1867

Views & Citations867

Likes & Shares

Keywords: Exchange rate volatility, Stock market index returns, Sensitivity, ARCH/GARCH model

As businesses expand, more financing sources are needed, which allows firms to use equities before using debt. To maximize their returns, given the risks associated with the investments, investors utilize models to measure the factors that influence the returns of the assets, such as stocks which can be applied to optimize returns (Sales, 2023). They emphasized that the appropriate selection of stocks in a portfolio can be used in investment decisions to reduce risks and maximize returns. As such, portfolio diversification is undertaken to spread or minimize risk, particularly in assets that are not integrated. Ahmed, (2022) emphasized that in many instances, risk is transferred in integrated markets, especially during crises. Moreover, political risks, economic downturns, and other macroeconomic shocks can create disruptions in the financial market which could cause price volatility in the different markets and affect not only businesses and investors but also households. To some extent, the economic repercussions of these external shocks can become gigantic which affect not only businesses and investors but also households.

Developing economies also experienced higher economic and political uncertainty, less competition, and lower transparency Lagoarde-Segot & Lucey, (2009) as cited in Gokmenoglu et al., (2021). This sometimes leads to a domino effect in the economy due to the interconnectedness of various markets and the entire economic systems. Chow (2017) emphasized that this spillover does not only occur during crises but also persists even after the crisis. This was also confirmed by Mohammed, (2021) where he mentioned that predicting a financial crisis can be challenging and fluctuations must be monitored in various time periods. Most of the studies that were conducted on financial market interconnectedness are related to cross-market volatility spillover in the equity market (Ahmed, 2022; Chow, 2017; Khan, 2023; Mateus, 2024). Some studies were conducted on the relationship between exchange rate and stock market index price or return (Adriano, 2018; Aloui, 2007; Omotayo & Efuntade, 2022; Panda & Deo, 2014; Satria, 2023) either by examining the unidirectional or cross-market relationships. However, mixed results were generated by the impact of foreign exchange volatility on the stock market performance in selected regions or countries.

Objectives of the Study

Against this background, this study aims to determine the impact of foreign exchange rate volatility on the stock market index returns in selected economies in the Asia Pacific region. Specifically, it aims to answer the following research objectives:

To determine which level of economic development (developed versus developing is more sensitive to foreign exchange volatility.

To measure the short-run and long-run impact of exchange rate volatility on the stock market index returns in selected developed and developing countries in the Asia Pacific region.

Research Hypotheses

Ho1. Exchange rate volatility does not have a significant influence on the stock market index returns in India, the Philippines, Singapore, and Japan.

Ho2. Developing countries are less sensitive to exchange rate volatility than developed countries.

Ho3. Exchange rate volatility has no long-run effect on the stock market index returns of select developed and developing Asian countries.

LITERATURE REVIEW

Adriano, (2020) investigated the volatility transmission between the foreign exchange rate and stock market index returns in the Philippines and South Korea using BEKK-GARCH model over the period 2004-2018. Their findings revealed that except for the period 2009-2013, 2004 to 2013 (longer period) and the subperiods 2004-2008 and 2009-2013 showed evidence of a unidirectional shock transmission from the USD/PHP exchange rate to the PSEi returns. This suggests that shocks in the Philippine foreign exchange market could influence its stock market resulting from the foreign capital inflow during the 2004-2013 period, which caused the PSEi to rise and the peso to appreciate. Inci & Lee (2014), as cited in Mechri, (2022) also showed a significant influence of exchange rates on equity prices in Canada, Japan, United States of America, and five (5) European countries. Dang, (2020) found a short-run relationship between the exchange rate and stock prices in Vietnam, which shows a symmetric effect on their relationship using NARDL framework.

Zada, (2021) examined the changes within equity market returns and integrated volatility in Asian developed and emerging markets using Swap variance (SwV) approach to identify monthly changes in equity market returns. They further revealed that fewer movements in stock return occur among the markets of developed countries, showing more positive than negative stock return movements. Ahmed, (2018) emphasized that the presence of low returns and low risk in developed markets may affect investment decisions among investors.

