Research Article

ENTRY BARRIERS FACING EGYPTIAN PRIVATE AIR CARRIERS IN EGYPT

3443

Views & Citations2443

Likes & Shares

ABSTRACT

The Egyptian aviation policy aims to promote travel and tourism to stimulate the economy. This will need the active participation of both the state-owned carriers and the private carriers.

The Egyptian aviation policy aims to promote travel and tourism to stimulate the economy. This will need the active participation of both the state-owned carriers and the private carriers.

Entry barriers that are facing the Egyptian private air carriers in Egypt are clearly identified and analyzed. An in-depth interview with 21 executives of the Private air carriers is carried out using a survey to identify those barriers in the Egyptian market.

The information obtained from both the interviews and the survey highlighted that there are several entry barriers facing the Egyptian private air carriers, the major factor of these barriers would be the protective nature of the Egyptian Aviation policy toward the State-owned incumbent carrier.

Egyptian Civil Aviation Authority should initiate policies and procedures to reduce the barriers to entry and propose economic regulation to ensure fair competition and prevent anticompetitive behavior of the incumbent.

Keywords: Deregulation, New entrants, Barriers to entry, Substantial ownership, Effective control.

Introduction

There are several studies that addressed the barriers to entry in the US and Europe within the legal and economic environment of these continents.

Though the Egyptian aviation industry is much smaller than that in the US and Europe, it was subject to policies that aimed to stimulate the Egyptian economy by promoting tourism and air travel to Egypt.

The research paper objectives are:

- Identify barriers to entry in general and those that are facing air carriers in particular.

- Identify the business model and nature of operation of the Egyptian private air carriers.

- Analyzing the barriers to entry in the Egyptian aviation market.

- Recommend Policies and procedures that may help the Egyptian Civil Aviation Authority to lower the entry barriers and promote a fair competition in the Egyptian Aviation Market.

Secondary data will be used to understand the nature of operation of the Egyptian private air carriers. The information related to the research subject will best be obtained through a qualitative study in the form of an in-depth interview using a survey questionnaire with 21 executives of the Egyptian private air carriers.

Prior to the US airline deregulation act in 1978 the global airline industry was heavily regulated (Doganis, 2001).

The traditional bilateral air service agreements defined the designation of airlines to operate on certain routes capacity and points served. The US renegotiated more open bilateral air service agreements that allowed more freedom and competition within the airline industry, except the ownership rules which require the designated airlines to be substantially owned and effectively controlled by the nationals of the designated state (Stewart, 1990).

ICAO (1996) states that the main objective of national regulations ownership is to provide for national interest, such as to aid in national development, to serve national defense and to meet disaster assistance needs and to provide also for the economic needs of the states.

The European liberalization program started with the first package in December 1987 and ended with the third package in January 1993. The outcome for the European Union members is unrestricted market access for airlines of the member states with no capacity and price controls. Ownership rules were reduced such that access rights are granted to nationals of any European Union member states.

New air services can boost the regional economy by creating new capabilities to the structure of the regional economy allowing new industries to exist and grow. The European union GDP grew by 4 percent since 1995 with the growth of air transport, and it is expected to grow by further 1.8 percent till 2025 (Euro Control, 2005).

Porter (1979) defined new entrants as those companies that are introduced in the industry recently or new in a specific market. The strategic decision to enter a new business depend on crucial economic principles that identify businesses that are attractive targets for entry and help determine what company assets and skills will make any entry profitable (Porter, 1980).

Deregulation which started in the United States in 1978 allowed more efficient new entrant air carriers to challenge incumbents leading to lower fares. New entrant air carriers provide new ideas and better service with lower cost structure to attract customers.

Windle & Dresner (1995) found that Southwest Airlines market entry had significant impact on both fares and number of passengers; a decline of 48 percent in air fares and an increase in passenger numbers by 200 percent was observed. Goolsbee & Syverson (2008) found that the threat of entry of Southwest lead incumbents to cut fares.

Baumol, Panzar & willing (1982) explained the theory of contestability where the threat of entry will act as an effective substitute for perfect competition. Button (1989) realized that the reality is different than the theory of perfect competition.

Levine (1987) points out that the economies of scale presented by the contestability theory would act as a barrier to entry to new entrant air carriers together with other factors such as economies of scope, contractual vertical integration, incumbent dominant hub carriers, alliances, mergers and acquisitions.

BARRIERS TO ENTRY

New entrant air carriers should make a good analysis of the competition environment, so they operate effectively. Preserve their market shares and achieve their aims and targets.

Competition is defined as mutual tactical struggles of the companies in a sector which they make to get a competition advantage and fulfill their aims (Grant, 2005).

Harrison (2004) defined the competition strategy as the formulas which the company develops about gaining a position different from its competitors in order to form a value for customers.

Porter (1980) pointed out barriers to entry that may face any firm in general who intend to enter a new market, while Guomudsson (1995) further illustrated those barriers for air carriers as follows:

- Economies of scale: New entrant firms may enter a market either at a large scale which may trigger retaliation from the incumbent or at a small scale with a cost advantage.

- Product differentiation: New entrant firms in order to overcome customer loyalties have no choice but to invest in product differentiation.

- High capital requirements: New entrant firms need a substantial amount of capital to be able to be noticeable in a market.

- Switching costs: New entrant firms face buyer switching cost of a product or service from an incumbent to the choice of a new entrant. Air carriers tend to provide loyalty programs to increase the switching cost of its customers. Frequent flyer program (FFP) passengers benefit from the rewards program especially frequent business travelers.

