Research Article

THE INFLUENCE OF TOUR OPERATORS PERSPECTIVES ON HOTELS MARKETING CASE STUDY: SHARM EL SHEIKH RESORTS AND GREATER CAIRO HOTELS

5280

Views & Citations4280

Likes & Shares

The TOs (Tour Operators) undertake the responsibility to bundle tourism products and promote them, provide information for prospective tourists and establish mechanisms that enable consumers to book and pay for reservations. The research objectives is to shed light on the effect of TOs in the tourism value system also to identify the marketing influence of tour operator on the hospitality industry and its impact on the quality of service given, Moreover evaluating the role of TOs in promoting by case study of some resort hotels. A survey was carried out on Twenty four Egyptian hotels and resorts in Cairo and Sharm El Sheikh, with supervisors it was mainly conducted through a self-administered interviews, Ten interviews were carried out with TOs on marketing and to evaluate these specific hotels/resorts and Fourteen interviews with hotel managers to identify their perspectives in terms of the marketing influence of tour operator on the hospitality industry. Data collected by personal visits, phone calls and emails. The major results and Conclusion indicated that, The marketing influence of tour operators on the hospitality industry had both positive and negative impacts on the hospitality and tourism Industry. Some of the positive influences include keeping the hotel operating throughout the year, helping in decreasing marketing expenses, while the negative aspects are related to low prices of selling rooms, tour operators force resort hotels to apply low priced all-inclusive programs consumed by segments of customers with low spending powers. Consequently, this results in increasing the waste and reducing profitability.

Keywords: Tour operators (TOs), Marketing, Quality, Relationship, Profitability resorts.

INTRODUCTION

Luong (2018) pointed out that, every year millions of people seek tour operators to provide them with holidays all over of the world. On the other hand, hotels working with tour operators fill a large part of their rooms through them and secure a significant traffic during the low and shoulder periods. It also secure on time payment of their money. Moreover (Joyce, 2017) illustrated that, whatever their size, tour operators must work through the same processes when planning, developing, selling and operating their holiday programmes. These different functions will be examined and time scales identified. Tourists rely on tour operators to prevent service failures related to the service and accommodation and to maintain the quality of the trip.

Hebestreit (2015) defines the ready-made inclusive tour as service packages includes at least two complementary travel services; it is created in advance for customers and is offered at a total price, with the prices of the individual services not being identifiable. The production and distribution system of inclusive tours comprises the following components:

- Producers of individual travel services (accommodation providers, transport companies, etc.)

- Tour operators acting both as producers (by combining the individual components into a new product) and wholesalers (through brochure production and reservation systems).

- Retailers (travel agencies, travel-related websites etc.).

REVIEW OF LITERATURE

Lockwood and Jone (2018) defined the hotel as “a large house run for the purposes of giving travelers food, lodging.etc. Soutar (2016) added that “An operation that provides accommodation and ancillary services to people away from home”. Moreover, Swain (2017) illustrated that, tour operator links between customers (tourists) and primary service providers. Tour operator is company or firm with experience and capacity to buy individual travel components separately from different suppliers and assembles them into attractive packages and adding their mark-up, then sell it to customers or through Travel Agents.

Reeves and Bednar (2011) defined service quality as excellence, value, conformance to specifications and meeting or exceeding customers’ expectations. It also defined by (Bitner, Booms & Mohr, 1994). As the consumer’s overall impression of the relative inferiority/superiority of the organization and its services. On the other hand, (Asubonteng, McCleary & Swan, 2006). Defined service quality as the differences between customer expectations for service performance prior to the service encounter and their perceptions of the service received. Similarly, Lenoir (2004) added that tourists may have choices of selecting accommodation depending on budget, facilities, locations and comfort. It adds value in package tour. Room, restaurant and cocktail services along with duty-free shopping, doctors on call, beauty parlor, fitness center, etc make a guest feel at home.

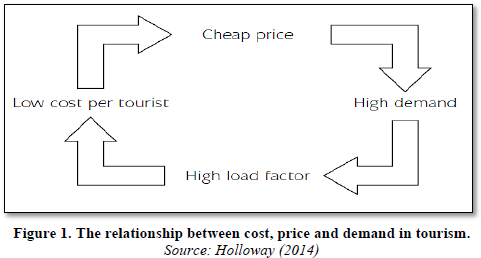

Karayanni (2004) illustrated that, tour operators dominated the holiday market because of the advantages of inclusive tours versus self-organized holidays, i.e. low cost, convenience and security. Tour operators are achieving volume discounts on room rates and a low cost per passenger on their charter flights due to limited overhead costs and high load factors. These savings are passed on to customers. Similarly, (Bastakis, Constantinos, Buhalis, Dimitrios & Butler, 2004). Stated that the tour operators control each destination’s airlift capacity as well as the inclusive tour prices offered in the source markets. The focus of mass-market tour operators on low prices is dictated by the underlying characteristics of the inclusive tour market, considering that the market volume is directly connected to the price level of inclusive tours (Holloway, 2014) added that, greater demand leads to lower prices, with transport and accommodation costs falling for each additional person booked, as there is a direct relationship between cost, price and demand (Figure 1).