In another study, Lakshmanasamy, (2021) found no significant effect of Indian Rupee’s exchange rate vis-à-vis Great Britain pound and US dollar on the Bombay Stock Exchange SENSEX return volatility. Jebran & Iqbal, (2016) also concluded the weak relationship between exchange rate changes and stock returns in Japan, China, and India, which may be due to the effective hedging strategies used to lessen currency risk. This is consistent with the findings of Adriano, (2020) on the impact of USD/KRW exchange rates on KOSPI returns in South Korea where the authors did not find cross-market shock transmissions between the two markets for all periods. Rahman & Uddin, (2009) as cited in Javangwe & Takawira, (2022) also revealed the absence of the short- and long-run influence of the foreign exchange volatility on stock returns in Bangladesh, India, and Pakistan, which suggests that authorities should not only depend on the relationship of the variables to predict the stock market performance.

Ahmed, (2020) examined the short- and long-run spillover effects of exchange rate fluctuations (both positive and negative) on Egypt’s EGX100 index returns across two different exchange rate regimes. During the soft peg regime period, positive and negative fluctuations in the EGP/USD exchange rates significantly affected the stock returns in the short and long run. During the free float regime period, weak and negative effects of the log changes in EGP/USD to stock returns were found, while a marginal and statistically significant positive effect of currency appreciation on stock returns and a negative and statistically significant effect of currency depreciation was seen.

Among the developing countries, Beckmann, (2015) as cited in Gokmenoglu, (2021) revealed that emerging market economies were able to attract more investors due to the rapid development of their stock markets arising from the capital inflows from developed markets. Zada, (2021) added that domestic and foreign institutions facilitated the extreme movement in the stock market in emerging market economies. Gay, (2016) proved the significant relationship between exchange rates and stock market returns in developing countries (China, Brazil, and India). Similar findings were generated in a study on the major stock market indices of these countries including South Africa. Ahmed, (2018) cited that many emerging markets can enter the global capital market but cannot compete with the developed markets due to liquidity risks issues.

Mukherjee & Naka, (1995) as cited in Gay, 2016) discovered the interconnectedness between the exchange rate levels and the stock market performance. They concluded that currency depreciation in ASEAN countries will exhibit lower values in their exported products and will be relatively cheaper on the world market, leading to higher profits and cash flows that will result in higher stock prices of the domestic firms. Ahmed, (2018) examined the stock returns volatility and other factors of the developed and developing financial markets. Their findings proved that higher returns can be achieved in emerging markets but may be accompanied by higher volatility and risk-return trade-offs.

Studies conducted on the Shenzhen Stock Exchange and the stock market of Zambia reinforced previous studies in their establishment, showing a negative relationship between the exchange rate volatility and stock market returns. Sichoongwe, (2016) and Khan, (2019) cited that exchange rate volatility has a significant and negative influence on stock returns in the Shenzhen Stock Exchange. Similarly, Ndlovu, (2018) evaluated the effect of several macroeconomic variables such as exchange rates on stock returns in the Johannesburg Stock Exchange and their findings revealed a unidirectional relationship between these markets. Delgado, (2018) also showed a significant and negative influence of exchange rates on the stock market index. This suggests that any appreciation in exchange rates would translate to increases in the stock market index. Bagh, (2017) presented traditional and portfolio approaches, as theories support the existence of a significant relationship between the two variables in the Pakistan stock exchange.

RESEARCH METHODOLOGY

Explanatory research design was used to examine how exchange rates cause changes in stock market returns and to evaluate the predictive capabilities of exchange rate fluctuations on the stock market returns of selected Asia Pacific countries. A comparative research design was also employed to compare the results on the impact of exchange rate volatility on the stock market returns between the developed and developing countries to identify potential differences in how exchange rate volatility affects stock market returns based on a country's level of economic development.

