1799

Views & Citations799

Likes & Shares

This study focuses on exploring the factors affecting the intention to purchase health insurance among selected adults in Cebu, Philippines. By identifying the factors that influence individuals' decisions to acquire health insurance coverage, this research aims to provide valuable insights into the drivers and barriers of health insurance enrollment in the specific context of Cebu. Numerous studies have examined the factors influencing individuals' intention to purchase health insurance, highlighting the significance of various factors related to demographic, socioeconomic, and psychosocial characteristics. In a study conducted by Jin & Lin, (2020) in China, it was found that factors such as age, gender, income level, educational attainment, and occupation significantly influenced individuals' intention to purchase health insurance. Additionally, perceived health risk, perceived benefits of health insurance, and trust in insurers were identified as important psychosocial factors influencing the intention to purchase health insurance.

Similarly, research conducted by Ng, (2019) in Malaysia explored the factors influencing the purchase of health insurance. The study found that factors such as income, education level, employment status, and previous experience with health insurance significantly affected individuals' intention to purchase health insurance. Moreover, factors such as perceived affordability, awareness of health insurance benefits, and trust in insurers were also important determinants of individuals' decision-making.

In the specific context of the Philippines, several studies have examined health insurance enrollment patterns and determinants. A study by Tabora & Delos Reyes, (2018) in the Philippines found that factors such as age, income, education, employment status, and previous healthcare utilization significantly influenced individuals' likelihood of purchasing health insurance. Additionally, factors such as trust in insurers, perception of affordability, and awareness of health insurance coverage benefits played a crucial role in shaping individuals' decisions.

Despite these existing studies, there is a need for further research to explore the factors influencing health insurance enrollment specifically in Cebu, Philippines. Cebu is one of the highly urbanized areas in the country, with a diverse population and unique socioeconomic characteristics. Thus, understanding the specific factors influencing individuals' intention to purchase health insurance in Cebu can help policymakers and insurers design targeted interventions and strategies to improve health insurance enrollment rates and promote better access to healthcare services. Therefore, this study aims to fill the research gap by investigating the factors affecting the intention to purchase health insurance among selected adults in Cebu, Philippines. By examining factors such as demographic characteristics, socioeconomic status, psychosocial factors, and perceived barriers to health insurance enrollment, this research will contribute to the body of knowledge and provide insights that can inform policies and initiatives aimed at improving health insurance coverage and healthcare access in Cebu.

OBJECTIVES

This study determined the factors that affect intention to purchase of health insurance among selected adults in Cebu and proposed an Insurance Model for the General Public. This research presented the following: (1) the characteristics of participants; (2) their level of perceptions on health insurance variables: perceived understanding, attitude towards insurance, subjective norm, perceived behavioral control, perceived product risk, as well as their level of intention to purchase health insurance; (3) the impact of participants’ characteristics and perceptions on their level of intention to purchase health insurance, and (4) proposed health insurance model.

The main objective of an insurance policy is to mitigate the risks individuals face when it comes to unexpected healthcare expenses, thereby protecting them from being negatively impacted by financial burdens (Owolabi, 2016). However, the choice to acquire health insurance is not a straightforward one, and this is frequently misunderstood by purchasers (Loewenstein, 2013). According to Ahmed, (2016) and Cheah & Goh, (2017). The importance of specific parameters within insurance contracts, such as access to healthcare providers, has gained widespread recognition globally. Health insurance serves as the means of financing medical care expenses, making the decision to obtain healthcare insurance a crucial one. The rising costs of medical services have made sustainable financial policies in healthcare insurance a pressing global issue. As emphasized in various healthcare service reform initiatives, the opinions and willingness to purchase of customers form the foundation of healthcare insurance policy goals (Jiang 2019; Wu, 2008).

Insurance literacy

According to Quincy, (2012); Williams, (2021) insurance literacy refers to the extent to which individuals are knowledgeable about health insurance plans. Health insurance literacy indicates an individual's ability, knowledge, and confidence in understanding accurate information about a healthcare plan. It also encompasses the ability to choose the most suitable insurance scheme based on their financial and health circumstances.

Insurance literacy comprises various components related to health insurance plans, including knowledge about health insurance, cognitive abilities, self-efficacy, the tendency to seek information, and proficiency in understanding and utilizing documents associated with health insurance (Mathur,2018; Paez, 2014).

Insurance literacy requires knowledge about healthcare services and the ability to utilize this information effectively when making decisions and selecting the most suitable health insurance plan. As discussed by Lin, (2019); Weedige, (2019) insurance literacy, which encompasses health literacy as well, is concerned with understanding how healthcare benefits are structured, comprehended, and assessed in terms of cost-sharing obligations.

In addition, Adepoju, (2019); Berkman, (2011) highlighted that health insurance literacy plays a crucial role in accessing and receiving improved healthcare services. Regardless of whether individuals intend to delay or forgo seeking healthcare due to the high costs involved, insurance literacy becomes a vital factor in decision-making.

Perceived usefulness

According to Dzulkipli, (2017); Liebenberg, (2012) perceived usefulness refers to the extent to which individuals believe that enhancing a specific utility will positively impact their attitude towards buying health insurance. When people perceive health insurance as valuable and beneficial in terms of providing financial protection and access to necessary healthcare services, they are more likely to have a positive attitude towards buying health insurance. This positive attitude, in turn, increases their intention to actually purchase health insurance. According to Berkman, (2011) perceived usefulness plays a significant role in shaping individuals' attitudes and intentions towards acquiring health insurance.

As stated by Tennyson, (2011) in his study, when individuals perceive health insurance to be more useful, their intention to purchase insurance also increases. Therefore, insurance companies should consider the psychological aspect of perceived usefulness in order to incentivize more people to buy health insurance. By recognizing and emphasizing the value and benefits of health insurance, insurance companies can effectively encourage individuals to understand its usefulness and make the decision to purchase coverage.

Attitude toward health insurance

Attitude towards health insurance reflects an individual's overall assessment of the value, importance, and desirability of having health insurance coverage. If someone has a favorable attitude towards health insurance, it means they perceive it as beneficial, necessary, and worthwhile. On the other hand, a negative attitude implies a belief that health insurance is unnecessary, too costly, or lacking in value (Ajzen, 1991; Fishbein & Ajzen, 1975).

In the Theory of Planned Behavior (TPB), the concept of attitude is measured using items that encompass both instrumental and experiential elements of attitudes. It recognizes that attitudes are influenced by both the perceived consequences and the subjective experiences associated with engaging in that behavior (Fishbein & Ajzen, 2005; Fishbein, 2001).

In the context of consumer behavior, these studies have applied the TPB to examine how consumers' attitudes towards specific products or services can influence their intention to make a purchase. By assessing consumers' perceptions, beliefs, and evaluations related to the products or services under investigation, researchers aim to understand the underlying factors that shape consumers' purchase intentions (Casidy, 2016; Chin, 2016; Hsu, 2017).

Subjective Norms

Subjective norm is a concept derived from the Theory of Planned Behavior (TPB), which suggests that individuals' behavioral intentions are influenced not only by their own attitudes and beliefs but also by the social context in which they exist (Hsu, 2017).

According to Norman & Conner, (2005) subjective norm reflects individuals' perceptions of what others, such as family members, friends, colleagues, or society as a whole, expect them to do in terms of a particular behavior. It captures the social pressure or influence individuals perceive regarding whether they should or should not engage in the behavior under consideration.

