163

Views & Citations10

Likes & Shares

The predetermined purpose of tax audits is to limit tax evasion on the one hand and maximize the government's revenue base as a result of taxpayer compliance with tax law provisions on the other (Mupimpila, 2020). In this way, compliance with the results of tax audits would not only contribute to the Internally Generated Revenue (IGR) of the Federal Republic of Nigeria, but will also enable the government to provide taxpayers with the necessary basic amenities (Nwafor, Obineme & Okey, 2021). Furthermore, the purpose of tax audits is to check that taxpayers have computed their tax liability in compliance with the applicable tax rules and regulations. The audit program of a revenue body serves a variety of crucial functions that, when carried out correctly, can significantly improve the management of the tax system. A tax audit is an investigation into the history of tax returns made to a tax agency by an individual or business (Olaoye, Ogunleye & Solanke, 2018). Even among individuals who believe their tax paperwork are in perfect order, the prospect of a tax audit typically induces apprehension. It is true that a tax audit may be prompted by the suspicion of an error in one or more returns, but it is also true that an audit may be conducted as part of a random sampling. Most governments in the globe have an organization tasked with supervising the tax collecting process from persons and businesses residing within their jurisdiction (Ngwu & Anih, 2021).

Similarly, tax audit is a process or series of processes carried out by a tax auditor to determine a taxpayer's correct tax liabilities for a specific accounting or tax period, by examining a taxpayer's organization procedures and financial records to assess compliance with tax laws and verifying the true, fair, reliable, and accuracy of tax returns, and financial statements (Arega, 2020). A tax audit is a financial audit that entails the collection and analysis of taxpayer information to determine their level of compliance with local tax laws (Oladele, Aribaba, Ahmodu, Yusuff, & Alade, 2019). A tax audit is an assessment of an individual's or organization's tax return by the relevant tax authorities to determine conformity with state tax rules and regulations. The Internal Revenue Service conducts a tax audit to certify that the taxpayer's tax returns are appropriate, adequate, and accurate. The formulation of an efficient tax audit policy can impact the production/revenue-generation decisions of enterprises and the government, respectively (Arega, 2020).

The purpose of this study is to investigate the effect of field and back duty tax audit and investigations on tax revenue generation in Ibadan, Oyo State Nigeria. The specific objectives are; to access the effect of field tax audit and investigations on tax revenue generation in Nigeria, and to evaluate the effect of back duty tax audit and investigations on tax revenue generation in Nigeria.

LITERATURE REVIEW

Tax Audit

A tax audit is a review of a taxpayer's financial records and business documents to determine whether tax rules and regulations are being followed. In addition to the statutory audit, tax officials from the relevant tax authorities conduct this audit. This is different from the statutory audit required by the Company and Allied Matters Act (CAMA) of 2020. It should also be highlighted that the criteria for selecting cases for tax audit include recurring losses, nil tax returns, refund cases, non-submission of returns, low tax yield, suspicion of tax avoidance, fraud, or evasion, transfer mispricing, and thin capitalization, among others. In the majority of tax jurisdictions throughout the world, tax audits are a crucial compliance tool (Tarfa et al., 2020). It has made a significant contribution to promoting awareness among stakeholders, bringing more taxpayers into the tax net, strengthening the self-assessment tax system, increasing tax revenue generation, and preventing various tax system abuses. The objective of a tax audit is to determine a true and accurate representation of the business's tax records. The tax audit officer is responsible for verifying the accuracy of the reported amount and the tax paid in line with tax laws and regulations. Obtaining voluntary conformity with tax laws and regulations and ensuring that the self-assessment system achieves a higher tax compliance rate are the other objectives of tax audits (Oyedokun, 2016).

The purpose of a tax audit is to give tax auditors the ability to confirm the following: The taxpayer's tax computations submitted to the authority are consistent with the underlying records, and all applicable tax laws have been followed. Adequate accounting books and records are present for the purpose of determining the taxpayer's taxable profits or losses and, consequently, the tax payable. the provision of a vehicle for educating taxpayers about various tax law responsibilities; discourage tax evasion; find and fix accounting and/or math problems in tax filings; give (tax administrators) input on different legal requirements and suggest potential adjustments; prohibit a taxable person from neglecting to file tax returns and prevent a taxable person from filing incomplete or inaccurate tax returns in support of the self-assessment scheme. Identify cases of tax fraud and propose their investigation. The extent and nature of auditing procedures would depend on the sort of audit to be conducted, the underlying trigger, and the desired outcomes. The Federal Inland Revenue Service (FIRS) conducts the following audits: Audits of Registration, Advisory Audits, and Record-Keeping (Dosumu, 2021).

