Research Article

AGILITY IN THE AIR TRANSPORT AND TOURISM SECTORS A WORLDWIDE VISION

18918

Views & Citations17918

Likes & Shares

Covid-19 pandemic had an unprecedented impact in air transport and hospitality worldwide. Facing an unexpected and brutal slowdown in economic activities, those sectors are heavily shaken, with million jobs at risk and the prospect of a sustained long-term slowdown in tourism growth. Air transport and tourism actors are demonstrating their agility when it comes to easing the recovery and anticipating the future tourism landscape. Through short-term actions, the whole tourism industry had to constantly adapt their operations to comply with fast-evolving health measures. They are redesigning the customer journey and focusing on communication to regain travelers’ confidence while ensuring staff safety. All airports have had to act in a reactive and agile manner, anticipating the evolving protective measures which would need to be implemented to deal with the crisis, ensuring the health and safety of the passengers and staff, and maintaining the facilities in operational conditions to restart. Airlines are concentrating their operations to support the vaccine supply chain. In parallel, sustainability, health and safety, the balance between professional and personal activity and experiential tourism are shaping a new paradigm for the medium-term horizon (2025). The result obtained aims at demonstrating that these concerns appear to be new business opportunities requiring the tourism industry to boost innovation to set the new future new standards. This paper illustrates the industry’s agility by describing the short- to medium-term views of and actions put in place by airports, air navigation service providers (ANSP) and hotels.

Keywords: Tourism, Air Transport, Agility, Economic crisis, Innovation

INTRODUCTION

The current pandemic is impacting the world in an unprecedented way, resulting in a health, social and economic crisis situation[1]. Air transport and tourism had had to face previous crisis during the last 20 years, such as the 9/11 terrorists’ attacks or the 2008 economic crisis. Those crises are much different from the one encountered from 2020 as it is a global crisis, providing global effects on people’s will and ability to travel. In mid-March 2020, the ordinary life and routines have stopped abruptly. From the perspective of the air transport and tourism industry, the movement restrictions imposed on the population and the closure of borders have disrupted the usual flow of travelers.[2] According to Zurab Pololikashvili, Secretary-General of the World Tourism Organization (UNWTO), the current crisis is an opportunity to rethink the tourism sector and the way it contributes to humankind, with sustainability, inclusivity, and resilience as core values. This is a unique situation so far, but the global warming challenge and the fear of new pandemics lead to consider that this kind of unpredictable crisis could happen again. Air transport and tourism need to prepare, implementing safe and reliable procedures or offering new services, to avoid reliving the effects of this crisis.

The evolution of travel trends, the changes in the landscape air transport players, and the development of territories will require agility from the relevant executives in order to be able to tackle the current changes and the resulting new business opportunities. Since 2012, the Master’s degree in International Management of Air Transport and Tourism at Toulouse III University in France (MITAT) has trained international professionals and researchers able to master the technical and economic aspects of both the air transport and tourism sectors, to work in an intercultural environment and to anticipate the future of the industry.

To embrace the current socioeconomic situation, the 2020 MITAT students organized a one-day workshop which has held on 21 January 2021. The objective was to bring together the visions and approaches of academics and professionals with regard to the outbreak, and to look at the short-term actions put in place by air transport actors and the trends in tourism which are now emerging. this white paper aims to summarize the analyses of professionals and academics presented at the event and proposes to consider a future “new normal” and the related new business opportunity.

PURPOSE OF THIS ARTICLE

The current pandemic has deeply impacted the air transport and tourism industry. According to the UNWTO, 1.5 billion international tourist arrivals, 8.8 billion domestic arrivals and $1.7 Trillion in export revenues were recorded in 2019, highlighting one decade of continuous and fast growth.

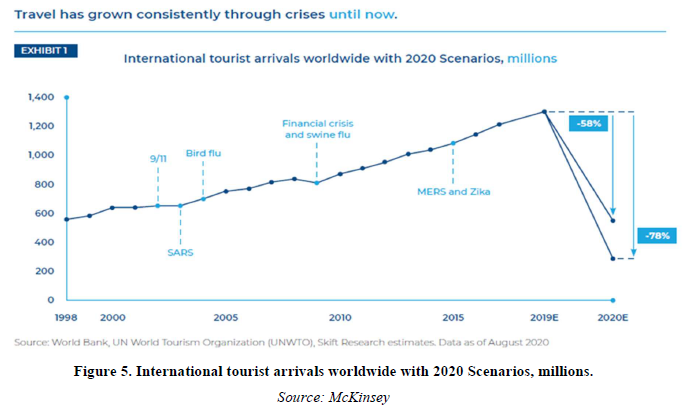

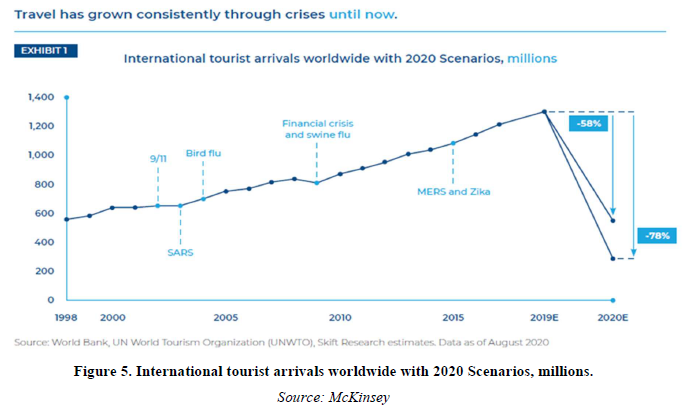

In 2020, 100% of the world’s destinations-imposed movement restrictions, disrupting the usual flow of travelers and social gatherings. The financial impact on all aviation actors has been tremendous, and the global demand for hotel services has collapsed in terms of generated turnover. The number of international arrivals has fallen by 74%, tourism receipts have seen a loss of $1.3 trillion, and up to 130 million direct jobs are at risk. International tourism is back to the 90s levels.

The tourism sector has already shown flexibility and agility in the past. However, the current situation is unprecedented and global. Recovery scenarios issued by the UNWTO forecast that it will take 2.5 to 4 years to recover to 2019 levels in terms of international tourist arrivals, the main barriers being travel restrictions, virus containment and the economic environment as the main barriers. In parallel, few trends in the way travelers behave were reported at the end of 2019. Travel restrictions have contributed to a revival of domestic and open-air tourism rebound in many countries as travelers have preferred natural, rural, and authentic holidays close to their homes (“staycations”), with health and safety as one of their main concerns. Tourism actors have had to adapt their communication to reassure customers and their pricing policies to address travelers’ budget requirements in a fast-paced health environment.

The tourism industry has an environmental footprint owing to the quantity of energy it requires (with already 5% of worldwide CO2 emissions attributed to tourism-related transport in 2016).

In parallel, tourism actively generates revenues which contribute to protecting biodiversity. As an example, 14 African countries generated roughly $142 million through national parks access fees. Closing these areas for health and safety reasons has scaled down the revenue and thus the related jobs, leading to a degraded protection of parks and an increase in poaching activities. In a similar way, the cancellation of events related to the intangible cultural heritage or the closure of handcraft markets have resulted in a loss of income for local populations and reduced protection of culture.

Once again, air transport and tourism actors are demonstrating their agility when it comes to easing the recovery and anticipating the future tourism landscape. Through short-term actions, they are constantly adapting their operations to comply with fast-evolving health measures. They are redesigning the customer journey and focusing on communication to regain travelers’ confidence while ensuring staff safety. As an example, the French airport of Tarbes-Lourdes, like all other airports, has had to act in a reactive and agile manner, anticipating the evolving protective measures which would need to be implemented to deal with the crisis, ensuring the health and safety of the passengers and staff, and maintaining the facilities in operational conditions to restart (see Jérémy Brilland interview). Airlines are concentrating their operations to support the vaccine supply chain. In parallel, sustainability, health and safety, the balance between professional and personal activity and experiential tourism are shaping a new paradigm for the medium-term horizon (2025). These concerns appear to be new business opportunities requiring the tourism industry to boost innovation in order to set the new future new standards. This article aims to illustrate the industry’s agility by describing the short- to medium-term views of and actions put in place by airports, air navigation service providers (ANSP) and hotels[3].

Among the first striking images of the COVID-19 crisis which most people will remember are those of airports flooded with thousands of passengers waiting to take repatriation flights before borders closed, followed a few days later by images of the same airports at a standstill, their runways being used as giant parking lots for airliners. Naturally, this series of articles starts with a testimony from a professional, Jérémy Brilland, Station Leader at Tarbes-Lourdes airport. He sheds light on the way this airport had to react to the immediate effects of the crisis.

INTERVIEW OF JÉRÉMY BRILLAND, TARBES-LOURDES AIRPORT (TLP)

Jérémy, could you please briefly introduce Tarbes-Lourdes airport and its activity?

Tarbes-Lourdes-Pyrénées airport (TLP) is a French regional airport located in the southwest of France, close to the Pyrenees Mountains. The platform serves the Marian city of Lourdes (one of the world's most important destinations of pilgrimage and religious tourism) and welcomes 430,000 passengers per year. Most of the traffic consists of international charter flights, regular low-cost flights and connections to Paris.

How have you managed the airport since the beginning of the pandemic?

Operational agility and a collaborative approach have been the key enablers. From the first days of the pandemic, we set up a tiger team to identify, in a collaborative way, the best solutions to ensure the safety of both passengers and airport staff safety.