Subjective norm refers to the perceived social pressure or influence that individuals experience when deciding whether to engage in a specific behavior (Al-Swidi,2014). In the case of tourism, it reflects the perceived expectations and opinions of others, such as family, friends, or colleagues, regarding the decision to visit a particular destination.

Also, Bianchi, (2018) stated that, applying the TPB to the context of health insurance, subjective norm emerges as a potential predictor that could affect consumers' behavioral intentions to purchase health insurance. If individuals perceive strong social pressure or influence from their social networks, such as the recommendations or opinions of family and friends, it is likely to impact their intention to purchase health insurance. Positive subjective norms, where the social environment encourages and supports the purchase of health insurance, can lead to a higher intention to engage in the behavior.

Ajzen, (1991) suggests that intention, which is influenced by subjective norm among other factors, serves as a reliable predictor of actual behavior. In many cases, individuals' intentions closely align with their subsequent actions. This indicates that when individuals have a strong intention to engage in a behavior, guided by subjective norm, it often translates into their actual behavior.

The studies conducted by Bianchi, (2018); Cheng, (2006) and Hsu, (2017) provide empirical evidence supporting the relationship between subjective norm and intention. Furthermore, subjective norm has a significantly positive effect on the intention to purchase health insurance (Mamun, 2021). The positive effect of subjective norm on the intention to purchase health insurance suggests that individuals are influenced by the beliefs and behaviors of their social environment. When they perceive that acquiring health insurance is socially expected or important, it enhances their intention to act and make the purchase.

Perceived Behavioral Control

Perceived behavioral control captures individuals' perception of the ease or difficulty of performing a behavior. It plays a crucial role in shaping individuals' intentions and subsequent behaviors (Hsu, 2017). When individuals perceive high levels of behavioral control, they believe that they have the necessary skills, resources, and opportunities to execute the behavior effectively. This perception of control enhances their confidence and motivates them to engage in the behavior.

According to l-Swidi, (2014) perceived behavioral control is a psychological construct that influences individuals' intention and actual behavior. It reflects individuals' beliefs about their personal capabilities, resources, and situational factors that may facilitate or hinder their ability to perform a specific behavior, in this case, purchasing health insurance. This perception of control empowers individuals and increases their confidence, which in turn positively influences their intention to purchase health insurance (Bianchi, 2018).

Hence, perceived behavioral control is influenced by various factors, including individual characteristics, external circumstances, and available resources. Personal factors such as knowledge, skills, self-efficacy, and past experiences can shape individuals' perceptions of their capability to navigate the process of purchasing health insurance. External factors, such as financial constraints, accessibility of information, and support from others, can also influence perceived behavioral control (Al-Swidi, 2014; Bianchi, 2018; Lam & Hsu, 2006).

In addition, the study conducted by Berkman, (2011) aimed to understand how perceived behavioral control and health values contribute to consumers' intentions to purchase health insurance in developing countries. the study shed light on the relationship between perceived behavioral control, health values, and consumers' intention to purchase health insurance in developing countries. Furthermore, perceived behavioral control has a significantly positive effect on individuals' intention to purchase health insurance (Mamun, 2021). When individuals feel more confident and in control of the process, their intention to obtain health insurance increases. This knowledge can inform the development of interventions and policies aimed at enhancing perceived control and promoting health insurance coverage among the population.

Perceived Product Risk

Perceived risk refers to the subjective evaluation individuals make regarding potential negative outcomes or uncertainties associated with a particular decision or action. In the context of academic research, scholars have recognized the significance of perceived risk and its impact on readers' engagement and motivation (Hussain, 2017 Yang, 2017).

According to Wei, (2018) the relationship between perceived risks and purchase intention can be influenced by various factors, such as the nature of the product or service, individual characteristics, prior experiences, and the availability of information or alternative options. It is important for businesses to understand and address customers' perceived risks in order to foster trust, reduce uncertainties, and enhance their purchase intentions.

In addition, Ali, (2019) revealed a significant relationship between income levels and individuals' purchase behavior. Income plays a crucial role in shaping individuals' purchasing behavior, as it provides the financial resources necessary to acquire goods and services. Higher income levels afford individuals greater financial stability, enabling them to meet their basic needs, fulfill aspirations, and participate in various economic activities.

Intention to Purchase Health Insurance

Nobles, (2019) highlights the significance of health insurance literacy in the context of individuals' decision-making process related to health insurance purchases. Health insurance literacy refers to the knowledge, understanding, and competency individuals possess in comprehending health insurance plans, terms, coverage, and associated factors.

According to Shao, (2004) and Karim, (2011) found a relationship between purchase intention and the inclination of individuals to purchase a specific product or service. Purchase intention refers to an individual's subjective inclination or readiness to engage in a purchase decision. When individuals have a positive purchase intention, it signifies their favorable attitude and interest in acquiring the product or service under consideration. Furthermore, the factors influencing purchase intention can vary depending on the context and nature of the product or service. These factors may include perceived value, quality, price, brand reputation, social influence, personal needs, and past experiences. Individuals assess these factors and form an intention that guides their subsequent purchasing behavior (Karim, 2011).

METHODOLOGY

Research Design

This research adopted the quantitative approach, employing structural equation modeling (SEM). Structural equation modeling is a statistical technique used to analyze complex relationships between variables and testing theoretical models. It allows researchers to examine both the measurement model (the relationships between observed indicators and latent variables or constructs), and structural (the relationship between latent variables) aspects of a proposed model simultaneously.

Further, in the context of the Intention to Purchase Health Insurance Data, these variables are latent constructs with about 5-6 measurable indicators, which related to the said constructs. An initial model can be defined basis the Theory of Planned Behavior and additional factors affecting intention to purchase health insurance.

Respondents of the Study

The target population of the study included all residents of the Province of Cebu. The sample were all those who responded to the questionnaire through Google Form. The researchers uploaded the Google Link in their respective Social Media Accounts and requested friends and friends of friends to answer the questionnaire on their intention to purchase health insurance. Sample size is a crucial consideration in structural equation modeling (SEM) as it directly affects the reliability and validity of the results obtained from our study. The adequacy of the sample size is essential to ensure that the statistical tests used in SEM are accurate and meaningful. As a general rule of thumb, larger sample sizes tend to be more robust and provide more reliable results in SEM. While there is no strict formula to calculate the perfect sample size for every study, researchers often use guidelines such as 10 participants per estimated parameter in the model as a starting point. Following this guideline, our research allotted two (2) weeks for data collection through Google Form. Within the two (2) weeks from June 18, 2023 to July 2, 2023, members of the research team monitored daily the number of respondents who answered our survey on the said topic. At the end of the second week, the researchers were able to obtain a purposive sample of 140.

Research Instrument

The research instrument that was used in this investigation was adopted from the study of Mamun, (2021). The questionnaire included 7 constructs-6 independent variables and 1 dependent variable, and 8 control variables. The 6 independent variables included: insurance literacy, perceived understanding, attitude towards insurance, subjective norm, perceived behavioral control, and perceived product risk. The dependent variable in this study is intention to purchase health insurance. The profile of the respondents was used as control variables, and these included: sex, age, marital status, education, employment status, monthly income, and living areas.

