Research Article

THE HOSPITALITY OUTLOOK: IMPLICATION FOR THE HOSPITALITY STUDENT TODAY

7457

Views & Citations6457

Likes & Shares

Purpose: The overarching purpose of this study was to examine the Hospitality outlook and the opportunities it presents for hospitality students/ graduates.

Design/methodology/approach: Use of desk research with various sources such as publications in journal articles and books.

Findings: The regional report of the World Travel and Tourism Council showed that, the travel and tourism industry of Africa saw an average of 65.3 million international tourist in 2013 alone. The WTTC projected an increase of additional 200,000 visits representing 4% increase in the subsequent year. The additional 4% increase in international arrival in 2014 implied that, the travel and tourism sector of the continent was going to the fastest growing one compared to other regions such as Europe, Pacific, Asia, Americas and the Caribbean. Reports from WTTC suggested that, the travel and tourism industry of Ghana generates at least 288,000 jobs in 2015. The WTTC projected an increase of 2.4% in 2016 as well as 4.7% progressive growth in 2017. Hence hospitality and Tourism is doing well in Ghana in terms of job creation. This increase in international visits has a positive effect on the hotel industry and consequently require quality workforce to boost guest satisfaction and sustainability in the hotel business (AIHO, 2017-2021).

Practical implications: this research identifies the need for hospitality student to upgrade skills, knowledge and change of attitude in order to meet industrial standards of operation and be able to compete with the current trend. The growing competition calls for innovation in hospitality and tourism. So, each student or students in teams should be encouraged to create something new.

Originality/ value: The focus is on the development need of the Ghanaian Hospitality student to have a change of attitude toward acquisition of knowledge and skill.

Keywords: Hotel industry, Hospitality outlook, Hospitality student, Ghana

INTRODUCTION

Tourism has over the past five decades been defined variously by scholars, researchers, international organizations and industry practitioners. For example, the UN World Tourism Organization (2008) explained tourism as activities which involve people travelling from their usual home of residences to other places for purposes of relaxation, leisure, business and pleasure for more than one day but less than one consecutive year. According to (Goeldner & Ritchie, 2009) the travel and tourism industrial is multifaceted in nature. (Goeldner & Ritchie, 2009) explain that, several components of activities and interrelating services come together to forms the travel and tourism industry. Imperatively, the industry is noted by (Goeldner & Ritchie, 2009). to comprise of travel (transportation), accommodation, attraction and other auxiliary services. These four major components of the industry come together relationally to deliver the expected experience to tourists and travelers.

The hospitality industry been a major facet of the travel and tourism industry is noted by (Goeldner & Ritchie, 2009) as very broad. According to (Cooper et al., 2009) the hospitality industry focuses on rendering essential services to tourist or traveler after the travel and tour package has been purchased. Noted by (Cooper, et al., 2009) the hospitality sector of the travel and tourism industry focuses on providing accommodation services, food and beverage services, entertainment services among others to the tourist at destination and attraction centers. According to (Goeldner & Ritchie, 2009) the hospitality sector is one of the multi-billion sectors of the global economy that generates significant revenues to countries as well improving the livelihoods of several millions of people through employment generation and income generation. As estimated by the WTTC, the hospitality sector of Ghana created more than 100,000 jobs in 2015 with a progressive growth projection of 5% per annum. It is expected that, the hospitality industry of Ghana would create at least 480,000 jobs by close of 2025 (WTTC, 2015). This study sought to provide relevant information and data on the current outlook of the hospitality industry and its related implications for contemporary hospitality students in Ghana.

PROBLEM STATEMENT

Several empirical studies (Asirifi et al., 2013; Avornyo; 2013; Nduro et al., 2015) have reported that, most tertiary graduates from institutions that provide higher learning hospitality education are not able to match the expected skills and competences demanded by employers within the industry.

For example, the studies of (Asifiri et al.,2013). (Avornyo ,2013). observed that hospitality tertiary graduates are not able to use their acquired skills to meet industrial expectations. Few Ghanaian writers have confirmed that there is a gap between school and industry and suggested industrial attachment as the solution to bridge the gap. (Asirifi et al., 2013, Nduro, et al, 2015). Yet the fact remains that the hospitality student attitude towards work leaves much to be desired. Lecturers are doing their best to find the solution to the declining condition. Probably, it is believed that the provision of facts regarding opportunities available for them to grasp will help solve the problem. This notion has motivated this study to find out the general direction the industry is going and the opportunities it presents to the hospitality student. The researchers therefore seek to explore the issues, challenges and trends facing the industry and the opportunities and threats it presents to the hospitality student.