Lagos state popularized the concept of tax audits by appointing monitoring agents to conduct tax audits on the government's behalf. These monitoring agents are primarily Certified Public Accountants tasked with conducting tax audits on PAYE. The duty of these monitoring agents, however, was assumed by tax consultants in 1996, who operate differently than monitoring agents (Olaoye et al., 2018). It has become common for state governments to conduct tax audits to ensure that the exact taxes owed to the government have been deducted and deposited into the government account. This exercise has been credited with positive outcomes, including making taxpayers familiar with applicable tax rules; increasing the rate at which taxpayers comply with tax laws; enhancing Nigeria's tax practice; and increasing government revenue (Nwaiwu & Okoro, 2018). According to some scholars, the following are reasons for tax audits: To assist the government in collecting the appropriate tax revenue necessary for budgeting, maintaining economic and financial order and stability, to ensure that tax payers submit satisfactory tax returns, to minimize tax avoidance and tax evasion, to increase the level of voluntary compliance by tax payers, to ensure strict compliance with tax laws by tax payers, and to ensure that tax payers pay their fair share of taxes. It will allow the government to monitor and enforce taxpayer compliance with tax regulations, hence increasing tax money collected from taxpayers (Nwaiwu & Okoro, 2018).

A tax investigation is the inquiry conducted on a firm to determine any unpaid taxes by the taxpayer, resulting from any action of the taxpayer that led to the taxpayer being under assessed. The objective is to collect delinquent taxes from the taxpayer. An efficient tax inquiry involves the auditor's impartial observations and judgement based on the corporate entity's accurate audited financial statement. Consequently, a functional and exhaustive investigative approach should generate a high-quality report that is useful and timely for many stakeholders. Prior studies had argued that the essence of initiating a tax investigation is where there has been alleged fraud, willful default, or neglect by the taxpayer, where there are reported failures to file tax returns by a potential tax payer, a situation where there is alleged action of reduction in income not in line with the nature of the taxpayer's trade, where there are reported errors or omissions in the assessment, and where there is a reported mismanagement (Olagunju, 2011; Dosumu, 2021).

In Nigeria, FIRS, as authorized by the enabling legislation, has the authority to engage special purpose tax officers to conduct or investigate, or cause an investigation to be undertaken, to determine whether a breach of tax laws has been reported to the FIRS. For instance, the FIRS may initiate an investigation into the properties of any taxable person if it appears that the individual's lifestyle and the size of his or her holdings are not justified by his or her claimed source of income (Eiya, 2016). If the inquiry exposes the commission of a crime or an attempt to commit a crime, the FIRS is responsible for prosecuting the crime.

Tax Audit and Tax Investigation

Criminal tax investigations concentrate on amassing sufficient evidence to prosecute tax evaders and establish their guilt (Ibadin & Kemebradikemor, 2020). The objective of Tax investigations varies from company to company. It guarantees that the exact tax amounts are collected, identifies the perpetrator of the offence, and follows through with criminal prosecution (Olaoye, & Ogundipe, 2018). Tax investigation has with its heavier fines and monetary repercussions than tax audit (Oyedokun, 2016). Tax officials examine a taxpayer's affairs, papers, and records as part of a tax investigation to determine if the correct amount of taxable income was reported and the correct amount of tax was paid in line with the law (Ehigiator, 2021). The primary distinction between a tax audit and a tax investigation is that a tax investigation will only be conducted if there is precise and conclusive evidence that the taxpayer has intentionally attempted to avoid paying tax or has committed an act of willful evasion in violation of the applicable Tax Laws.

It is also crucial to mention that, unlike conventional auditors and investigators, there is no specialized qualification required of would-be tax auditors or tax investigators. However, it is assumed that anyone that will assumes the roles of tax auditor and tax investigator must first be a tax administrator or consultant with the necessary taxation training. In Nigeria, the Chartered Institute of Taxation of Nigeria (CITN) is the most recognized and acknowledged taxation professional certification (Olokooba, 2019). The Institute, which was founded in 1982 and chartered by Act No. 76 of 1992, is charged with regulating tax administration and practice in the country. The Institute bestows Associates and Fellowship to its deserving members and provides MPTPs (Mandatory Professional Training Programmes) on occasion (Ocheni, 2015).

