing analysis. CRIS-Bulletin of the Centre for Research and Interdisciplinary Study 2015(1), 11-29.

- Karagiannopoulos, G.D., Georgopoulos, N., & Nikolopoulos, K. (2005). Fathoming Porter’s five forces model in the internet era. Info 7(6), 66-76.

- Koehn, N.F. (2002). Howard Schultz and Starbucks Coffee Company. Harvard Business School 801-361.

- Lucas, A. (2020). Starbucks CEO: ‘We are playing the long game in China’. Available online at: https://www.cnbc.com/2019/01/24/starbucks-ceo-we-are-playing-the-long-game-in-china.html

- Larson, R.C. (2008). Starbucks a Strategic Analysis. Past Decisions and Future Options.

- Maybury, M.T., & Belardo, S. (1992). Five forces. In System Sciences, 1992. Proceedings of the Twenty-Fifth Hawaii International Conference on 4, 579-588. IEEE.

- Pickton, D.W., & Wright, S. (1998). What's swot in strategic analysis? Strategic change 7(2), 101-109.

- Prasad, A. (2011). The impact of non-market forces on competitive positioning understanding global industry attractiveness through the eyes of ME porter. Journal of Management Research 11(3), 131-137.

- Roby, L.R. (2011). An Analysis of Starbucks as a Company and an International Business.

- SBUX, A. (2016). Starbucks: A Technology Pioneer. Technology and Operations Management. Available online at: https://digital.hbs.edu/platform-rctom/submission/starbucks-a-technology-pioneer/

- Sholihah, P.I., Ali, M., Ahmed, K., & Prabandari, S.P. (2016). The Strategy of Starbucks and its Effectiveness on its Operations in China, a SWOT Analysis. Asian Journal of Business and Management 4(5).

- Sokolowsky, J. (2019). Starbucks turns to technology to brew up a more personal connection with its customers | Transform. Available online at: https://news.microsoft.com/transform/starbucks-turns-to-technology-to-brew-up-a-more-personal-connection-with-its-customers/