Data Collection Procedure

The researchers utilized an online platform in conducting the survey proper. This was the most convenient and safest way of acquiring primary data from respondents given the circumstances. The data gathering process through google forms were answerable in a maximum of 10 min, depending on the time availability of the respondents. The secondary data, however, were collected using data that has already been collected by other researchers. The secondary data collected in this study were gathered from online journals and articles, books, reliable internet sources, and dissertations. The researchers administered the research instrument to the target population using their different social media accounts. The internet link of the survey was posted in the social media account. Friends of the researchers were also asked to share the link in their active social media accounts. Data collection was conducted in two (2) weeks from June 18-July 2, 2023.

Data Analysis

To determine the effects or impact of the identified factors and the profile of the respondents to the intention to purchase health insurance, structural equation modeling was employed. The researchers treated data with factor model, path model, and bootstrapping using partial least squares structural equation modeling (PLS-SEM). To evaluate the path coefficients and p-values, the bootstrap model was used as the criterion. It was required to adjust in the graphical output-factor model (outer loadings) in order to decide what to consider and what not to. Bootstrapping was carried out in SmartPLS 4.0 with parameters that included 5000 subsamples. The PLS-SEM algorithm is divided into two stages: the measurement model-the stage wherein the researchers make sure that the measurements are loading well and valid and reliable, as well as if the constructs utilized in the study are valid. The second stage of PLS-SEM is the structural path model wherein the researchers estimated the coefficients for the paths whether it is significant or not. All statistical calculations and analyses were performed using IBM-SPSS and SmartPLS 4.0. Statistical significance was evaluated at the 0.05.

Ethical Considerations

The researchers ensured that all ethical protocols were in place. Voluntary involvement of respondents in the research is vital. As a result, the participants had the freedom to withdraw from the research at any time. Participants participated with their informed permission through Google Docs. The notion of informed consent entails researchers implying involvement and enabling participants to make a fully informed, thoughtful, and freely made decision whether or not to participate, without the use of any kind of pressure or influence. Furthermore, the researchers were completely aware that the confidentiality and secrecy of responders was critical. As a result, the researchers assured anonymity and secrecy of all questionnaire information. Such knowledge is beneficial to any individual or company. Individuals' personal information received through surveys were managed in line with the terms of the Personal Data Protection Act of 2012.

RESULTS AND DISCUSSIONS

All tables are presented in the Appendix. Majority of the respondents are female at 60%, whereas male respondents are 40%. It reveals that women are more likely to purchase health insurance rather than men as stated by Lin, (2017). on their research in Taiwan. In contrast, the study results of Mulenga, et al. (2021) in Zambia stated that men dominated the purchasing of health insurance from 2007 to 2018. This result can relate to patriarchal norms and customs in which women are usually discriminated and this leads to various gender inequalities including access to health insurance. The research conducted by Zhou, (Zhao & Zhao, 2021) in China confirmed this result that men are more likely to have health insurance due to higher labor force participation rates. This result also emphasized that employment rate of men is higher rather than women. Furthermore, Nosi, (2014) stated that gender is a moderating effect on health insurance purchase intention. It means that the relationship between health insurance purchase intention and some other variables (such as age, income, or health status) changes based on the gender of the individual.

The distribution of respondents based on age groups showed that respondents below 20 years old and 21-25 years old are the highest number of respondents at 24.3% and 33.6% respectively. While the lowest number of respondents are from 46-50 years old, that is, only five (5) respondents. This highlights the tendency of younger people to have health insurance as the best preparation for their future life. The study conducted in Senegal by Jutting, (2002). stated that the majority of people who purchase health insurance is age 21-40 years old. It suggests that people in this age group are more likely to seek health insurance coverage compared to other age groups. Generally, many people in this age group are employed and may receive health insurance benefits from their employer. This group is also more likely to work full-time jobs that offer benefits like health insurance. Furthermore, Schnake-Mahl & Sommers, (2017) in their research about the health care access in the suburbs of America found that people age of 45-54 years old are more likely to have health insurance, whereas people age of 18-24 years old are less likely to have it. Conversely, Keisler-Starkey & Bunch, (2022) in the report of health insurance coverage in the United States in 2021 stated that people below 21 years old are also more likely to seek health insurance, aside from people of more than 50 years old. It is because they are included to public health insurance, whereas the other age groups are in the private health insurance. Most adults aged 50 and older are eligible to attain health insurance coverage benefits provided by Medicare. Under the Affordable Care Act (ACA), young adults can stay on their parents’ health insurance plan until age 26. This has led to more young adults having access to health insurance, which may explain why they make up a significant proportion of health insurance purchasers. Additionally, children under the age of 19 may qualify for coverage through Medicaid or the Children’s Health Insurance Program (CHIP).

The distribution of respondents’ location showed that 65.7% are in the city, whereas the remainder are staying in the province. It means that mostly people in the urban areas have health insurance compared to those in the rural areas as confirmed by Amu, (2018) in their study about variations of health insurance coverage in Ghana, Kenya, Nigeria, and Tanzania. The same tendency appeared regarding purchasing private health insurance in Australia. Doiron, Jones and Savage, (2008) in their research in Australia about the demand for private health insurance found that those living in more rural areas are less likely to purchase private health insurance. Currently, Shao, Tao & Luca, (2022) examined the effect of urbanization on health care expenditure in China. They discovered a significant positive impact of urbanization on healthcare expenditures. It has evidence that urbanization has had a beneficial effect on healthcare ownership. This may be due to increased access to healthcare facilities, a larger population needing healthcare services, and better healthcare infrastructure in urban areas. This research emphasized that urban people are more likely to purchase health insurance rather than those in rural areas.

The highest number of respondents are single (69.3%), whereas the remainder are married, which comprised about 31% of the study respondents. This implied that single people are more likely to purchase health insurance. Similarly, Kong, (2010) found that divorced and widowed people are less likely to have health insurance in America. They mentioned following reasons. First is the absence of a spouse. When someone gets divorced or their spouse dies, they may lose access to health insurance coverage through their spouse’s employer or plan. This can make it more difficult and expensive for them to obtain health insurance on their own. Second, divorced or widowed individuals may not be employed in the type of full-time positions that are likely to offer health insurance. Moreover, married individuals are more likely to have at least one spouse who “specializes” on full-time work. This full-time working spouse, then, is likely to be eligible for health care benefits that cover the entire family. So, married persons would be more likely to have health insurance than divorced or widowed individuals. This result was confirmed by Schnake-Mahl & Sommers, (2017) through their research that examined health care in the suburbs of America. The highest having health insurance is married people. It is followed by single and divorced people. Therefore, marital status can have a significant impact on the purchase of health insurance, with married individuals generally having more access to coverage and shared financial responsibility, while divorced and widowed individuals may face more challenges in obtaining coverage. The result also showed that the greater proportion or 39.3% of respondents are college graduate. Cheng, Zhang & Shen, (2014) examined the effects of the education on elder’s health in China. The results showed that education has a significant role in promoting the health of the elderly. It means higher education level brings higher understanding of health. The similar result was also discovered by Nosratnejad, (2014) through their research on 300 households head in all Iranian provinces. They found that the positive correlation in which education level of household heads indicated that they are more willing to pay for health insurance coverage. A higher education levels can often obtain better occupations and higher income, so that more funds can be invested in personal health, such as regular medical examinations and insurance. Generally, with the improvement of academic qualifications, individuals’ job ranks and economic incomes tend to increase. It was in line with the statement of Schnake-Mahl & Sommers, (2017) who said that college graduate and post graduate have been more likely to have health insurance. Research on the countries of Organization for Economic Cooperation and Development still emphasized that adults with higher educational attainment have better health and lifespan compared to their less- educated peers (Raghuphati & Raghuphati, 2020). People with higher levels of education are often more aware of the risks associated with not having health insurance. They are more likely to understand the potential financial impact of an unexpected medical emergency and are more likely to take steps to protect themselves and their families by purchasing health insurance.