LITERATURE REVIEW

Global Hospitality Outlook

The travel and tourism industry from the global perspective was valued around 7.5 billion USD in 2015. This valuation according to (WTTC,2015). represented 10% of the global gross domestic product. The WTTC projected progressive average annual growth of 3.8%. It was estimated by the (WTTC,2015). that, the value of the global travel and tourism industry would reach 2 trillion USD by close of 2025 with a progressive average growth of 4.7% 2026 and beyond. Aggregate investment in the travel and tourism sector across the globe was estimated to be around 850 million USD in 2014 with an average progressive growth of 4.5%. Aggregate investment in the travel and tourism industry as projected by (WTTC,2025). is expected to reach 1.2 trillion by close of 2025.

The travel and tourism industry alone contributed at least 109 million jobs worldwide in 2016 generating at least 2.3 trillion direct incomes to direct employees within the industry. The travel and tourism sector are expected to create at least 292 million direct jobs with close to 7.6 trillion direct incomes to employees within the industry by close of 2021. Significantly, the travel and tourism industry across the globe contributes 1 out of every ten jobs when compared to other industries such as healthcare, manufacturing, banking, agriculture etc. According to (WTTC,2017). direct international tourists’ expenditure contributes at least 28% of the aggregate revenue accrued from the travel and tourism industry.

More recently, in 2018, the WTTC reported that international travel and tourism documented a growth rate of 3.9% and contributed revenue amounting to $8.8 trillion and created 319 million employments globally. This signifies that growth within the international tourism and hospitality industry was superior to the world’s GDP recorded at 3.2%. Furthermore, the industry accounted for 10.4% of global economic activity and was specifically responsible for one-tenth of all jobs worldwide (WTTC, 2019).

The increase in global consumption rate is enhanced by the growth in the travel and tourism industry. As explained by (Goeldner & Ritchie, 2009) the travel and tourism industry is multifaceted in nature hence growth in the sector also trigger direct and indirect growth in other sectors through forward and backward linkages. The 2019 report of the WTTC showed that, countries such as USA, Japan, Germany, China and the UK were the top five markets of the travel and tourism industry globally. Similarly, the 2019 Edition of the International Tourism Highlights further reports that global tourism and hospitality continue to outperform the global economy whereby tourism exports generate more revenue than merchandise exports which have led both emerging and advanced economies to reap positively from the income generated from the sector. Moreover, Travel & Tourism has become a catalyst for economic growth and development as well as stimulating innovation and small-scale businesses worldwide (UNWTO, 2019).

According to (WTTC, 2015) Europe took a greater percentage of the global travel and tourism industry contributing at least 51% of the industry’s contribution to global GDP in 2015. Imperatively, the (WTTC, 2015). Attributed this scenario to spikes in international tourist arrivals to countries such as UK, Spain, France, Germany and Italy. According to (WTTC, 2015).the UK alone contributed at least 142 billion USD to the global tourism industry in 2015 alone. The (WTTC, 2015) regional report covering the Americas cite the United State of America as the largest contributor of the region’s travel and tourism industry in terms of revenues. According to (WTTC, 2015) The US contributed at least 1.2 trillion USD in 2015 which was followed by Canada’s 98.2 billion USD. The report also observed that, the Asia-Pacific tourism region contributed approximately 9.4% to the global tourism aggregate revenues. This figure was expected to surpass that of Europe by close of 2025 due to increase in disposable income in countries such as China, India, Japan and Singapore due to massive economic expansion in those four countries.

The African Hospitality and Tourism Industry

The travel and tourism industry of Africa is considered as the fastest growing one when compared to other regions such as Asia-Pacific, Europe and the Americas. This is because the economic outlook of Africa since 2015 has shown massive growth and economic expansion. Rising economies such as Ghana, Rwanda, Tanzania and Kenya have enhanced consumption and investment in the travel and tourism industry of Africa. Despite the recent regional pandemic of Ebola and global COVID-19 pandemic, the travel and tourism sector of the region is expected to grow by 28% in 2025 and beyond due to massive investment in the sector (Hospitality Outlook, 2020).