- Access to distribution channels: New entrant firms face difficulty to persuade travel agents that benefit from incumbent volume commission overrides or air carriers recognized brands to book them.

- Government policy: New entrant firms may face government regulations that limit the ability of use of necessary resources or the ability to acquire the licenses needed for operation. This may include certification requirements, labor and social regulations, financial regulations and the minimum requirements required by the civil aviation authority to approve nominated post holders.

- Cost disadvantages independent of scale: New entrant firms may face the incumbent’s advantage of numerous contacts, vast experience and lots of information which may hinder their market penetration.

- New entrant air carriers face the dominant position of hub carriers, especially those that have code sharing agreements. The carriers that are part of an alliance with extensive code share agreements provide many choices of destinations and options with schedule frequencies that act as a barrier for new entrant air carriers.

- New entrant air carriers face the incumbent carrier extensive use of preferred airport terminals and gates. The dominant position of the incumbent carrier would restrict the new entrant air carriers from use of airport facilities. Monopoly of airport facilities such as the ground handling facilities may push new entrant air carriers to establish their own facilities which raise the investment needed and entry costs.

- New entrant air carriers face the restricted availability of capital to finance their start up. In most years investors risking their capital in the aviation industry have not been rewarded adequately (IATA, 2020). New entrant air carriers would rely on self-finance or in limited cases from private sector or employees to raise capital.

- New entrant air carriers face the availability of needed aircrafts for their operation. There are several sources to obtain aircrafts, either to buy or lease a new aircraft or a used one.

- New entrant air carriers face the economic regulation that is set by the civil aviation authority. Those economic regulations may limit the chances for a free market competition by protecting the incumbent carriers.

The protection policy can vary from excluding the designation of new entrant air carriers from certain bilateral agreements in certain markets to the availability of slots at peak times from certain airports thus preventing them from capturing the high demand at peak hours.

EGYPTIAN AVIATION POLICY

The ministry of the Egyptian civil aviation was established by presidential decree no. 56/2002. The ministry was charged with certain responsibilities which included the development of an integrated plan to develop an efficient civil aviation sector that would integrate with the social and economic development of the country and to develop the air transport in Egypt to reach international standards (Berger, 2007).

EGYPTIAN LIBERALIZATION POLICY

The Egyptian government started from 1996 to promote travel to and from Egypt in order to develop the tourism industry. Several ministerial decrees were issued to liberalize the traffic to/from the Egyptian tourist destinations airports, which started with the Ministerial decree 52/1996 that allowed charter flights to operate to all Egyptian airports except Cairo airport.

And ended with the Ministerial decree 164/20 which allowed all designated foreign air carriers to operate scheduled flights from their home base to/from the Egyptian tourist attraction airports (Luxor - Hurghada - Sharm El Sheikh – Taba – Aswan – Saint Catherine - Alamein) with no restriction on frequency or capacity. The central Agency for Public Mobilization and Statistics illustrates in the statistical yearbook tourism section the total number of tourist arrivals in Egypt starting from 2009 till 2018 (CAPMAS, 2019).

From Figure 1, the total tourist arrivals in Egypt are illustrated and this indicates that the Egyptian aviation policy helped the tourism industry to reach its peak in 2010 with nearly 14,731,000 tourist arrivals. In 2011, as a result of the 25th of January Arab Spring tourist arrivals dropped to 9,845,000 tourists.

The tourist arrivals after a short relief in 2012 dropped again to 9,464,000 tourists as a result of the 30th of June 2013 Egyptian revolution.

Barely picking up in 2014 the tourism industry was further hit by the tragedy of the Russian Metro jet airline plane crash terrorist act over Sinai on the 3rd of October 2015. The tourist arrivals dropped to 5,399,000 tourists in 2016 from 9,328,000 tourists in 2015.

