4408

Views & Citations3408

Likes & Shares

ABSTRACT

Egypt Air suffered from great losses as a result of the 25th of January 2011 Arab spring in Egypt. As a result of decline in travel demand to/from Egypt due to the political instability and security concerns, Egypt Air promoted transit traffic through Cairo hub but suffered further losses due to low yield of the connecting traffic.

Egypt Air initiated several strategic turnaround decisions to try to stop the performance decline and build for the future. The initiatives were followed with a restructuring project to reduce cost and increase efficiency.

A descriptive analysis of the strategic turnaround decisions and the restructuring program is carried out supported with an in-depth interview with Egypt Air executives to understand the nature of those decisions and the challenges facing Egypt Air in the future.

The Egyptian government should support Egypt Air transformation plan financially to be able to meet its obligations during this transition phase. After restructuring Egypt Air should seek a strategic partnership with a global carrier to be able to meet competition or arrange for a part IPO to be able to fund its future development and expansion. Several other initiatives regarding business process, employee training, talent recruitment, asset retrenchment should be addressed to able to be profitable again.

Keywords: Political instability, Performance decline, Strategic decisions, Turnaround strategy, Network optimization, Economic reform.

Introduction

Egypt Air suffered from a performance decline post the 25th of January 2011 Arab spring. The political instability, terrorism and the security concern impacted the demand to travel to/from Egypt. Egypt Air business model as a network carrier operating from Cairo airport was greatly impacted.

The decline in demand to travel to Egypt and especially Cairo impacted both the local and connecting traffic. Egypt Air subsidiary companies providing third party services were further impacted from the traffic decline at Cairo airport since many international carriers stopped or reduced their operation significantly.

Egypt Air as a state-owned carrier helps to promote travel to/from Egypt which in turn helps to develop the Egyptian economy. Its survival and existence are important for the future development of the country; thus, it is a requisite to identify characteristics of declining industries and nature of strategic turnaround decisions, analyze different cases of airline recovery and transformation and understand Arab Spring impact on the Egyptian economy and Egypt Air performance.

Egypt Air initiatives for strategic turnaround had to be carefully analyzed while addressing the future challenges and recommendations to stop performance decline and achieve sustainable profitability. Furthermore, an in-depth interview had been carried out with 10 Egypt Air executives, the interview revolved around the recovery and transformation plans that included different turn around strategic decisions to stop the performance decline and try to return to sustainable profitability.

DECLINING INDUSTRIES PERFORMANCE

Porter (1980) indicates that the declining industries are those that have experienced an absolute decline in unit sales over a sustained period of time. Slower economic growth, product substitution resulting from cost inflation and continued technological change would further impact the decline in performance.

Market conditions change, and when they do change then existing routines and practices may no longer be optimal. This change is difficult, and it can sometimes mean losing core competences (Dobrev et al., 2001).

Organizations are slow to adapt to changing market conditions. The existing employee’s skills and motivations are committed to the current processes and procedures, which may create political opposition to the coming change (Dobrev & Barnett, 2001).

Under the political opposition of the employees, and the unwilling top management team to pursue change due to fear about their own future, management may try to delay the change until it is absolutely deemed necessary hoping that the environmental conditions would change and the business would catch up.

TURNAROUND STRATEGIC DECISIONS

Barker & Duhaime (1997) suggest that turnaround occurs when a firm suffers from a survival threatening performance decline over a period of years, but is able to reverse the performance decline, end the threat to firm survival and achieve sustained profitability.

Stacey (1993) observed that managers who think strategically are bound to act more effectively in dealing with the future. To be strategic an action must reinforce or change one or more of the following:

A- The scope of the corporation portfolio of businesses.

B-The market or horizontal scope of an individual business.

C-The value offered to customers of an individual business.

D-The competitive advantage sought by a business.

E-The operating strategy used by a business to deliver value to its customers.