According to (WTTC, 2015). Africa offers the best dynamic range of attractions which include culture, food, nature, heritage, hospitality and tradition. These resources put together with the increasing improvement in the built attraction sector is expected to attract international tourists from the US, Europe and Asia to the continent. According to (WTTC, 2020) the recent Year of Return which was organized by the government of Ghana in 2019 pulled more than 3 million visitors to from America and the Caribbean to the continent.

Generally, South Africa, Nigeria, Kenya, Morocco, Egypt and Tanzania take the majority of share of international arrivals and revenues in Africa. These countries as reported by (WTTC, 2020) accounts for 38% of the travel and tourism market share of Africa. Emerging countries such as Ghana, Mauritius and Rwanda are also making significant progression in terms of international arrival and revenue generation. For example () reports that, Ghana after the Year of Return was ranked the fourth most visited country in Africa scoring an increase of 1.9 billion USD in revenue generation.

As reported by (WTTC, 2016). the travel and tourism industry accounted for more than 5.9 million jobs in Africa with an estimated progressive growth of 2.5% per annum. The progression in terms of job creation corelate with intensive investment in the hotel industry, airline industry, food and beverage industry, leisure industry and destination. It is estimated that, jobs within the travel and tourism industry of Africa will reach 7.6 million by close of 2025 with expected annual increase of 3.8%.

The Ghanaian Tourism and Hospitality Industry

Ghana is regarded as one of the countries in Africa that has shown significant progression in terms of tourism development over the past two decades. According to Asirifi et al. (2013), Ghana is rich in diverse yet outstanding cultures and traditions, heritage and historical monument, natural parks and reserve, lakes, ocean beaches, waterfalls among others that attract millions of international tourists on yearly basis. According to WTTC (201), Ghana receives an average of 1 million international tourists on yearly basis. According to Ghana Tourism Authority (2020), the 2019 maiden edition of the Year of Return project brough more than 1.2 million tourists from the diaspora fetching the country over 1.9 billion USD.

The travel and tourism industry is regarded as one of the primary contributor to Ghana’s socio-economic growth in terms of employment creation and income generation. According to reports by CitiFm.com, the travel and tourism industry contributed 1.3 billion USD to Ghana’s GDP in 2013. The figure was expected to increase by an annual average of 2.8%. A total of 124,000 direct jobs were supported by the tourism industry and USD303 million of investment executed in the travel and tour sector.

Implication for hospitality students and graduates

Globally, tourism has impacted the world’s economy. Being one of the world largest industries, the travel and tourism industry is expected to create more jobs and generate substantial income for hospitality students and graduate. Imperatively, the growth in the travel and tourism industry provides the right avenue for hospitality students and graduate to exhibit their entrepreneurial capabilities by establishing Small and Medium Scale Enterprises. This suggests, hospitality students may not become employees but also employers within the sector.

METHODOLOGY

The researchers employed the use of desk research with various sources such as publications in journal articles and books. (Doorewaard,2010). explained desk research as a research approach or strategy in which the researcher does not rely on collecting raw data to provide an entirely new set of information but utilize the data provided by other researchers. Imperatively, the results provided in this study draw clues and findings of what other researchers have done in relations to the issues raised in this study.

RESULTS

The data gathered from the varied sources shows that, the global tourism industry as at 2014 was valued at 7.5 trillion USD which represented 10% of the global gross domestic product. This revenue was projected to see an increase of at least 3.8% in the subsequent year. Per the estimation made by (WTTC,2017). revenue inflow to the global tourism industry was projected to reach 11.3 trillion by 2025 contributing 10.6% to the global GDP. This implies that, the global tourism industry was projected to grow in terms of revenue by an average of 4% from 2017 to 2025. This growth rate will continue to positively affect the economy therefore if the government distributes its revenue strategically the unemployment problem might swiftly be addressed in the next few years. Data from 2015 shows that, Europe has progressively been the largest tourism destination accounting for 51% of the total travel and tourism market share. According to Oxford Economic (2015), Europe receive about 4750 million international arrivals on yearly basis. (Hoctrec, 2016) also suggested that, travellers and tourists spend at least 1.5 billion nights in commercial accommodation facilities such as hotels, inns, motels, guest houses etc. across Europe on yearly basis. According to Oxford Economics (2015), the hospitality industry contributed approximately 1.1 billion pounds to the economy of Northern Ireland in 2015 alone.