For the distribution of monthly income of respondents, most of them are included in the first income group, that is, ₱10,957 and below (37.9%). This proportion of respondents is opposite to the finding of research conducted by Lin, Hsiao & Yeh, (2017) in China. This research found that personal income is the main factor affecting the demand for life insurance, and has a significant relationship with premium expenditure. People who earn more tend to spend more on health insurance premiums. The research suggests that there is a positive correlation between personal income and premium expenditure, which means that as personal income increases, the amount spent on health insurance premiums also tends to increase. This showed that people with higher incomes tend to prioritize protecting their financial future with health insurance purchase.

Majority of the respondents or 64% have subscribed to health insurance. According to Wang, (2014) at the end of 2011, 97.5% of the Chinese population has been covered by health insurance schemes. This result showed that the government succeeded to attain the main goal of health insurance reform that is to make it more accessible and more affordable (Wang, 2014). The health insurance system in China is composed of basic health insurance and commercial health insurance. For the basic health insurance, its premium contributions are subsidized by the central and local governments, while contributions from the insured are relatively limited. Whereas commercial health insurance is supplementary to basic health insurance and targeting mainly the upper class. Rashidian, (2014) found the similar result on their research that stated that majority of Iranian population was covered by health insurance. Only 6.8% of them are not supported by any health care insurance. Furthermore, Lin, (2017) indicated that in Taiwan, with the democratization of politics and the popularization of human rights thought, more people regard access to health care services as a basic human right and demand health care services. The government and healthcare providers in Taiwan, then need to respond to the increased demand for healthcare services. Ultimately, the recognition of healthcare as a basic human right can lead to improvements in the overall health and wellbeing of the population.

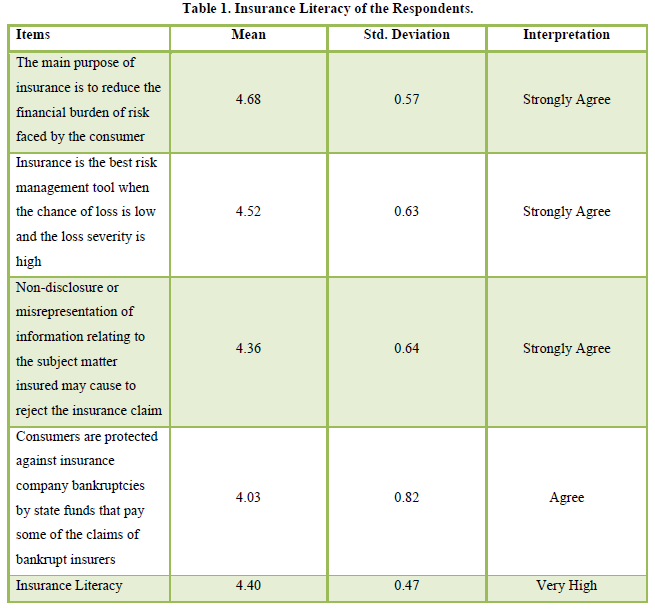

Table 1 measured the respondents’ level of insurance literacy through four questions as stated above. The first statement emphasized the main purpose of having health insurance, that is, to provide peace of mind and financial protection to customers against unexpected and unpredictable losses. It collected the highest mean of 4.68. The second considered insurance as an effective risk management tool when the potential losses are significant, but the likelihood of the loss occurring is low. It has averaged a mean of 4.52. Moreover, the third statement related to the subject matter insured means customers have failed to provide accurate and complete information to the insurance company when applying for coverage, which may result in the insurance company rejecting a claim for compensation in the event of a loss. This statement obtained a mean rating of4.36. The last statement, which has the lowest mean of 4.03, talked about the guarantee for customers if there were bankrupt insurers. Its lowest mean could be a result of low insurance literacy. So, the overall mean score for insurance literacy is 4.40, which can be described as very high.

Based on the United States survey study of 506 insured adults, Tipirneni, (2018) found that lower health insurance literacy may be associated with greater avoidance of both preventive (regular check-ups, cancer screenings and vaccinations) and non-preventive services (surgery or prescription medications). It was caused by the insufficient understanding of their health insurance benefits and coverage options. Due to a lack of understanding of essential aspects of health insurance, consumers are unable to make either full informed choices in choosing the best health plan or appropriately using their coverage to effectively obtain healthcare services. It was consistent to previous research conducted by (Sarwar & Qureshi,2013). that stated the lack of insurance knowledge was one of the most significant barriers of health insurance purchasing decision. Thus, this will increase the rate of uninsured people and most pronounced among low income and elderly’s people (Tipirneni, 2018). This relationship has been confirmed by Hansen, Shneyderman & Belcastro, (2015) on their study among 362 domestic students in the United States. This study aimed to assess the functional health literacy of domestic students by using a short test. Based on the results, 85.1% of the respondents were classified as health literate, indicating that they have skills and knowledge needed to understand and use health information to make informed decisions and manage their health effectively. The remaining (14.9%) of the respondents were classified as not health literate, which means they have difficulty understanding and using health information to navigate their health outcomes. It seems that majority of domestic students had sufficient health insurance literacy, this encourages them to purchase health insurance. Here, having adequate health insurance literacy is an important factor to purchase insurance as discovered by Wilfred, (2020) through her research in Kota Kinabalu Sabah among 200 respondents. Furthermore, Kakar, (2022) on their research on 45 adult residents of South Louisville, Kentucky stated that despite having adequate health insurance literacy, most participants expressed frustration with the amount of time and effort they spent to determine the best insurance plan, obtain covered health services, and settle claims, often with ineffective results. The results showed that access to health care is significantly influenced by both the structural context of the complicated, expensive, and bureaucratic health care system as well as the individual context of health insurance literacy knowledge, experience, and personal circumstances. However, all participants recognized an acute need for more personalized and accessible health insurance information. It means that all participants recognized the benefit of health insurance literacy. It was needed to select and enroll in the appropriate health plans, to understand and use a plan once enrolled, and to resolve problems related to healthcare access and billing. Therefore, it assumes a significant role of health insurance literacy and information to encourage people purchase health insurance. Additionally, Kim, Braun & William, (2013) underscore three components of health insurance literacy. First is health literacy. It involves understanding health insurance terminology, benefits, and coverage options. Second, numeracy relates to crucial knowledge of deductibles, copays, and coinsurance in the context of healthcare expenses. Third is financial literacy. It considers understanding the costs associated with different health insurance plans, including premiums, deductibles, copays, and coinsurance. By honing these abilities, people are better able to understand their insurance options and navigate the convoluted healthcare system.

Perceived usefulness of the respondents was measured through five items and the first statement “Purchasing health insurance enables me to ease my future expenses” had a highest mean which is 4.54. This statement means that insurance clients recognized the potential benefit of health insurance, that is, to ease their future costs. It connected to the last item “Using health insurance policy will enhance my dependents ability to cope with their financial needs”, which examined the positive impact of health insurance coverage with managing financial needs, especially in the family. This result was proved by the mean of 4.49 and is the second highest mean score, highlighting the benefit of using health insurance policy to enhance the ability to cope with the financial needs. It means that having a health insurance policy can be advantageous in managing the financial impact of unexpected health care costs. Without insurance coverage, people may have to pay for medical bills out of their own pockets. The potential benefit of health insurance coverage was apparently at odds with the result of a survey conducted by Kakar, (2022) Most participants in this survey found the health insurance system as complex and confusing to navigate. Experiences with health care bureaucracy led to fear and mistrust. Respondents gave examples of how systemic complexity led to bureaucratic errors, often related to billing. Examples included denials of valid claims and billing for medical supplies not received.