Method of Data Collection

The study utilized secondary data sources that consist of monthly mean exchange rates (USD/INR, USD/PHP, USD/SGD, and USD/JPY) and monthly stock market index prices from January 2011 to December 2021. The foreign exchange data were culled from the Federal Reserve and Yahoo Finance websites while the data for the stock market index prices (Nikkei 225 (Japan), Straits Times Index (Singapore), Nifty 50 (India), and PSE Composite Index (Philippines) were gathered from the Refinitiv Eikon database.

The authors utilized purposive sampling in selecting the countries using the following criteria:

Level of economic development using the 2020 Asia and Pacific Regional Economic Outlook of the International Monetary Fund (IMF) categorization. Japan and Singapore were classified as advanced economies or developed countries, while India and the Philippines were classified as emerging markets or developing economies.

Completeness of data for 10 years using monthly data whose dates must be aligned which covers the post-financial crisis up to pandemic periods.

Method of Data Analysis

The study involves several steps, from data preparation, data processing, and data analysis. Stock market index returns were computed using log returns. The data was then sorted, coded, and tabulated.

Diagnostic tests were undertaken by the author before applying the primary statistical models to answer the research objectives. The Breusch-Pagan test was performed to check for equal variance of residuals. If heteroskedasticity were detected, the response variable was transformed using logarithmic regression. The Augmented Dickey-Fuller (ADF) test for unit root was also conducted to determine the presence of stationarity of the variables. For non-stationary results, differencing was undertaken to make them stationary.

The researchers employed three statistical models with Autoregressive Conditional Heteroskedasticity (ARCH), and Generalized Autoregressive Conditional Heteroskedasticity (GARCH), and Autoregressive Distributed Lag (ARDL) as the main statistical estimations. The ARCH and the GARCH models were employed to estimate the volatility of the exchange rates for each of the four countries, namely, India, the Philippines, Singapore, and Japan. The Autoregressive Distributed Lag (ARDL) model was utilized to ascertain the long-run effects of exchange rate volatility on the stock market index returns. This also involved developing an Error Correction Model (ECM). An F-bounds test was conducted within the ARDL framework to determine the existence of cointegration or long-run relationship between the foreign exchange volatility and stock market index returns. To determine the short-run effect of the exchange rate volatility on the stock market index returns, a simple linear regression was employed. This also measures the sensitivity of developed versus developing countries to exchange rate volatility.

RESULTS AND DISCUSSIONS

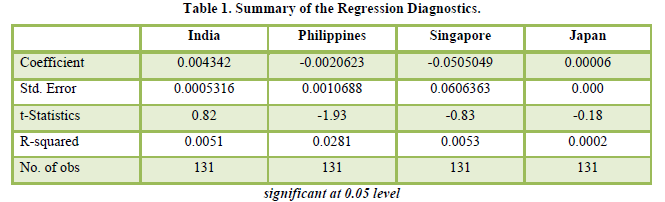

Table 1 provides the regression diagnostic that was performed before running the Breusch-Pagan test. The results of the linear regression test, with the stock market index returns and exchange rate volatility as the dependent and independent variables, respectively, showed that the coefficients are not statistically significant based on the 0.05 level. This proves that there is no strong evidence of a statistically significant linear relationship between the two markets for any of these countries. The r-squared values also indicate that exchange rate volatility explains a very small portion of the variation in stock market returns in these countries.