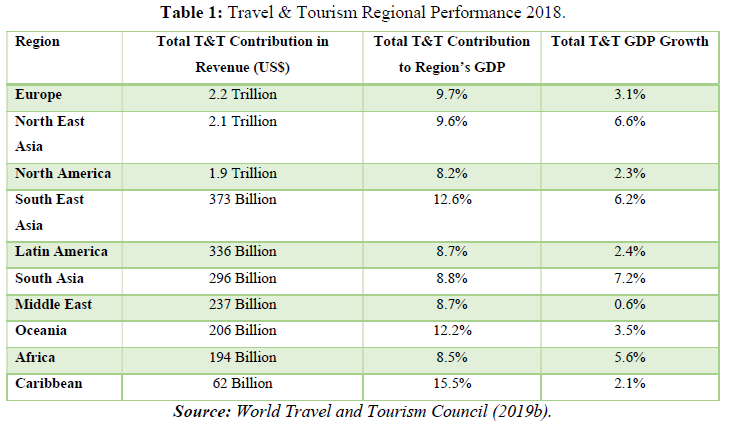

Across the major regions of the world, the 2019 World Travel & Tourism Economic Impact revealed that travel and tourism generated 2.2 trillion dollars in economic output which translated into 9.7% of the GDP of Europe whereas the industry’s contribution in North America was 1.9 trillion dollars in revenue and 8.2% to GDP. Moreover, within the North East Asian region, travel and tourism contributed revenue amounting to 2.1 trillion dollars and 9.6% to the regions’ GDP while the figures in Latin America were 336 billion dollars in revenue and 8.7% to GDP. In the Oceania region, travel and tourism was noteworthy because it was responsible for 206 billion dollars in revenue and 12.2% to GDP whereas within the Caribbean region, the industry’s contribution was recorded at 62 billion dollars in revenue and 15.5% towards GDP (WTTC, 2019).

(Hotrec, 2016) reported that, the travel and tourism industry offered direct employment to 9.5 individuals across 1.7 million firms within the industry. This accounted for 4.4% of aggregate employment in Europe as well as 8% of firms in market-oriented economies. The hospitality sector is cited by (Hotrec, 2016). as significant employer of young individual of ages below 35 years. According to (Hotrec, 2015) women account for about 55% of the workforce of the travel and tourism industry across the globe (Table 1).

(Walker, 2010) cited the travel and tourism industry as one of the largest industries of the global economy. The is supported by the 2014 travel and tourism report made by WTTC which showed that, the travel and tourism industry contributed 7.58 trillion USD to the global GDP from which 3.85 trillion were accrued from direct spending of tourist. According to (WTTC, 2014) the aggregated international arrivals across the globe in 2014 was 973.8 million with Europe accounting for more than 50% of the arrivals. Comparatively, the data by (WTTC, 2014). showed that, the industry had seen significant growth in terms of visitor and tourist numbers looking at the aggregate international arrival of 250 million recorded in 2005. Projections made by The Travel and Tourism Competitiveness Report (2015) suggests that, global international arrival will reach 1.81 billion by close of 2030. A recent report by the U.S Department of Commerce and International Trade Administration in 2018 showed that, the travel and tourism industry alone generated 1.6 trillion USD to the US economy. The industry also accounted for 7.8 million that is 11% of aggregate jobs in the US.

Global data and reports on travel and tourism shows that, inbound tourism has showed progressive growth from 2008. According to (UNWTO, 2019) inbound tourism has since 2008 showed an average of 5% growth. By implication, this signifies that, globally, travel and tourism offer enormous opportunities for employment creation, career advancement as well as economic growth and development. Therefore, the hospitality students are faced with and positive prospects for the future within the travel and tourism sector of the global economy.

AFRICA

The data from (Word Bank, 2013) suggests that, the number of international tourist arrival within the Sub Saharan African region has since 1990 see over 300% growth with 2012 making the peak arrival of 33.8 million visitors and tourists from other regions. Income generation and circulation within the travel and tourism industry of Africa has also seen significant growth. According to (World Bank, 2013) the travel and tourism industry contributed over 36 billion USD to Africa’s economy. This revenue accounted for only 2.3% of the continent’s aggregate gross domestic product. Despite decline in financial stands of Africa, international arrival in general has progressed by an average of 8% beginning from 2012. This makes the continent the fastest growing regions compared to other regions such as the Pacific and East Asia. In 2018, World Travel & Tourism Council statistics depicted that travel and tourism generated revenue totaling 194.2 billion dollars in economic output and contributed 8.5% of the GDP on the African continent (WTTC, 2019) Likewise, in the same year, international tourist arrivals to Africa rose to 67 million which indicates 7% increase from 63 million in 2017 (UNWTO, 2019).