We have reviewed the passenger flow and marked every instance which needs to be adapted to comply with the local authority requirements. The adapted passenger path had to be easily quickly identifiable (e.g., Signage, displays, floor and seats markings, etc.), engaging (e.g., hydro-alcoholic gel dispensers, social distancing, etc.) while allowing the smooth flow of passengers.

From a management point of view, we have focused on the human factors and reassured employees through consistent communication and a “just” culture (meaning they have to watch over one another). We have organized specific recovery meetings and provided our collaborator employees with protective equipment, updated our internal procedures, and run trainings. We have also performed additional checks on all our equipment.

What about your customer airlines?

Following the temporary shutdown of operations, it was essential to provide reassurance with regard to the airport’s operational readiness. We had to report on passenger safety procedures, personnel training, ground support equipment, airport infrastructures and airport security.

The effects of the crisis on air transport are fast and high. In the following article, Fabrice Drogoul, EUROCONTROL expert, describes these consequences on European air transport and invites us to imagine on how air transport industry could recover.

OVERVIEW OF THE IMPACT OF COVID-19 ON EUROPEAN AVIATION

By Dr. Fabrice Drogoul, Human Factor and Safety Expert, Eurocontrol

COVID-19 has wreaked havoc on national economies, with a particularly disastrous impact on global air transport. This article takes a look at some of the key impacts of COVID-19 on European aviation, and argues that this health crisis will forever change the behavior of passengers and the vision behind air traffic management.

State of play

European aviation: state of play in 2021

The aviation industry is one of the most affected industries by the outbreak of COVID-19. There are uncertainties regarding the duration and the impact of the outbreak, but the impact is already massive. Movement restrictions imposed on the population and the closure of borders have disrupted the usual flow of travelers. The fear of contagion in confined space or of meeting thousands of people in airports has discouraged many to use air travel. Passenger traffic has never seen a downfall like this before in all regions of the world and especially in Europe. The global number of flights has also drastically been reduced. In 2020, airports became parking lots for aircraft worldwide. In April 2020, at the climax of the pandemic, there were 16,707 aircraft parked up worldwide. Some airports found a new role as long-term storage facilities for aircraft as airlines were forced to mothball airframes. Older, less efficient aircraft were disposed of and new orders put on hold.

The financial impact on all aviation actors was tremendous, with just European airlines, airports and air navigation service providers (ANSPs) alone losing €56 billion in 2020.

The pandemic has also generated extra cost and expenditure for aviation actors regarding new health and safety protocols such as:

- Temperature and symptom screening

- Use of masks and PPE (Personal Protective Equipment)

- Physical distancing requirements that reduced available capacity/staffing in airports, aircraft and ANSPs

- Cleaning and disinfecting infrastructure

- COVID-19 testing and antibody testing (past infection)

- Measures to assist contact tracing

As well as measures related to pilot and crew members and their layover experience.

In aviation there is a history of bounce-backs from past major shocks - 9/11, SARS, the Financial Crisis, the European ash cloud crisis of 2010 - which varied in their impact, but in all cases, aviation would recover past growth and resume business as usual. However, COVID-19 has had a truly global impact on aviation and has the potential to change significantly long-term growth patterns.

COVID-19 has had a different impact. Airlines cannot adjust their networks to avoid affected markets, as all markets are affected and restrictions are universal. And the slow pace of vaccine rollouts and recovery times after treatment continues to push back the likely date that traffic will recover significantly to come closer to 2019 levels.

European traffic currently remains at around 34% of 2019 levels, a 66% reduction in traffic. Passenger volumes are much further down. At the lowest point of the pandemic, European traffic stood in April 2020 at 93% down on 2019 traffic levels, when borders closed, countries locked down, and most flights were repatriation or cargo. The partial recovery over the summer saw traffic recover to around 50% of 2019 levels, mostly intra-European, but the second and third pandemic waves, and the related patchwork of State restrictions, have seen volumes dip again.

Airlines and lost jobs

The dramatic drop in demand from passengers due to the COVID-19 pandemic and containment measures is threatening the viability of many firms in both the air transport sector and the rest of the aviation industry, with many jobs at stake. State aid has kept some airlines on life support but others have gone under. In Europe alone, Air Italy went bankrupt just before the pandemic was declared, Flybe immediately after, with major airline groups shutting down operations at some subsidiaries (e.g., Germanwings, LEVEL Europe, SunExpress), and more consolidation is to be expected the longer the crisis continues. All airports have been massively hit by lost revenues and have struggled to reduce fix costs while operating at fractions of their usual capacity.

The same picture is repeated across all parts of the industry. The financial and the economic impact is also proportionally transferred to the supply chain, to training schools, simulator centers, maintenance organizations, assessment centers or parts manufacturers and to certain sectors that drive or promote demand for aviation.

Recovering from COVID

Scenarios envisaged Recovery to pre-COVID levels is heavily dependent on the success of vaccines in controlling the disease and restoring confidence. Most industry experts do not expect a recovery to 2019 levels of traffic before 2024, and this could be much later.

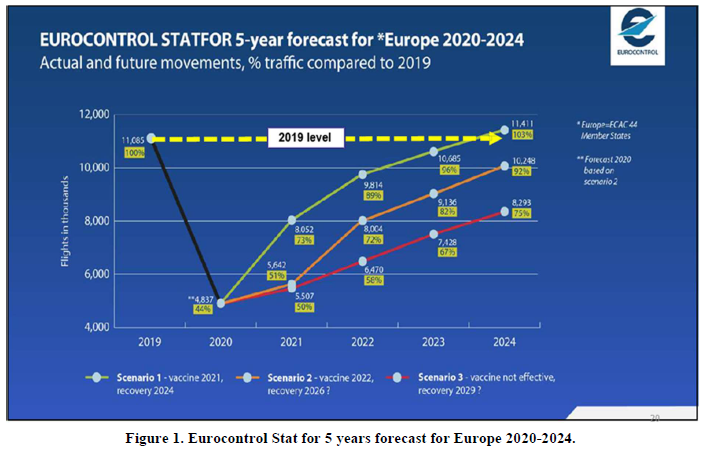

In early November 2020, EUROCONTROL released a new five-year forecast considering the possible evolution of air traffic in Europe over the coming five years. The forecast shows that the evolution of the aviation sector is strongly dependent on how soon effective vaccines are made widely available Fiand by levels of public confidence. In a very volatile environment and a fast-evolving COVID-19 situation, the forecast identifies two main scenarios. In the most optimistic scenario, the forecast considers traffic returning to 2019 levels by 2024. However, in the second scenario (based on vaccines only being widely available and taken up in 2022), 2024 traffic would only be at 92% of the 2019 figure. However, in a third scenario, traffic in 2024 would represent 75% of the 2019 figure and would not reach the figures seen in 2019 until 2029. Even the best-case scenario shows a catastrophic picture for the aviation industry in terms of lost growth and jobs and shows clearly why it is so important for States to take consistent and coherent measures to support the aviation industry and make passengers feel safe to fly again (Figure 1).

Current COVID challenges

The COVID crisis has added two elements to any of the previous crises faced by aviation that are toxic for the industry: a far-reaching worldwide economic recession, and a loss of faith in air travel.

The pandemic is also significantly shaping societal demands. Government orders to stay home have resulted in drastic cuts to people’s day-to-day travel - particularly for commuting to and from work, which leads into another growing global trend, more remote work and increasingly flexible working patterns. These changes look set to stay, and it is safe to state that sustainability will play a much stronger role within public transport policies and the allocation of economic relief funds. Sustainability is both one of the main challenges and opportunities that the air transport sector is facing with.

Side effects on the aviation sector are also now surfacing. For instance, one of the latent challenges is the possible reduction of the budget allocated to civil aviation authorities as a consequence of the fiscal crisis may put at risk the safe and secure recovery of international civil aviation. Deskilling and future skill needs in an unpredicted environment are also at stake.

The immediate future for aviation

Throughout the pandemic, air cargo has played a key role in supplying medical equipment, essential supplies and now vaccine transports. Air cargo is the only market segment to have increased its share and airlines have shown adaptability by optimizing freight capacity and using many passenger aircraft for cargo-only purposes, as a recent EUROCONTROL Data Snapshot has revealed.

Aviation will continue to be central to the global recovery from COVID-19. McKinsey believes around 15,000 flights will be needed for global coverage of the COVID-19 vaccine in the next two years, with only air transport capable of transporting huge volumes of vaccine quickly from one country to another while respecting the cold temperature conditions necessary for the good conservation of the vaccine.

Air transport is a key input for downstream sectors, as it enables several economic activities by way of trade in goods and especially in services through the movement of people. It remains an essential service for remote areas, and the only way of travelling quickly between continents. Inter-modality also looks set to grow as air seamlessly integrates with high-speed rail networks on short- and medium-haul routes.

Future of aviation

Future trends: Ecological, technological and societal challenges.

New trends will emerge in the future and will contribute to the creation of alternatives within the air transport sector. These alternatives are keys to ensuring sustainable aviation. An example is urban air mobility in which small passenger-carrying aircraft (e.g., sky taxis or PAVs - passenger air vehicles) could soon be sharing airspace with traditional traffic as well as drones. A majority of the predicted progressions focus on advanced automation to support service provision. Sustainability and a low ecological footprint goal for air transport can also be achieved thanks to technological progress.