EMPIRICAL REVIEW

Awotomilusi (2022) evaluated how tax administration affects tax revenue generation in Nigeria. The government tax administration mechanisms, which are used to monitor tax collection, include tax audit, tax amnesty, tax enforcement and tax penalties. The study adopted survey research design analyzed with descriptive and inferential statistics. The population of the study consisted of 302 audits and risk department personnel from the State Board of Internal Revenue and the Federal Inland Revenue Service in the southwest Nigerian states of Ekiti, Ondo, Osun, Oyo, Ogun, and Lagos. A total of 172 persons were sampled using the Taro Yamane sampling method to obtain the sample size. The researcher created a closed-ended questionnaire to obtain primary data for the study. The data were analyzed using multiple linear regression analysis to obtain inferential statistics. According to the findings, tax penalties should be strong enough to deter would-be tax defaulters, tax administrators should continue to enforce tax laws against taxpayers. Tax audit should be intensified to unravel any act of tax evasion and tax amnesty should be seldomly granted due to its negative effect on tax revenue in Nigeria.

Oladele, Ndalu and Akani (2021) investigated the impact of tax audit practices on revenue generation in Nigeria with its specific objectives such as to determine the relationship between tax audit practices dimensions and company income tax. The population of the study consisted of 26 tax offices across South - South, Nigeria with 900 staff of Federal Inland Revenue Service (FIRS). The sample size for the study consisted of 277 staff of FIRS which was determined using Taro Yemane formula for sample size determination. Primary data were collected from respondents using the questionnaire instrument. Pearson Product Moment Correlation Coefficient was also used with the aid of Statistical Package for Social Sciences (SPSS) version 23.0 to test the null hypotheses. The findings of the study revealed that desk tax audit and field tax audit have a positive relationship with company income tax. The study, therefore, recommends that tax authorities should not concentrate only on desk tax audit but also on field tax audit so that revenue leakages will be blocked and increase the level of taxpayers’ compliance. Finally, there should be regular tax audit practices by tax authorities in Nigeria. This will assist in increasing government tax revenue.

Ogunwole et al., (2020) determined in a study, the effects of tax audit on revenue collection in Nigeria. The study adopted a descriptive approach. Both Primary and secondary data was used and then analyzed through SPSS version 21. Data analysis involved statistical computations for averages, percentages, and correlation and regression analysis. Ordinary Least Squares (OLS) regression method of analysis was adopted to determine the inferential statistics. From the findings, tax administration, tax revenue performance, revenue protection system, tax automation to a constant zero, revenue collection would be at 0.347. A unit increase on Tax administration would lead to increase in revenue collection by a factor of 0.162, a unit increase in tax revenue performance would lead to increase in revenue collection by a factor of 0.282, a unit increase in revenue protection system would lead to increase in revenue collection by a factor of 0.194 and unit increase in tax automation would lead to increase in revenue collection by a factor of 0.211. Therefore, Tax audit actually has an effect to revenue collection as according to the t-tests there is significance in the correlation between tax collected before the audit and after the audit. This clearly indicates that tax audit increases revenue collection. That in essence means that the more the tax audit conducted the more revenue is collected.

Dada and Taiwo (2020) examined the impact of tax audit on revenue generation in Ekiti State. The data used for this study was gathered using a structured questionnaire administered to 312 staff of the Ekiti State Internal Revenue Service. A regression analysis technique was adopted, and the result revealed that certain per cent of the revenue generated in Ekiti State could be explained by the tax audit; It was also discovered that auditing access, auditing officials, an effective tax audit, non-compliance, audit fieldwork, tax audit control, and corruption affect the revenue generation by 1.188, 0.319, 0.596, 0.148, 0.157, 0.125 and 0.002 respectively; the probability value 0.00, 0.01, 0.00, 0.022 and 0.00 ˂ 0.05 showed that auditing access, auditing officials, effective tax audit and incentive were statistically significant at 5 per cent level; the probability of F-statistic value 0.000 ˂ 0.05 revealed that the model was appropriate for determining the impact of tax audit on revenue generation in Ekiti State. Thus, the study concluded that tax audit should be embraced as it maximizes the collection of revenue which enables the government to address developmental projects that will benefit its citizenry and also helps in strengthening the businesses of the taxpayer.