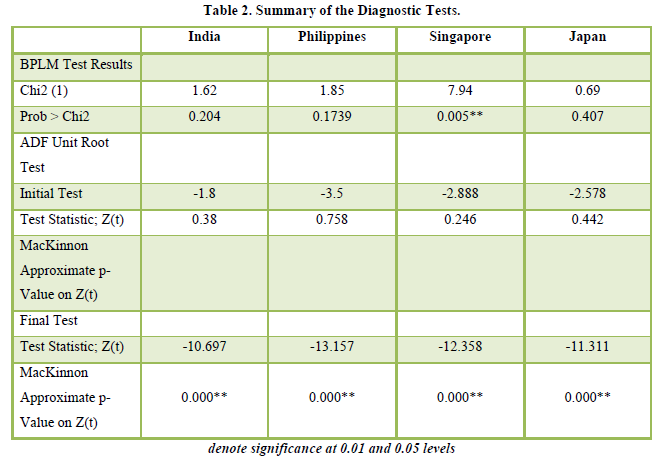

Table 2 provides the Breusch-Pagan/Cook-Weisburg test result for heteroskedasticity for each of the four countries. The data for Singapore showed the presence of heteroskedasticity (p-value <0.05), while the data for Japan, India, and the Philippines were homoscedastic, as their p-values are greater than 0.05. Further, the initial Augmented Dickey-Fuller (ADF) test result was conducted and revealed that the exchange rate volatility variables for each country have unit root and were stationary. Thus, another ADF test was administered, where the exchange rate volatility series were differenced to eliminate non-stationarity. The results revealed that the test statistic Z(t) and MacKinnon approximate p-values were less than 0.05 level, which led to the data becoming stationary after differencing.

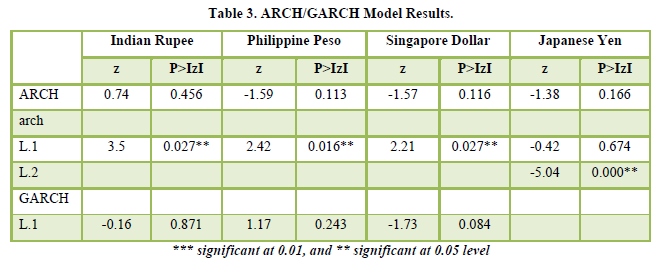

Table 3 indicates the outcomes for both a GARCH (1,1) model and an ARCH (1) model for India, the Philippines, Singapore, and Japan’s datasets. The ARCH model test results indicated the presence of significant volatility in the exchange rates in these countries during the period 2011-2021. Therefore, the significance of the lagged ARCH terms (the second lag for Japan, as GARCH cannot be applied to the dataset) and the first lag for India, the Philippines, and Japan led to the rejection of the null hypothesis. This proves that there is significant exchange rate volatility in all four countries, which was a prerequisite for the subsequent linear regression analysis.

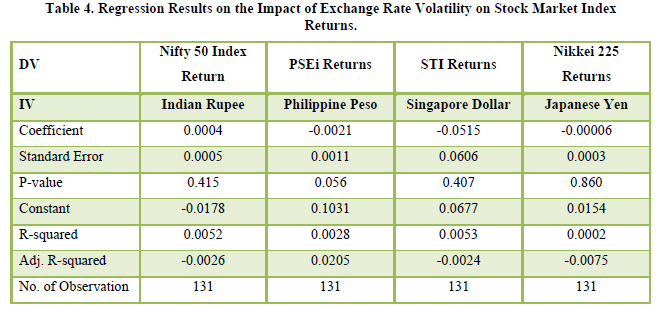

Table 4 shows the linear regression test results for the impact of exchange rate volatility on stock market index returns in the four Asia Pacific countries. The p-value generated for each of the country’s exchange rates is greater than the 0.05 level, thus, the null hypothesis was not rejected. We can infer that foreign exchange volatility (USD/INR, USD/PHP, USD/SGD, and USD/JPY) in these countries showed no effect on their respective stock market index returns over the 2011-2021 period.

This is consistent with the previous research (Frank and Yong, 1972 as cited in Suriani et al., 2015; Jebran and Iqbal, 2016; Mburu, 2015), which suggests an insignificant interaction between exchange rates and stock markets. The results for Japan, Singapore, and the Philippines corresponded to the analysis conducted by Jebran and Iqbal (2016), wherein an insignificant negative relationship was discovered between exchange rate volatility and stock returns for China, India, and Japan. Only India showed a positive insignificant interaction between the Indian Rupee’s volatility and Nifty 50 index returns.