The (World Bank, 2013) reported that, the hotel industry of Africa moving from 2013 was going to see significant investment due to the accelerated increase in international arrival to the continent. According to (World Bank, 2013) the increase in international arrival in Africa has enhanced both public and private sector investment into building modern hotel chains to accommodate the increase in international and domestic tourism and hospitality related accommodation demands. Imperatively new set of findings from the (WTTC, 2019) suggests that, the increased investment in the hotel industry of African can create additional 3.8 million jobs in Africa over the next decade. As reported by (World Bank, 2013) one out of every twenty jobs in Africa have direct relationship with the travel and tourism industry. This figure is expected to increase to one out of every ten jobs in 2020 (WTTC, 2019).

GHANA

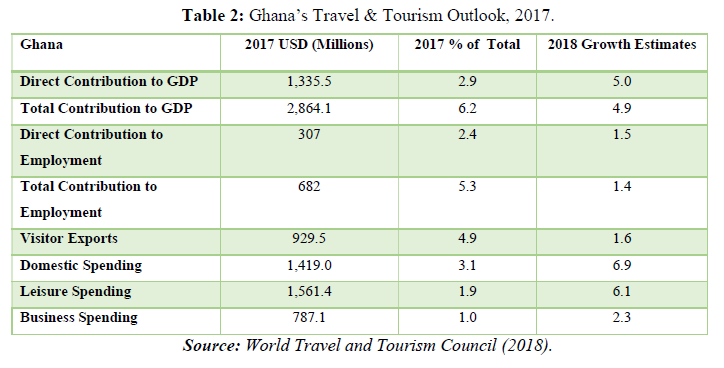

Data from the World Travel and Tourism Council showed that in 2017, travel and tourism made a direct contribution of GHC5.8 billion (US$1.3 billion) to Ghana’s GDP, which represented 2.9% of total GDP. Also, the industry directly supported 307,500 jobs translating into 2.4% of total employment as well as providing 682,000 jobs (5.3%) in both direct and indirect employment (WTTC, 2018).

Statistics from the Ghana Immigration in 2011 on international tourism related travels showed that, Nigeria accounted for 19%, The US 13%, The UK 9%, Canada 3% and Cote d’Ivoire 5% of travels to Ghana in 2011. Data from the Ghana Tourism Authority (2009) also suggested the, Ghana’s international tourism market are generated from the U.K, U.S, Canada, Germany, India, South Africa and the Netherlands. The report of (GTA,2009). showed that, these countries accounted for 45% of international tourists’ arrival in 2009. The report also showed that, the top three reasons why international tourist visit Ghana included; education, businesses and conference as well as leisure. According to (GTA,2009). the most visited places in Ghana from the international tourist’s perspective include; Kakum National Park, Cape Coast Castle, Elmina Castle and Manhyia Palace Museum. Other fringe attractions also include; Wli Falls, Mole National Park, Kumasi Zoo, Kumasi Central Market and Lake Bosumtwi.

Kotoka International Airport and Kumasi International Airports are Ghana’s only two international airports that foster international tourists’ arrival. According to Ghana Airport Company Limited over 80,000 flight movement were recorded in 2019 although the figured dropped to 6000 between December 2019 and October 2020 due to the COVID-19 global pandemic. As at 2015, there were five domestic airliners operating in Ghana with an average movement of 780,000 passengers (Williams, 2015). Ghana was ranked the 119th most visited country out of 140 countries in 2015 (Williams, 2015). Rapid economic expansion and innovative tourism product development and marketing by the Ministry of Tourism and Ghana Tourism Authority have triggered significant growth in international arrival over the last 5 years. For example, the Year of Return brought in about 1.2 million international tourists to Ghana which made Ghana ranked as the 4th most visited destination in Africa in 2019.(Table2).