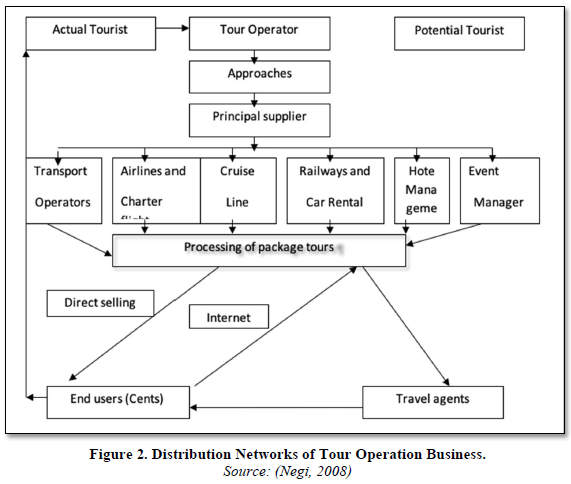

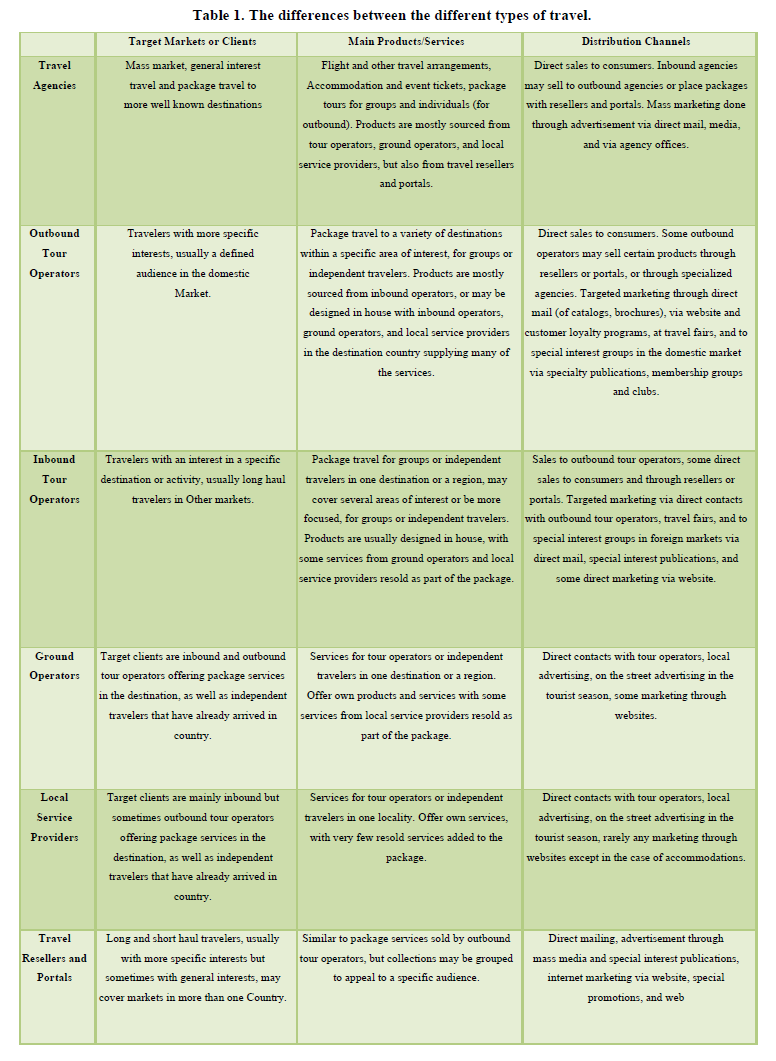

Negi, (2008) illustrated that, The Distribution Networks of Tour Operation Business. It presents in Figure 2 Distribution Networks of Tour Operation Business. Saffery (2007) presented an overview of the differences between the different types of travel operations in the leisure travel industry in terms distribution channel (Table 1).

Roberts (2017) mentioned that, the business relationship between hotels and tour operators/travel agents represents an important aspect of the tourism industry in any destination. Agreed with Johann (2014) explored that establishing a successful relationship between hotels and tour operator/travel agents is a very important issue to ensure business success and competitiveness of both partners. Similarly, (Beech, 2009) Mentioned that, Destination marketers today are faced with a series of challenges, many of which are a function of tourism and others a function of the external environment in which tourism operates. The tourism sector has been impacted by a variety of external forces which range from high fuel prices, fluctuating currency exchange. Agreed with (Haywood, 2007) that global warming, terrorism threats, changing passport regulations, hurricanes, tsunamis, a slowdown in the US economy, bland destination image.

(Lee, Guillet & Law, 2015) stated that, Tour operators/travel agents handle the majority of the distribution and sales functions enabling hotel management to focus on providing better accommodation services and recreation facilities. Also, tour operators/travel agents help hotels to reduce their operational expenses as hotels only pay commissions for transactions that had been produced, as well as to decrease promotional expenses of hotels through marketing and advertising support. Similarly, Bowie (2014) mentioned that, even though tour operators enable package tourism experiences by planning, bundling, and selling experience products, they cannot guarantee that their package tours result in successful tourism experiences. Still, they have the opportunity to influence all the phases of the tourism experiences in order to trigger the experience formation. Moreover, (Schiffauerova & Thomson, 2013) illustrated that, the cost of quality (COQ) can be explained in terms of the combination of conformance and non-conformance costs. While (Cooper, 2008) added that during the on-site activities, the tourists’ experiences are influenced by the accommodation and transportation service providers, which are chosen by the tour operator.

Karayanni (2007) illustrated that, tour operators offers low-priced travel components, Lower cost structure as compared to conventional inclusive tour distribution, User-friendly interfaces, and Dynamic packaging allowing travelers to tailor their package of travel services to their individual needs while still enjoying low prices. (Bamford & Land, 2006). Added that, The costs of conformance are the prices paid for prevention and appraisal of poor quality activities, while the costs of non-conformance are the costs of poor quality caused from products and services due to internal or external failure activities.

METHODOLOGY

The research sample was chosen randomly. According to Egyptian Hotel Association (EHA) (2019), there are 84 five and four-star resort hotels in Sharm El Sheikh and 41 five and four-star resort hotels in Cairo; those hotels are A sample consisting of 12 of five and four-star resort hotels which represents 14% of the total five-star resort hotels population in Sharm El sheikh destination and 12 of five and four-star resort hotels which represents 29% of the total four-star resort hotels population in Cairo destination.

RESULTS AND DISCUSSION

Survey study

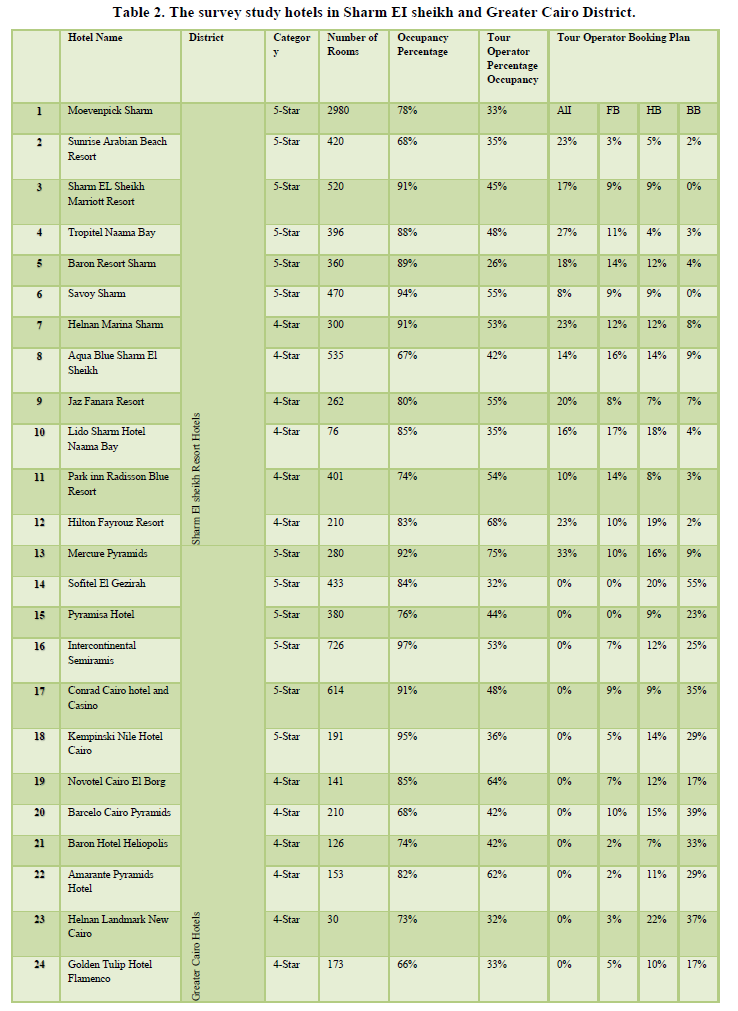

In order to assess the scale the relationship between TOs and hotels and to evaluate the role of TOs in promoting the case study resort/hotels in Sharm El Sheikh and Cairo compared to other accommodation and booking plans, the researcher surveyed 24 resort hotels. 12 of five and four-start resort hotels in Sharm El Sheikh and 12 of five and four-star resort hotels in Cairo. The survey was conducted during the period of (June, 2019 to Dec, 2019).

The Cranach Alpha reliability was computed and the tests showed that the reliability coefficients for all the instruments were above 0.98, which indicates that the instrument is reliable for being used. Cronbach alpha for all survey instruments.

Table 2 summarizes the results of survey conducted. The survey was conducted through phone calls, e-mails, and personal visits to the hotels locations and it mainly focused on obtaining information such as the number of rooms, occupancy percentage with an emphasis on the occupancy percentage booked by tour operator. In addition, the researcher obtained information regarding the major type of reservation preferred to book by tour operator “all-inclusive, bed and breakfast, half board, and full board.