Sustainability was already firmly set on the policy agenda before the pandemic and now all discussions about ‘building back better’ are factoring in how to achieve a green recovery from the pandemic. Already inefficient older aircraft have been retired, and the pace of technological investment in new technologies like Sustainable Aviation Fuels (SAF) and innovative propulsion systems (e-planes, or hydrogen powered ones) is increasing, particularly in Europe in order to meet ambitious emissions and climate targets. There are already proposals on the table which have the potential to be game changers in terms of helping European aviation “build back better”.

Air traffic management also has a key role to play in delivering a more sustainable sector. The EUROCONTROL Network Manager is still working hard with all operational actors to eliminate network inefficiencies and achieve more direct, fuel-efficient flights. Current estimates are that European flights use between 8.6% and 11.2% more fuel than the ideal, most efficient flight, which highlights the potential for decarbonization.

The societal challenge is also an important aspect. Aviation needs to meet evolving passenger needs and regain passenger confidence to persuade people to fly again.

Finally, aviation actors need to take into consideration employee well-being: they are the first to be affected by the current fragility of air transport. The pandemic is a significant source of anxiety, stress and uncertainty for everyone. Worries about unemployment for aviation staff and their relatives may be exacerbated. During the lockdown, with people working from home and therefore isolated from normal support, the personal well-being of many professionals will have suffered. For those working, this may lead to distraction from/interruption of tasks, workload/task saturation, or to instructions or requirements not being followed. Regardless of whether personnel are working, are employed, are furloughed or are unemployed, we have a duty of care to support the well-being of aviation professionals.

Can aviation recover

Aviation is a symbol of global cooperation, both economic and person-to-person. The recovery of aviation will say a lot about the global recovery.

A digital world will prevail, generating cyber-dependency and the use of new technological alternatives. We must harness all that potential to modernize the way in which civil aviation is connected with users and delivers its services. Changes of ideals, opinions or trends will generate increasingly different post-COVID-19 paradigms. The civil aviation industry should “read” those signals and extend its reach to external actors, for the benefit of air transport. This crisis is unprecedented in its duration, its scope and its structural impact on the sector. Unprecedented, as it will most likely also change travel behaviors, resulting in new patterns for travel demand and passenger expectations.

COVID-19 has been an unprecedented calamity for European aviation, and its effects will be with us for many years to come. However, at the same time, it represents an unprecedented opportunity for all aviation actors to work together to make our industry better and to tackle the big, longer-term questions right now, even while the crisis is continuing. Sustainable aviation is the next goal and the hope of the air transport industry.

Impacts of Covid-19 on U.S. air transport and tourism by Andrew r. Goetz, author and professor, University of Denver

March 11, 2020 marked a critical turning point when the United States and the entire global community began to realize that COVID-19 was going to affect the world in a major way. On that day, the World Health Organization (WHO) declared COVID-19 to be a pandemic, the U.S. banned travel from Europe (the U.S. had previously banned travel from China on January 31), and the U.S. stock market plunged as the Dow Jones Industrial Average dropped 1200 points in one day, resulting in a 20% decline from its peak in February (Wamsley, 2021). While the novel coronavirus that causes COVID-19 was first detected in China at the end of 2019 and the first U.S. case was reported on January 20, it was not until March that the seriousness of the situation began to penetrate the collective consciousness of the U.S. and the world.

A year later, we have seen how COVID-19 has ravaged many parts of the world, especially the United States. There have been over 30 million cases of COVID-19 in the U.S., resulting in over 550,000 deaths. The U.S. has nearly a quarter of the world’s cases, and accounts for roughly 20% of the world’s deaths from COVID-19. The U.S. has had a very uneven response to the pandemic, including widespread skepticism from the Trump Administration, numerous U.S. state governors, and a sizeable proportion of the population, which has been a contributing factor to the high case numbers and deaths. The new Biden Administration and a number of other U.S. state governors have taken COVID-19 much more seriously, enacting numerous public health restrictions, and expanding vaccine development and distribution significantly. It is estimated that over 50 million Americans (15% of total population) have been fully vaccinated as of the end of March 2021, and expectations are that 70-85% of adult Americans will be fully vaccinated by summer 2021.

The effects of COVID-19 on the United States and the world have extended to many facets of life, including disruptions to work, school, personal gatherings, vacations, and especially travel. In addition to the initial bans on international travel, many U.S. state and local governments issued stay-at-home orders that severely limited domestic and international travel. Many businesses encouraged employees to work at home, thus limiting the need for both short and long-distance travel, while many individuals made similar decisions to eliminate travel, especially long-distance travel. It is no wonder then that air transportation activity declined significantly, and the overall travel and tourism industry suffered greatly as a result of COVID lockdowns and decisions to forego travel.