Shoenberg, Collier & Bowman (2013) identified six most frequent turn around strategies that were applied by firms that suffered from a performance decline to achieve a sustained recovery. These turnaround strategies are:

- Cost Efficiencies: Is a first step short term action to stabilize finances and improve cash flow until more complex strategies are devised.

- Asset Retrenchment: Following cost efficiencies, firms may appraise areas within to determine possibility to raise efficiencies for better performance or to divest the asset to generate cash flow.

- Focus on Core Activities: Turn around strategies that include focus on core activities has been successful. Firm activities are refocused around markets, product lines and customer segments that will achieve the highest profits.

- Build for the Future: After recovery and the stabilized financial position of the firm the growth strategy for the future includes asset reconfiguration, entering new geographic markets, extending the product line based on current resources.

- Reinvigoration of Firm Leadership: When a firm is considered in serious difficulties, change in leadership is a signal to the media and shareholders that the turnaround process has begun.

A new top management team with new skills to focus on the new strategies is considered a precondition for almost all successful turnaround (Hofer, 1980).

- Culture Change: Past beliefs that are taken for granted and assumptions that declined the firm’s performance should be changed.

CASE STUDIES OF RECOVERY AND TRANSFORMATION

Lawton et al. (2011) identified two distinct strategic reorientation approaches of legacy airlines to adapt to the changing environment, leading to a new value proposition.

The first approach focuses on Improvement and innovation favored by companies that have fallen behind adopted by Aeroflot, Air Canada and ANA.

This approach is based on reinforced corporate strategy and organizational restructure to regain customer trust and loyalty. Network restructure, business process reengineering, and cost control provided a new value proposition to existing and potential customers.

Customers of Air Canada had the choice to pick from several sub-branded fare structure under the new a la carte pricing offer (Hampton, 2006). The airlines took advantage of the internet to make their products easily accessible through their internet sites and E-ticketing.

To achieve a leaner group structure the airlines pursued fleet optimization and network realignment to increase traffic through their hubs while trimming cost.

The second approach focuses on extension and expansion. Underperforming airlines due to decline in their own historical markets such as LAN and TAM preferred this strategy to extend their services and expand in other geographical locations where opportunities exist.

LAN implemented a boundary Breaker strategy to setup airlines based on its strong customer focused value proposition in new markets away from its home country.

TAM airlines took advantage of the decline of Varig Airlines in Brazil through a reorientation strategy of product extension and market expansion. TAM adopted a more cost-efficient model to compete with the low fare carriers. TAM attracted the business of the market by a strong brand identity (Pereira, 2006).

(O’connell & Connolly, 2016) uncovered the turnaround strategies pursed by Aerlingus to transition into a value hybrid air carrier retaining both elements of network airlines and low-cost carriers’ basic principles.

Aerlingus founded in 1936. A state-owned airline acting as the national carrier of Ireland, suffered from inefficiency and bureaucracy that classified it with the symptoms and characteristics of distressed state airline Syndrome (Doganis, 2001).

Capacity discipline, cost control, value added product differentiation, innovative partnership, hub re-engineering at Dublin airport to target connecting traffic flows between Europe and north America were all part of a visionary turnaround strategy.

Transportes Aereos Portugueses (TAP) escaped from bankruptcy by undertaking a major restructure and transformation strategy. TAP suffered from government interference, poor interval communication, financial difficulties, and industrial disputes embraced with strikes and low employee motivation.

TAP strategic turnaround decisions addressed the closure of non-profitable routes, network and fleet optimization, wage freeze with a consensual labor terminations and salary reduction, business process redesign to improve customer service with a brand recognition campaign to improve customer perception. TAP increased its efficiency and lowered its cost of operation while reinforcing its hub and spoke strategy at Lisbon airport. A new pricing strategy was introduced 2008 to serve different passenger segments.