THE MAJOR SURVEY FINDING AND RESULTS

The survey results are obtained from "twenty-four Resort/Hotels" "Twelve” of five-star resort hotels and "twelve" from four-star resort hotels in Cairo and Sharm El sheikh. The major findings of this survey illustrated that all the sample depend on the tour operator on their booking plan with a high occupancy percentage.

The all-inclusive programs have become the most important accommodation plan in Sharm El Sheikh because of the huge number of booking by tour operator prefer to book in all-inclusive programs compared to other accommodation plans. Obviously, most of the customers preferred all inclusive programs due to the fact that these programs present advantages that make the customers feel satisfied and comfortable, in other sense, present what the customers really need for a price they can afford without the extra worries.

The main disadvantage of working with tour operators is the constant pressure to lower room rates, as has been mentioned by 70% of surveyed hotels. 48% of respondents feel that tour operators are channeling their clients to other destinations, 33% have had trouble in getting paid on time, while only 6% complain that they get just a small number of clients through tour operators.

INTERVIEWS WITH HOTELS/RESORTS MANAGERS

Personal interviews identify the perspectives of hotel regarding the marketing influence of tour operator on the hospitality industry. Data were collected from the hotel managers via face-to-face and interviews in the same investigated hotels. The researcher asked the hotel managers a set of questions.

THE MAJOR SOURCES OF RESERVATION

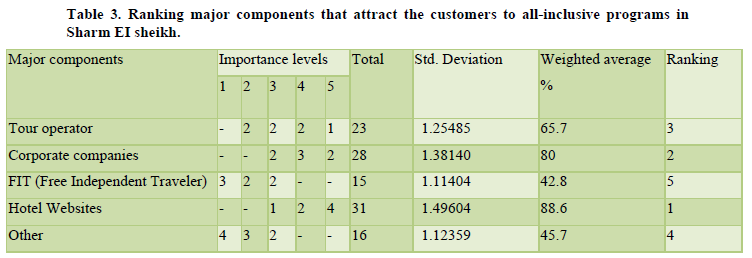

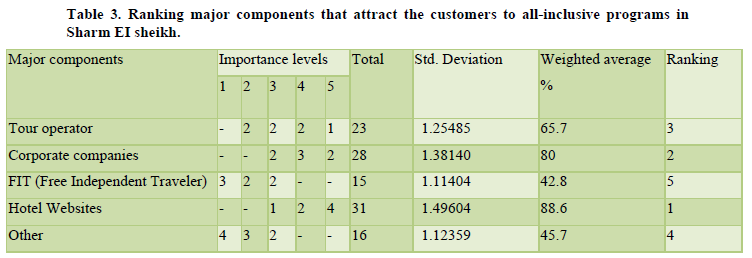

The interviewees were asked to illustrate the major sources of reservation applied in their hotels and resorts by customers. Table 3 presents this issue in all the investigated resort hotels. From the data illustrated in Table 3. it can be noticed that, hotel websites was considered as one of the most important major sources of reservation that attract customers of tour operator in Greater Cairo hotels by an average of 88.6%; secondly Corporate companies by an average of 80%. Thirdly, tour operator was an average of 65.7%, fourthly other was an average of 45.7% and finally FIT by an average of 42.8%. Therefore, hotel managers should be fully aware regarding all these attributes to meet customer expectations to achieve their satisfaction. These findings are supported by two of the interviewees who stated that: Social media, booking and trip Advisor are considered as one of the most important source of reservation. It identifies our facilities and services to our guests and the grade of hotels is important to our guests to make reservation.

Sharm El Sheikh resorts/hotels

Greater Cairo hotels

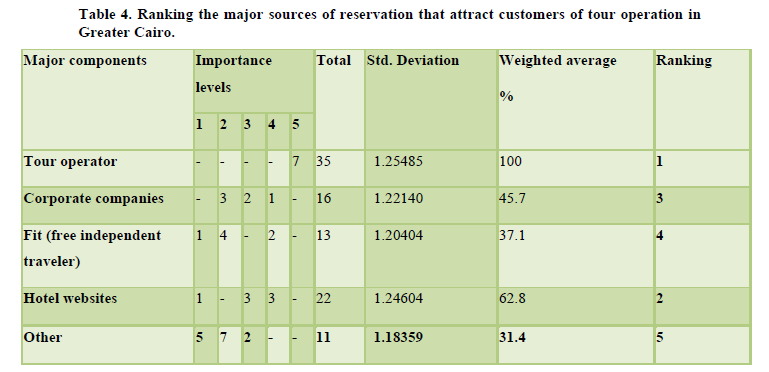

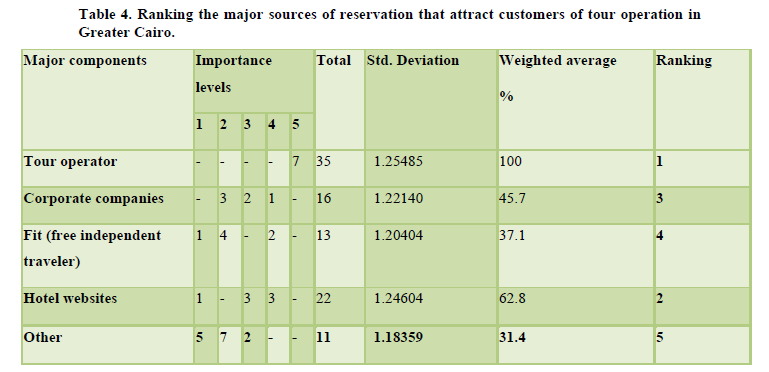

It can be concluded from the data tabulated in Table 4 that tour operator was considered as one of the most important major sources of reservation that attract customers of tour operator by an average of 100%; secondly hotel Websites by an average of 62.8%. Thirdly, corporate companies with an average of 45.7%, fourthly FIT with an average of 37.1% and finally other by an average of 31.4%. Therefore, hotel managers should be fully aware regarding all these attributes to meet customer expectations to achieve their satisfaction. These findings are supported by three of the interviewees who stated that: We prefer tour operators because they achieve large number of guests and consider the cheapest method of marketing

Briefly, it can be concluded from the above findings that most of the customers prefers to reserve resorts/hotels in Sharm El Sheikh by tour operator rather than other customers in Greater Cairo who prefer to reserve by hotel websites. This is because tour operator is the cheapest and the easiest alternative compared to other sources of reservation.

REASONS OF CHOOSING TOUR OPERATOR TO MANAGE HOTELS MARKETING

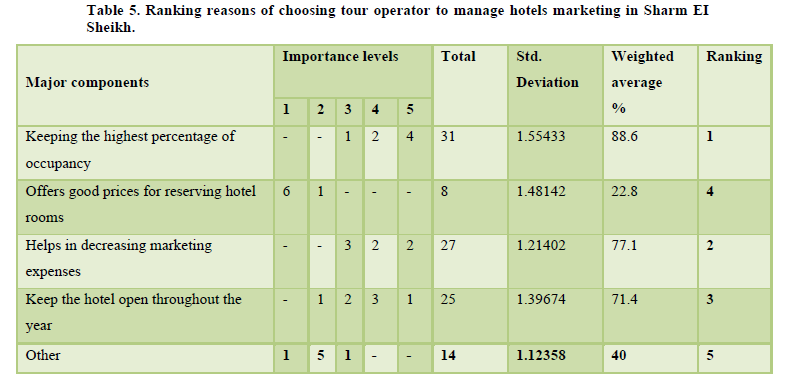

The interviewees were asked about reasons of choosing tour operator to manage hotels marketing. The following paragraphs present this issue in all the investigated hotels.