IMPACTS ON U.S. AIR TRANSPORT

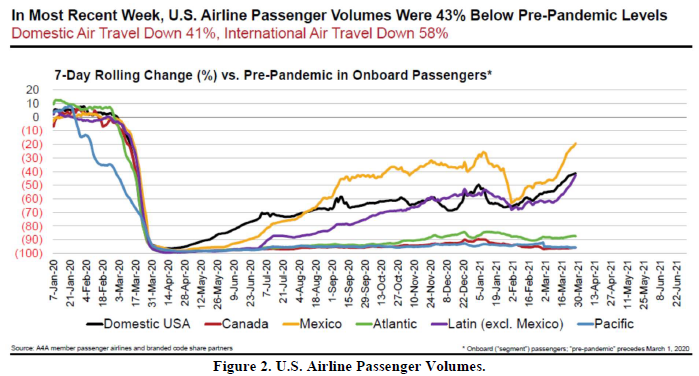

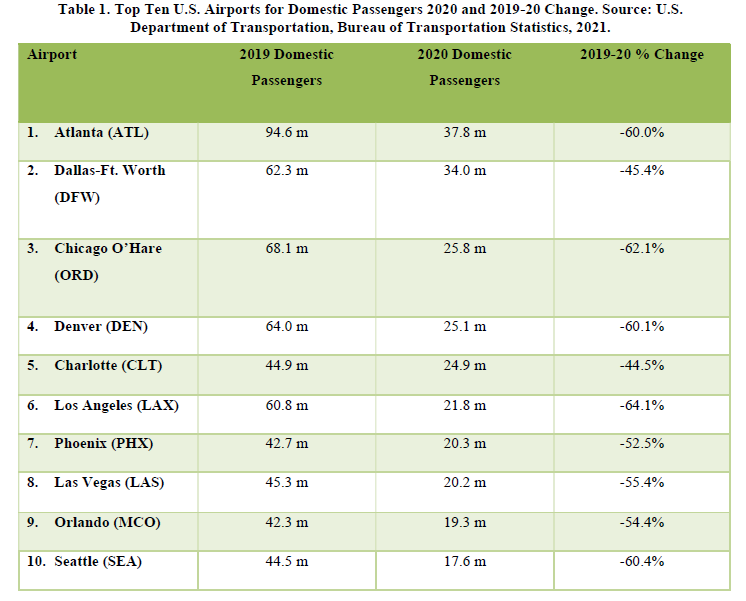

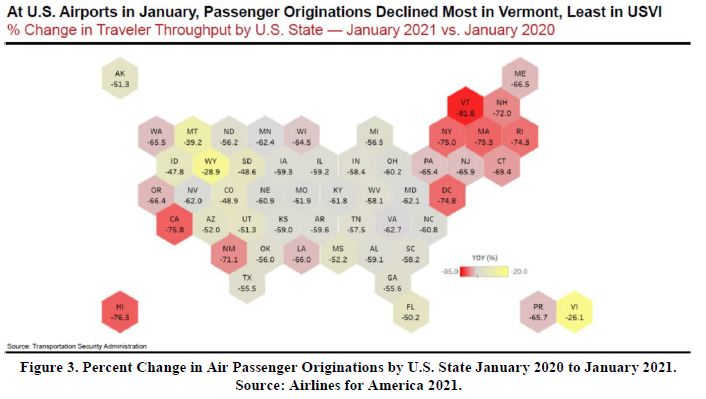

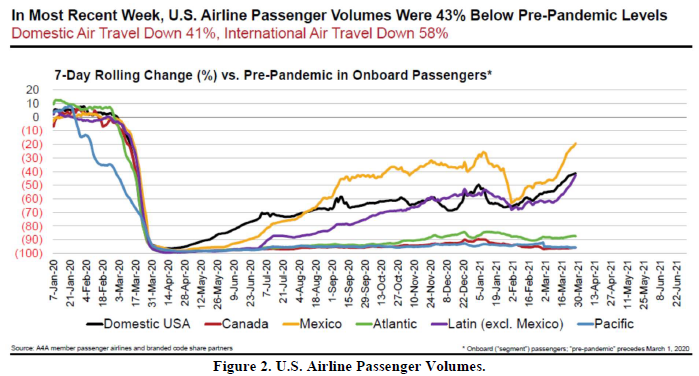

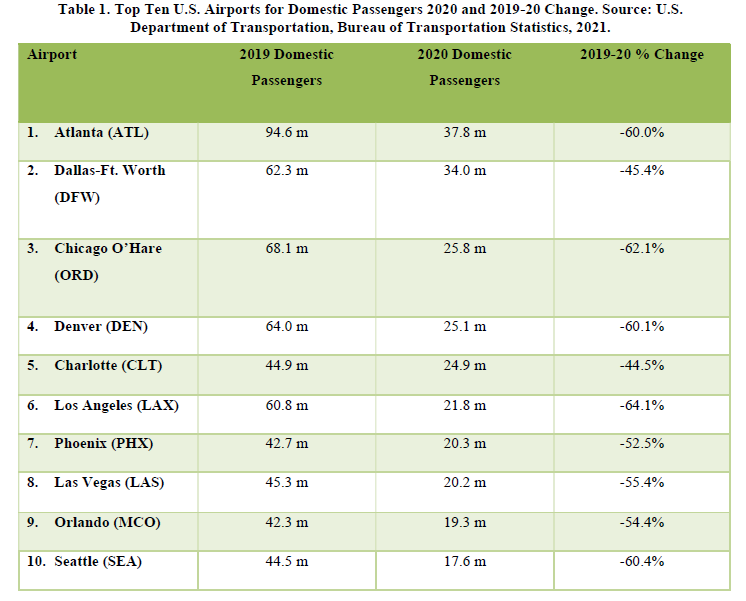

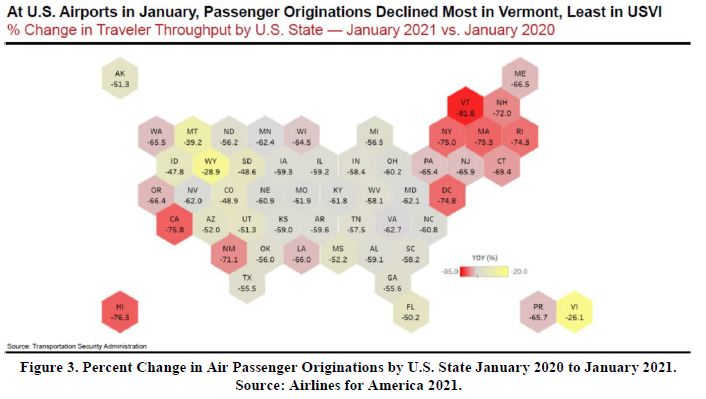

Similar to the rest of the world, air passenger transport activity in the United States plunged after restrictions on travel were enacted. According to U.S. Department of Transportation statistics, air passenger totals systemwide were approximately 60% lower in 2020 than in 2019 (U.S. Department of Transportation, 2021; U.S. GAO 2021). The number of flight departures declined in tandem with the reduction of passenger demand. The temporal pattern of traffic exhibited a precipitous decline during March 2020 which equated to a nearly 100% volume drop compared to pre-pandemic levels (Figure 1). Since then, U.S. traffic has continued to be well below pre-pandemic levels although some limited improvement in domestic travel as well as travel to Mexico and Latin America occurred through the rest of 2020 and into early 2021. International travel to Canada and across the Atlantic and Pacific has still remained at levels 90% or more below pre-pandemic levels (Airlines for America, 2021). Within the U.S., declines have been dramatic across the board for virtually all airports, although those airports more reliant on international travel have experienced larger declines than airports that serve mostly domestic routes. Airports in the U.S. northeast, including New York, Boston, and Washington, DC, as well as airports in California have experienced the largest declines in passenger traffic (Figure 2; Airlines for America, 2021). Inland domestic hub airports, such as Charlotte, North Carolina and Dallas-Ft. Worth, have experienced somewhat less decline in domestic passenger totals (Table 1; U.S. Department of Transportation 2021).

While air passenger transport has been devastated, U.S. air cargo traffic actually increased by 20% between January 2020 and January 2021 (Airlines for America, 2021). Initially, cargo traffic declined due to the pandemic-related economic slowdown, but then cargo traffic picked up with shipments of pandemic supplies, such as personal protective equipment and other medical supplies, as well as general commodities as economic growth expanded again (Figure 2).

The sharp declines in U.S. passenger traffic have resulted in devastating financial and employment losses. U.S. passenger airlines have incurred $46 billion in pre-tax losses in 2020, the worst financial performance in the history of the U.S. airline industry. U.S. passenger airline operating revenues fell 67% from 2019 to 2021 (Airlines for America, 2021). According to the U.S. Bureau of Labor Statistics, as of November 2020, an estimated 122,600 jobs in the air transportation sector-over 23 percent-have been lost since peak employment levels of 516,900 in February 2020 (U.S. GAO 2021) (Figure 3).

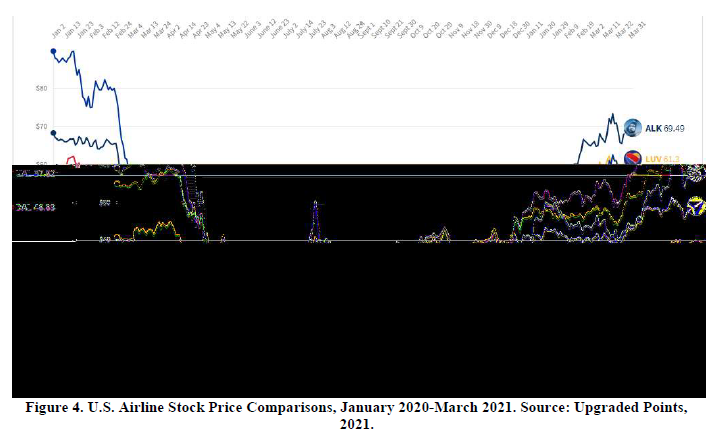

All U.S. passenger airlines have been affected. Those airlines with more international service have experienced more severe declines in passengers and revenues, while airlines that have a more domestic focus have been somewhat less impacted. Stock prices for all major U.S. airlines dropped dramatically starting in February 2020, bottomed out from March through May 2020, and then began a slow and uneven process of recovery (Figure 3). Stocks are now at their highest level since the beginning of the pandemic, but in almost all cases they are still below pre-pandemic levels. Stock prices for Alaska Airlines (ALK) and Southwest (LUV) have performed relatively better, but those for United (UAL), Delta (DAL), Spirit (SAVE), American (AAL), and Jet Blue (JBLU) have not recovered (Upgraded Points 2021). It is estimated that it will take at least several years before airlines are able to recoup their losses from the pandemic (Airlines for America, 2021) (Table 1).

The U.S. government reacted to the economic perils of the pandemic by providing emergency relief funding for especially hard-hit industries and economic sectors, including airlines and air transportation. In March 2020, the U.S. Congress passed and the President signed the CARES (Coronavirus Aid Relief and Economic Security) Act which appropriated $88 billion to help the aviation industry and airports respond to and recover from the economic fallout due to the pandemic. Up to $32 billion was provided for payroll support that allowed air carriers and aviation contractors to continue salaries, wages and benefits for employees, up to $46 billion in loans and loan guarantees for aviation businesses, and $10 billion to support airports (U.S. GAO, 2021). The Consolidated Appropriations Act was passed and signed at the end of 2020 and provided an additional $16 billion to provide payroll support for passenger air carriers and some aviation contractors, and $2 billion for eligible airports and some tenants (U.S. GAO, 2021) (Figure 4).

IMPACTS ON U.S. TRAVEL AND TOURISM

The negative impacts of COVID-19 on air transport paralleled a general decline in travel and tourism throughout the U.S. Travel spending declined 42% in one year, from nearly $1.2 trillion in 2019 to $679 billion in 2020 (U.S. Travel Association, 2021). The losses affected every state, including 18 states or territories with more than a 40% downturn in travel spending, led by Hawaii (-60% in 2020). Business travel overall was down more than leisure travel, as most conventions, meetings, and regular business activity avoided in-person formats. Leisure travel was somewhat less impacted, as travelers chose more local destinations and places more accessible by road rather than air.

The hotel and restaurant industries, heavily dependent on travel and tourism, suffered greatly. Hotel occupancy was down 33% from 2019 and revenue per available room was down 48%. Luxury hotels were hardest hit, falling 69% from 2019 to 2020 (U.S. Travel Association, 2021). Restaurants were also severely affected as total sales were $240 billion below the National Restaurant Association’s (2021) pre-pandemic forecast for the year. Restaurants were affected by declining numbers of both tourists and local customers. In-person dining was restricted in most states at various times throughout the year, while take-out dining provided at least some revenue opportunities though not nearly enough to offset the overall decline. As of Dec. 1, 2020, more than 110,000 eating and drinking places were closed for business temporarily or permanently (National Restaurant Association, 2021). The eating and drinking place sector finished 2020 with nearly 2.5 million jobs below its pre-coronavirus level, and at the peak of initial closures up to 8 million employees were laid off or furloughed.

PROJECTING FOR THE FUTURE

Despite the horrible statistics in 2020 for air transport and the greater travel and tourism industry, there is some limited hope of better news for 2021 and the next several years. The pace of vaccinations has accelerated and expectations are that over 70% of adult Americans will be vaccinated by summer 2021. The spread of new COVID variants may prove to diminish the positive effect of the vaccines, but the number of both cases and deaths from COVID has been declining since January 2021, and there is guarded optimism that those declines will continue through the rest of the year and beyond. Due to this outlook and pent-up demand, airline bookings are rising and airlines are increasing the number of flights and seats in response to increasing demand, especially for the summer months. Most of the current demand is for leisure and personal travel. Americans are looking for scenic beauty, warm weather outdoor activities, beach destinations, and national parks for their 2021 vacations, though many will choose road instead of air trips (U.S. Travel Association, 2021). Optimistic forecasts show a return to 2019 air passenger traffic levels by 2023, led by leisure travel. It is expected that it may be at least five years before business air travel will return to pre-pandemic levels (Airlines for America, 2021). As a result, it is expected that U.S. airlines will continue to burn cash at least throughout 2021, and will be forced to take on more debt to survive.