The top management team emphasized the importance of communication between them and the employees, a culture change lead by informality, flexibility and reduction of bureaucracy (Monsanto, 2014).

ARAB SPRING IMPACT ON THE EGYPTIAN ECONOMY

The Egyptian economy was negatively affected by the 25th of January 2011 Arab spring. The Egyptian economy real growth rate reached 1.8% in 2010/2011 and 2.2% in 2011/2012 post the revolution dropping from a soaring growth rates of 7.2% in 2007/2008 and 4.7% in 2008/2009 as a result of the world economic recession fueled by the global financial crisis in 2008/2009 (Abdou & Zaazou, 2013).

The Egyptian foreign currency reserves dropped from US $ 36 billion pre-revolution to a US $ 15 billion post-revolution. The fiscal year 2010/2011 in Egypt witnessed deterioration of foreign investment after the revolution. Foreign investment dropped from US $ 6.8 billion pre-revolution to just US $ 2 billion post-revolution (Central Bank of Egypt, 2011).

As a result of the political upheaval, the unemployment rate reached 11.9% in the 1stquarter of 2011 post the revolution (CAPMAS, 2011).

The tourism industry revenues in Egypt dropped by nearly 60% with arrivals dropping to nearly 45% in the 1st quarter of 2011 (World Bank, 2011).

(Mansfeld & Winklere, 2015) illustrated that the Arab spring impact on tourism was unprecedented in the region, especially Egypt with its ramification spreading for many years. Political instability and war in the Middle East spreading from Libya to Syria and Yemen further aggravated the situation.

(Pizam & Mansfeld, 1996) elaborated that the tourism sector and in consequence the travel business is affected directly and indirectly from violent conflicts and/or political instability.

The mass media coverage negatively depicted the political instability in Egypt. The media exaggerated facts which deterred travelers away. (Baral, et al. 2004) elaborates that terrorism and political instability are one of the main coverage topics in contemporary media.

The fear of travel would be more pronounced by the travel warning issued by the western countries. The travel warnings lead to a drop in air travel to and from Egypt (Nasr, 2012). The central Agency for Public Mobilization and Statistics illustrates in the statistical yearbook tourism section the total number of tourist arrivals in Egypt starting from 2009 till 2018 (CAPMAS, 2019).

From Figure 1, it is concluded that the Egyptian tourism industry reached its peak in 2010 with nearly 14,731,000 tourist arrivals. In 2011, as a result of the 25th of January 2011, Arab spring tourist arrivals dropped to 9,845,000 tourists.

The tourist arrivals after a short relief in 2012 dropped again to 9,464,000 tourists as a result of the 30th of June 2013 Egyptian revolution.

Barely picking up in 2014 the tourism industry was further hit by the tragedy of the Russian Metrojet plane crash terrorist act over Sinai on the 31st of October 2015. The tourist arrivals dropped to 5,399,000 tourists in 2016 from 9,328,000 tourists in 2015.

At the end of 2016, the introduction of the Egyptian government economic reform promoted tourism in Egypt, tourism flourished, and tourist arrivals grew to reach 11,347,000 tourists in 2018.

ARAB SPRING IMPACT ON EGYPT AIR PERFORMANCE

Egypt Air was founded in May 1932. A state-owned airline acting as the national carrier of Egypt, transformed in July 2002 into a holding company and nine subsidiaries.

Egypt Air group consolidated revenue dropped to 12,890 billion EGP in the FY 10/11 less 4.5% from 13,504 billion EGP in FY 09/10. The group consolidated cost increased to 14,945 billion EGP more 15% than the cost of 12,971 billion EGP in financial year (FY) 09/10. The net result for the group was a total loss of 2,059 billion EGP in the FY 10/11, which is a sharp drop from a profit of 533,122 million EGP in FY 9/10 (Egypt Air, 2011).

As a result of the political upheaval the chairman and CEO of Egypt Air Holding Company announced that the Group is ready to lease up to 25% of Egypt Air fleet (CAPA, 2011).