There is a positive relationship between perceived usefulness of health insurance benefits and its purchasing intention among 200 young adults (18-25 years old) in Malaysia as shown on the study conducted by Yeow, (2021). The result implies that an individual is likely to look for protection, especially on the financial side, to cover high medical costs or reduce financial loss during an unexpected health event. Therefore, purchase health insurance is like having financial security. The health insurance scheme will be useful in handling clients’ financial needs. These researches highlighted that perceived usefulness was a crucial role in deciding of the purchase of health insurance. It tallied with the previous study conducted by Berkman, (2011). Similarly, Dzulkipli, (2017) added the effect of perceived usefulness to the attitude towards purchasing health insurance. There is a correlation between people’s belief that improving the usefulness of health insurance will increase their attitude to purchase it. Thus, perceived usefulness of health insurance potentially influences buyers’ attitude in terms of purchasing it.

Six items highlighted the understanding and attitude of respondents related to health insurance coverage. The item “I think buying health insurance is valuable” has the greatest mean of 4.49. Because it is valuable, buying health insurance is automatically a good idea, a good choice, and essential for everyone. Nevertheless, it cannot be made an obligation for all citizens to buy it. So, the overall attitude of respondent towards health insurance is descriptively very high or very positive with the mean of 4.31. In their research on 311 insurance holders from five Indonesian big cities, (Brahmana, Brahmana & Memarista, 2018). found the correlation between attitude towards health insurance and perceived usefulness and risks of it. This correlation is moderated by health value. This relationship was confirmed by the next study conducted by Jassam, (2019) on 123 participants in Iraq. Additionally, Yeow, (2021) on their study among 200 young adults in Malaysia confirmed this positive relationship as well. Particularly, the item “I believe that purchasing health insurance is advantageous” received the highest means score among attitude items and had similar meaning with the item, “I think buying health insurance is valuable” from this result. This suggests that the two statements were likely measuring the same underlying attitude towards health insurance, and that participants responded similarly to both items. So, an individual who portrays positive attitude towards health insurance originates from the belief and trust that it could reduce the financial risk and burden an unforeseen health issue (Abdul Manan, et al., 2020). However, it could not be denied that people’s attitude may be developed based on the individual previous experiences of the same behavioral episode (Dzulkipli, 2017). Therefore, people’s attitude and intention to purchase health insurance is directly influenced by their past experiences. Moreover, regarding the statement “I think buying health insurance should be compulsory”, this was implemented in the United States particularly for the international students.

Overall, the subjective norms have the mean score of 4.40 and it was interpreted as very high. According to Gine, Townsend & Vickery, (2008) the dissemination of information about insurance products occurs via the social network. When individuals are considering purchasing health insurance, they may turn to their social network for information, advice, and recommendations. In this way, social network can play a significant role in shaping individual’s attitudes and beliefs about health insurance, and ultimately their purchase decisions. Therefore, social influence is a strong source that causes people to change their mind about health insurance. It related to the opinion of Hsu, Chang &Yansritakul, (2017) who emphasized subjective norm as a predictor of intention, which has been acknowledged within the social science domain. Therefore, in the context of purchasing health insurance, subjective norm is an important factor to consider when predicting an individual’s intention to have it, and that it has been widely recognized as such within the social science domain. Subjective norms significantly influence the intention to purchase health insurance (Brahmana, Brahmana & Memarista, 2018). This means that the behavior to purchase health insurance is influenced by others such as family, relatives, friends, colleagues, or other important people to them. The next study conducted by Wilfred, (2020) found that there is a positive relationship between social influence and intention to purchase health insurance. It is shown that the respondents perceived the awareness on the rising of medical cost, words of mouth of its benefits, purchase insurance by the influence of news, and recommended by friends. In contrast, this statement is opposite with the finding of Ackah & Owusu, (2012) in their research on 303 Ghanaian households. Ghanaians are generally presumed to be ignorant about the importance of insurance. Additionally, the average Ghanaian is preoccupied with his or her survival (is poor) and is thus unable to save towards cushioning against future catastrophes. These reasons stated that the intention of purchasing health insurance is not merely influenced by subjective norms, but culture and life circumstances are the integral part of humans to have a strong influence regarding the intention to purchase health insurance.

Moreover, Yeow, (2019) on their study discovered a negative relationship between subjective norms and purchase intention of health insurance among young adults in Malaysia. This may be explained by the fact that health insurance is still not a social norm among Malaysians due to low awareness and unaffordability (The Star, 2020). Also, it might be caused by their financial constraints. It could prevent young adults from getting health insurance. They might prioritize other costs, such as housing or college expenses over health insurance.

The overall response related to the perceived behavioral control to purchase health insurance stated that it was descriptively very high with the mean of 4.41 (Giri, 2018). stated that perceived behavioral control is not significant in influencing the purchase intention of life insurance. The explanation is that it requires a certain extent of 16 financial literacy and skills to evaluate the risk and fully understand the insurance products and policy, rather than only based on an individual’s perception. This statement was consistent with the research conducted by Karde & Madan, (2018). This research focused on the influence of the dimensions of perceived behavioral control, subjective norms, attitude towards behavior and purchase intention on the buying behavior of 200 Indian women towards insurance policies. They found that there is no significant influence on perceived behavior control on insurance purchase intention of women. It suggests that other factors may have more significant impacts on women’s decisions to purchase health insurance than perceived behavior control. Conversely, Yeow, (2019) emphasized the significant relationship between perceived behavioral control and intention to purchase health insurance among young adults in Malaysia. In their research, the item “I am knowledgeable enough to purchase health insurance” was the highest mean score. It was similar with the survey result on which the item “I have sufficient knowledge to purchase health insurance” was one of the greatest mean score among other items. It seems that two items have similar meaning. The same thing also occurred for the lowest mean point in the research conducted by Yeow, (2019) and the lowest mean score from this study which is “Respondents do not need anyone’s assistance to purchase health insurance”.

Regarding the level of respondent on perceived product risks, the respondents strongly agreed with the statement “Failure to perform the desired outcome, the insurance poses a threat to the physical well-being of me and my dependents” as it has the highest mean value of 4.44. Respondents knew the consequence of the insurer failures, that is, to bring a threat to the physical well-being for customers. This is the biggest risk that must be borne by insurance clients. Overall, the survey result of perceived product risks was descriptively high with mean point of 4.33. Brahmana, Brahmana, & Memarista, (2018) emphasized an important role of perceived future risk on the intention to purchase health insurance through attitudinal behavior. The worry about health in the future encourages people to buy health insurance. People are driven to obtain health insurance for a variety of reasons, such as uncertainty surrounding the expense of healthcare and their own future health. On their survey among 311 insurance holders from five Indonesian big cities, they discovered the significant contribution of perceived risk to attitude towards purchasing health insurance. It indicated that the more people know about their uncertainty in the future, the higher the intention to purchase insurance. This is related not only to the financial literacy, but also to the information dissemination of the insurance product. Therefore, people who perceive greater risk in their future are more likely to have a positive attitude towards purchasing health insurance. According to Bong, (2019) increased risk perception of consumers was consistent with the increase in their confidence about the low potential for uncertain negative outcomes from transactions made. In the context of Indonesia, this can happen because all insurance products sold must obtain a permit from the Financial Services Authority. Thus, all insurance products purchased by customers have product quality with low risk, because insurance products circulated to the public are subject to strict supervision from the authorities (Brahmana, Brahmana & Memarista, 2018). Furthermore, Sang & Cheng, (2020) on their research for 869 community health insurance in Shanghai-China found that patient anxiety was associated with contracting diseases and positively related to the intention to seek services from community-based providers, whereas their perceived risk of these providers had a negative relationship with such an intention.