SHARM EL SHEIKH RESORT HOTELS

Table 5 clarify that keeping the highest percentage of occupancy was considered as one of the most important major reasons of choosing tour operator to manage hotels marketing in Sharm El Sheikh Resort Hotels by an average of 88.6%; secondly helps in decreasing marketing expenses by an average of 77.1%. Thirdly keep the hotel open throughout the year was an average of 71.4%, fourthly offers good prices for reserving hotel rooms was an average of 22.8% and finally Other by an average of 40%. These findings are supported by two of the interviewees who stated that: Intense competition among resorts prompts us to cooperate with tour operators to maintain a high occupancy rate regardless of the sales price.

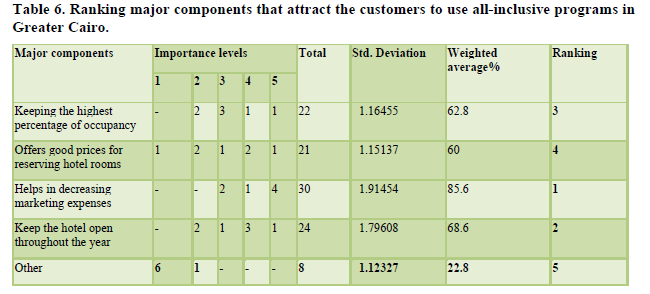

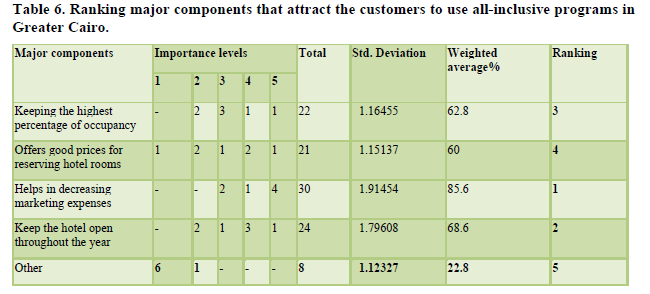

Greater Cairo hotels

Table 6 clarify that TOs helps in decreasing marketing expenses was considered as one of the most important major reasons of choosing tour operator to manage hotels marketing in Greater Cairo Hotels by an average of 85.6%; secondly keep the hotel open throughout the year by an average of 68.6%. Thirdly keeping the highest percentage of occupancy was an average of 62.8%, fourthly offers good prices for reserving hotel rooms was an average of 60% and finally other by an average of 5%. Therefore, hotel managers should be fully aware regarding all these attributes to meet customer expectations these findings are supported by two of the interviewees who stated that: Marketing expenses outside Egypt are high and we cooperate with tour operators to reduce marketing expenses, but recently we rely on social media.

In summary, it can be concluded from the previous findings that the majority of Sharm El Sheikh and Greater Cairo managers of the resorts and hotels prefer to sell their rooms by tour operators because Tour operators secures highest percentage of occupancy and help in decreasing marketing expenses and keeping the hotel open throughout the year.

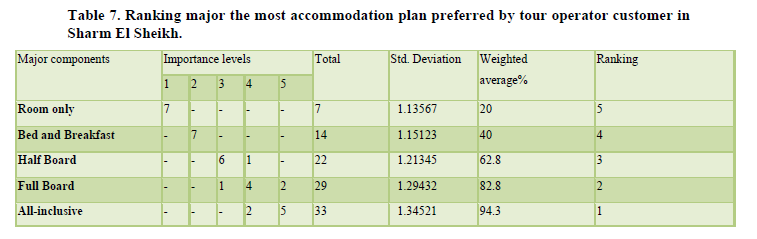

Preferred accommodation plan

The interviewees were also asked to show the proffered accommodation plans of tour operator customer`s. Table 7 illustrates the findings regarding this issue in all the hotels.

Sharm El Sheikh resort hotels

As shown in Table 7, it can be noticed that all-inclusive program was considered as one of the most important major accommodation plan preferred by tour operator customer in Sharm El Sheikh resort hotels by an average of 94.3%; secondly Full Board by an average of 71.4%. Thirdly, Half Board was an average of 62.8%, fourthly bed and breakfast was an average of 40% and finally room only by an average of 20%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations in order to achieve their satisfaction. These findings are supported by two of the interviewees who stated that: Most of guests prefer all-inclusive programs because guests can relax without worrying about prices and he can get everything with low price cheaper than his country.

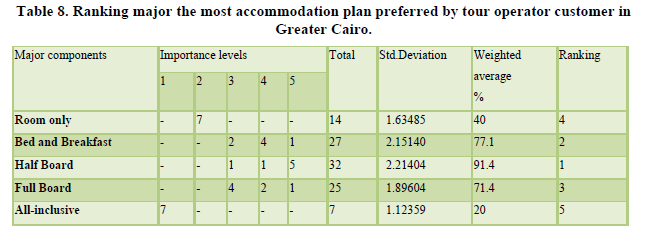

Greater Cairo hotels

As shown in Table 8, it can be noticed that half board was considered as one of the most important major accommodation plan preferred by tour operator customer in Greater Cairo hotels by an average of 91.4%; secondly bed and breakfast by an average of 77.1%. Thirdly, Full Board was an average of 71.4%, fourthly room only was an average of 40% and finally all-inclusive program by an average of 20%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations in order to achieve their satisfaction. These findings are supported by two of the interviewees who stated that: Preferred accommodation plan for most our guests is half board because they want visit monuments and another places around Cairo and get another meal outside hotels.

It can be concluded from the previous findings that the most tour operator customers in Sharm El Sheikh resort/hotels prefer all-inclusive programs. On the other hand, the most tour operator customers in Sharm El Sheikh resort hotels prefer half board. So, hotel managers should be fully aware of customer requirements of each accommodation plan in order to achieve their satisfaction.

NATIONALITIES OF CUSTOMERS WHO PREFER RESERVATION BY TOUR OPERATOR

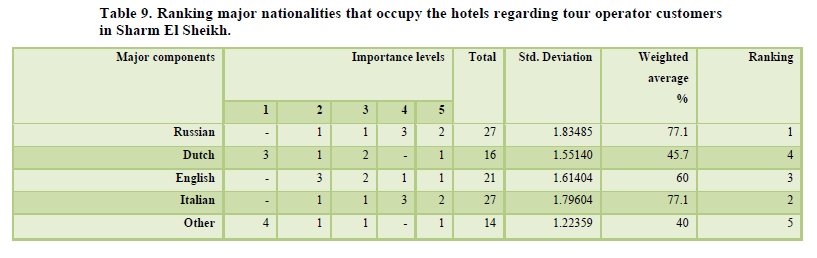

The managers were asked about the nationalities of customers who prefer the reservation by tour operator in their hotels. Table 9 illustrates the findings regarding this issue.

Sharm El Sheikh resort hotels

From the data illustrated in Table 9 it can be seen that Russian and Italian were considered as one of the most important major nationalities that occupy the hotels regarding tour operator customers in Sharm El Sheikh resort hotels by an average of 77.1%; secondly English by an average of 60%. Thirdly, Dutch was an average of 45.7%, and finally other by an average of 42.8%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations in order to achieve their satisfaction. These findings are supported by four of the interviewees who commented that: Russian and Italian customers prefer accommodation Sharm El Sheikh because it is very cheap compared with other destination or their country.