The situation during the events of the political upheaval was marked by labor disruption and industrial demands from labor unions. Eminent strikes were always around the corner, with continuous interference from unions into management decisions. Egypt Air airlines alone lost 2,204 billion EGP in FY 10/11(Egypt Air, 2011).

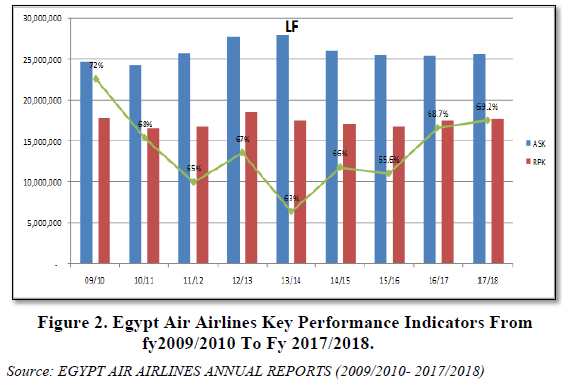

From Figure 2, Egypt Air Airlines key performance indicators are illustrated from FY 2009/2010 to FY 2017/2018. There were three major events in the period from FY 2009/2010 to FY 2017/2018 that affected Egypt Air performance.

The 25th of January 2011 Arab spring had a major impact on load factor as it dropped from 72% in FY 09/10 to 68% in FY 10/11 then to 65% in FY 11/12. The 30th of June 2013 Egyptian revolution dropped the load factor to 63% in FY13/14 from a load factor of 67% in FY12/13. The tragedy of the Russian Metrojet crash over Sinai on 31 October 2015 due to a terrorist act had a slight impact on the load factor as it dropped from 66% in FY 14/15 to 65.6% in FY 15/16 since it mainly affected tourist arrivals in both Sharm El Sheik and Hurghada.

Following the 25th of January Arab spring Egypt Air airlines strategy aimed to increase the connecting traffic at Cairo hub to compensate for loss of demand of inbound tourism and business travel markets, the Available seat kilometers (ASK) increased from 24,337 billion ASK in FY10/11 to 25,745 billion ASK in FY11/12 and 27,685 billion ASK in FY12/13 and 27,971 billion ASK in FY13/14.

Egypt Air Airlines implemented network adjustments expanding in Africa, Europe and the Middle East with new destinations in Asia. Transit traffic at Cairo hub increased from only about 3% before the political turmoil to reach 17% in FY 12/13 then to further increase to reach nearly 30 to 35% out of Egypt Air total traffic in FY 13/14 (CAPA, 2014).

The increase in transit traffic pressured the yield down through heavy discounting as the cumulative losses have reached almost USD 1.5 billion since the political upheaval (CAPA, 2014).

After FY13/14 Egypt Air started to reduce capacity to match demand and increase load factor. The ASK was reduced to reach 25,614 billion ASK in FY 16/17 which is a reduction of about 8.5% from the 27,971 billion ASK in FY 13/14. The result was an increase of load factor to reach 69.2% in FY 17/18 which is about 6.2 points more than the 63% load factor in FY13/14.

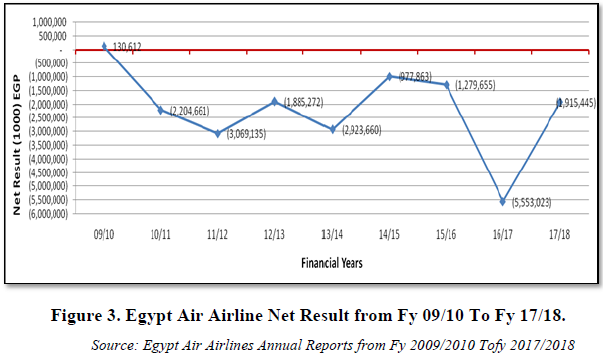

From Figure 3, Egypt Air Airlines net results are illustrated for the period from FY 09/10 to FY 17/18. As a result of the 25th of January 2011 Arab spring and the political unrest that was accompanied with it, the demand to travel to Egypt diminished especially Cairo airport which is Egypt Air Airlines dedicated hub.