Regarding the respondent’s intention to buy health insurance, the statement “Given the chance, I predict I will purchase health insurance in the future” has the highest mean point of 4.54. It seems that this statement is the conclusion of other items because it states the respondent prediction after passing over some consideration and understanding about health insurance. Although people have already known the value of personal insurance, they will buy or subscribe to it as stated on the third statement. People still need to digest all values before making decision. The overall mean score for intention of purchasing health insurance is 4.31, which can be described as very high. It means that respondents surely want to purchase it in the future. Yeow, (2019) on their research treated intention to purchase health insurance as dependent variables for attitude, subjective norms, and perceived behavioral control as independent variables. The item of purchase intention “If given the opportunity, I will buy health insurance in the future” has similar meaning and was the highest mean score with the item on table 14 that is “Given the chance, I predict I will purchase health insurance in the future”. According to Weedige, (2019) purchase intention of customers for insurance products is related to the reputation of the company that sells the product. Customer research and evaluate different insurance companies based on their reputation before deciding. A good insurance company automatically provides good services. Customer’s purchase intention is influenced by the services provided by the company and its good reputation (Tran and Le, 2020). Nevertheless, the decision to purchase health insurance is not easy, which is often misconstrued by buyer Loewenstein, (2013) who typically have the right to claim through the insurance policy (Born & Sirmans, 2019). It highlighted the decision to purchase health insurance as a complex and difficult one, and that many buyers may not fully understand the details of their insurance policy or the process of making a claim.

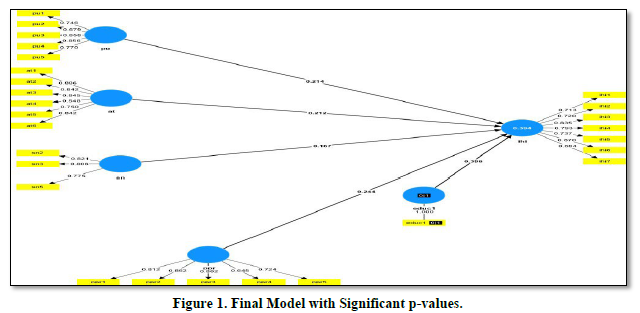

Model Development Using Structural Equation Modeling (SEM)

As mentioned in the methodology, SEM involved two (2) stages: (1) Measurement of Model Quality, and (2) Structural Model Quality. Measurement of model quality determined the quality of items that are used to measure the variables or the constructs in the study. This included convergent reliability and validity, confirmatory factor analysis, and discriminant validity.

The consistency between various measurements of a variable is measured in terms of reliability. Internal consistency, or consistency among the variables in a summated scale, is a frequent approach of gauging reliability, according to Hair, Black, Babin & Anderson, (2018). Each scale item should measure the same construct and be highly correlated as a result. Chronbach's alpha is one of the most often used techniques for evaluating the internal consistency of measurement instruments, according to Drost, (2011) Good dependability of the measured items is indicated by a Cronbach's alpha of 0.7 or above (Nunnally, 1978). Additionally, construct validity is the degree to which the theoretical construct that the item is intended to test is actually reflected in the item (Hair, 2018).

The values of Cronbach alpha, composite reliabilities as measured by rho a and rho c values, of the constructs except for il (Insurance Literacy) have met the standard criterion of at least 0.70. As shown in the table, reliability values ranged between 0.711 and 0.879. This means that the items measuring the six (6) constructs are reflective of the construct being measured. However, the construct - insurance literacy has a Cronbach alpha value of 0.681 did not attain the standard value of at least 0.70, but it is close to 0.70. Furthermore, if the composite reliabilities criteria are to be used, there was no problem with the items under insurance literary. On the other hand, the average variance extracted (AVE) for each construct has also met the criterion of at least 0.50, except for pbc or pn. Note that the lowest value is 0.501 (il) and the highest is 0.641 (sn). The AVE measures the variance extracted by the items for the specific construct, and the minimum requirement for the construct to be valid is 0.50. Moreover, the AVE of the construct pbc did reach the minimum standard value. The results indicated that there are some issues or problems with the items under constructs - insurance literacy and subjective norm.

Discriminant validity is proved, in accordance with the Fornell and Larcker Criterion, for any given construct, the correlation with all other constructs is smaller than the root of AVE for the constructs. The correlation of latent constructs is compared with the square root of the average variance extracted (AVE). Instead of the variance of other latent constructs, a latent construct should be able to better explain the variance of its own indicator. As a result, the correlations with other latent constructs should be smaller than the square root of each construct's AVE. The values on top are all greater than the values below the top values, for example, for the variable at-the top value is 0.794, which is greater than all values below it. In the same way, all other values on top are greater than the values below them. Take note that the values on top are the square roots of the AVE values presented in the table. Based on the information provided, the constructs are unique and are independent of each other, thus, the constructs that are used in this study possessed very good discriminant validity.

Regarding the structural model of the study which investigated the impact or influence of the six (6) independent variables and the control variables (6) to the intention to purchase health insurance of the respondents, only 6 control variables were tested in the model. The researchers decided to exclude subscription of health insurance. Except for education, the other variables under profile of the respondents do not influence their intentions to purchase health insurance as reflected by their p-values which are all greater than 0.05. On the other hand, for the variable education has a p-value that is shown to be significant (p = 0.05). This implies that education of the respondents has some effects to their intention to purchase health insurance. Looking at the value of beta, which is 0.314, means that the higher the level of education of the respondents increases intention to purchase health insurance by an average 0.314 points. Education can indeed influence a person's intention to purchase health insurance. Several research studies have explored this relationship and found that higher levels of education are often associated with a greater likelihood of purchasing health insurance. People with higher education levels tend to have a better understanding of the importance of health insurance and the benefits it provides. People with higher incomes are more likely to afford health insurance and see it as a worthwhile investment to protect themselves and their families from high healthcare costs. Education can improve health literacy, enabling individuals to recognize the importance of preventive care and early medical intervention, which can be facilitated by health insurance (Kapur, 2017).

In terms of the main six (6) independent variables, the following did not influence respondents’ intention to purchase health insurance: insurance literacy (p = 0.400), perceived behavioral control (p = 0.781). However, the following variables influenced intentions to purchase health insurance: attitude towards insurance (p = 0.013), perceived product risk (p = 0.003), perceived understanding (p = 0.017), and subjective norm (p = 0.025).