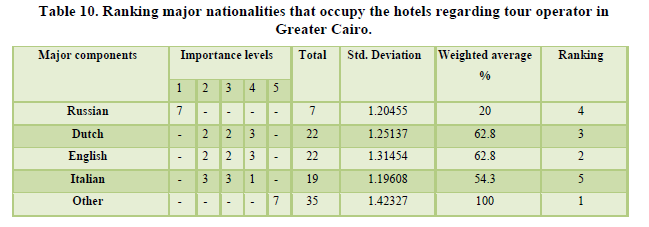

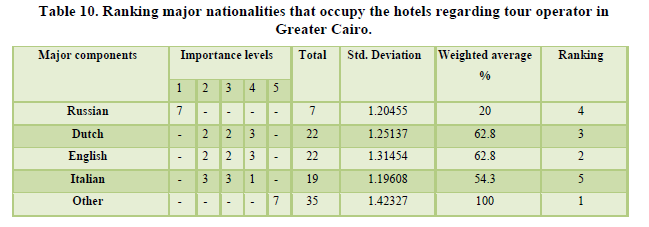

Greater Cairo hotels

From the data illustrated in Table 10, it can be seen that other such as (Arabian, American and French) was considered as one of the most important major nationalities that occupy the hotels regarding tour operator in Greater Cairo hotels by an average of 100%; secondly Dutch and English by an average of 62.8%. Thirdly, Italian was an average of 54.3%, and finally Russian by an average of 20%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations in order to achieve their satisfaction. These findings are supported by two of the interviewees who commented that: Arab, English and America are our main nationalities and probably they are business man or come to Egypt for visiting Egyptian monuments.

Briefly, it can be concluded from the above findings Italian and Russians prefer visiting Sharm El Sheikh resort hotels by tour operator because of the price. On the other hand, there are other nationalities prefer to visit greater Cairo hotels such as Arabian, American and French nationalities. In that sense, hotel managers should be fully aware the needs of each nationality in order to meet customer expectations and thus to achieve customer satisfaction.

AVERAGE LENGTH OF STAY

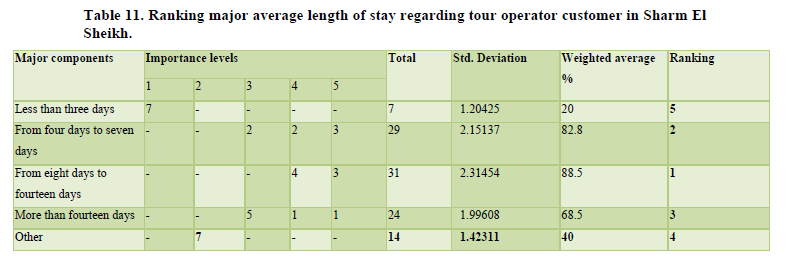

The managers were asked about the average length of stay for tour operator customers in their hotels and Resorts.

SHARM EL SHEIKH RESORT HOTELS

It can be noticed from the data tabulated in Table 11 that From eight days to fourteen days was considered as one of the most important major average length of stay regarding tour operator customer in Sharm El Sheikh by an average of 88.5%; secondly From four days to seven days by an average of 82.8%. Thirdly, More than fourteen days was an average of 68.5%, fourthly More than fourteen days was an average of 40% and finally Less than three days by an average of 20%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations. These findings are supported by two of the interviewees who commented that: Most customers who are staying in resort hotels are usually accommodate not less than on a week because the accommodation is very suitable for them compared to getting all-inclusive.

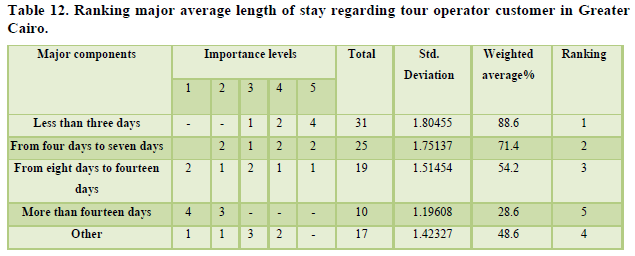

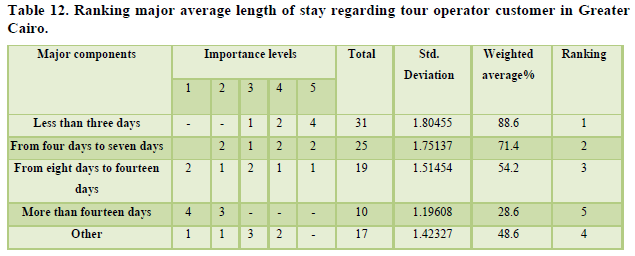

Greater Cairo hotels

It can be noticed from the data tabulated in Table 12 that Less than three days was considered as one of the most important major average length of stay regarding tour operator customer in Greater Cairo hotels by an average of 88.6%; secondly From four days to seven days by an average of 71.4%. Thirdly, from eight days to fourteen days was an average of 54.2%, fourthly other was an average of 48.6% and finally More than fourteen days by an average of 28.6%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations in order to achieve their satisfaction. Often our guests stay less than four days because most of them want to visit other cities such as Luxor, Aswan and Hurghada and some of them came for business and meetings.

To summarize, it can be concluded from the above findings the average length of stay for the majority of tour operator customers in Sharm El Sheikh resort hotels varies between eight days to fourteen days more than other customers in Greater Cairo who prefer to stay less than three days by tour operator. Therefore, it can be noticed from the previous findings that the average length of stay by tour operator in Sharm El Sheikh greater than customers in greater Cairo.

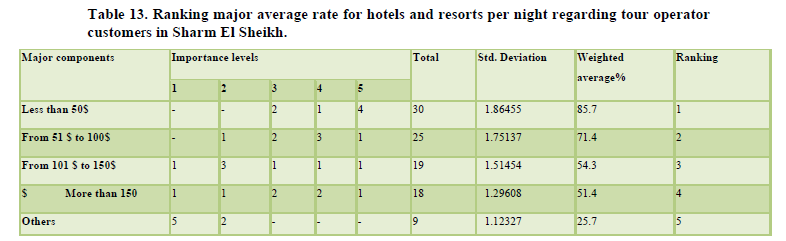

Average rate for tour operator customers

The managers were asked about the Average rate for tour operator customer`s in their hotels and Resorts. The next paragraphs present the findings in regard to this issue in two different contexts: five Sharm El Sheikh Resort and Greater Cairo Hotels.

Sharm El Sheikh Resort hotels

Table 13 clarify that less than 50$ was considered as one of the most important major average rate for hotels and resorts per night regarding tour operator customers in Sharm El Sheikh resort hotels by an average of 85.7%; secondly From 51 $ to 100$ by an average of 71.4%. Thirdly from 101 $ to 150$ was an average of 54.3%, fourthly More than 150$ was an average of 51.4% and finally other by an average of 25.7%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations in order to achieve their satisfaction. These findings are supported by four of the interviewees who commented that: Most of Sharm El Sheikh resort/hotels sell its all-inclusive rooms ranging from 25$and to 35$ because of heavy competition with resort hotels to attract tour operator with low price.