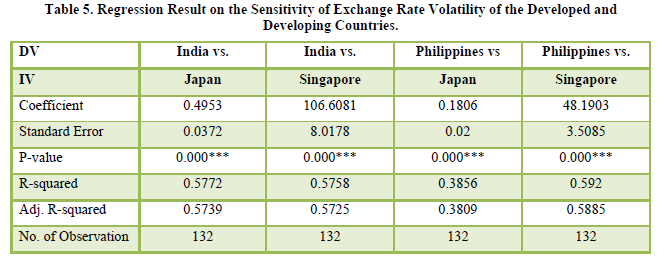

Table 5 provides the results of linear regression estimation to determine differences in the sensitivity of exchange rate volatility between developed and developing countries. Based on the p-values for all four pairs (India vs. Japan, India vs. Singapore, Philippines vs. Japan, and Philippines vs. Singapore), the results are 0.0000, which is less than the significance level of 0.05. The results are statistically significant, and these reject the null hypothesis, which proves that developing countries were less sensitive to exchange rate volatility than developed countries. This is supported by the finding of Zada et al. (2021), which suggested that developing markets are more prone to recurrent jumps.

The coefficients shown in Table 5 are all positive, suggesting a positive relationship between the exchange rates being compared. For example, the coefficient of 0.4953 for the India vs. Japan comparison indicates a positive association between the Indian Rupee and the Japanese Yen exchange rates vis-a-vis US dollar over 10 years. The r-squared values, ranging from 0.3856 to 0.5920, suggest that a moderate to relatively high proportion of the variation in the developing countries' exchange rates can be explained by the variation in the developed countries' exchange rates in the respective pairs.

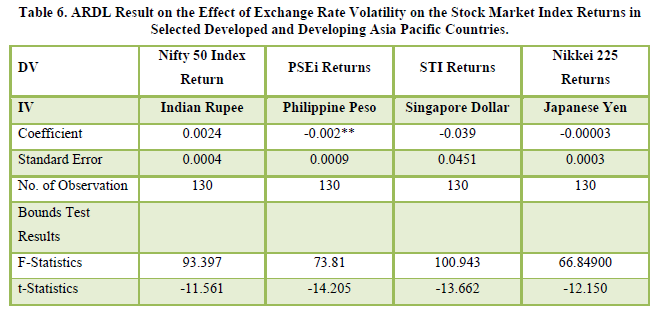

Table 6 presents the results of the Autoregressive Distributed Lag (ARDL) model to determine the long-run impact of exchange rate volatility on stock market index returns for Singapore, Japan, India, and the Philippines. The coefficients provided above suggest the long-run change in stock market index returns for a one-unit change in exchange rate volatility. For Japan, Singapore, and the Philippines, the coefficients are negative, indicating a potential inverse long-run relationship. For India, the coefficient is positive, suggesting a direct long-run relationship. Also, based on the p-values, only the long-run effect of exchange rate volatility on the Philippine stock market index returns is statistically significant at the 0.05 level.

The bounds test shown above also reveals that the F-Statistics generated for the four countries are greater than the upper bound critical value of 5.732. The t-statistic is -11.561, which is less than the lower bound critical value of -3.222. Based on these results, the null hypothesis of no long-run relationship is rejected for all countries, which proves that there is evidence of a statistically significant long-run relationship found between exchange rate volatility and stock market index returns. The results are aligned with Ahmed (2020) and Sohail and Hussain (2009, as cited in Kotha and Sahu, 2016), who found the existence of long-run influence between exchange rates and stock returns in Egypt, and Pakistan, respectively.