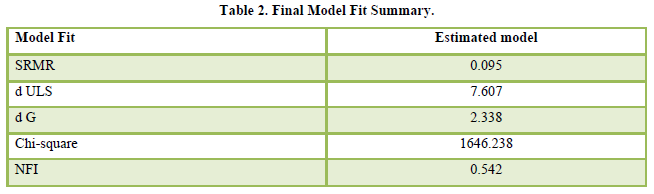

Table 2 provided the model fit summary of the structural model shown in Figure 1. The model fit was measured using the Bentler-Bonett Normed Fit Index (NFI). NFI is an incremental measure of goodness of fit for a statistical model, which is not affected by the number of parameters/variables in the model. PLS-SEM uses NFI to determine the fitness of the model. As shown in the above table, NFI of the estimated model is 0.548 or 54.8. In addition, SRMR value is shown to be 0.046. Values for the SRMR ranged from zero to 1.0 with well-fitting models obtaining values less than 0.05 (Byrne, 1998; Diamantopoulos and Siguaw, 2000), however values as high as 0.08 are deemed acceptable (Hu and Bentler, 1999). Thus, an SRMR value of 0.095 is considered as a well-fit model.

Shown below is the Final Model of the study with significant p-values (Figure 1).

CONCLUSION

The primary objective of the research study was to investigate the impact of perception towards health insurance on the decision-making process of the population regarding its purchase. It was found out that in this study that insurance literacy and perceived behavioral control did not influence intention to purchase health insurance. On the other hand, attitude towards insurance, perceived product risk, perceived understanding, and subjective norm, have influenced to the intention to purchase health insurance. Moreover, education also influenced intention to subscribed to health insurance.

The results of the study carry substantial implications for various stakeholders including current and potential policyholders and the health industry as a whole. Overall, the results of this research study have significant implications for stakeholders in the health insurance sector, offering valuable guidance for strategic decision-making and fostering improvements in policies, products, and services.

The analysis of the structural model indicated that the questions related to perceived understanding, attitude towards health insurance, subjective norm, and intention to purchase health insurance, which serve as measurement scales for assessing perception towards health insurance, have a positive impact on purchase decisions. This suggests that subjective or endogenous factors play a crucial role in influencing the respondents' decisions. These findings provide valuable insights for insurance agents and companies, emphasizing the importance of focusing on subjective factors in their marketing strategies. By expanding their marketing avenues and enhancing users' knowledge about health insurance, insurance agents and companies can effectively influence purchase decisions and cater to the specific needs and preferences of the target audience.

- Ackah, C. & Owusu, A. (2012). Assessing the knowledge of and attitude towards insurance in Ghana. Research Conference on Micro Insurance. Available online at: https://www.semanticscholar.org/paper/Assessing-the-Knowledge-of-and-Attitudetowards-in-Ackah-Owusu/6210cbdcbe9039e4cdc7326a609652a687043d0d

- Abdul Manan (2020). Effects of social media advertisements on intention to purchase health and beauty products. Journal of International Business, Economics and Entrepreneurship, 5, 59-68.

- Adepoju O., Mask A., McLeod A. (2019). Factors associated with health insurance literacy: Proficiency in finding, selecting, and making appropriate decisions. Journal of Health Management, 64, 79-89.

- Al-Swidi A., Mohammed Rafiul Huque S., Haroon Hafeez M., Noor Mohd Shariff M. (2014). The role of subjective norms in theory of planned behavior in the context of organic food consumption. British Food Journal, 116, 1561-1580.

- Ajzen I. (2002). Perceived behavioral control, self-efficacy, locus of control, and the theory of planned behavior 1. Journal of Applied Social Psychology, 32, 665-683.

- Amu, H. (2018). Understanding variations in health insurance coverage in Ghana Kenya Nigeria and Tanzania Evidence from demographic and health surveys. PLoS One Journal, 13.

- Azman Ab Rahman, Ng Kuan Pin, & Nor Afifah Basri., (2019). Factors Influencing the Purchase of Health Insurance Evidence from Malaysia.

- Berkman, N. D. (2011). Low health literacy and health outcomes an updated systematic review. Annals of Internal Medicine Journal, 155, 97-107.

- Bianchi M., Bagnasco A., Aleo G., Catania G., Zanini M. P., et al. (2018). Preparing healthcare students who participate in interprofessional education for interprofessional collaboration A constructivist grounded theory study protocol. Journal of Interprofessional Care, 32, 367-369.

- Bong, S.(2019). Risk, Crisis and Disaster Management for a Sustainable Tourism Industry. Jakarta PT. Gamedia Pustaka Utama.

- Born, P. H. & Sirmans, E. T. (2019). Regret in health insurance post-purchase behavior. Journal of Risk Management and Insurance Review, 22, 207-219.

- Brahmana, R., Brahmana R. K. & Memarista, G. (2018). Planned behavior in purchasing health insurance. The South East Asian Journal of Management, 12, 5.

- Casidy R., Phau I., Lwin M. (2016). The role of religious leaders on digital piracy attitude and intention. Journal of Retailing and Consumer Services, 32, 244-252.

- Cheah Y. K., Goh K. L. (2017). Determinants of the demand for health screening in Malaysia: The case of the aged population. The Social Science Journal, 54, 305-313.

- Cheng S., Lam T., Hsu C. H. C. (2006). Negative word of mouth communication intention: An application of the theory of planned behavior. Journal of Hospitality & Tourism Research, 30, 95-116.

- Cheng, L.G., Zhang, Y. & Shen, K. (2014). How does education affect people’s health Evidence from the elderly? China Economic Quarterly Report, 14, 305-330.

- Doiron, D., Jones, G. & Savage, E. (2008). Healthy, wealthy, and insured. The role of self-assessed health in the demand for private health insurance. Health Economics Journal. 17, 317-334.

- Dzulkipli M. R., Zainuddin N. N. N., Maon S. N., Jamal A., Omar M. K. (2017). Intention to purchase medical and health insurance Application of theory of planned behavior. Advanced Science Letters, 23, 10515-10518.

- Gine, X., Townsend, R. & Vickery J. (2008). Patterns of rainfall insurance participation in rural India. Journal of The World Bank Economic Review, 22, 539-566.

- Giri, M. (2018). A behavioral study of life insurance purchase decisions. Department of Industrial and Management Engineering Indian Institute of Technology Kanpur. Available online at: https://www.iitk.ac.in/ime/devlina/data/Manohar%20Giri%20PhD%20Thesis%20_Final-4-10-19.pdf

- Hansen, H. R., Shneyderman, Y. & Belcastro, P. A. (2015). Investigating the association of health literacy with health knowledge and health behavior outcomes in a sample of urban community college undergraduates. American Journal of Health Education, 46, 274-282.

- Hsu C. L., Chang C. Y., Yansritakul C. (2017). Exploring purchase intention of green skincare products using the theory of planned behavior: Testing the moderating effects of country of origin and price sensitivity. Journal of Retailing and Consumer Services, 34, 145-152.

- Jassam, B. H. (2019). Factors affecting intention to participate in health insurance. International Journal of Academic Accounting, Finance & Management Research, 3, 7-11.

- Jiang S. J., Liu X., Liu N., Xiang F. (2019). Online life insurance purchasing intention Applying the unified theory of acceptance and use of technology. Social Behavior and Personality An International Journal, 47, 1-13.

- Jin, Jun, & Lin, Wei (2020). Factors Influencing Individuals Intention to Purchase Health Insurance: A Study on the Significance of Demographic Socioeconomic and Psychosocial Characteristics in China.

- Jütting J. (2002). The impact of health insurance on the access to health care and financial protection in rural areas of developing countries: The example of Senegal. Health, Nutrition, and Population Discussion Paper. Available online at: https://www.oecd.org/dev/2510494.pdf

- Kakar, (2022). Health insurance literacy perceptions and the needs of a working-class community. Health Literacy Research and Practice Journal, 6, 61-69.