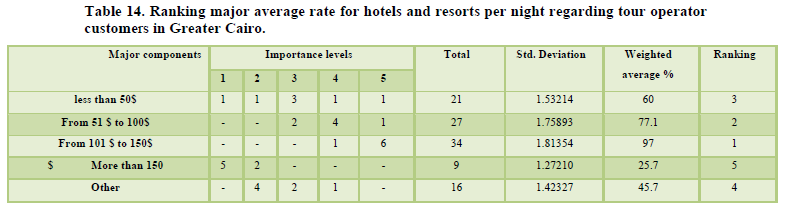

Greater Cairo hotels

Table 14 clarify that less than 50$ was considered as one of the most important major average rate for hotels and resorts per night regarding tour operator customers in Greater Cairo hotels by an average of 97%; secondly From 51 $ to 100$ by an average of 77.1%. Thirdly less than 50$ was an average of 60%, fourthly other was an average of 45.7% and finally more than 150$ by an average of 25.7%. Therefore, hotel managers should be fully aware regarding all these attributes in order to meet customer expectations in order to achieve their satisfaction. These findings are supported by two of the interviewees who commented that: The average daily rate per guest ranging from $100 to 250$ because our hotels are attracting good segments of the do not focusing on price but focusing on art of service.

Briefly, it can be concluded from the previous findings the most managers in the investigated Sharm El Sheikh resort hotels are in agreement that spending power of greater Cairo hotels greater than the spending power of Sharm El Sheikh resort hotels so the customers in Sharm El Sheikh resort hotels prefer reservation by tour operator.

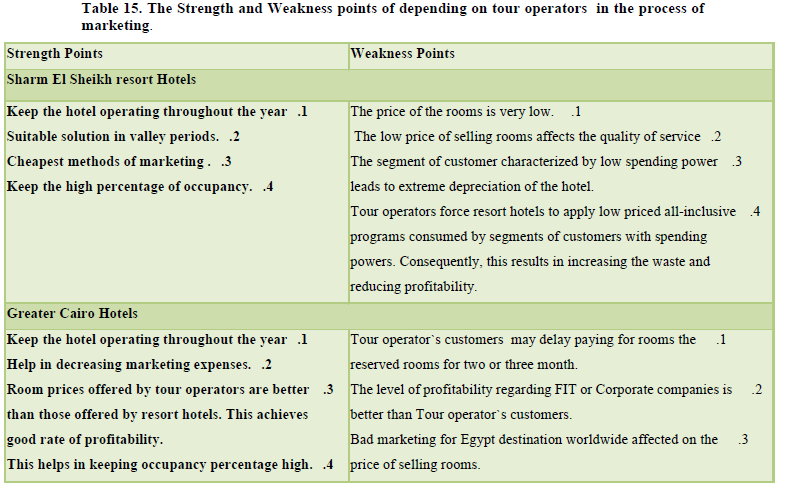

THE STRENGTH/WEAKNESS POINTS OF DEPENDING ON TOUR OPERATORS IN THE PROCESS OF MARKETING

This section provides the strength and weakness points of depending on tour operators in the process of marketing. These points are gathered from Sharm El Sheikh and greater Cairo hotels managers. Table 15 summarizes the strength and weakness points.

These findings are supported by two of the interviewees who commented that: Cairo hotels targeted market segmentation characterized by good spending power focusing on the quality of the service and the customer ready to pay for this service.

To summarize, it can be concluded from the previous findings that managers in Sharm El Sheikh resort hotels and greater Cairo hotels agree that the popular and common strength points as stated by the majority of the managers is keeping the hotel operating throughout the year with high occupancy percentage. Moreover, managers in Sharm El Sheikh resort hotels and greater Cairo have different opinions about weakness points. Most of managers in Sharm El Sheikh indicated that the low price of selling rooms affects the performance of the hotel. On the other hand, most managers in greater Cairo pointed out that tour operators' customers may delay paying for the reserved rooms for two or three months and the prices of rooms are good.

HOTELS PERFORMANCE DUE TO DEPENDING ON TOUR OPERATORS MARKETING

The interviewees were asked about existence of any effect on hotels performance due to depending its marketing on tour operators. The following paragraphs present this issue in all the investigated resort hotels.

SHARM EL SHEIKH RESORT HOTELS

All managers (seven managers) in investigated Sharm El Sheikh resort hotels agree that the quality of service offered in resorts is lower than that in Greater Cairo hotels regarding food quality and service due to offering all-inclusive programs, low-priced rooms for tour operators' customers otherwise the hotels will be excluded from tour operators' databases. These findings are supported by three of the interviewees who commented that: Many factors that affect us is the rise in raw materials and with this we cannot raise our prices with tour operators due to intensity of competition all this leads to failure in the quality of the product.

GREATER CAIRO HOTELS

Most managers (five managers) in investigated greater Cairo hotels agreed that the quality of service and food is good due to the selling rooms with good prices. On the other hand, two managers agreed that the Egyptian destination could be marketed with better prices to gain better standard of quality. These findings are supported by two of the interviewees who commented that: Factors that affect the quality deal difference between the dollar and the euro with tour operators that make currency difference.

Briefly, it can be concluded from the previous findings that the most managers in the investigated Sharm El Sheikh resort hotels and greater Cairo agree that it is must responsible of tourism market the Egyptian destination with a good price to produce the best quality for customers.

MANAGERS RECOMMENDATIONS THAT HELP HOTEL TO IMPROVE SERVICE QUALITY AND ACHIEVE CUSTOMER SATISFACTION REGARDING TOUR OPERATOR CUSTOMER

This section provides managers' recommendations that could help hospitality owners/managers to deal with the negative impacts of tour operator marketing and its effect on hotels quality.

- Focusing on the quality of services rather than focusing on offering rooms with low prices.

- Not relying mainly on tour operator but rather on other methods of marketing such as social media, attracting Egyptian customers and corporate companies.

- Not giving a license to open new resorts because supply is more than demand, leading to the descent of prices.

- Dealing with new markets (Southeast Asia) rather than relying on the Russian tourism.

- Targeting the best market segmentation through dealing with well-reputed tour operator worldwide focusing on quality instead of pricing.

- In case of exploitation of tour operator for hotels, the Ministry of Tourism must establish a union for hotels which refuse the policy of lower prices and refuse dealing with these tour operators.

- Due to the current political and economic situations of the country, resort hotels must not surrender to tour operators' negative exploitation of such situations and rely on domestic tourism.

- Resort hotels should pay more attention to tour operators who deal with Arab tourists. This is because Arab tourists are characterized by good spending power.

INTERVIEWS WITH TOUR OPERATOR MANAGERS

Interviews were carried out with the different tour operator department managers. The purpose of these interviews was to find out and to identify the perspectives of tour operator managers regarding the marketing influence of tour operator on the hospitality industry.

The first questionnaire has been distributed to 10 top tour operators in Egypt and conducting personal interviews with them, to know their opinions on the subject of the search, and then analyze the data contained in the questionnaire using the Statistical Package for Social Sciences (SPSS Version 21).

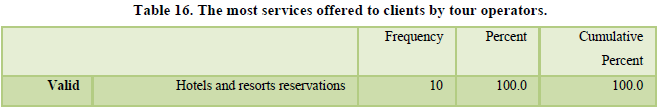

THE MOST SERVICES OFFERED TO CLIENTS BY TOUR OPERATORS

The previously mentioned in Table 16 show that, all tour operators agreed that hotels/resorts reservations are the most tourism services offered by an average of 100%.