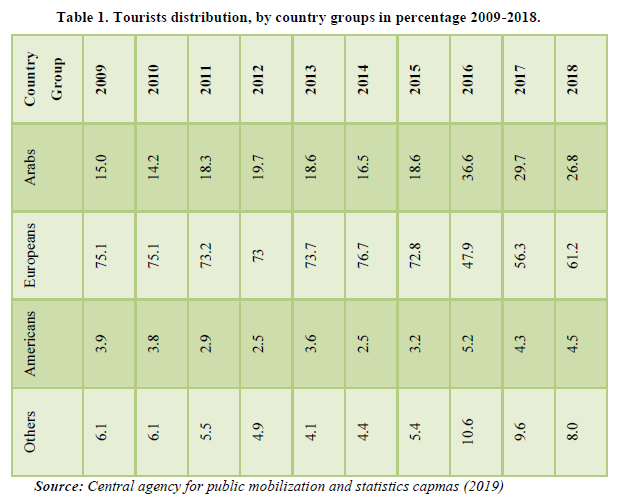

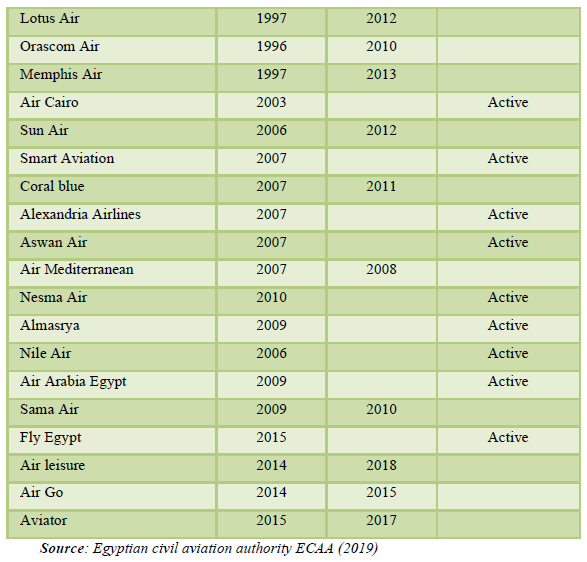

At the end of 2016, the introduction of the Egyptian government economic reform and the change of the foreign currency exchange rate promoted tourism in Egypt. As a result of the economic reform tourism flourished and tourist arrivals grew to reach 11,347,000 tourists in 2018. To understand which are the most important regions the inbound tourism to Egypt originates, the central Agency for Public Mobilization and Statistics illustrates in the statistical year book tourism section the total number of tourist arrivals in Egypt starting from 2009 till 2018 the tourist distribution percentage by country group (CAPMAS, 2019) (Table 1).

From Table 1, the tourist distribution by country group is illustrated. And this indicates that the two largest tourist country groups by percentage are Arabs and Europeans.

Both the Europeans and the Arabs tourist country group by percentage constitute about 90.1% of the total tourist arrivals in Egypt in 2009 and 88% in 2018. Both tourists’ country groups represent a huge percentage of tourist arrivals in Egypt.

The proximity of these two country groups allows air carriers to use narrow body aircrafts with maximum utilization, maximum passenger payload range providing the needed efficiency to achieve lower cost and profitability.

EGYPTIAN PRIVATE AIR CARRIERS

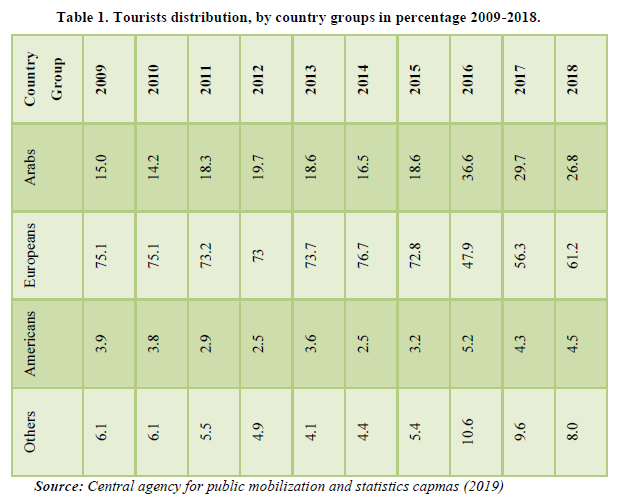

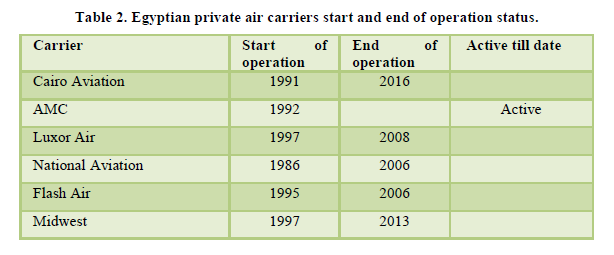

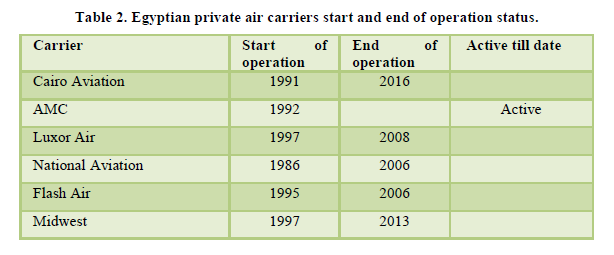

The Egyptian private air carriers existed side by side the state-owned carriers but with a less pronounced role. They mainly operated as charter air carriers and few of them reshaped their business model to operate both low cost flights to near Middle East destinations and charter flights to Europe. Table 2 shows the active private Egyptian air carriers and start and end of operation and of the non-active ones.

From Table 2, it shows that only 10 Egyptian private air carriers are still active operating in the Egyptian market from a total of 25 air carriers in the period starting from 1986 till 2020.

Most of those carriers started operation after the issue of the Ministerial Decree 52/1996 that allowed charter flights to operate to all the Egyptian airports except Cairo airport.

The life span of the carriers that seized operation ranged from a minimum of one year to a maximum of nearly 15 years. The shortest life span was Sama Air which started operation in 2009 and ended operation in 2010. The longest life span was both Air Memphis that lasted 16 years and Cairo Aviation that lasted 25 years.

EGYPTIAN PRIVATE AIR CARRIERS ‘FLEET COMPOSITION

The Egyptian private air carriers’ fleet is very small compared to mainline air carriers or even charter and low-cost carriers with the same business model. The total fleet count of the Egyptian private air carriers are 57 aircrafts, 27 aircrafts of them are owned while 30 aircrafts of them are leased. The fleet categories are composed of 2 wide body aircrafts, 40 narrow body aircrafts, 3 regional jets, 9 business jets, 3 turbo prop aircrafts (ECAA, 2019).

The narrow body fleet constitutes about 70% of the total fleet. Airbus A320 family counts for 25 aircrafts while Boeing B737 family counts for 15 aircrafts. The rest of the fleet is just short-range regional jets and business jets that operate on charter bases. With just 2 wide body aircrafts that operate on charter basis. The leased aircrafts constitute about 53% of the total fleet count (ECAA, 2019).