- Kapur, K., Karaca-Mandic, P. & Abraham, J. M. (2017). The Impact of Education on Health Insurance Coverage Decisions”. International Journal of Health Economics and Management.

- Keisler-Starkey, K. & Bunch, L. N. (2022). Health insurance coverage in the United States: 2021. United States Department of Commerce & Census Bureau. Available online at: https://www.census.gov/library/publications/2022/demo/p60-278.html

- Kharde, Y. & Madan, P. (2018). Influence of intentions on buying behavior of women towards insurance purchase. An empirical Study. International Journal of Business and Management Invention, 7, 19-27. Available online at: https://www.ijbmi.org/papers/Vol(7)2/Version-2/C0702021927.pdf

- Kim, J., Braun, B. & Williams, A. D. (2013). Understanding health insurance literacy, A literature review. Family and Consumer Sciences Research Journal, 42, 3-13.

- Kong, J. S.T. (2010). The effects of marital status & gender on health care insurance coverage in the United States. Honor Projects Journal, 111.

- Lin X., Bruhn A., William J. (2019). Extending financial literacy to insurance literacy A survey approach. Accounting and Finance, 59, 685-713.

- Lin, C., Hsiao, Y. J., & Yeh, C. Y. (2017). Financial literacy financial advisors and information sources on demand life insurance. Pacific-Basin Finance Journal, 43, 218-237.

- Lin H. Y., et al. (2017). Place of death for hospice-cared terminal patients with cancer: A nationwide retrospective study in Taiwan. Journal China Medical Association, 80, 227-232.

- Lin, X., Bruhn, A. & William, J. (2019). Extending financial literacy to insurance literacy: A survey approach. Accounting and Finance Journal, 59, 685-713.

- Loewenstein G., Friedman J. Y., McGill B., Ahmad S., Linck S., et al. (2013). Consumers misunderstanding of health insurance. Journal of Health Economics, 32, 850-862.

- Mathur T., Das G., Gupta H. (2018). Examining the influence of health insurance literacy and perception on the people preference to purchase private voluntary health insurance. Health Services Management Research, 31, 218-232.

- Mulenga, J., et al. (2021). Examining gender differentials and determinants of private health insurance coverage in Zambia. BMC Health Service Research Journal, 21, 1212.

- Nobles, A. L. (2018). Health insurance literacy A mixed methods study of college students. Journal of American College Health, 67, 469-478.

- Norman P., Conner M. (2005). The theory of planned behavior and exercise Evidence for the mediating and moderating roles of planning on intention-behavior relationships. Journal of Sport & Exercise Psychology, 27, 488-504.

- Nosi C., (2014). Saving for old age: Longevity annuity buying intention of Italian young adults. Journal of Behavioral and Experimental Economics, 51, 85-98.

- Nosratnejad, S., et al. (2014). Willingness to pay for social health insurance in Iran. Global Journal of Health Science, 6, 154-163.

- Owolabi A. O., Adegbola D. D., Afolabi T. S. (2016). Health challenge as a factor affecting health insurance purchase in private sector organizations in Kwara state, Nigeria. International Review of Management and Business Research, 5, 1313.

- Paez K. A., Mallery C. J., Noel H., Pugliese C., McSorley V. E., et al. (2014). Development of the health insurance literacy measure (HILM): Conceptualizing and measuring consumer ability to choose and use private health insurance. Journal of Health Communication, 19, 225-239.

- Quincy L. (2012). Measuring health insurance literacy: A call to action – A report from the Health Insurance Literacy Expert Roundtable. Retrieved: June 05, 2020, from: https://advocacy.consumerreports.org/research/measuring-health-insurance-literacy-a-call-to-action/

- Raghupathi, V. & Raghupathi, W. (2020). The influence of education on health an empirical assessment of OECD countries for the period 1995-2015. Archives of Public Health Journal, 78.

- Rashidian, A. (2014). Irans multiple indicator demographic and health survey Study Protocol. International Journal of Preventive Medicine, 5, 632-642.

- Sang, H. & Cheng, J. (2023). Effects of perceived risk and patient anxiety on intention to use community healthcare services in a big modern city. Journal of Savings and Growth for Education, 10, 1-10.

- Sarwar, U. (2000). Research Methods for Business: A Skill Building Approach 4th edition. New York John Wiley & Sons.

- Schnake-Mahl, A. S. & Sommers, B. D., (2017). Health Care in the suburbs: an analysis of suburban poverty and health care access. Health Affairs Journal, 36, 1777-1785.

- Shao, Q., Tao, R. & Luca M. M. (2022). The effect of urbanization on health care expenditure Evidence from China. Frontiers in Public Health Journal, 15, 850872.

- Tabora, Joseph B., Delos Reyes, Carlo Irwin A., (2018). Determinants of Health Insurance Enrollment in the Philippines Examining the Influence of Age Income Education Employment Status and Previous Healthcare Utilization.

- Tennyson S. (2011). Consumers insurance literacy Evidence from survey data. Financial Services Review, 20, 165-179.

- Tipirneni, R. (2018). Association between health insurance literacy and avoidance of health care services owing to cost. Journal of the American Medical Association Network Open, 1, 184796-184796.

- The Star (2020). Malaysians have Poor Health Coverage. Available online at: https://www.thestar.com.my/news/nation/2020/05/30/malaysians-have-poor-health-coverage

- Tran, V. D. (2020). The relationship among product risk, perceived satisfaction and purchase intentions for online shopping. Journal of Asian Finance, Economics and Business, 7, 221-231.

- Tran, V. D. & Le, N. M. T. (2020). Impact of service quality and perceived value on customer satisfaction and behavioral intentions Evidence from convenience stores in Vietnam. Journal of Asian Finance, Economics and Business, 7, 517-526.

- Vorndran, K. (2015). International medical insurance for students studying at American universities. Tokio Marine HCC Blog Post. Available online at: https://www.hccmis.com/blog/insurance/international-medical-insurance-for-students-studying-at-american-universities/

- Wang, X., et al. (2014). Integration of rural and urban healthcare insurance schemes in China The empirical research. BMC Health Services Research Journal, 14, 142.

- Weedige, S. S. (2019). Decision making in personal insurance Impact of insurance literacy. Journal Insurance Sustainability, 11, 6795.

- Wilfred, V. (2020). Factors influencing the purchase intention of health insurance in Kota Kinabalu Sabah. Malaysian Journal of Business and Economics, 7, 99-121.

- Williams C. B., Pensa M. A., Olson D. P. (2021). Health insurance literacy in community health center staff. Journal of Public Health, 29, 1261-1265.

- Weedige S. S., Ouyang H., Gao Y., Liu Y. (2019). Decision making in personal insurance Impact of insurance literacy. Sustainability, 11, 6795.

- Wu H. L., Liu C. Y., Hsu W. H. (2008). An integrative model of customers perceptions of health care services in Taiwan. Service Industries Journal, 28, 1307-1319.

- Yang H.-H., Su C.-H. (2017). Learner behavior in a MOOC practice-oriented Course in Empirical Study Integrating TAM and TPB. The International Review of Research in Open and Distributed Learning, 18, 35-62.

- Yeow. (2021). Why do Malaysian young adults buy health insurance. Journal of International Business, Economics and Entrepreneurship, 6, 46-54.

- Zhou, M., Zhao, S. & Zhao, Z. (2021). Gender differences in health insurance coverage in China. International Journal for Equity in Health, 52.