TYPES OF RESORT/HOTELS THAT TOUR OPERATORS PREFER TO RESERVE FOR THEIR CLIENTS

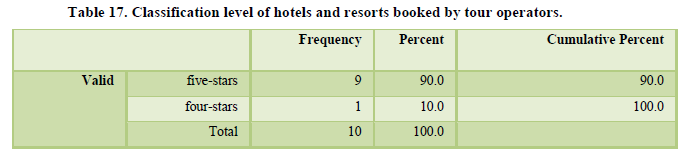

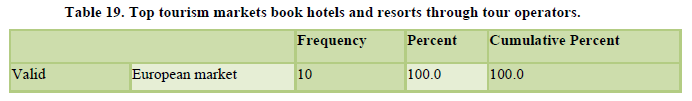

It can be concluded from the data tabulated in Table 17, that 90% of tour operators booked five-stars hotel and resorts, only 10% of tour operators booked four-stars hotel and resorts.

THE MOST TOURIST DESTINATIONS BOOKED BY THE TOUR OPERATORS

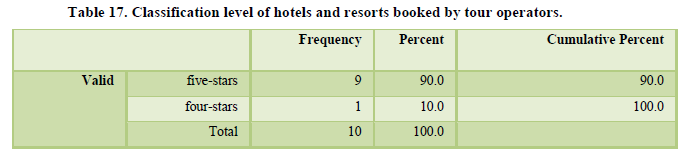

The previous mentioned in Table 18 shows that 80% of all tour operators booked hotels and resorts in Sharm El Sheikh area, while, 20% of them booked hotels and resorts in Cairo and Giza area.

TOP TOURISM MARKETS THAT TOUR OPERATORS DEPEND ON TO BOOKING THEIR HOLIDAYS

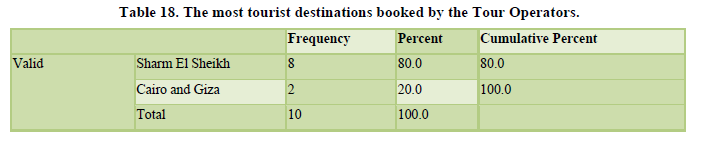

It can be concluded from the data tabulated in Table 19, That All tour operators agreed that European market is the main market that book hotels/resorts through tour operators by an average of 100%.

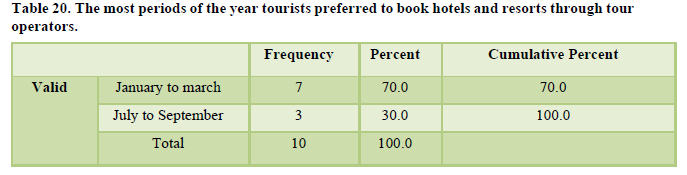

THE MOST PREFERRED PERIODS FOR BOOKING THE HOLIDAY THROUGH TOUR OPERATORS

As shown in Table 20, 70% of tourists preferred to book hotels and resorts during the period from January to March (winter Holidays), while, 30% of tourists preferred book hotels and resorts during the period from July to September (summer Holidays).

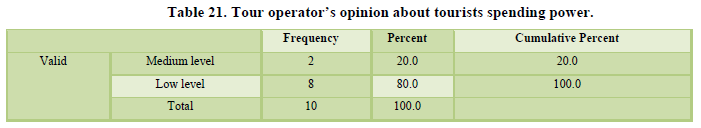

THE TOUR OPERATOR’S OPINION ABOUT TOURISTS SPENDING POWER

From the data illustrated in Table 21, tour operators confirmed that tourists spending power in Egypt is low level by an average of 80%. while, 20 % of them think that tourists spending is medium level.

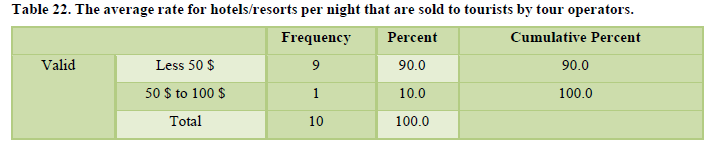

THE AVERAGE RATE FOR HOTELS/RESORTS PER NIGHT THAT ARE SOLD TO TOURISTS BY TOUR OPERATORS

The previous mentioned Table 22, shows that 90 % of tour operators chose less 50$, is the average rate for hotels and resorts per night that are sold to tourists through them, while 10% of them think from 50$ to 100$, is the average rate for hotels and resorts per night that are sold to tourists through them.

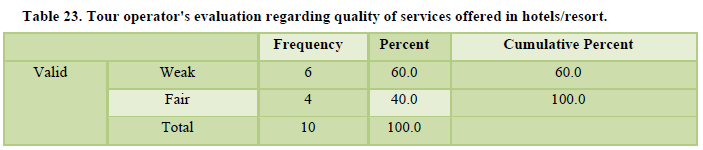

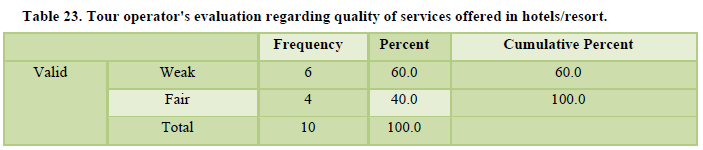

TOUR OPERATOR'S EVALUATION REGARDING QUALITY OF SERVICES OFFERED IN HOTELS/RESORT

It can be noticed from the data tabulated in Table 23, that 60% of tour operators think that the quality of services offered to tourists in hotels and resorts is weak, while 40% of them, mentioned that the quality of services offered to tourists in hotels and resorts is fair.

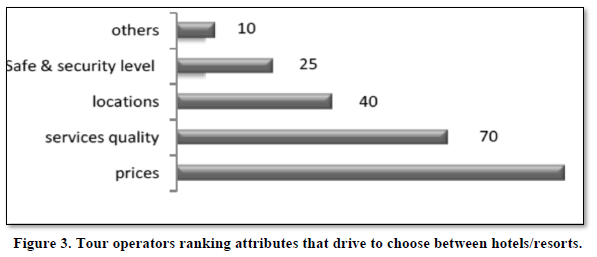

RANKING THE ATTRIBUTES THAT DRIVE YOU TO CHOOSE THE BOOKING BETWEEN HOTELS/RESORTS

It can be noticed from the data tabulated Figure 4, that 100% of tour operators think that prices is the first attributes that drive them to choose between hotels/resorts, secondly, services quality by an average of 70%, Thirdly locations were an average of 40%, fourthly safe and security level was an average of 25% and finally 10 % of them, seen others attributes that drive them to choose between hotels and resorts.

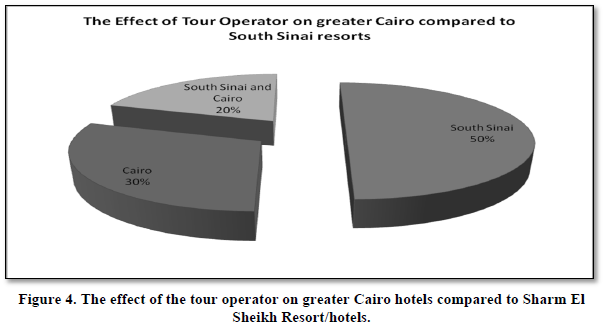

THE EFFECT OF THE TOUR OPERATOR ON GREATER CAIRO HOTELS COMPARED TO SHARM EL SHEIKH RESORT/HOTELS

From the data illustrated in Figure 5, that five of the tour operators confirmed that they have an influence on the resorts of Sharm El Sheikh in terms of getting a low price, but the consequent decline in the quality of hotel services provided by hotels, while three of tour operators think that their influence is in Cairo hotels allow them to get a good price, while two of tour operators confirmed that their influence on the resorts and hotels of Sharm El Sheikh and Cairo hotels are same.