Egypt Air Airlines suffered from continues losses that started from FY10/11 with a loss of 2,204 billion EGP to totally reach accumulated losses of 20 billion EGP in FY 17/18. The losses in FY 16/17 reached alone 5,553 billion EGP as a result of low yield, low load factor and the foreign exchange currency rate losses due to the introduction of the Egyptian government economic reform measures by end of 2016.

RESULTS & DISCUSSION

Egypt Air strategic turnaround decisions

An in-depth interview was carried out with 10 executives of Egypt Air to understand the environment that surrounded the strategic turnaround decisions and the objectives that were meant to be achieved.

The new executive team at Egypt Air holding company announced at the beginning of 2014 capacity cuts as part of a new strategic turnaround plan. The slim network strategy announced by the CEO includes frequency cuts on some European, Asian and Middle Eastern routes. Unprofitable routes such as Jakarta and Kuala Lumpur that are heavily dependent on transit passengers with low yields were suspended (CAPA, 2014).

As a result of the slim network strategy the capacity reduction was 8.5% and the load factor increased 6.2 points by the FY 17/18. The excess fleet capacity as a result of capacity reduction was leased out, two Boeing B777-200 were leased to Biman Bangladesh Airline and five narrow body aircrafts were leased to other Egyptian air carriers.

The introduction of the slim network strategy with a modest capacity reduction of 8.5% did not stop the continuous losses of Egypt Air. A consultant was appointed in December 2014 to develop a project for further strategic decisions for turnaround.

The transformation plans covered work streams in commercial and operations areas in order to achieve growth, improve products and services, develop an effective organization and achieve Profitability to fund the future (El Hefny, 2019).

The strategic turnaround decisions were as follows:

- Network development by adding new markets and increasing frequencies, achieving economics of scale, improving connectivity to build a strong Cairo hub.

- Expand Egypt Air global reach through star alliance.

- Fleet optimization to achieve commonality, replacement of old aircrafts with new technology aircrafts to reduce cost and increase efficiency to achieve profitability.

- Improve crew resource management with new organization structure, policies and processes using new technology to increase efficiency and lower cost with better work environment.

- New dynamic and competitive pricing policy to attract more customers via the Cairo hub and increase market share.

- Apply best revenue management practices to maximize revenue.

- Develop a performance driven sales organization.

- Reduce the cost of sales, develop Egypt Air call center and website booking engine to increase direct sales through Egypt Air.

- Improve Egypt Air brand perception; upgrade product and customer service to increase customer satisfaction.

- Introduce new ancillary products to meet competition from low cost carriers.

- Increase marketing activities especially digital marketing to attract new customers and retain loyal ones.

- Streamline the organization and manage intercompany service agreements effectively while investing in information technology to accomplish the strategic turnaround strategy.

There was a change of leadership by the end of 2015. The new Egypt Air holding company CEO announced that Egypt air would be implementing a new major restructuring plan. The plan core elements include network and fleet development with a cost reduction plan (Egypt Air, 2016).

(Mousallam, 2019) explained that the major restructuring plan included cost efficiencies as follows:

- Renegotiating payable accounts term with the travel agents.

2- Renegotiating with aircraft lessors to reduce aircraft rents and extend lease contracts.

- Postponing employee pay increase until when financial performance improves.

- Increase both Egypt Air airlines and Egypt Air Express capital to relief the debt payment endured from the deterioration of the financial performance.

- Better aircraft route allocation, capacity reduction to match supply with demand to reduce cost of operation as a result of the changes in demand patterns after the political upheaval.