The COVID pandemic has wreaked havoc upon the United States, including its air transport and tourism industries. The year 2020 has been the worst in the history of the U.S. airline industry with unprecedented declines in passengers, flights, and revenues. Overall travel and tourism have suffered greatly, as lockdowns and travel restrictions caused many people to stay home. There is not much positive that can be said about the status of these industries except that there have been some tepid steps toward recovery after the initial precipitous decline in March 2020. Looking forward, there is a limited sense of optimism due to the declining number of COVID cases and deaths, and rising rates of vaccinations. Recovery in the air transport and tourism industries will continue slowly through 2021, but a return to pre-pandemic traffic and revenue levels is at least several years away based on the most optimistic forecasts.

The hospitality sector, like air transport, suffered immediately and durably from the health crisis. In the face of the virus, hotel professionals had to adapt their processes to ensure the safety of their guests during their stay and to restore confidence. This process is described in the following research article by Thomas Silvie.

How to welcome post-lockdown guests in the hotel industry By Thomas Silvie, Consultant and Founder, back of the house

On 16 March, 2020, a first nationwide lockdown started in France, due to COVID-19. It was a phase of abrupt shutdowns for the hotel industry. Opening rates ranged from 18% in Île-de-France to 28% in provincial towns (MKG – July 2020). This first lockdown ended on 11 May.

In May 2020, a group of researchers from Washington State University started to conduct a series of nationwide studies to track the effects of the COVID-19 pandemic on restaurant and hotel customers’ feelings (Gursoy, Chi & Chi - 2020). In the November study, we learn that hotels are still struggling to welcome guests (only 33.78% of respondents are willing to stay at a hotel). Even with hand sanitizers at the entrance, staff wearing masks and gloves, social distancing, and other safety protocols, customers still do not feel comfortable staying at a hotel. This study underlines the two sides of the customer experience (Ritzer - 1999): the rational side (where the standards of rationalization meet), and the emotional side, where daily interactions with front-line employees play a significant role.

This research article aims to investigate whether and how front-line employees’ training enables hotels to recover faster from this unprecedented pandemic (Gössling, Scott & Hall - 2020).

The purpose of this study was to check three hypotheses:

H1: in the COVID-19 crisis, guests are looking for safety protocols to be place (rational side).

H2: in the COVID-19 crisis, guests are expecting reassurance and empathy throughout the daily interactions they will have with the hotel front-line employees (emotional side)

H3: Hotels are setting up a specific training programs to explain emotional expectations and operational needs to front-line employees, and train to meet these needs in their daily interactions with guests.

RESEARCH DESIGN

To address this study, semi-structured interviews were conducted with general managers, human resources manager and front-line managers. They were identified as the key players in the success of the reopening after lockdowns.

Our sample was drawn from our LinkedIn network, depending on opportunities and availability of future interviewees.

The interviews took place from November to December 2020, via Zoom. This type of interview enabled us to receive information on a series of guiding questions and to offer our various interlocutors a framework in which they could express themselves freely, from a qualitative perspective. The themes addressed during the interviews concerned the management of the re-opening, the training to prepare front-line employees ready, the way managers supported their team, and the evolution of the service culture as a result of the pandemic.

The final choice was made taking into account the defined criteria:

- Position held (general managers, human resources director or reception services managers)

- Geographical location (France / abroad)

- Type of establishment (independent or hotel group).

- The appointments were made by phone and via LinkedIn's messaging system, and the interviews were then carried out by phone and on Zoom.

To carry out this study, 8 semi-structured individuals 45 min interviews were conducted with:

- 5 general managers,

- 1 human resources manager

- 2 front-line managers (chief concierge and front office manager)

- To maintain the anonymity of participants, they are referred to as "hotelier 1," "hotelier 2," etc., to "hotelier 8" in the tables which present the results.

Findings

Hypothesis 1: As the last report of Gursoy and Chi & Chi (November 2020) shows, around 91% of customers are expecting hotels to take some safety precautions, which is confirmed by the hotelier interviewed: “We keep clients informed of all health and safety the sanitary procedures in place and reassure them if needed” (Hotelier 7).

with regard to the rational side, customers are indeed looking for safety protocols to be in place during their stay. One hundred percent of hotel groups and hotels have implemented safety protocols. Three hotels out of 8 (38%) have set up a label to communicate and reassure customers, and 1 hotel has 2 labels (the country label and the group label). One hundred percent of respondents trained their team in safety measures and protocols. Front-line employees were first trained online prior to the opening, then on-site.

Hypothesis 2: While all of the hoteliers interviewed confirm that empathy is one of the basic soft skills required for hospitality professions, and that providing the customer with reassurance is a daily task, none see the need to strengthen these skills due to the COVID-19 crisis: “There was no specific training on customer emotional expectations. These trainings existed before. These are classic trainings” (hotelier 5); “We don't do such training. Customers who come to us see that we have secured the entire resort and therefore feel secure.” (Hotelier 4); “This has always been a practice at the hotel. There is no training on dealing with emotions. For us, common sense will prevail and will allow us to have the tools to be able to react to a situation” (hotelier 1). Only hoteliers 7 and 8 carried out some specific actions in this regard: “The idea is to find the right path to make everyone understand that they should put themselves in the shoes of the customer. This year, we have done scenarios in which people test positive for COVID-19”.

Hypothesis 3: One hundred percent of hotels set up specific training programs to address operational needs only, and train front-line employees to meet these needs: “We have run training sessions so that our employees understand everything related to the virus, how to wash their hands, what infected symptoms people infected have, how to wear a mask, what are the rules of social distancing” (hotelier 4); “There was general training for all employees on the virus: how it is spread, how to limit the risks, what actions to adopt” (hotelier 3).

This study is a first step which confirms that the main focus when training people in the COVID-19 crisis is safety; but very few employees are trained to improve the customer experience. More interviews will have to be carried out to analyze this in greater depth.

Two more major findings of this study will be investigated in the near future:

The first one is the recognition of the pre-arrival interactions as a new moment of truth within the customer journey. One hundred percent of hoteliers said that COVID-19 has brought some changes to their customer journey. And 87.5% mention that the pre-arrival phase has become a real moment of truth: “We've had so many changes in the rules dictated by the government that it is better to call clients to inform them prior their arrival” (hotelier 7); “It’s not a big change because this moment already exists. It’s a big change because this moment has become fundamental. The decision of our customers to come or not depends on it” (hotelier 6).

The second major finding relates to multitasking. Today, implementing multitasking is a must do for 100% of respondents. Because hotels now run with unprecedented low occupancy rates, hoteliers have to rethink their organization to reduce staff while providing almost as many services. The receptionist therefore becomes a bartender and a car valet. “We do more multitasking- to a point where the customer no longer understands. For example, it is the waiters who now welcome guests for the breakfast, and no longer a hostess” (hotelier 6). Whether before the COVID-19 crisis, hoteliers were mainly looking for people with good interpersonal skills, finding employees who master hard skills may become a more significant issue in the near future.

What are the levers which can enable the hospitality sector to renew its growth? In the following article, Monica Basile describes the impact of the crisis on the global hotel industry and shares the new expectations of visitors while proposing innovative experiences and strategies for the industry.

Global hospitality marketing strategies to face Covid-19 By Dr. Monica Basile, Global Tourism Expert, UNWTO, OECD, Council of Europe

One year after the outbreak of the pandemic, the world has not yet recovered, and it is experiencing the so-called "new normal".

Nations are still maintaining borders closed and the access is allowed only on presentation of a negative COVID-19 test result. Measures to prevent the spread of the virus are still in place such as lockdowns, smart working, bans on winter sports, closure of ski lifts, restaurants and bars, and bans on social activities.

This project was taken and elaborated with the following aims:

- To analyze the impact that COVID-19 still has on the global tourism sector with a focus on worldwide hotel performance.

- To share the best practice concerning the marketing strategies introduced by the hospitality industry.

- To support the design of innovative hotel experiences in order to tackle the crisis and support demand which is still very low.

MATERIAL AND METHODS

The study was conducted through applying the international methods concerning the crisis management as well Hospitality worldwide best practices elaborated on by the author facing the previous crisis situations of 11/9 and Sars. Since the very beginning of the pandemic the author analyzed wide sources of desk analysis and updated information (and she is still monitoring the situation which quickly evolves). Going into details the article is based on a wide spectrum of worldwide Academic articles from several Universities (such as Cornell University, école Hôtelière de Lausanne (EHL), Instead, Harvard, Yale on crisis management), Tourism Industry analysis (which include present and future forecasts concerning tourism and hotel performances worldwide elaborated from STR), E.U. UNWTO International statistical data and forecast as well as new worldwide destination policies which were put into place to support recovery, Consultancy Agencies (such as Deloitte, McKinsey, Oxford Economics). These updated Covid-19 information were integrated within the local development model named “Win-Win UNESCO Experience” designed and applied by the author to several tourist destinations in order to co-design experiential tourist products by enhancing local heritage experiences that can be done in local natural and cultural heritage.

RESULTS

We present the main results concerning the impact of Covid-19 on tourism Industry, the main new market trends that took place on the demand side.