The Egyptian private air carriers’ fleet composition serves the main objective of those carriers, which is mainly charter operation to transport tourists to the Egyptian leisure destinations from Europe and the Middle East. While at the same time some of them operate scheduled low fare flights from the Egyptian regional airports to the Middle East destinations.

NEW SECONDARY AIRPORTS NEAR CAIRO

Cairo airport acted as a barrier to entry for new-entrant air carriers. The policy set by the Egyptian civil aviation authority excluded low cost carriers and Egyptian national scheduled air carriers to operate on routes flown by Egypt Air from Cairo airport.

There are two new secondary airports adjacent to Cairo international airport. One is located in the new administrative capital and is called Capital International while the other is located near the Giza Pyramids and is called Sphinx International. Both of these airports will create an opportunity for new entrant air carriers especially the low-cost carriers to operate to and from the greater Cairo metropolitan area.

Dresner & Windle (1995) explained that the airport proximity and flight frequency was much more important to business travelers than leisure travelers who seek lower prices and less convenience.

SURVEY RESULTS AND DISCUSSION

Due to the limited number of Egyptian private air carriers in the Egyptian market an in-depth interview was conducted with the top management teams at those airlines using a structured survey of 10 questions. The total population sample was about 30 individuals.

The air carrier Smart Aviation was excluded from the process since it provides charter services for private business jets, and though it owns two Turboprop passenger aircrafts with about 75 seats each, but it leases them as dry operating lease to other carriers.

A new company under certification called Cobra Jet Aviation was included in the process. Cobra Jet Aviation intends to operate long haul charter flights to China using 2 Airbus A330 aircrafts.

Though that CIAF Leasing Company has an Air Operator Certificate for both charter and scheduled operation it provides mainly ACMI (Aircraft, Crew, Maintenance, and Insurance) lease of its fleet to other carriers.

NEW ENTRANT AIR CARRIER’S IDEAS AND SERVICE

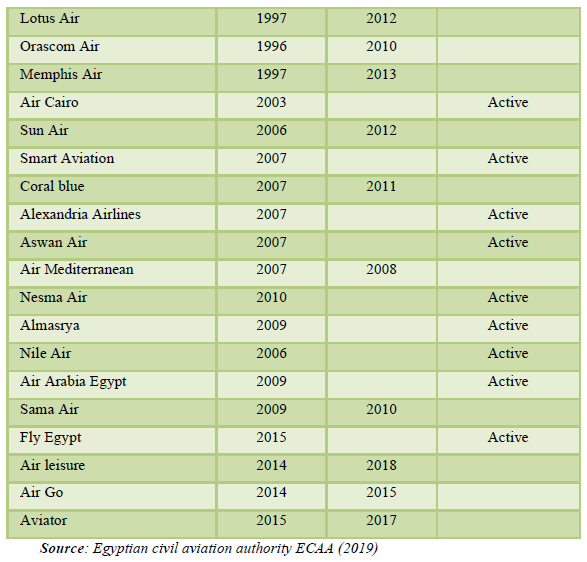

New entrant air carriers are supposed to enter the market with new ideas and better service to attract customers. The new entrant should have a competitive advantage and cost efficiency to be able to sustain the competition (Figure 2).

A 45% of the respondents strongly agree that new entrant air carriers provide new ideas and better service with lower cost structure while 36% slightly agree and 18% strongly disagree.

The respondents expressed that most of the new entrants tend to offer a different product than the existing business models. Most of the new entrants did not have the opportunity to challenge the incumbent directly on their main product offer, while they are competing against each other in secondary markets from the regional airports with nearly the same product features.

Few carriers enter the market with new ideas, like CIAF leasing which provide ACMI aircrafts to other air carriers which is considered a new approach in the Egyptian market.

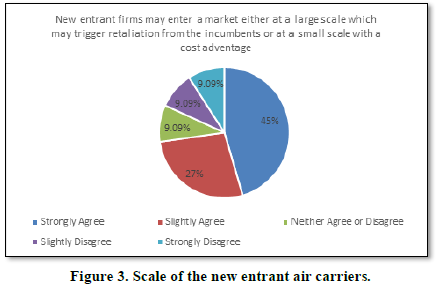

SCALE OF THE NEW ENTRANT AIR CARRIERS

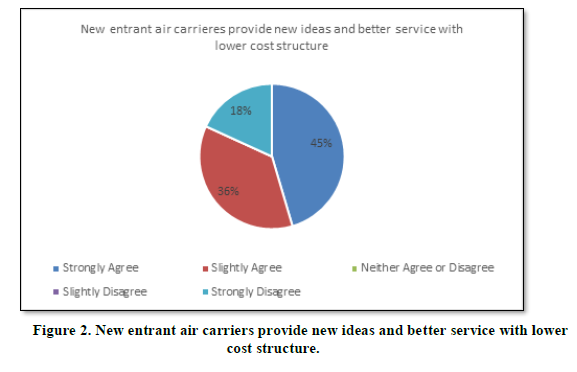

The scale of the new entrant air carriers depend on the scale of the incumbent since retaliation would be expected if the new entrant would enter the market at a large scale. The cost advantage of the new entrant air carrier would enable it to enter at a small scale and avoid retaliation from the incumbent (Figure 3).

45% of the respondents strongly agree while 27% slightly agree that the best way to enter the Egyptian market is to be at a small scale with a cost advantage since the opportunities to serve the large travel market out of Cairo airport is limited and retaliation would be expected from the incumbent. While the charter market is dominated by the foreign charter carriers who are vertically integrated with the mega tour operators.