CONCLUSIONS AND RECOMMENDATIONS

The following conclusions can be drawn from the results shown in the preceding discussions:

- Developing countries were less sensitive to exchange rate volatility than developed countries, which suggests that the market reactions in developing countries to exchange rate volatility could be less pronounced or different compared to the mature and potentially efficient and developed markets in the Asia Pacific region such as Japan and Singapore.

- The regression results proved a weak impact of exchange rate volatility on stock market index returns for Japan, Singapore, and India in the long run, but showed a statistically significant negative long-run effect in the Philippines. However, the ARDL bounds test provided evidence of a statistically significant long-run relationship between exchange rate volatility and their respective stock market index returns. The results for the other countries did not reveal statistically significant long-run effects of exchange rate volatility on their respective stock market index returns. It also suggests that although the direct linear impact of exchange rate volatility on stock returns in the long-run regression might be weak or influenced by other factors, the two variables seemed to be moving together in the long term.

- One of the limitations of the study is the use of simple statistical models to analyze the data. Future studies can be conducted by using other models, such as EGARCH, BEKK-GARCH, DCC GARCH, and Go GARCH, among others, to measure the interaction between two financial markets. It can also investigate how other macroeconomic variables such as interest rates, commodity prices, precious metal prices, monetary policies, and inflation rates can influence a financial market using time series data.

- Since the study utilized monthly data for 10 years, similar studies can be conducted using larger datasets that employ daily or weekly data to generate an accurate measure of exchange rate volatility. Likewise, the time-period can be extended or expanded backward to remove the datasets during the pandemic period. This can provide a more conclusive inference on the relationship between exchange rate volatility and stock market returns.

- Adriano, A. J. M., Cagampan, M. L. L., Lee, J. J. K., Ng Cha, A. M. G. S., Patiu, L. S. et al. (2020). Volatility Transmission between the Foreign Exchange Rate and Stock Market from An Empirical Analysis of Selected Emerging Markets of Asia-Pacific Region. Philippine Academy of Management e-Journal, 3, 57-78.

- Ahmed, R.R., Vveinhardt, J., Štreimikienė, D., Ghauri, S.P., & Ashraf, M. (2018). Stock returns, volatility, and mean reversion in emerging and developed financial markets. Technological and Economic Development of Economy, 24, 1149-1177.

- Ahmed, W.M.A. (2020). Asymmetrical impact of exchange rate changes on stock returns evidence of two de facto regimes. Review of Accounting and Finance, 19, 147-173.

- Ahmed, R. I., Zhao, G.& Habiba, U. (2022). Dynamics of Return Linkages and Asymmetric Volatility Spillovers among Asian Emerging Stock Markets. The Chinese Economy, 55, 156-167.

- Aloui, C. (2007). Price and volatility spillovers between exchange rates and stock indexes for the pre and post-euro period, 7688.

- Bagh, T., Azad, T., Liaqat, I., Razzaq, S., & Khan, M.A. (2017). The impact of exchange rate volatility on stock index: evidence from Pakistan stock exchange (PSX). International Journal of Academic Research in Accounting Finance and Management Sciences, 7, 70-86.

- Chow, H. K. (2017). Volatility Spillovers and Linkages in Asian Stock Markets Volatility Spillovers and Linkages in Asian Stock Markets. Emerging Markets Finance and Trade, 53, 2770-2781.

- Dang, V.C., Nguyen, Q.K., Le, T.L., & Tran, D.Q. (2020). Linkage between exchange rate and stock prices: evidence from Vietnam. The Journal of Asian Finance Economics and Business, 7, 95-107.

- Delgado, N.A.B., Delgado, E.B., & Saucedo, E. (2018). The relationship between oil prices the stock market and the exchange rate evidence from Mexico. The North American Journal of Economics and Finance, 45, 1-24.

- Javangwe, K. Z. & Takawira, O. (2022). Exchange rate movement and stock market performance An application of the ARDL model. Cogent Economics & Finance, 10(1).

- Jebran, K. & Iqbal, A. (2016). Dynamics of volatility spillover between stock market and foreign exchange market evidence from Asian countries. Financial Innovation, 2, 1-20.