EFFECTS OF COVID-19 ON THE TRAVEL AND TOURISM INDUSTRY

The travel and tourism industry as noted by (IATA,2020). is one of the most severely hit industries across the globe. This section provides an evidence-based report on the general outlook of the travel and tourism industry amidst the COVID-19 pandemic.

Impact on Air Travel

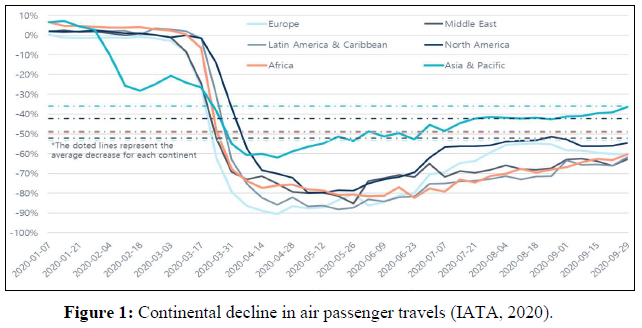

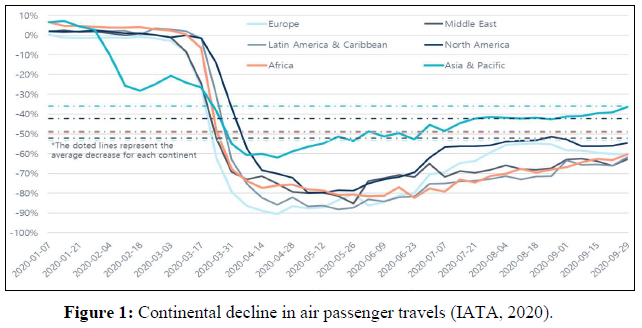

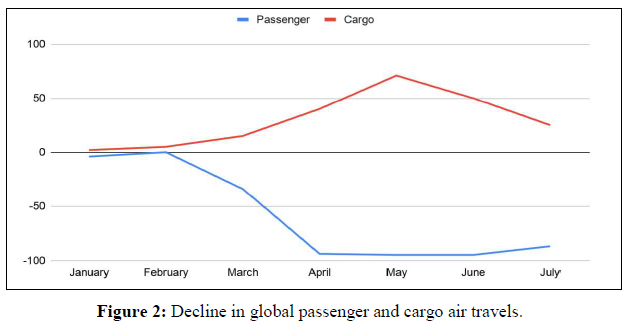

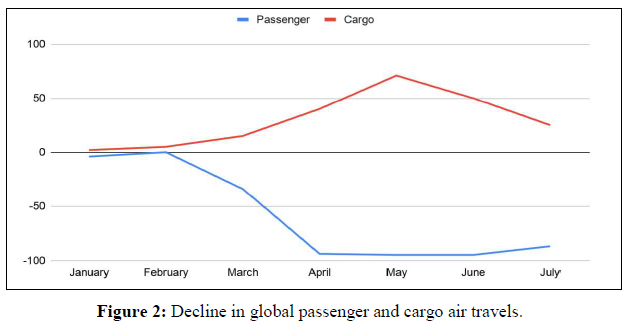

One of the key areas of the travel and tourism industry that has suffered severe shocks during Covid-19 is air travels. According to there have been negative fluctuations in air travels since the Covid-19 was declared as a global pandemic by the World Health Organization. According to Gilchrist (2020) available data on continental air travels suggests, the air passenger arrivals for most countries run into negatives during the early periods of the pandemic. (IATA, 2020) attributes this development to the total and partial lockdowns as well as closure of international borders across the globe. The European Data Portal (2020) suggests that, most airlines stopped operations between May and September 2020 since there were minimal international air travels. (Figure 1) shows the continental data that explains the decline in air passenger travels. From (Figure 2) it can be seen that, the average decline in air passenger travels across Europe between January to October 2020 was 53%. Within the same period, air passenger travels across Middle East and Africa saw declines of 52% and 49% respectively. Latin American and the Caribbean, North America and Asia Pacific regions also saw an average decline in air passenger travels of 49%, 42% and 36% respectively.

According to EDP (2020), air travels in terms of passenger seats and cargo saw significant drop to about 90% between January to July 2020 from the global point of view. (Isabelle,2020). also attributes this significant drop in international air travel to travel bans which were implemented by several governments across the globe. The aggregate decline in both passenger and cargo air travel as reported by is illustrates in (Figure 2).