9.09% strongly disagree while 9.09% slightly disagree since they think that the best way to enter the Egyptian market is at a large scale if they have the opportunity to exist next to the incumbent to fill the capacity gap which is already in the market and not in favor of the Egyptian carriers against the foreign competitors.

9.09% of the respondents neither agree nor disagree as they think that the Egyptian Government should set policies to promote investment in new air carriers and protect against retaliation from the incumbent.

NEW ENTRANT’S WAYS TO OVERCOME CUSTOMER LOYALTY

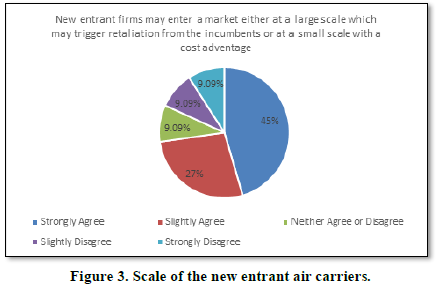

Customer loyalty is one of the most important issues that new entrant air carriers should address when entering a new market. Depending on the business model product differentiation would be a valuable option to attract the incumbent loyal customers (Figure 4).

27% of the respondents strongly agree and 36% of the respondents slightly agree that new entrant air carriers in the Egyptian market in order to overcome customer loyalty have no choice but to invest in product differentiation.

While 18.18% of the respondents strongly disagree and 18.18% of the respondents slightly disagree to invest in product differentiation as the only mean to overcome customer loyalty since they are mainly competing on price.

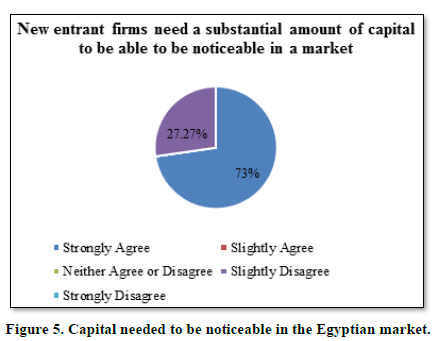

CAPITAL NEEDED TO BE NOTICEABLE IN THE EGYPTIAN MARKET

The nature of the airline business is capital intensive. Aircrafts need a large amount of capital to be acquired. The civil aviation regulations would decide the minimum amount of capital needed for new entrant air carriers. The scale and scope of the new entrant business model would be the major factor to decide the capital needed (Figure 5).

73% of the respondents strongly disagree while 27.27% of the respondents slightly disagree that new entrant firms need a substantial amount of capital to be able to enter the Egyptian market.

The Ministerial decree 607/2015 sets the capital requirements for air carriers engaged in scheduled transport of passengers with a minimum of 100 million Egyptian pounds and 50 million Egyptian pounds for non-scheduled transport. Only 10% of this capital would be paid by the shareholders at the begging of the operation.

The respondents consider that the low capital requirements enabled the existence of small air carriers with poor financial foundation that helped to fragment the aviation market.

TRAVEL AGENTS AND BRAND IMAGE IMPACT

Selection of distribution channels by new entrant air carriers depends on the nature of the target market and its infrastructure. In some markets the travel agents still play an important role to reach customers. Brand recognition would be an important factor by customers for the choice of the airline (Figure 6).

36% of the respondents strongly agree and 36% of the respondents slightly agree that new entrant air carriers face difficulty to persuade travel agents who benefit from incumbent volume commission overrides or air carrier recognized brand to book them. While 18.8% slightly disagree and 9.09% neither agree nor disagree that new entrants face that kind of difficulty.

The reason is that the wide network of the incumbent gives the travel agents many choices of destinations to sell and achieve the target volume of sales and hence they are eligible for the agreed commissions. The Egyptian private air carriers are small entities with limited choice of destinations which makes it difficult to overcome the travel agents commission overrides or the incumbent recognized brand.

The Egyptian aviation market lack the infrastructure for online sales and most of the Egyptian air carriers consider that travel agents are considered their first choice of distribution.

GOVERNMENT REGULATIONS AS A BARRIER TO ENTRY

The government policy to attract new entrant air carriers is important for stimulating the economty.Government regulations may ease of operation and the flexibility to start operation for new entrant air carriers in the Egyptian market. This may include certification requirements, local regulation of labor and social and financial, and the minimum requirements to approve nominated post holders (Figure 7).

27% of the respondents strongly agree while 18% slightly agree that government regulations that may limit the ability of use of necessary resources or the ability to acquire the licenses the licenses needed for operation act as a barrier to entry.

36.3% strongly disagree and 18% slightly disagree that the government regulations may limit the ability of use of necessary resources or the ability to acquire licenses needed.

The reason for this nearly split of respondents on this issue is that the government started lately to facilitate the investment regulations to try to stimulate the Egyptian economy. The respondents noticed lately this new approach but still it needs more streamlining of required processes to fulfill the requirements of certification.

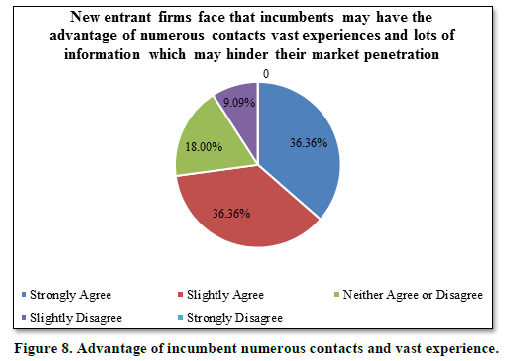

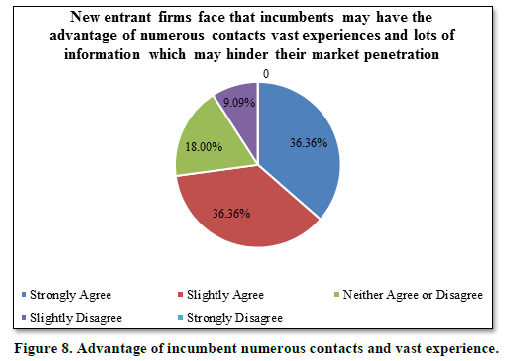

ADVANTAGE OF INCUMBENT NUMEROUS CONTACTS AND VAST EXPERIENCE

The many years of experience of the incumbent in the market would enable the existence of a wide network of business relations and public relations. This would give the incumbent an advantage against new entrant air carriers (Figure 8).