- Network optimization to increase load factor by introducing tag flights to certain destinations for cost reduction.

- Upgrade the frequent flyer program to increase its efficiency for better customer satisfaction and retention.

- Reduction of outstations marketing expenses.

As a result of the two stage strategic turnaround initiatives that started from 2014, Egypt Air cash flow improved and losses reduced in FY 14/15 to reach 977,863,000 EGP from a loss of 2,923,660,000 EGP in the FY 13/14 which is a reduction for about 66.5%in losses. A purchase/sale/lease back of nine Boeing B737-800 was conducted as part of the fleet renewal plan to reduce cost of fuel and maintenance and increase cash flow (Egypt Air, 2015).

A 5-year fleet plan to increase the fleet size to 84 aircrafts by 2021 ended with an agreement to lease 6 Boeing B787-9 and 15 Airbus A320 NEO and the purchase of 12 Airbus A220-300 with an additional option of 12 aircrafts (Egypt Air, 2017).

By mid-2018 there was another leadership change with the appointment of a new CEO at the head of Egypt Air holding company who announced the hire of another consultant to assist with a new strategic turnaround plan and its implementation phase. The aim of this new strategic turnaround plan was to improve the performance of the group subsidiaries and their inter relations to increase efficiency by relocating certain activities and processes within the group (Rivers, 2019).

Adel (2019) indicated that Egypt Air group restructure strategic turnaround included the following:

- Merge of Egypt Air Airlines with Egypt Air Express and the flight operations of Egypt Air Cargo into one entity under the name of Egypt Air Airlines.

- Increase Egypt Air holding company stake in Air Cairo from 60% to 100% in order to change its business model from a charter carrier with part scheduled operation to a low-cost carrier within the group.

- Shift of the passenger handling activities from Egypt Air Airlines, the cargo warehouse from Egypt Air Cargo, the cabin cleaning and aircraft push back services from Egypt Air Maintenance to be functioned by Egypt Air Ground Services to provide a more efficient full package ground handling services to in-house subsidiaries and third-party clients.

- Transform Egypt Air Holding Company into a slim organization to concentrate on corporate strategy and planning rather than incorporating operational activities. This would be done by transferring operational activities such as security, construction and facilities management to Egypt Air Supplementary Industries Company.

- Transfer the Alliance department to the commercial sector of Egypt Air Airlines for better coordination with the commercial department.

- Study the transfer of Egypt Air Training Academy from under the jurisdiction of the holding company to either Egypt Air Airlines or to merge with the Egyptian Aviation academy. The aim is to provide full package training from the basic training to the advanced training and to make the best use of synergies that may arise from such a merge.

The new turnaround restructure plan improved the group performance, the consolidated group result losses decreased to just 1,915 billion EGP for FY 17/18 from a heavy loss of 5,553 billion EGP in FY 16/17.

FUTURE CHALLENGES FACING EGYPT AIR

Egypt air faces the following challenges

1. Raising capital to fund future transformation and product upgrade. This challenge would be more pronounced with the Egyptian government comprehensive economic program that includes an initial public offering (IPO) for state owned companies in all their forms and legal nature. The economic program aimed to raise additional funds and lure more investments and to optimize the state’s assets.

- Effective integration of the merged business units and stream liming business process under the new organization restructuring program.

- Achieving high aircraft and crew productivity with the merger of Egypt Air Express and Egypt Air Cargo within Egypt Air Airlines.

- The presence of different aircraft types and configuration within the same business unit would be a challenge to streamline operations processes and procedures.

- Surplus employees as a result of the organization restructuring program. State owned companies work force lay off program is based on a voluntary initiative from the employees themselves.

- Motivating the employees for the new turnaround plan and maintaining an encouraging working environment to engage employees for better performance.

- The start of operation of the new Capital International Airport near the new administrative capital and the new Sphinx International Airport near the new Grand Egyptian museum in Giza.