Tarfa et al., (2020) investigated the effects of tax audit on revenue generation. Taxation is a compulsory payment or transfer of resources from private to public sector levied on the basis of the determined criterion and without reference to specific benefits received in order to accomplish some of the nation’s economic and social objectives. The study was undertaken to address the tax audit practice in Jimma and Hawassa Branches of Federal Ministry of Revenue. To conduct the study a mixed method or quantitative and qualitative approach has been executed to address issues that could not be obtained by adopting a single method. Further, in the study both descriptive and explanatory research design were employed. To achieve the objective of the study, purposive sampling techniques was employed, and the sample size was computed scientifically. The researchers analyzed the data collected via questionnaire with the aid of Statistical Package for Social Sciences (SPSS) version 20.0 and Stata software. The study revealed that tax audit techniques applied and provision of training to the taxpayers are positive factors affecting the tax revenue generation significantly, on the contrary, an illegal practice of taxpayer is negative factor that is affecting the tax revenue generation. It is recommended that ministry of revenue should consider factors affecting revenue generation.

THEORETICAL REVIEW

This study in anchored on the theory of reasoned action (TRA) which was propounded by Fishbein and Ajzen in 1975 (Augustine et al., 2020). The theory of reasoned action predicts behavioral intentions, which are a result of a perspective on the behavior and subjective standards for how it should be performed (Augustine et al., 2020). A person's attitude toward an action is characterized as his or her positive or negative feelings about executing the behavior. It is determined by evaluating an individual's beliefs regarding the consequences of the behavior (Augustine et al., 2020). Subjective norm is described as a person's judgement of whether influential individuals believe the activity should be performed.

These individuals may include managers, coworkers, community leaders, family members, close friends, and others of importance. While the TRA has been applied in numerous contexts, it bears the restriction of presuming that when a person forms the purpose to act, they are free to act (Augustine et al., 2020). In actuality, environmental restrictions will restrict the ability to act freely. The theory of planned behavior (TPB) was proposed to overcome the limitations of TRA. As an extension of TRA, TPB proposes that a given behavior is directly controlled by behavioral intents, which can be predicted by attitude toward the conduct, subjective norm regarding the behavior, and perceived behavioral control. This theory is relevant in this study because it helps to explain the connection between taxpayers and tax authorities. The level of tax payer compliance is constantly dependent on the activity of the tax authorities. This theory asserts that awareness of tax audits is a significant predictor of tax payer compliance.

METHODOLOGY

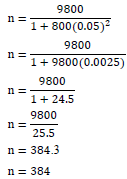

The study adopted a descriptive survey design method for the purpose of carrying out a good analysis and reaching a reasonable conclusion. The population of this study consist of 9800 staff at the Federal Inland Revenue Service from which the target and accessible population will be drawn. However, the respondents include top, middle, and lower-level public sector management personnel. The data used in this study were mainly collected through primary sources with the use of a well-structured questionnaire. However, secondary data were also collected from documents and published records like state development journals, newspapers, magazines, internet sources which are majorly used for diverse literature review. Random sampling technique was used to ensure that each sample has an equal chance or probability of being chosen. Taro Yamane formula was adopted for the calculation of the sample size and the formula is expressed as:

Where n is the required sample size, N is the total population, e is the margin of error at 5% confidence level. Therefore, the study sample size with the total population of 9800 calculated as

.

The primary data collected was analyzed and computed in accordance with the study's research objectives. Using descriptive statistics such as percentages, frequencies, tables, and graphs, the data acquired from primary sources were examined. The analysis adopted inferential statistics such as correlation coefficients, t-test, regression analysis, standard deviation, and ANOVA to demonstrate significance. As a result, the study employed simple regression analysis to assess hypotheses. Analysis of Variance (ANOVA) was performed to compare the variation within each sample to the variation between samples. The data analysis was performed using the software Statistical Package for Social Sciences (SPSS version 23).

RESULTS

In total, three hundred and eighty-four (384) copies of questionnaires were distributed to the sampled respondents in the selected FIRS office in Ibadan. About three hundred and thirty (330) were retrieved, three hundred (300) were rendered valid and useful for analysis. Thus, the analysis was based on returned valid copies and this gave a response rate of 78.1%.

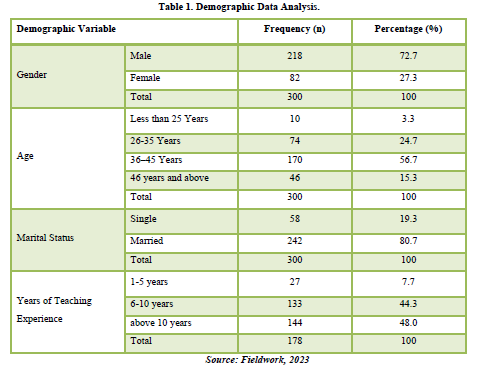

Table 1 shows the frequency distribution of respondents’ demography in selected FIRS offices in Oyo State. From the table, 72.7% (218) of the respondents were male, while 27.3% (82) are female. This shows that male FIRS staff are more in this study. This suggests dominance of male to female FIRS staff in Oyo State. The majority of the respondents, 56.7% (170) are within 36-45 years of age, 24.7% (74) are within 25-35 years, 15.3% (46) are 46 years and above, while 3.3% (10) are Less than 25 Years. This implies that most of the respondents are young and in their mid-age. The majority of the respondents, 80.2% (242) are married, while 19.3% (58) are single. This suggests that a major portion of the respondents are married.