36.36% of the respondents strongly agree and 36.36% slightly agree that the new entrant air carriers face that incumbents may have the advantage of numerous contacts, vast experiences and lots of information which may hinder their market penetration.

9.09% of the respondents slightly disagree of the incumbent’s contacts, vast experience and information may hinder their market penetration, while 18.0% neither agree nor disagree.

The reason is that the Egyptian private air carriers which operate scheduled flights suffers from the incumbent long years of market existence and the strong relation with the industry stockholders which may hinder their market penetration. While the air carriers operating charter flights suffer from the vertical integration between the foreign charter operators and the mega tour operators in the market and their relationship with the different travel agents.

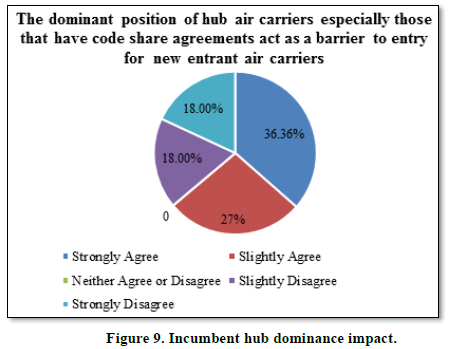

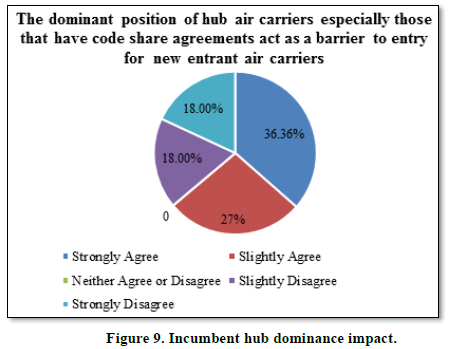

INCUMBENT HUB DOMINANCE IMPACT

Air carriers target to achieve hub dominance to protect its home market. Code share agreements and alliance membership is a marketing strategy to increase market share and prevent market penetration by new entrants (Figure 9).

36.36% of the respondents strongly agree and 27.0% slightly agree that the dominant position of the hub carrier especially those that have code share agreements act as a barrier to entry.

18.0% of the respondents strongly disagree and 18.0% slightly disagree that the dominant position of the hub carrier and its code share agreements would impact them.

The reason for this is that the carriers that would like to operate in the domestic market have no chance in front of Egypt Air to be able to have a noticeable market share since Egypt Air operates with a heavy schedule and the Egyptian Civil Aviation Authority requires that the new entrants file a time table schedule different from that of Egypt Air. While in the international market to the major destinations in the Middle East and Europe Egypt Air operates with several frequencies per day plus the code share flights within the Star Alliance.

The other Egyptian private carriers which operate from the regional airports scheduled flights disagree that there is an impact of a dominant carriers; actually, the market is fragmented between them.

While the carriers that operate charter flights from the tourist destinations suffer from the dominance of the charter operators who vertical integrate with the big tour operators which make it nearly impossible to capture any sizable market share from some markets. This is very obvious for the Russian travel market.

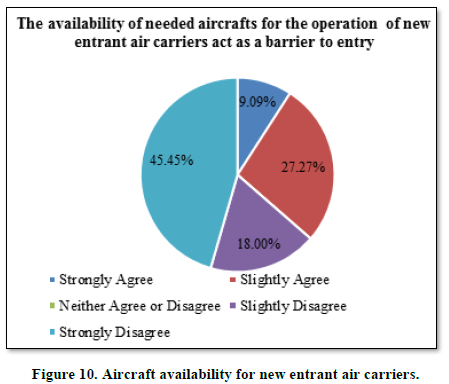

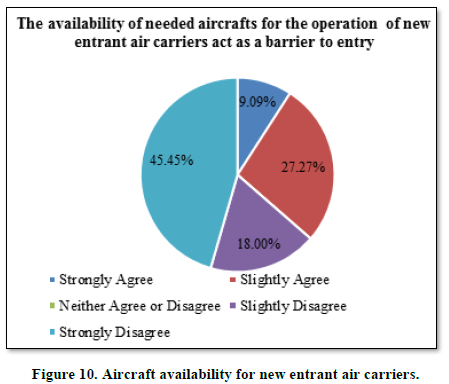

AIRCRAFT AVAILABILITY FOR NEW ENTRANT AIR CARRIERS

The availability of aircrafts depends on the economic cycle and the financial ability of the carriers. Air carriers acquire needed aircrafts either direct purchase from original equipment manufacturers or through lease from leasing companies (Figure 10).

9.09% of the respondents strongly agree and 27.27% slightly agree that the availability of needed aircrafts would be a barrier to entry. The reason is that few international lessors in the market would agree to lease aircrafts to the Egyptian private air carriers since their credit rating is low. To overcome this situation the Egyptian private air carriers, lease aircrafts from CIAF the Egyptian leasing company. Most of the Egyptian private air carriers prefer leasing needed aircrafts rather than owning them due to their limited capital and their financial applicability.