- Competition from low cost carriers (LCC) operating from the new secondary airports near Cairo airport.

- Growth of Egyptian private air carries and the new start up ones under the Egyptian government economic reform program that aim to restore economic investors’ confidence and encourage private sector led growth.

- The introduction of open skies policy into future agreements and the aero political pressure to liberalize traffic rights into Cairo airport as a result of government initiative to promote travel to Egypt to stimulate the economy.

- Weak balance sheet due to the burden of the accumulated losses that reached nearly 20 billion EGP. This burden will curtail the strategic turnaround plan and future growth.

CONCLUSION

Egypt Air was subject to heavy losses due to the 25th of January 2011 Arab spring political instability. As a result of reduced demand to travel to/from Egypt, Egypt Air tried to increase its load factor by promoting connecting travel through Cairo hub. The increase of frequency and new destinations supported with heavy discounting failed to increase the load factor, the result was continuous heavy losses.

Egypt Air initiated several strategic turnarounds plans for recovery and transformation. The strategic turn around decisions addressed fleet development, network optimization, pricing, revenue management, branding and organizational restructuring that included the merger of several subsidiaries within the group to reduce cost and improve productivity.

RECOMMENDATIONS

Recommendations regarding Egyptian government policy

- Since the decline in financial performance was due to the political upheaval, the Egyptian government should inject a onetime public subsidy into Egypt Air to support fulfilling its financial obligations and the strategic turnaround plan.

Recommendations regarding Egypt Air strategic decisions

- After the completion of the strategic turnaround, Egypt Air should seek a strategic partnership with a global carrier; this might include an equity share. Or arrange for an IPO as part of the government economic reform plan, to seek funding its future development and expansion.

- Egypt Air should streamline its business processes to capture the synergies of merge of several subsidiaries and the transfer of several functions to other ones within the group. This should be done with the introduction of an information technology (IT) platform to integrate the business units of the group. Such actions would reduce bureaucracy, improve communication and increase efficiency.

- Egypt Air should train the surplus employees as a result of the organization restructure into new duties and responsibilities to accommodate them within the new organization structure. This would support frontline employees and the offered service standard while increasing productivity to reduce cost and achieve profitability.

- Egypt Air should maintain a continuous communication channel with the employees to explain reasons behind the tough decisions and objectives of the strategic turnaround strategy. This would improve the working environment and build trust between management and staff while motivating them for a better performance.

- Egypt Air should initiate a fleet optimization plan to match future demand with supply. Aircraft types and configuration should achieve the business model objective. Fleet streamlining would reduce cost and improve crew and aircraft productivity.

- Egypt Air fleet transformation plan should phase out older aircrafts with lower fuel efficiency with new aircrafts with higher fuel efficiency to reduce cost of operation and increase profitability.

- Egypt Air should redefine its business model after the merger of Egypt Air Express and Egypt Air Cargo within Egypt Air Airlines. The new business model would clearly define the target markets and customer segments, the product and service offered.

- Egypt Air should coordinate with its charter subsidiary Air Cairo the best way to transform it into a low-cost arm. The coordination should include network reallocation, marketing initiatives to maintain market share and turn unprofitable routes into profitable ones.

- The strategic turnaround of Egypt Air requires the recruitment of talented managers in marketing, customer service, and public relations to change public perception and attract new customer to be able to sustain future growth and development.

- Egypt Air should adopt an asset retrenchment strategy where areas of the group that are underperforming are appraised to determine if its performance can be improved or whether it is best to divest the asset completely. This decision should be thoroughly investigated since the divested business may be part of a total strategy involving the whole group.

- Egypt Air should put into effect a crisis management plan based on lessons learnt from the past political instability of the Arab spring. The plan should include actions to be taken in case of operation disruption due to acts of terrorism, regional conflicts and economic recessions.

Abdou, D. & Zazou, Z. (2013). Impact of the socio-economic situation post Egypt revolution 2011. International Journal of Service Science, Management and Engineering 5(3): 65-74.