Looking at the sharp declines in both passenger and cargo travels, it can be said that, the early periods of the pandemic had a significant negative implication on air travels hence its induced effects on airlines, airports, aircraft manufacturing companies and their employees as well as allied services providers were expected to be very devastating.

It is evident that while most airlines were grounded during the early periods of the pandemic, revenue generation and circulation within the global travel and tourism industry was going to see a sharp decline. According to (Isabelle, 2020) because most airlines between the periods of March and October 2020 halted operations, it resulted in most airports shutting down to air travels. Although some several airports were opened to receive essential cargo only. This development affected the revenues of both airlines, destinations, hotels, car rentals, travel and tour operators etc. According to (WTTC, 2020) while these two major facets of the industry were hit, it meant that, other auxiliary service providers such as ground operations firms, catering service providers, ground transportation firms, freight forwarders, air craft repair and maintenance firms among others were also going to see decline in their revenues.

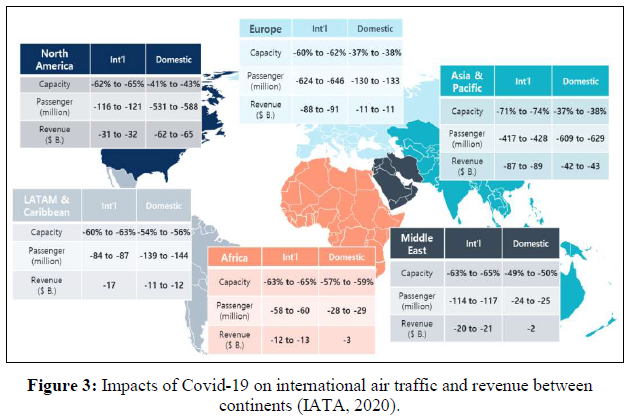

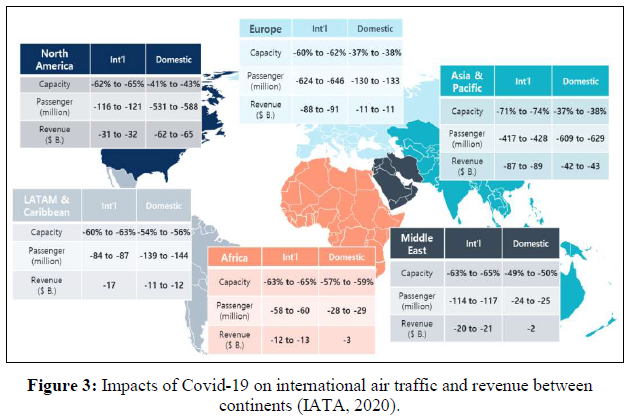

According to (IATA, 2020) the global airline industry which forms the pivot of the international travel and tourism saw about 65% in terms of passenger revenue between April to November 2020. According to (ICAO, 2020) the global airline industry lost close to 100 billion US dollars in the periods between March to December 2020 due to the fact that, air passenger travels saw a significant decline between those periods. According to (ICAO, 2020) the triple effect of this situation resulted in other affiliate industries such as travel and tourism also losing close to 200 billion US dollars since international tourist arrivals run into negatives. (Figure 3) shows an illustration of the drops in global air travel revenue across all the continents.

From (Figure 3).it can be seen that, the airline industry saw between 88 to 91 billion USD decline in revenue in terms of international air travels. Africa also witnessed between 12 to 13 billion USD decline in revenue due to drops in international air travels. North America also witnessed a decline of 31 to 32 billion USD in terms of revenues due to drops in international travels. Asia Pacific also saw a decline of 87 to 89 billion USD due to drops in international travels. Latin American and the Caribbean region also saw a decline of 17 billion USD due to drops in international air travels. From the statistics presented above, it can be said that, the pandemic has had a significant negative effect on revenue generation within the aviation industry.

Social Impacts of Covid-19 on the Aviation Industry

According to (Isabelle, 2020) the direct negative impacts of Covid-19 on air passengers and cargo travels as well revenue generation have resulted in trickling effect on employees within the travel and tourism industry. According to (Kotoky et al.,2020), the induced effects of Covid-19 on the travel and tourism industry from the global point of views lies in the number of jobs that have been lost. According to (Kotoky, et al., 2020) while airlines shut down operations between April and September, 2020, most of them had to lay off significant quantum of their workers as trade-off mechanism to balance the negative effects of Covid-19 on revenues. According to (Wyman, 2020) most airline companies as well as travel and tourism firms and hotels laid off some employees in order to survival the financial shocks their firms experienced during the peak period of the pandemic.