The Ministerial decree 607/2015 sets an age limit to register acquired aircrafts by 17 years for narrow body and 20 years for wide body aircrafts. These limits do not apply if the private air carriers acquire aircrafts that are already registered within the Egyptian Civil Aviation Authority. This age limit reduces the chances to acquire good airworthy aircrafts with less capital cost.

45.45% strongly disagree and 18.0% slightly disagree that the availability of needed aircrafts would be a barrier to entry. The majority of the air carriers consider that aircrafts are available in the lease market. The stronger financial foundation of those carriers does not limit their ability to acquire whatever needed aircrafts.

The Egyptian Aviation ministerial decree 607/2015 requires that air carriers engaged in non-scheduled transport operation of passengers and cargo its fleet shall be at least composed of one aircraft owned or finance leased. While air carriers engaged in scheduled operation its fleet shall be composed of at least three aircrafts, one of those aircrafts shall be fully owned by the air carrier.

Egyptian air carriers according to the Egyptian regulation would just need to own just one aircraft within its fleet which eases the requirement to raise large capital amounts to acquire needed aircrafts.

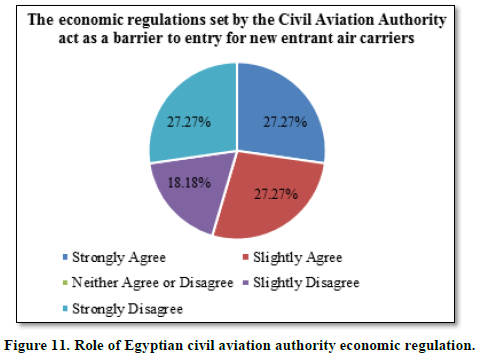

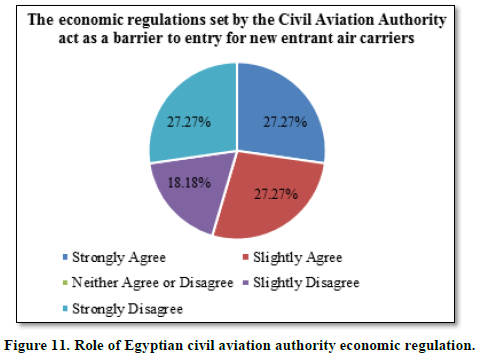

ROLE OF EGYPTIAN CIVIL AVIATION AUTHORITY ECONOMIC REGULATION

The economic regulations of the civil aviation authority play an important role to set the basis for fare competition and welfare equilibrium. The economic regulations may hinder or attract new entrant air carriers to develop the aviation industry in Egypt (Figure 11).

27.27% of the respondents strongly agree and 27.27% slightly agree that the economic regulation set by the Egyptian Civil Aviation Authority act as a barrier to entry since those carriers are unable to operate scheduled flights out of Cairo airport to markets served by Egypt Air.

27.27% of the respondents strongly disagree and 18.185% slightly disagree that the economic regulation set by the Egyptian Civil Aviation Authority act as a barrier to entry since they operate as charter flights from Cairo airport and scheduled flights from the regional airports with no restrictions.

CONCLUSION

The constant threat of new entry by new firms is a fundamental prerequisite for effective competition, where companies try to gain competitive advantage and be smarter, control cost and offer lower prices.

The Egyptian private air carriers are small entities with a considerable small capital. They operate mainly charter flights to/from the Egyptian tourist destinations and scheduled low fare flights from the Egyptian regional airports.

The Egyptian private air carriers suffered from the fluctuations of tourist arrivals due to global and local crisis events. The Egyptian tourism industry suffered from the impact of terrorism and political unrest in the last 10 years which impacted the revenue streams and the growth plans for the Egyptian carriers.

The Egyptian private air carriers cannot benefit from the economies of scale to reduce their cost since each of them has a small fleet size. The economic regulation set by the Egyptian Civil Aviation Authority deprive them from operating side by side Egypt Air to the major markets from Cairo airport.

The lack of a strong brand and the availability of large choice of destinations hinder their revenue streams and their growth plans while the dominance of the charter carriers’ vertical integrators prevent them from entering certain markets.

The Egyptian private air carriers that stopped operation suffered from many reasons of failure. Those reasons ranged from poor management, incumbent protection especially from Cairo airport which limits the designation of new entrant Egyptian private air carriers to scheduled route rights to the major markets in Europe and the middle east, poor financial foundation due to small capital and fluctuation in demand as a result of terrorism and economic decline, lack of skills in the field of marketing and branding.

There is a great opportunity for the Egyptian aviation industry to benefit from the availability of secondary airports near Cairo airport that would impact the in-market competition and will drive efficiency levels higher from all carriers to provide lower fares and better service to achieve a sustainable profit in the future.

The aviation industry is vital for the Egyptian economy especially the tourism industry which depends mainly on-air travel. The existence of robust Egyptian air carriers would help to support the air travel market in Egypt which will support the growth of tourism and eventually the economy.

RECOMMENDATIONS

RECOMMENDATIONS REGARDING THE EGYPTIAN MINISTRY OF CIVIL AVIATION POLICIES

- The Egyptian Ministry of civil aviation should raise the minimum capital required for the Egyptian air carriers. This would prevent the existence of small fragile entities with poor financial foundation. New entrant air carriers need capital to be able to invest in assets, technology, marketing skills, product differentiation to compete against the incumbents and the charter foreign air carriers. Robust airlines would be able to withstand the economic fluctuations that may affect the industry as a result of economic decline, terrorism, epidemics.