Lastly, majority of the respondents, 48% (144) have above 10 years of experience, 44.3% (133) of the respondents have between 6-10 years of working experience, while few, 7.7% (27) have 1-5 years of experience. This clearly indicates that most of the staff of FIRS in Oyo State are well experienced.

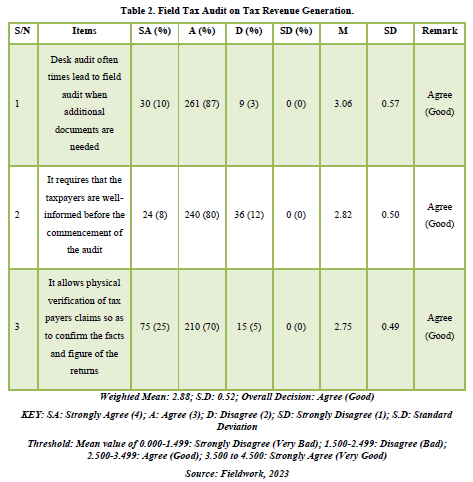

Research Question One: What is the effect of Field tax and investigations on tax revenue generation in Nigeria?

Table 2 shows the effect of field tax audit on tax revenue generation. From the table, most of the respondents 87% (261) agreed that desk audit often times lead to field audit when additional documents are needed, 10% (30) strongly agreed, 3% (9) of the respondents disagreed. Also, majority 80% (240) of the respondents agreed that it requires that the taxpayers are well-informed before the commencement of the audit, 12% (36) of the respondents disagreed, 8% (24) of the respondents strongly agreed, none strongly disagreed. Further, most of the respondents 70% (210) agreed that field audit allows physical verification of tax payers claims so as to confirm the facts and figure of the returns, 25% (75) of the respondents agreed and 5% (15) disagreed. Also, the Table generally shows that the effect of field tax and investigations on tax revenue generation in Nigeria is good (weighted mean = 2.88 S. D = 0.52).

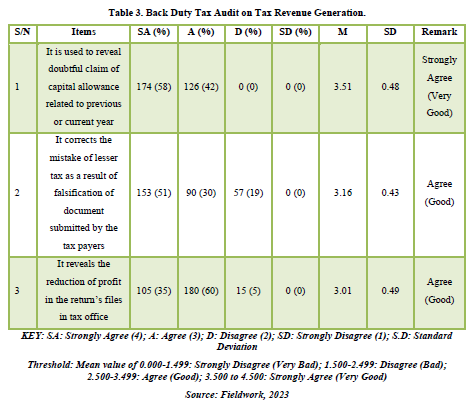

Research Question Two: To what extent is the effect of Back Duty tax audit and investigations on tax revenue generation in Nigeria?

From the Table 3 majority of the respondents 58% (174) strongly agreed that Back duty tax is used to reveal doubtful claim of capital allowance related to previous or current year, 42% (126) agreed, none of the respondents disagreed or strongly disagreed. Also, majority 51% (153) of the respondents strongly agreed that Back duty tax corrects the mistake of lesser tax as a result of falsification of document submitted by the taxpayers, 30% (90) of the respondents agreed, 19% (57) of the respondents disagreed, none strongly disagreed. Further, most of the respondents 60% (180) agreed that Back duty tax reveals the reduction of profit in the return’s files in tax office, 35% (105) of the respondents strongly agreed and 5% (15) disagreed. Also, the Table generally shows that the effect of back duty tax audit and investigations on tax revenue generation in Nigeria is good (weighted mean = 3.23 S. D = 0.47).