CONCLUSION

The study on the outlook of the travel and tourism industry suggests that, the industry has over the last two decades remained robust and seen significant growth in terms of international arrivals, revenue generation, employment creation and contribution to global gross domestic product. Generally, the study has shown that, the travel and tourism industry has seen an average growth rate of 3.8% with an expected growth rate of 3.1% from 2025 and beyond. Imperatively, the travel and tourism industry has over the last two decades been a medium of promoting world culture, peace, harmony and wealth creation through ownership of businesses within the industry. The study has shown that, long term growth of the travel and tourism industry looks very viable due to increased investment and development in tourism and hospitality in several economies across the globe. The study has shown that, Africa has become the fastest growth region in terms of arrival due to increase development and investment in the industry which is led by public and private sector participation. Job creation in the travel and tourism as well as hospitality industry is expected to reach 380 million by close of 2027. This implies that, tourism and hospitality students and graduates will have greater opportunities to exhibit their entrepreneurial capabilities by way of creating and owning SMEs in the industry.

RECOMMENDATION

The Ghana government should focus on the hospitality and tourism sector because research shows the boom will continue amid challenges such as COVID 19. Students should be advised to choose degrees and do research related to the sector. Likewise, institutions should think of programmes related to the area of hospitality and tourism. Existing hospitality schools should collaborate with the industry in training manpower for the industry.

- European Data Portal. (2020). The COVID-19 related traffic reduction and decreased air pollution in Europe. Available online at https://www.europeandataportal.eu/en/impact-studies/covid-19/covid-19-related-traffic-reduction-anddecreased-air-pollution-europe

- IATA. (2020). Facts and Figure Available online at https://www.atag.org/facts-figures.html

- ICAO. (2020). Economic Impacts of COVID-19 on Civil Aviation. Available online at https://www.icao.int/sustainability/Pages/Economic-Impacts-of-COVID-19.asp

- Isabelle, H. (2020). A study of COVID-19s Impact on the Aviation Industry. Available online at https://static1.squarespace.com/static/562ce074e4b03f1a9736745a/t/5f551f637db55519624a694f/1599414148492/Isabelle+Hasell+-+Report+-+A+study+of+COVID 19%27s+Impact+on+the+Aviation+Industry.pdf.

- Kotoky, A., Modi, M. & Turner, M. (2020). Jobs Are Being Wiped Out at Airlines, And Theres Worse to Come Available online at https://www.bloomberg.com/news/articles/2020-07-23/400-000-jobs-lost-at-airlines-during-coronavirus-pandemic

- Ministry of Tourism National Tourism Development Plan (2013-2017) Accra, Ghana.

- U.S. Department of Commerce and International Trade Administration. (2018). The Travel Tourism and Hospitality Industry in the United States Overview. Available online at: https://www.selectusa.gov/travel-tourism-and-hospitality-industry-united-states

- UNWTO. (2019). International Tourism Highlights Edition. United Nations World Tourism Organisation Madrid.

- Vallen, G.K., & Vallen, J.J. (2000). Check In Check Out. United States Prentice Hall.

- Walker, J. R. (2010). Introduction to Hospitality Upper Saddle River NJ Pearson Prentice Hall.

- World Bank (2014). Harnessing Tourism for Improved Growth and Livelihoods H street NW Washington DC 20433.

- World Bank. (2013). Tourism in Africa Harnessing Tourism for Growth and Improved Livelihoods Washington USA 2013.

- World Economic Forum. (2013). Travel and Tourism Competitiveness Index Geneva Switzerland.

- World Economic Forum. (2013). Travel and Tourism Competitiveness Index Geneva Switzerland.

- WTTC. (2018). Ghana Annual Research Key Facts. World Travel and Tourism Council London UK.

- WTTC. (2019). Travel & Tourism continues strong growth above global GDP. World Travel & Tourism Council, London, UK.

- WTTC. (2019). Travel & Tourism Economic Impact. World Travel & Tourism Council London UK.

- WTTC. (2019). Africa 2019 Annual Research Key Highlights. World Travel & Tourism Council London UK.