The tourism industry: impact and behaviors market trends

COVID-19 versus previous crises: (9/11 and SARS (2003))

For the first time since the globalization of tourism, all countries in the world have imposed travel restrictions in order to counter the COVID-19 pandemic. After a complete lockdown in the first phase of the pandemic (March, April and May), since mid-June 2020 countries have slowly and gradually started to reopen and allow movement of domestic tourists who spent summer holidays in their countries of residence.

What is the difference between the COVID-19 crisis and previous crises?

In the previous decades too, international hotel chains have had to deal with large-scale crises. Among those we would like to draw attention to are the terrorist attack on the Twin Towers (11.9.2001) which caused the American market to come to a complete standstill owing to people’s fear for their safety, as well as the SARS epidemic which took place in Asia in 2003.

The main difference between COVID-19 and the other two crises is that they were limited to a single segment of tourism (e.g., the US, China, etc.). Therefore, hotel chains which owned properties in the countries affected introduced recovery plans in order to attract new clients from other countries. With COVID-19, however, the crisis is spread worldwide, with all countries putting a stop to tourism, even if at different times.

IMPACT OF COVID-19 ON THE TOURISM INDUSTRY

In recent decades, travel has grown constantly, even during previous crises such as the 9/11 attacks on the Twin Towers, SARS, bird flu and Zika. The situation today is completely different. Scenarios from the United Nations World Tourism Organization (UNWTO) estimate that in 2020, international tourist arrivals suffered a decline of between 58% and 78%. (Figure 5).

Market trends in tourism: COVID-19 has strongly impacted the organization of societies and has defined new market trends and new consumer behavior in order to reintroduce safe travel. At the end of summer 2020, analysts remarked that these trends are quite similar worldwide since tourists have adopted similar behavior in resuming travel in a safer way. Owing to the rapid changes related to the evolution and transformation of the pandemic, it is important to outline the major market trends to develop effective marketing strategies, contributing actively to the recovery of the sector.

Destination: Worldwide analysis has shown that during summer 2020, domestic leisure destinations close to home were considered very attractive by customers, compared with international long-haul destinations which are still considered unsafe. This trend is supposed to continue in the future too.

Means of transport: car versus plane: US customers as well as Europeans chose to travel by car to reach nearby leisure destinations, such as (for Europe) Austria, Switzerland and Croatia, and took flights to Greece and Norway, for example, only very late in the summer, when it became clear that the rate of spread of COVID-19 was low.

Holiday products: Adventure travel” is the type of product which has recorded the highest percentage of increase compared with other types of holidays such as "sea and beach". In addition, data from Trivago[1] confirms that globally travel involving outdoor activities has recovered faster than other types of products. Similarly, the World Travel and Tourism Council (WTTC) together with the McKinsey observatory on the recovery of tourism demand confirm that all over the world (excluding China), adventure travel has recorded a greater increase compared with other types, led by Europe. This is because such travel allows for natural social distancing.

Booking window: The time that occurs between the booking of the holiday and the customer’s day of arrival, both in Germany and the United States, has shortened considerably compared with 2019. This is also because tourists are using cars instead of planes to get to nearby destinations and do not have to book plane tickets far in advance. They wait until a few weeks before the planned departure, monitoring the evolution of the COVID-19 situation, and book only at this later stage.

Price: Surveys in the US have shown that price was the most important search criterion in April, but later in July it became the least important factor, overtaken by the criterion of being a short distance from home.

Digital nomads and “Bleisure”: Smart working have intensified the phenomena of digital nomads and “Bleisure” (travel which combines relaxation and work). During the pandemic, the average length of travel has increased compared with 2019. Customers are looking for accommodation and a destination from which they can work (combining smart working with enjoyable holidays).

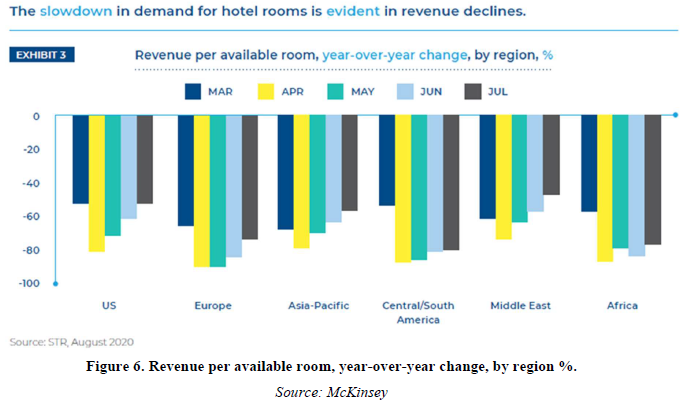

Focus on the global hospitality sector: In the travel and tourism sector, the hotel industry is still badly hit, one year after the start of the pandemic. We will now focus our attention on hotel travel indicators such as income, occupancy rate, and performance in order to provide an updated overview of the situation.

Hotel performance during the first lockdown: STR[2] data shows how global demand for hotel services collapsed in terms of turnover generated ("Revenue per available room (Rev Par)"). The chart below shows how COVID-19 reduced hotel turnover during the lockdown months of 2020 (compared with the same period in 2019) (Figure 6).

STR analysts estimate that hotel demand will reach pre-COVID-19 levels only in 2023, while we must wait until 2024 to reach the same income per "available room".

Globally, hotels that registered positive performance during summer 2020 are those that hosted leisure tourists (domestic / national customers) and budget hotels which reached a higher performance compared to luxury hotels.

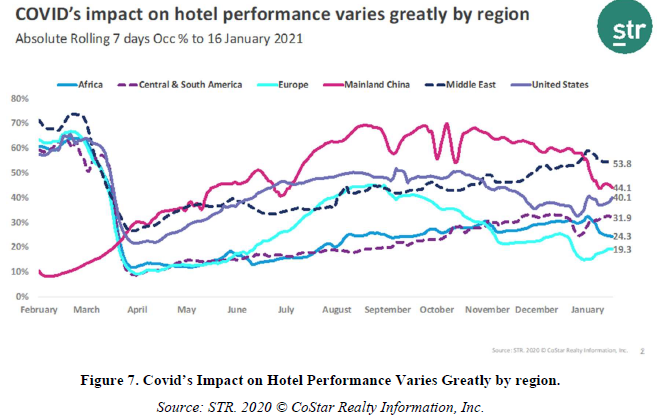

Global Hotel Occupancy Rate in 2020 compared to 2019

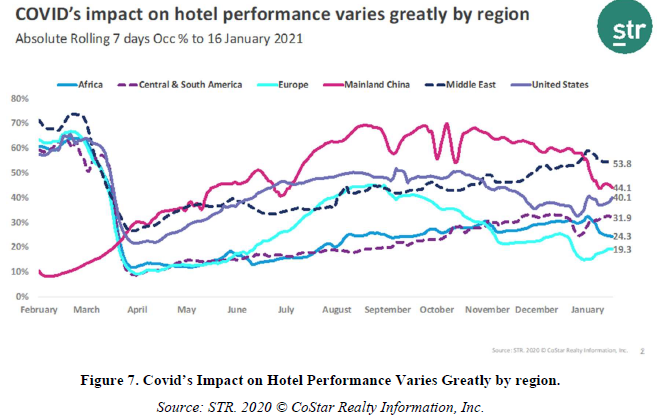

The graph shows the impacts of COVID-19 on the hotel performance in different continents throughout the months, since the beginning of the pandemic.

Since the beginning of the pandemic (March 2020) all regions have experienced an enforced closure of the hotel sector that led to a drastic fall in occupancy rate. The only exception is China since it faced COVID-19 crisis a month and a half earlier than the rest of the world, so in May the facilities were already re-opened and hosted already domestic tourism.

The worldwide hotel performance had been fluctuating during 2020, but during the summer period (July-September) showed a worldwide increase in occupancy rate, driven by the sharp increase of leisure domestic demand and by staycations (holiday taken close to home) (Figure 7).

A snapshot of the global occupancy rate in mid-January 2021 shows that the Middle East has the highest rate (53.8%), followed by China (44.1%), the United States (40.1%), Central and Latin America (31.9%), Africa (24.3%), and, lastly, Europe (19.3%) (Figure 8).

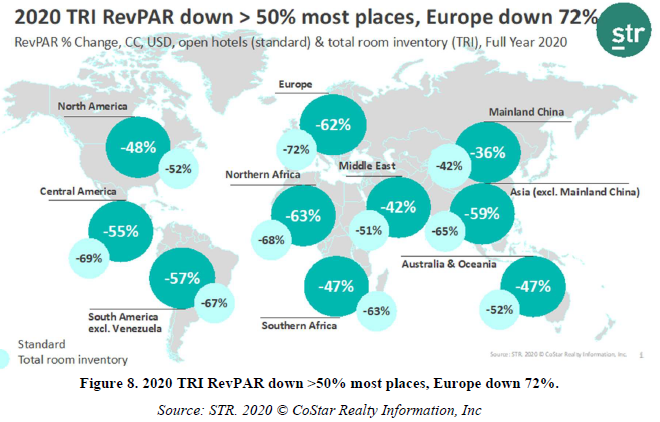

Hotel income in 2020 compared with 2019

The chart shows the dramatic decrease in income registered by the hotel industry in 2020.

The income calculated through the hotel financial indicator RevPar (revenue per available room) decreased by 50% in 2020. Europe led this decline with a decrease of 72% compared with the previous year.