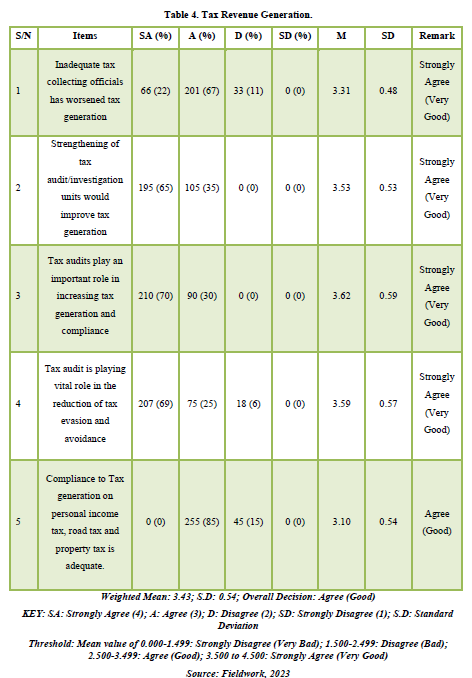

Table 4 shows statements on tax revenue generation. From the Table, majority of the respondents 67% (201) agreed that inadequate tax collecting officials has worsened tax generation, 22% (66) of the respondents agreed, and 11% (33) of the respondents disagreed while none of the respondents strongly disagreed. Also, on the statement “strengthening of tax audit/investigation units would improve tax generation”, majority 65% (195) of the respondents strongly agreed, 35% (105) of the respondents agreed, none of the respondents disagreed and strongly disagreed. Further, most of the respondents 70% (210) strongly agreed that tax audits play an important role in increasing tax generation and compliance, 30% (90) of the respondents agreed and none disagreed or strongly agreed. Similarly, the majority 69% (207) of the respondents agreed that tax audit is playing vital role in the reduction of tax evasion and avoidance, 25% (75) of the respondent agreed, 3% (8) of the respondent disagreed, none of the respondents strongly disagreed. Finally, most of the respondents agreed that compliance to tax generation on personal income tax, road tax and property tax is adequate, 15% (45) of the respondents disagreed. None either strongly agreed or strongly disagreed. Hence, Table 4 generally shows that the tax revenue generation in Nigeria is good (weighted mean = 3.43 S. D = 0.54).

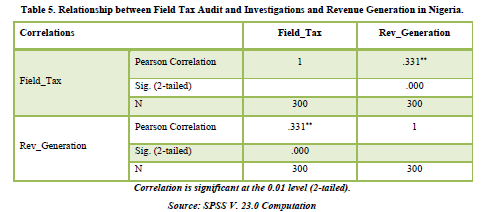

H01: There is no significant relationship between Field tax audit and investigations on tax revenue generation in Nigeria.

To investigate this relationship between field tax audit and investigations on tax revenue generation in Nigeria, Pearson Correlation was also used with a two-tailed test of significance at PTable 5, the p-value is 0.000 which is significant at 0.01 level (2-tailed). We therefore reject the null hypothesis and also conclude that there is relationship between field tax audit and investigations on tax revenue generation in Nigeria. Similarly, the sample correlation is 0.331 (shows that field tax audit and investigations correlate with tax revenue generation in Nigeria at (0.331) which is positive and also shows that the relationship is moderate. The (**) means that Correlation is significant at the po1-There is no significant relationship between field tax audit and investigations on tax revenue generation in Nigeria. Thus, answered the third research objective.

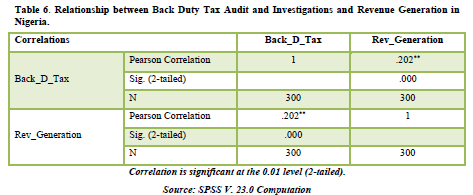

H02: There is no significant relationship between Back Duty tax audit and investigations on tax revenue generation in Nigeria.

To investigate this relationship between Back Duty Tax audit and investigations on tax revenue generation in Nigeria, Pearson Correlation was also used with a two-tailed test of significance at PTable 6, the p-value is 0.000 which is significant at 0.01 level (2-tailed). We therefore reject the null hypothesis and also conclude that there is relationship between field tax audit and investigations on tax revenue generation in Nigeria. Similarly, the sample correlation is 0.202 shows that Back Duty Tax audit and investigations correlates with tax revenue generation in Nigeria at 0.202) which is a positive relationship. The (**) means that Correlation is significant at the po2-There is no significant relationship between Back Duty Tax audit and investigations on tax revenue generation in Nigeria. This therefore answered the research fourth objective.

Finally, to investigate the combined relationship of all the independents variables (Desk Tax Audit, Field Tax Audit, and Back Duty Tax Audit) on dependent variable (tax revenue generation in Nigeria), the multiple regression analysis was used.