Adel, A. (2019). Author interview with ex-Chairman and CEO Egypt Air Holding Company, Cairo.

Baral, A., Baral, S. & Morgan, N. (2004). Marketing Nepal in an uncertain climate: Confronting perceptions of risk and insecurity. Journal of Vacation marketing 10(2): 186-192.

Barker, V.L. & Duhaime, I.M. (1997). Strategic change in the turnaround process: Theory and empirical evidence. Strategic Management Journal 18: 13-38.

Centre of Asia Pacific for Aviation. (2011). Egypt Air chairman states plans to lease up to 25% of aircraft only one option.

Centre of Asia Pacific for Aviation. (2014). Egypt Air plans further restructuring as losses mount, but outlook may brighten as Egypt stabilizes.

CAPMAS (2011). Central Agency for Public Mobilization and Statistics.

CAPMAS (2019). Central Agency for Public Mobilization and Statistics, statistics yearbook, tourism section.

Central Bank of Egypt (2011). Annual report.

Dobrev, S. & Barnett, W. (2001). Organizational roles and transitions in entrepreneurship, working paper. University of Chicago, Graduate School of Business.

Dobrev, S., Kim, T.Y., & Hannan, M.T.(2001). Dynamics of niche width and resource partitioning, American Journal of Sociology, 106(5): 1299-1337.

Doganis, R. (2001). The Airline Business in the 21st Century. Routledge, London.

Egypt Air. (2011). Annual report.

Egypt Air. (2015). Annual report.

Egypt Air. (2016). Annual report.

Egypt Air. (2017). Annual report.

El Hefny, S. (2019). Author interview with ex-Chairman and CEO Egypt Air Holding Company, Cairo.

Hampton, M. (2006). Flag carrier fights back. Travel Weekly, February 24th, pp: 60-65.

Hofer, C.W. (1980). Turnaround strategies. Journal of Business Strategy 1: 19-31.

Johnson, G. (1987). Strategic change and the management process, Basil Blackwell, Oxford.

Lawton, T., Rajwani, T. & Kane, O. (2011) .Strategic reorientation and business turnaround: The case of global legacy carriers. Journal of Strategy and Management 4(3).

Mansfeld, Y. & Winckler, O. (2015). Can this be spring? Assessing the impact of the Arab spring on the Arab tourism industry. Turizam: Zaonstveno- strucni casposis 63(2): 205-223.

Monsanto, G. (2014). TAP Portugal-lessons from its turnaround. MSc in Business, Universidade Catolica Portuguesa, Lisbon.

Mousallam, S. (2019). Author interview with ex-Chairman and CEO Egypt Air Holding Company, Cairo.

Nasar, M.A. (2012). Political unrest costs Egyptian tourism dearly: An Ethnographical study. International Business Research 5(10): 166-174.

Oconnel, J. & Connolly, D. (2016). The strategic evolution of Aerlingus from a full-service airline to a low-cost carrier and finally positioning itself into a value hybrid airline. Tourism Economics 23(6): 1296-1320.

Pereira, E. (2006) Brazil’s New Leader. Air Transport World, 43(12).

Pizam, A. & Mansfeld, Y. (1996). Tourism, crime and international security issues. John Wiley, Chichester.

Porter, M.E. (1980). Competitive strategy: Techniques for analyzing industries and competitors, free press, New York.

Rivers, M. (2019). Egypt Air set for restructuring as questions linger over 2016 crash. Forbes.

Shoenberg, R., Collier, N. & Bowman, C. (2013). Strategies for business turnaround: A review and synthesis, Cranfield University, School of Management. European Business Review 25(3): 243-262.

Stacey, R. (1993). Strategic thinking and the management of Change, Kogan Page, London.

World Bank. (2011). World Development Report. The World Bank. Washington, DC, USA.