The important suggestion from Tour Operators Managers to increase the occupancy percentage in Egypt:

1- Need to reconsider the current marketing strategies in various inbound tourist’s markets.

2- Opening new tourist markets rather than relying on the traditional tourist markets.

3- Activating the role of the Egyptian Tourism offices abroad.

4- Adoption of an intensive advertising campaigns relying on modern plans and ideas.

5- Re-opening the closed airports for charter flight and reducing flight fares.

6- Improve tourist services especially on high way Roads.

7- Improve services quality in hotels and resorts.

8- Appeal to some hotels and resorts owners to reduce high prices to meet current tourism crisis in Egypt.

9- Intensification of cooperation between the private and public sectors to increase hotel and resorts occupancy percentage.

CONCLUSION AND RECOMMENDATIONS

Hospitality is based on three basic manufacturers, namely; hotels, motels and resorts. They produce various forms of goods and services. Tourists, business travelers and weekend travelers consume such services and goods. How to get the consumer to the consumption site is the aspect that embodies the chief challenge. This necessitates the need to apply a distinctive type of distribution system inside hotels. Goods and services are distributed variously by hotels. The hotel channel of distribution encompasses intermediaries like tour operators, retail travel agents, specialists, consortia, reservations systems, global distribution system, the internet and concierges. Nevertheless, tour operators constitute the most substantial source of reservation to hotels and resorts.

The marketing influence of tour operator on the hospitality industry had both positive and negative impacts on the hospitality and tourism Industry. Some of the positive influences include keeping the hotel operating throughout the year, helping in decreasing marketing expenses, room prices offered by tour operators are better than those offered by resort hotels, achieves good rate of profitability and helps in keeping occupancy percentage high. The effect of tour operator on hotel performance have weakness points such as the low prices of selling rooms (which affect the performance of the hotel), the segment of customer characterized by low spending power leads to extreme depreciation of the hotel, tour operators force resort hotels to apply low priced all-inclusive programs consumed by segments of customers with low spending powers. Consequently, this results in increasing the waste and reducing profitability.

The current study evaluated the marketing influence of tour operator on the hospitality industry through personal interviews with seven hotel managers in Greater Cairo and seven resort hotels in Sharm El Sheikh; survey was done through telephone calls, field visits in order to find out occupancy percentage, percentage of tour operator reservation in Greater Cairo and Sharm El sheikh resort hotels and preferred accommodation plans for tour operator customers. This survey was done on twelve resort hotels in Sharm El-Sheikh and twenty four hotels in Greater Cairo, and personal interviews with representatives of tour operator. This leads to the following recommendations:

- Opening new tourist markets rather than relying on the traditional tourist markets.

- Reducing flight fares to attract new tour operators.

- Activating the role of the Egyptian tourism offices abroad.

- Adoption of intensive advertising campaigns relies on modern ideas such as advertising Egyptian destinations on famous global sports channels.

- Focusing on the quality of services rather than focusing on lower prices.

- Not relying mainly on tour operator but rather on other methods of marketing such as social media, attracting Egyptian customers and corporate companies.

- Not to give a license to open new resorts because supply is more than demand, leading to the descent of prices in this period.

- Dealing with new markets (Southeast Asia) rather than relying on the Russian tourism.

- Targeting the best market segmentation through dealing with well-reputed tour operator worldwide focusing on quality instead of pricing.

- In case of exploitation of tour operator for hotels, the Ministry of Tourism must establish a union for hotels which refuse the policy of lower prices and refuse dealing with these tour operators.

- Due to the current political and economic situations of the country, resort hotels must not surrender to tour operators’ negative exploitation of such situations and rely on domestic tourism.

Resort hotels should pay more attention to tour operators who deal with Arab tourists and good market segments characterized by good spending power.

- Asubonteng, P., McCleary, K.J. & Swan, J.E. (2006). SERVQUAL revisited: A critical review of service quality. Journal of Services Marketing 10(6), 62-81.

- Bamford, D.R. & Land, N. (2006). The application and use of the PAF quality costing model within a footwear company. International Journal of Quality and Reliability Management 23(3), 265-278.

- Bastakis, Constantinos, Buhalis, Dimitrios, & Butler, R. (2004). The perception of small and medium sized tourism accommodation providers on the impacts of the tour operators power in Eastern Mediterranean. Tourism Management press 25(2), 151-170.

- Beech, M. (2009), Weathering the perfect storm, St. Catharines Standard 1-2.

- Bitner, J., Booms, H., Mohr, A. (1994). Critical Service Encounters The Employee Viewpoint. Journal of Marketing 58(4), 95-106.

- Bowie, D., & Chang, J.C. (2014).Tourist satisfaction. Recreation 95-105.

- Bowie, D., & Chang, J.C. (2005). Tourist satisfaction:A view from a mixed international guided package tour. Journal of Vacation Marketing 11(4), 303-322.

- Cooper, C., Fletcher, J., Gilbert, D., Shepherd, R. & Wanhill, S. (2008).Tourism Principles and practice. 2nd edition Addison Wesley Longman Harlow, pp 34-65.

- Haywood, M. (2014). Lead performing to potential. Hotelier press 29.

- Hebestreit, D. (2015). Touristik marketing grundlagen ziele basisinformationen, instrumentarien. Organisation und Planung des Marketing von Reiseveranstaltern 3.

- Holloway, J. (1994).The Business of Tourism. 4th ed London publishing 2-75.

- Johann,M. (2014). The relationship building strategy with partners in tourism market. European Journal of Tourism and Hospitality and Recreation pp 95-106.

- Joyce, S. (2017). A social media strategy for tour and activity operators. Rezgo Print Canada pp 26-43.

- Karayanni, A. (2007). Dynamic Packaging I nea tasi sta paketa diakopon. Travel Daily News 24(5), 5-27.

- Lee, H., Guillet, B.D., & Law, R. (2015). An examination of the relationship between online travel agents and hotels a case study of choice hotels international and Expedia.com. Cornell Hosp Quart, pp: 95-107.

- Luong, L. (2018). Domestic tourism in vietnam greifswald articles. International Edition 32, 144-146.

- Lenoir, S. (2004). Distribution Channels for Tour Operators. Rezdy Publishing Sydney Australia 11- 46.

- Lockwood. A., & Jones, P. (2018). The management of hotel operations. Thomson Publishing London 34-123.

- Negi, J. ( 2008). Travel agency and tour operation concepts and principles. Kanishka Publishers New Delhi India, pp: 34-65.

- Palatlova, M. (2013). Management of travel agencies and tour operators. Grada Publishing Limited Praha Czech Republic 54-57.

- Reeves, C. & Bedner, D. (2011). Defining Quality: Alternatives and Implications. The Academy of Management Review 19(4), 419-424.

- Roberts, M. (2017). The supplier relationship practices of travel agencies in the Western Cape Province. What is the status quo? Acta Commercii 10, pp: 1-14.

- Saffery, A., (2007). The business of inbound tour operators. USAID Publishing USA, pp: 1-4.

- Schiffauerova, A. & Thomson, V. (2013). A review of research on cost of quality models and best practices. International Journal of Quality and Reliability Management, 23(6), 647-669.

- Soutar, G. (2016). Tourists intention to visit a country. The impact of cultural distance Tourism Management 28(6), 1497-1506.

- Swain, S. (2017). Travel agency and tour operation management. Oxford Publishing, London, pp: 92-95.