Results of the demographic data analysis of the respondents showed that 72.7% (218) of the population were male, while 27.3% (82) are female. This shows that male FIRS staff are more in this study. This suggests dominance of male to female FIRS staff in Oyo State This particular finding was also observed in a study on employee perception on the impact of reward system on employee performance in FIRS Lagos which reported more 30 or 53.00% male respondents while 27 or 47.37% are females. The results also showed that the majority of the respondents, 56.7% (170) are within 36-45 years of age, 24.7% (74) are within 25-35 years, 15.3% (46) are 46 years and above, while 3.3% (10) are less than 25 years. This implies that most of the respondents are 36-45 years. Almost all the respondents, 80.2% (242) are married, while 19.3% (58) are single. This suggests that a major portion of the respondents in FIRS Oyo state are married.

Findings of the study further showed that majority of the respondents, 56.3% (169) have Bachelor's degree as their highest form of degree which is an indication majority of FIRS staff are either university or polytechnic graduates. However, 28% (84) of the respondents have M.Sc. 10.7% (32) of them have Ph.D. Professional Qualifications, while 5% (15) of have PGDE. This suggests that some of the FIRS staff are advancing their qualifications to the post graduate level which is very good for the government agency. This result agrees with a work on “Leadership Style: An Empirical Analysis of Federal Inland Revenue Service, Gombe” which revealed that educational qualification of the respondents shows ND/NCE (3%), Degree/HND (76%), second degree (21%) and Ph.D. (0%). Further, the majority of the respondents, 48% (144) have above 10 years of experience, 44.3% (133) of the respondents have between 6-10 years of working experience, while few, 7.7% (27) have 1-5 years of experience. This clearly indicates that most of the Oyo State FIRS staff are well experienced. This result opposes a finding that revealed that majority 47% of the respondents were employed 5-10 years, 41% were employed in less than 5 years, 11-15 years has 10% while 16 and above years has 2%2. This result is consistent with a finding in a study on the “Effect of Auditor Functional Competence, Integrity, and Utilization of Information Technology on Tax Audit Quality” which reported that majority (73%) of the respondents have work experience from 11 years and above.

Findings from research question one revealed shows that the effect of field tax and investigations on tax revenue generation in Nigeria is good, Weighted Mean = 2.88. This indicates that desk audit frequently leads to field audit when more documents are required, permits physical verification of taxpayer claims in order to check the accuracy of the returns' facts and figures, and necessitates that the taxpayers are fully notified prior to the audit's start. A study titled "The Impact of Tax Audit Practices on Revenue Generation in Nigeria" supports this conclusion (Oladele et al., 2021). According to their research, the association between a field tax audit and corporate income tax is moderate with the correlation coefficient value of r = 0.545** significant at pv = 0.00 < 0.05. Also, field tax audit statistically affects company income tax.

Similarly, findings from research question two shows that the effect of back duty tax and investigations on tax revenue generation in Nigeria is good, Weighted Mean = 3.23. This result is corroborated by a study on “Tax Audit and Tax Revenue Generation in Nigeria” which reported that back duty tax audits have a significant positive impact on tax revenue generated Nigeria (Adelana, 2022).

CONCLUSION AND RECOMMENDATIONS

Tax is an important source of government revenue. As such, the government must adopt strategies that will promote a sustainable level of tax revenue and avoid leakages that will defer government developmental projects. The study found that tax audit and investigation are important compliant tools that can generate and increase government revenue. Specifically, this study investigated effect of tax audit and investigations on tax revenue generation in Ibadan, Oyo State Nigeria. Tax auditors should possess special skills in preparation of audit findings, audit selection techniques and special training in investigation and intelligence. The study showed the effect of field tax audit and back duty tax audit and investigations on tax revenue generation in Nigeria is likewise at a good level.

Based on the findings and objectives of this research, the study recommends that the effect of tax audits and investigations on the generation of tax income in Nigeria is good. The tax audit is therefore advised to be conducted on a regular basis to act as a check and a preventive measure for tax evasion and revenue generation. And in order to increase government tax revenue generation in Nigeria, tax audit should be intensified by Nigeria government.

- Adeusi, A. S. & Uniamikogbo, E., Erah, O. D. & Meshack, A. (2020). Non-oil revenue and economic growth in Nigeria. Research Journal of Finance and Accounting, 11, 95-106.

- Agbo, E. I. (2020). Aggressive tax planning in Africa. International Research Journal of Human Resource and Social Sciences, 7, 48-67.

- Arega, S. (2020). Assessment of Tax Audit Practice of Ministry of Revenues Eastern Addis Ababa Small Taxpayers Branch Office. Doctoral dissertation St Marys University.