- Khan, M. K. (2019). Impact of exchange rate on stock returns in Shenzhen stock exchange: analysis through ARDL approach. International Journal of Economics and Management, 1(2), 15-26.

- Kotha, K.K. & Sahu, B. (2016). Macroeconomic factors and the Indian stock market: exploring long and short run relationships. International Journal of Economics and Financial Issues, 6, 1081-1091.

- Khan, Maaz, Mrestyal Khan, Umar Nawaz Kayani, Khurrum Shahzad Mughal (2023). Unveiling Market Connectedness: Dynamic Returns Spillovers in Asian Emerging Stock Markets. International Journal of Financial Studies, 11, 112.

- Lakshmanasamy T. (2021). The relationship between exchange rate and stock market volatilities in India ARCH-GARCH estimation of the causal effects. International Journal of Finance Research, 2, 244-259.

- Gay, R.D. (2016). Effect of macroeconomic variables on stock market returns for four emerging economies Brazil Russia India and China. International Business & Economics Research Journal, 15, 119-126.

- Gokmenoglu, K., Eren, B.M., & Hesami, S. (2021). Exchange rates and stock markets in emerging economies New evidence using the Quantile-on-Quantile approach. Quantitative Finance and Economics, 5, 94-110.

- Mateus, C., Bagirov, M. and Mateus, I. (2024). Return and volatility connectedness and net directional patterns in spillover transmissions East and Southeast Asian equity markets. International Review of Finance, 24, 83-103.

- Mechri, N., Peretti, C, & Hamad, S.B. (2022). The impact of the exchange rate volatilities on stock markets dynamics Evidence from Tunisia and Turkey. Global Economics Science, 3.

- Mohammed, W. A. (2021). Volatility Spillovers among Developed and Developing Countries the Global Foreign Exchange Markets. Journal of Risk and Financial Management, 14, 270.

- Mroua, M. & Trabelsi, L. (2020). Causality and dynamic relationships between exchange rate and stock market indices in BRICS countries Panel/GMM and ARDL analyses. Journal of Economics, Finance and Administrative Science, 25, 395-412.

- Ndlovu, B., Faisa, F., Resatoglu, N.G., & Türsoy, T. (2018). The impact of macroeconomic variables on stock returns A case of the Johannesburg Stock Exchange. Romanian Statistical Review, 2, 87-104.

- Omotayo, E. O. & Efuntade, A. O. (2022). Systematic review of nexus between exchange rate fluctuations and stock market price movements Flow oriented theory stock-oriented theory and portfolio balance theory. International Journal of Social Sciences and Management Research.

- Panda, P. and Deo, M. (2014). Asymmetric cross-market volatility spillovers evidence from Indian equity and foreign exchange markets. Decision, 41, 261-270.

- Sales, M. B. Y., Ramos, N. H. D., Santos, D. J., Inson, J. R., Patiu, L. S. et al. (2024). Portfolio Optimization among Philippine Shari’ah Compliant Securities and Philippine Stock Exchange Composite Index Securities: A Single Index Model Approach. Review of Integrative Business and Economics Research, 13, 404-417.

- Satria, D. (2023). Composite stock price index and currency exchange rates of 4 countries in Southeast Asia after Covid-19. Jurnal Keuangan dan Perbankan, 27, 65-80.

- Sichoongwe, K. (2016). Effects of exchange rate volatility on the stock market the Zambian experience. Journal of Economics and Sustainable Development, 7, 114-119.

- Sui, L. & Sun, L. (2016). Spillover effects between exchange rates and stock prices Evidence from BRICS around the recent global financial crisis. Research in International Business and Finance, 36, 459-471.

- Zada, H., Hassan, A., & Wong, W. (2021). Do jumps matter in both equity market returns and integrated volatility a comparison of Asian developed and emerging markets. Economies, 9, 1-26.