- The Egyptian Ministry of civil aviation should coordinate with the finance sector and the information technology sector to develop policies that will promote the online sales infrastructure within the Egyptian market and payment through alternative methods. This would reduce the impact of the travel agents on the airline sales and directs the customers to more direct payment methods to the airlines.

- The Egyptian Ministry of civil aviation should set policies to develop the leasing industry in Egypt, also should coordinate with the finance and banking sector to provide several means to provide capital for the leasing industry in Egypt to be able to cater for the needs of the Egyptian air carriers. The ECAA should ease the aircraft registration age limit restrictions provided full compliance with the airworthiness and maintenance regulations.

RECOMMENDATIONS REGARDING THE EGYPTIAN CIVIL AVIATION AUTHORITY REGULATIONS, POLICIES AND PROCEDURES

- The Egyptian Civil Aviation Authority (ECAA) should initiate policies to promote the role of the private Egyptian new entrant air carriers to provide new ideas and better service with lower cost to challenge the incumbent carriers which will benefit the customers. The competition will drive the industry to become more efficient which help promote tourism and stimulate the Egyptian economy.

- The ECAA should develop policies to identify anticompetitive behavior and enforce actions to correct such behavior to prevent retaliation against new entrant air carriers. The ECAA should set policies to ensure a fair market share in the charter market for the Egyptian private air carriers to provide the opportunity for those carriers to grow and develop without applying protection measures.

- The ECAA should develop procedures to facilitate the issue of licenses and certificates needed for new entrant air carriers to make best use of its resources and start operation as early as possible. The availability of online services for the application and certification phases would reduce the amount of time and paper work needed which will make the whole process more efficient.

- The ECAA should develop policies to prevent anti-competitive behavior by the incumbents to exclude the new entrants from the needed information for market entry, and implement the antitrust laws that prevent practices that may hinder fair market competition.

- The ECAA should develop policies to ensure that the dominant position of hub air carriers at Cairo airport does not violate the antitrust law and that equal opportunities for new entrant air carriers are available for both the domestic and international market. These policies should ensure that the alliance code share agreements do not act as a barrier to entry. These policies should also ensure that there is no protection in favor of the incumbent carriers.

- The ECAA should develop economic regulations that provide the gradual liberalization of Cairo airport. This would give the opportunity for both Egypt Air and the Egyptian private air carriers to grow and be able collectively to have a fair market share of the travel market to/from Cairo airport that can match the supply of foreign air carriers.

- The ECAA should grant traffic rights for the Egyptian private air carriers to operate from the secondary airports near Cairo airport and designate them within the bilateral air service agreements. This would allow those carriers to provide a new service to the Egyptian market that would attract new customer segments and help the growth of the travel market and the creation new jobs which would benefit the Egyptian economy.

RECOMMENDATIONS REGARDING NEW ENTRANT AIR CARRIERS PRODUCT FEATURES

The new entrant air carriers should invest in product differentiation based on the target customer segment. Though price is a main factor of competition for those carriers to attract new customers, but they need to provide better service offer to attract the loyal incumbent customers.

Baumol, W.J., Panzar, J.C. & willing, R. (1982). Contestable markets and the theory of industry structure. Harcourt. Brace Jonanovich, Sandiago.

Berger. (2007). National airport master plan, Phase IV Financial/Regulatory and updating plan, The Louis Berger Group, INC, Washington, DC, USA.

Button, K. (1989). The deregulation of U.S. interstate aviation: An assessment of causes and consequences, Transport reviews 9(2): 108.

CAPMAS. (2019). Central Agency for Public Mobilization and Statistics, statistics yearbook, tourism section.

Doganis, R. (2001). The airline business in the twenty first century. Routledge, London.

ECAA. (2019). Egyptian private air carriers fleet composition, Egyptian Civil Aviation Authority.

Euro Control. (2005). The Economic catalytic effects of air transport in Europe, Euro control experimental center Bretigny, Surorge, Cedex.

Goolsbee, A. & Syverson, C. (2008). How do incumbents respond to the threat of entry? Evidence from the Major airlines. Quarterly Journal of Economics 123(2008), 1611-1663.

Grant, R.M. (2005). Contemporary strategy analysis. UK. Backwell publishing.

Guomundsson, S.V. (1995). Corporate failure and distress prediction based on the combination of quantitative and qualitative data sources: The case of new-entrant airlines in the United States, PhD thesis, Department of Air Transport, Canfield University.

Harison, S.J. (2004). Foundation in strategic management. United States of America, Thomson: Southwester.

IATA. (2020). Economic performance of the airline industry, Midyear report.

ICAO. (1996). International civil aviation organization, Manual on the regulation of international air transport.

Levine, M.E. (1987). Airline competitions in deregulated markets theory: Firm strategy and public policy, Yale Journal on regulation 4(2), 404-405.

Porter, M.E. (1979). How competitive forces shape strategy. Harvard Bus Rev 57(2), 137-145.

Porter, M.E. (1980). Competitive strategy: Techniques for analyzing industries and competitors, free press, New York.

Stewart, J.T.JR. (1990). United Sates citizenship requirements of the federal aviation act: A misty moor of legalisms or the rampart of protectionism? Journal of Air Law and Commerce 55, 685-724.

Windle, R.J. & Dresner, M.E. (1995),.The Short and Long Run Effects of Entry on U.S. Domestic Air Routes. Transportation Journal 35(1995), 14-25.