- Augustine, A. A., Adewale, O. T. & Babatunde, L. A. (2020). Forensic accounting tax fraud and tax evasion in Nigeria Review of literatures and matter for policy consideration. International Journal of Emerging Trends in Social Sciences, 9, 21-28.

- Awotomilusi, N. S. (2022). Tax administration and generation of tax revenue in Nigeria. International Journal of Scientific and Management Research, 5, 145-152.

- Dada, R. A. & Taiwo, I. B. (2020). Bearing of tax audit on tax compliance and revenue generation in Ekiti State. Asian Journal of Finance and Accounting, 12, 115-130.

- Dosumu, C. M. (2021). Relevance of tax audit and tax investigation in Nigeria. Journal of Social and Administrative Sciences Studies, 5, 56-72.

- Ehigiator, E. (2021). The legal framework, procedure and challenges of tax audit and investigation in Nigeria a Comparative Analysis of the United Kingdom and United States of America. Madonna University Nigeria Faculty of Law Journal, 8, 10-34.

- Eiya, O. (2016). Companies' income tax audit in Nigeria Legal and administrative framework as well as rights and obligation of taxpayers. CARD International Journal of Management Studies, Business & Entrepreneurship Research, 1, 98-113.

- Ibadin, P. O. & Kemebradikemor, E. (2020). Tax fraud in Nigeria: A review of causal factors. Journal of Taxation and Economic Development, 19, 64-71.

- Jibir, A. & Aluthge, C. (2019). Modelling the determinants of government expenditure in Nigeria. Cogent Economics & Finance, 7, 23-41.

- Mupimpila, R. A. (2020). Factors inhibiting tax compliance among the Small Medium Enterprises (SMEs) in Kabompo District Central Business Zambia. The International Journal of Multi-Disciplinary Research, 6, 12-35.

- Ngwu, G. E. & Anih, S. C. (2021). Problems facing taxation under the Nigerian laws and the way forward. International Journal of Comparative Law and Legal Philosophy, 3, 76-91.

- Nwafor, I. V., Obineme, C. H. & Okey, P. C. (2021). Land-based taxation and internally generated revenue: An empirical investigation of its outputs in Abia State, Nigeria. International Journal of Development and Economic Sustainability, 9, 20-35.

- Nwaiwu, J. N. & Okoro, I. (2018). Government regulations on tax audit and government tax revenue in Nigeria. International Journal of Advanced Academic Research/Accounting and Economic Development, 4, 74-93.

- Ocheni, S. A. (2015). causality analysis between tax compliance behavior and Nigerian economic growth. Mediterranean Journal of Social Sciences, 6, 577-582.

- Ogunwole, A. E., Adebayo, A. M., Olaiya, L. A. & Omotayo, G. O (2020). Effect of Tax Audit on Revenue Collection in Nigeria. KIU Journal of Humanities, 5, 87-98.

- Oladele, A. O. Ndalu, T. C. & Akani, F. N. (2021). The impact of tax audit practices on revenue generation in Nigeria. International Journal of Innovative Finance and Economics Research, 9, 42-50.

- Oladele, R., Aribaba, F. O., Ahmodu, A. O., Yusuff, S. A. & Alade, M. (2019). Tax enforcement tools and tax compliance in Ondo State, Nigeria. Academic Journal of Interdisciplinary Studies, 8, 10-27.

- Olagunju, A. (2011). An empirical analysis of the impact of auditors’ independence on the credibility of financial statement in Nigeria. Research Journal of Finance and Accounting, 2, 82-99.

- Olaoye, C. O. & Ogundipe, A. A. (2018). Application of tax audit and investigation on tax evasion control in Nigeria. Journal of Accounting, Finance and Auditing Studies, 4, 79-92.

- Olaoye, C. O., Ogunleye, S. A. & Solanke, F. T. (2018). Tax audit and tax productivity in Lagos state, Nigeria. Asian Journal of Accounting Research, 3, 202-210.

- Olokooba, S. M. (2019). Practitioners and Stakeholders in the Nigerian Tax Policy Making. In Nigerian Taxation. Springer Singapore 43-58.

- Oyedokun, G. E. (2016). Relevance of tax audit and tax investigation in Nigeria. SSRN Electric Journal, 1-16.

- Tarfa, E. G., G. Tarekegn & Yosef, B. (2020). Effects of tax audit on revenue generation. Journal of International Trade, Logistics and Law, 6, 65-74.