The standard RevPar (dark green) is calculated taking into consideration only the number of available rooms in the hotels open in a specific destination. Total room inventory (pale blue colour), instead, takes into consideration the maximum capacity of a destination’s hotel rooms, which also includes the rooms of the closed hotels.

The difference between the two indexes shows the number of closed hotels in each destination.

DISCUSSION

After having illustrated how Covid-19 impacted on the demand and on the offer point of view, we introduce an innovative element to the discussion. We focus the attention on how new product strategies should be introduced by that tourism industries and by destinations in order to co-design a new experiential product that takes into account the “new normality” (such as distancing, small groups, open air activities…) and reassure customers.

PRODUCT INNOVATION

Owing to COVID-19, the tourism and hotel industry has had to face the great challenge of re-designing its product experience by introducing innovative strategies to reassure customers that they can have a safe holiday.

Experiential tourism which enhances local heritage

Design experiential products which can be enjoyed in the open air, based on the "Win-Win UNESCO Experience" methodology, designed and applied by the writer in several destinations. It consists of developing long-term multi-stakeholder (private and public) partnerships in order to design a sustainable experiential product linked to the discovery of local tangible and intangible heritage. Hoteliers located near UNESCO Heritage Sites (natural and cultural) should design, for cultural tourists, a unique experience linked to the heritage and local population (e.g., learning how to make a vase, cook a local dish, paint a local landscape).

Customers’ interest and curiosity in learning as well as experiencing local culture is the driving force for building sustainable but profitable tourism linked to small and medium-sized local entrepreneurial activities.

Promote marginalized or off-the-beaten-track destinations which can be easily reached by families and individual tour groups by car. It is also appropriate to promote soft activities focused on natural well-being in the open air (i.e., walking or activities in the nature) or related to gourmet cuisine, wine, landscapes, and open-air discovery.

Invite tourists to discover the destination, recommending nearby hotels and promoting activities organized by natural parks.

Draw attention to vacation rentals and parking services

Customers’ preference for holiday homes and apartments must be used by hoteliers with housing units as a competitive advantage. Hoteliers should draw attention to their vacation rentals in a central place on the homepage of their website.

Likewise, hoteliers should highlight the availability of guaranteed parking (free of charge or at an extra service) since customers arriving by car will highly appreciate this in order to avoid contact with other travelers.

Inform guests about the health and safety measures in place in their holiday destination

Hoteliers should use an integrated communication strategy to inform guests about the standard health and safety procedures which they can expect to find during their holiday. We suggest that hoteliers introduce the following effective strategies, taken from the international hospitality best practices and from know-how stemming from previous experience with crisis management.

Inform guests that all the hotel staff use personal protective equipment (mask, gloves), and provide guests with a self-sanitizing kit. Provide a daily cleaning service upon request in exchange for added-value benefits if clients refuse it (e.g., a daily little gift such as a free drink).

Specify that all hotel safety protocols are implemented.

Advice: Avoid using a prescriptive/normative tone and language ("We have adopted the protocols"). Instead, communicate a warm message such as: "Your health and safety are a priority for us, so we have intensified the safety measures already in place in order for you to have a relaxing and enjoyable stay”.

Create a self-made video (at no cost) showing the cleaning and hygiene strategies adopted by the hotel staff in the rooms and common areas.

Reverse housekeeping shifts in common areas and plan the cleaning activities during the day instead of in the evening, in order to reassure customers that hygiene measures are being taken several times per day.

Introduce integrated communication strategies to spread the “hygiene and safety measures”: website, quote email, phone calls, social networks, etc.

Hotel marketing strategies to reassure guests

The analysis of the first year of the pandemic shows several tourism trends such as leisure demand vs business travel, domestic destinations vs long-haul, car vs plane, long-term holidays vs short-term holiday, house rental vs hotels, marginalized and rural destinations vs large cities, and natural and intangible heritage vs tangible heritage such as museums.

Based on customer analysis and the analysis of market trends, we strongly suggest introducing new hospitality strategies to adapt the customer journey to the “new normal”. In order to support the re-start of travel and tourism, significant attention should be paid to product innovation and to the communication of safety measures to clients.

We previously advised the hospitality sector and destination management to introduce the above-mentioned recommendations in order to restart tourism.

The situation is rapidly changing and it is very important that the tourism and hospitality sectors keep up to date with and are aware of social changes in order to be able to design innovative hotel product experiences.

Times of crisis are particularly favorable to innovation. To conclude these exchanges with experts in air transport and tourism, we wanted to give the final word to a specialist in innovation in emerging and non-conventional mobility systems, Manuel Chaufrein.

A look at the future of airports: The development of emerging and non-conventional means of transportation

Airports are hubs connecting various means of transport. Thus, sustainability of air travel is linked to smart traffic management of both air and ground transfers. It relies on innovative solutions for operations, smart mobility (car sharing, autonomous shuttle buses, airport parking services), green logistics (drones carrying luggage) and road infrastructure. For example, the development of non-conventional solutions such as autonomous driving systems and electric vehicles (EV) are beneficial. They can reduce the level of road congestion while reducing emissions. In addition, the related information technologies allow for predictions, optimization and the connection of all infrastructure. Smart airports also cover the use of alternate sources of energy such as hydrogen.

Some companies, like AVAIRX, are already involved in the transition towards smart airports.

INTERVIEW WITH MANUEL CHAUFREIN, CEO AND FOUNDER OF AVAIRX

What is the purpose AVAIRX?

Founded in 2012, AVAIRX is a strategic consulting firm specialized in the planning and urbanization of emerging, non-conventional and innovative transport systems. The company started with electric vehicle (EV) operations and helped airports in developing new business models linked to access, mobility and urbanism. AVAIRX has developed various emerging and non-conventional solutions around the world. In its missions, the company brings an “avant-garde” perspective and looks at the future impacts of these new solutions.

Can you share what your recent involvement in the area of airports has been?

Airports have been an important territory for AVAIRX; they are key clients and, for some, strategic partners. Helping our clients to look for new solutions especially in times of pandemic is one of our missions. Building on a number of strategic consulting missions for public transport operators, airports, OEMs and start-ups, as a result of the roadmap and project specifications provided by AVAIRX, the Aéroports de Paris (ADP) Innovation Hub was able to explore the potential of autonomous vehicles for airport access and airside operations, as two autonomous shuttles were able to connect the Groupe Aéroports de Paris headquarters with two hotels and the Roissy RER suburban train station.

In this framework, we provided opportunity and feasibility studies, resulting in test phases in 2018. From this first trial, ADP set up a roadmap of strategic autonomous systems with the ambition to extend the usage of autonomous vehicle solutions on its territory. Following this major milestone, between 2019 and 2020, the company launched initiatives and provided strategic insights to high-stake decision-makers.

AIRPropriation is another initiative and mission led by AVAIRX. In 2019, we supported a group of students developing a unique advanced air mobility (AAM) concept drone to join the Boeing GoFly Challenge (a sponsored flying machine design competition). Since the inception of AIRPropriation, AVAIRX has supported the development of new value propositions and business model concepts in AAM and UAM, bridging the future of connected digital infrastructure with the future of aviation, whether with future jet fuels, new aircraft types or innovative concepts of operations applied to priority use cases. Thanks to the application of design thinking, our own methods and tools, we are delighted to observe the first results of our strategic missions with key partner airports, such as the development of next generation mobility hubs and the use of renewable energy to turn airports into power hubs, going beyond their function as air and rail transport hubs.

SUMMARY

Air transport and tourism are interdependent as they are both components of the notion of travel. A crisis in the field of air transport can have consequences for the tourism activity of a region. Following the same logic, a political crisis leading to the closure of borders, as observed during armed conflicts or terrorist attacks, leads to economic consequences for the carriers operating in those regions. Previous crises such as 9/11, SARS-CoV2 and the 2008 economic crisis illustrate these connections. Although they were relatively brief and had a regional impact, these crises were also characterized by a rapid and very marked rebound which allowed for a recovery and relative cushioning of the economic consequences.

As the contributions to this White Paper show, the COVID-19 crisis is unlike any previous crisis. It is a long, brutal and global crisis which has brought air transport and tourism to a standstill simultaneously, with no fallback solution. Beyond the unprecedented economic consequences and political responses, the crisis has brought to the fore new problems and societal upheavals which need to be considered to work towards a sustainable resumption of leisure activities and air mobility.

While our experts agree on the effects of the global crisis, it is also interesting to look in detail at the reasons why the health crisis is having such a massive impact on air transport, tourism and hospitality. Two factors should be considered to understand the effects of the crisis: the questioning of freedom of travel and the individual, possibly irrational, behavior of holidaymakers or business travelers in the face of a health threat. The freedom of travel and the confidence linked to the physical integrity of the traveler are the two pillars of the growth of transport and tourism, and they are directly impacted by the effects of the health crisis. Hindered by restrictions, planes are grounded. Worried about the crisis, travelers are staying at home.

With regard to the drop-in activity resulting from the pandemic, statistics show the common orders of magnitude of its impact on the air transport and hospitality fields, ranging from a cessation of nearly 96% of activity at the height of the crisis in March and April 2020, to a limited recovery of only very rarely more than 50% of activity over the summer period versus 2019.

This global crisis is therefore having profound effects which must be considered when dealing with recovery scenarios. It is not to be compared to the pre-COVID period, as the behavioral and regulatory changes are so intense and lasting. The concept of the "new normal" reflects the expectations and constraints of the traveler. Hotel professionals are preparing for this "new normal" by implementing health and hygiene standards to restore visitors’ confidence. From start to finish, the "health bubble" must be preserved. This is also the principle on which airports and airlines have focused their efforts in order to restore confidence and demonstrate that airports and aircraft are safe places thanks to their organization, staff training and the advanced technology used on board as well as at passenger reception and transit points. There is a common will among airport operators, service providers, airlines and the States to prepare for a better resumption of activities, albeit sometimes in a degraded mode, which guarantees optimal health and safety.

It has been over a year since the beginning of the crisis and the European sky is still cloudy. Depending on the evolution of the pandemic and the health measures put in place, the tourism industry is either going to open or close. Once again, confidence is the only factor that can sustainably revive air transport and tourism.

We also observe this same situation on the other side of the Atlantic. Air transport statistics in the United States show the same pattern as in Europe. They describe a sharp drop in traffic from the beginning of March 2020 and a slow and irregular recovery in the domestic or proximity segments which characterize “visiting friends and relatives” patterns. Massive vaccination against COVID-19, the issuance of globally recognized vaccination certificates and the homogenization of health and safety procedures are the key elements for sustainable recovery. The harmonization of policies dealing with the entry of foreign visitors and the provision of clear information to hoteliers prior to stays should help to restore travelers’ confidence, guaranteeing safety and security.

The health crisis has brought with it lasting changes in our way of socializing. Thus, hotel professionals are finding that their customers want to reduce their interactions with staff or other customers. They ask about the conditions of reception beforehand and want high standards of hygiene. Professionals are therefore developing labels to guarantee consumers that health standards are respected. Another significant fact is the generalization of remote working which brings with it new opportunities for hoteliers and destinations. Indeed, remote working make it possible, provided there is a good internet connection on-site, to stay for a few days, weeks, or months in a third location which is neither the place of work nor the home: the concept of "Bleisure", an alternative offering hotel accommodation and leisure activities but also the facilities required to work, is thus emerging. Finally, emergency economic action plans will encourage technical innovation and the development of new technologies such as non-conventional and emerging transport systems. These systems can help to improve the user’s experience while reducing the carbon footprint of air travel. The recovery will also require the greening of aviation and therefore massive investment in research into hydrogen engines.

The COVID-19 crisis will remain a landmark in the history of air transport and tourism. Longer and deeper than previous crises, it is pushing these industries to reinvent themselves, and to invest in new technologies and training. Known for its resilience, tourism and air transport will take advantage of the crisis to propose a more sustainable model, respectful of the planet and human beings, and will come back stronger.

CONCLUSION

European air traffic is particularly affected by this sanitary crisis. 2020 traffic fell massively compared with 2019, leading to an annual loss of 6.2 million flights operated. Many jobs in the air transport sector were lost in 2020 (almost 200,000 by year-end in Europe) and many more are at risk in 2021. This pandemic will certainly lead to radical changes in the travel habits of passengers. However, hope must not be lost, and although this crisis will certainly have negative impacts on the aviation sector, there will also be positive impacts. The crisis has accelerated the need for the development of new technologies in response to environmental, economic and societal concerns. New interests are emerging and the sector is being challenged more than ever to move faster and take into account all the current issues. Air transport players are showing that they are capable of adapting quickly to revive the sector and reduce the negative effects of this pandemic. Hope is justified; the sector will rebound and recover.

DISCLAIMER

This article represents a personal assessment of the author of the situation of European air traffic and its future, taking a look using official EUROCONTROL data at the main impacts of COVID-19 on European air traffic, the probable scenarios for the years to come, and the future of aviation after COVID-19. Any views expressed in this paper are those of the author and were expressed in open discussions in a student forum and do not represent any EUROCONTROL official opinion or NM position.

The crisis is not limited to European borders but has the particularity of being global. Thanks to Andrew R. Goetz from the University of Denver, we can gain insight into how the United States has reacted to the crisis in the air transport and hospitality sectors and how it plans to recover in a post-COVID-19 world.

- Arnould E. & Price L. (1993) River Magic: Extraordinary Experience and the Extended Service Encounter, Journal of Consumer Research 20: 24-45.

- Calhoun, J. (2001). Driving loyalty by managing total customer experience. Ivey Business Journal 65(6): 69-73.

- Basile M., Della Lucia., M., & Giudici., E. (2020) A new entrepreneurial training model the Win Win UNESCO Experience. In Humanistic Tourism Values Norms and Dignity Routledge.

- Basile, M., Luger, K., & Ripp., M. (2020) A new entrepreneurial model towards co-planning a “Win-Win UNESCO Experience”. In World Heritage, Place Making and Sustainable Tourism. Studien Verlag.

- Basile, M., (2020) Comunicare ai tempi del COVID-19 le esperienze internazionali Turismo e Ospitalità nel Trentino 7-8: 14-15.

- Basile, M., (2020) Strategie di viaggio ai tempi del COVID-19 Turismo e Ospitalità nel Trentino n. 11: 10-14.

- Binggeli U., Constantin M., & Pollack E., (2020) COVID-19 tourism spend recovery in numbers McKinsey and Company Available online at: www.mckinsey.com.

- Borko S., Geerts W., & Wang H., (2020). The travel industry turned upside down Insights analysis and actions for travel executives, September McKinsey & Company Copyright McKinsey & Company. All rights reserved Reprinted by permission. Available online at: www.mckinsey.com.

- Chen G., Enger W., Saxon S., & Yu J., (2020) What can other countries learn from China’s travel recovery path McKinsey & Company. Available online at: www.mckinsey.com

- Embling D., & Southan J., (2020). Travel after what will tourism look like in our new reality Euro News & The Globetrotter.

- Oxford Economics, (2020). The Economic Impact of the Coronavirus Due to Travel Losses.

- World Travel (2020). Tourism Council, Guidelines for WTTCs Safe & Seamless Traveler Journey - Testing, Tracing and Health Certificates, June 2020. All rights reserved. Licensed under the Attribution, Non-Commercial International Creative Commons Licence.

- World Tourism Organization (2020). UNWTO Briefing Note Tourism and COVID-19 How are countries supporting tourism recovery UNWTO Madrid, 1. Available online at: https://doi.org/10.18111/9789284421893

- World Tourism Organization (2020). UNWTO Briefing Note Tourism and COVID-19 Understanding Domestic Tourism and Seizing its Opportunities UNWTO Madrid, 3. Available online at: https://doi.org/10.18111/9789284422111

- Filser, M. (2002). le marketing de la production d expérience statut théorique et implications managériales Décisions marketing N 28 spécial extension du domaine de experience pp: 13-22.

- Frow, P. & Payne, A. (2007). Towards the perfect customer experience Journal of Brand Management 15: 89-101.

- Gössling S., Scott D. & Michael Hall C. (2021). Pandemics tourism and global change: a rapid assessment of COVID-19 Journal of Sustainable Tourism 29: 1-20.

- Grönroos, Ch. (1990), Service Management and Marketing Managing the Moments of Truth in Service Competition Toronto Lexington Books pp: 42.

- Gursoy D., Chi C. G. & Chi O. H. (2020). COVID-19 Study Restaurant and Hotel Industry Restaurant and hotel customers sentiment analysis. Would they come back If they would WHEN. Available online at: http://www.htmacademy.com/wp-content/uploads/2020/11/COVID-19-November-study-summary-report.pdf

- Holbrook, M.B. & Hirschman, E.C. (1982). The Experience Aspects of Consumption Consumer Fantasies Feelings and Fun Journal of Consumer Research 9(2): 132-140.

- Ritzer, G. (1999), Enchanting a disenchanted world revolutionizing the means of consumption Thousand Oaks Calif Pine Forge Press.

- Shaw, C. & Ivens, J. (2002). Building great customer experiences Palgrave Macmillan. UNTWO global review for tourism. Available online at: https://webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2020-12/201202-Travel-Restrictions.pdf

- Airlines for America. (2021). Tracking the Impacts of COVID 19. Available online at: https://www.airlines.org/dataset/impact-of-COVID19-data-updates/#

- National Restaurant Association (2021). State of the Restaurant Industry report measures virus' impact on business. Available online at: https://restaurant.org/articles/news/new-report-measures-pandemics-effect-on-business

- U.S. Department of Transportation Bureau of Transportation Statistics (2021) Tran Stats Airport Snapshots. Available online at: https://www.transtats.bts.gov/airports.asp?20=E

- U.S GAO, (2021). COVID-19 Pandemic Preliminary Observations on Efforts Toward and Factors Affecting the Aviation Industry’s Recovery.

- Testimony Before the Subcommittee on Aviation Committee on Transportation and Infrastructure House of Representatives (2021).

- U.S. Travel Association. (2021). COVID-19 Travel Industry Research. Available online at: https://www.ustravel.org/toolkit/COVID-19-travel-industry-research

- Upgraded Points. (2021). The Impact of Coronavirus (COVID-19) on U.S. Airlines. Available online at: https://upgradedpoints.com/coronavirus-impact

- Wamsley., Laurel. (2021). The Day Everything Changed, National Public Radio. Available online at: https://www.npr.org/2021/03/11/975663437/march-11-2020-the-day-everything-changed

- EUROCONTROL Data Snapshot on cargo flights. Available online at: https://www.eurocontrol.int/publication/eurocontrol-data-snapshot-all-cargo-flights-market-share

- EUROCONTROL COVID-19 on European Aviation-Think paper. Available online at: https://www.eurocontrol.int/archive_download/all/node/12598