Research Article

DIFFERENCES PROFITABILITYOF CONVENTIONAL COMMERCIAL BANK SYSTEMS AND ISLAMIC COMMERCIAL BANK SYSTEMS IN INDONESIA.

947

Views & Citations10

Likes & Shares

Conventional commercial banks and Islamic commercial banks use different principles in obtaining a profit. Profitability is one indicator of bank performance. The bank that can generate higher profitsmakesthe higher value of the bank and attract investors. This study aims to look at the influence of internal and externalfactors on profitability and differences in profitability between the two types of banks. The analysis method used the Error Correction Model and difference test. Based on the results on conventional commercial banks, the factors that influence profitability are capital, credit risk, rentability, total assets, and the middle exchange rate (Rp/US$).

Meanwhile, Islamic commercial banks are liquidity risk, credit risk, total assets, and the middle exchange rate (Rp/US$). In addition, there is a difference between the profitability of Islamic Commercial Banks and Conventional Commercial Banks. Conventional commercial banks cause this difference to maintain profits by allowing credit risk to increase, but this affects the burden of non-performing loans in the future and a decrease in capital. In contrast, Islamic commercial banks tend to maintain the sustainability of bank operations by adding reserves so that the burden of bad credit and capital is held.

Keywords: Profitability, Conventional commercial banks, Islamic commercial banks, Internal factors, External factors, Bank performance

INTRODUCTION

Commercial Banks are divided into Conventional Commercial Banks and Islamic Commercial Banks. The principle is used in obtaining profits of two banks are different,which is conventional commercial banks use the interest rate system. In contrast, Islamic commercial banks use theprofit-sharing system (Mukti &Noven, 2019).

Profitability, one indicator of banking performance, is the company's ability to generate profits related to sales from its capital or total assets (Sartono, 2014). In 2015, the profitability of commercial banks in Indonesia decreased due to Greece's debt to IMF, which matured in June 2015, amounting to 243 billion euros(Pane, 2016). Thiscrisis was a continuation of the 2008 crisis, andfor the Indonesian economy, this crisis led to a depreciation in the exchange rate (Rp/US$) (Wirabrata, 2015). This weakening of the exchange rate had an impact on rising prices for imported goods which led to an increase in production costs and a decrease in the ability of customers to repay loans (bad credit) which in turn affected bank profitability (Hidayati, 2014; Almaqtari, 2019; Swandayani 2012). This inflation causes an increase in production costs, which affects the ability to repay loans (Boyd & Champ, 2006; Taswan, 2010). In 2014, bank profitability also decreased due to the slowing growth of Gross Domestic Product in the mining and quarrying, and industrial sectors. The slowing growthof GDP indicates a decline in economic activity, which impacts the ability of debtors to repay loans (bad credit) so that it is affecting bank profitability (Ahmad et al., 2013; Dendawijaya, 2009).

According to the Regulation of Bank of Indonesia for Conventional Commercial Banks and Regulation of Financial Services Authority for Islamic Commercial Banks, the bank's profitabilityis also caused by the bank's health level. In both regulations, it is stated that the indicators used in assessing bank health level consist of risk profile, Good Corporate Governance (GCG), earnings, and capital. If management can handle risk management, GCG, earnings, and capital better, the bank is getting optimal in obtaining more profit(Irma et al., 2016; Sirait et al., 2019). In addition, banks withsignificant total assets will be more profitable than banks with small total assets because banks with substantial assets have high efficiency in achieving profitability (Kosmidou, 2008; Abduh & Issa 2018).

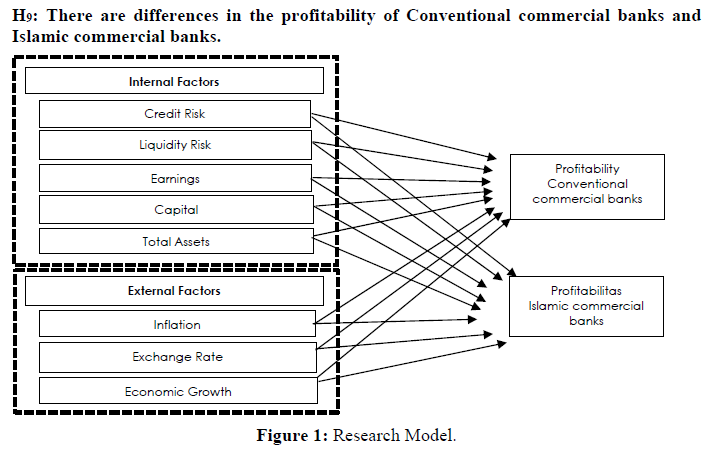

Previous research has shown that internal and external factors significantly affect the profitability of conventional commercial banks and Islamic commercial banks using multiple linear regression and pooled ordinary least squares. (Gunartin, 2015; Zarrouk, 2014; Abduh & Issa, 2018). There are also differences in profitability of the two types of banks using different tests (Deliman et al., 2019; Gunartin, 2015; Qian & Velayutham, 2017). This study aims to examine the influence of internal factors (credit risk, liquidity risk, capital, profitability, and total assets) and external factors (inflation, exchange rates, and Gross Domestic Product) on the profitability of conventional commercial banks. It also examines the difference in the profitability of conventional commercial banks and Islamic commercial banks in the long and short term.

LITERATURE REVIEW AND HYPOTHESIS

Credit Risk

According to the Regulation of Financial Services Authority, credit risk is the risk due to the party's failurein fulfilling obligations to the bank. The variable that can represent credit risk is Non-Performing Loans (Jin, et al., 2012). Non-Performing Loan (NPL) is a risk that arises because a counterparty fails to meet its obligations. It can also be defined as a loan that is experiencing repayment difficulties or is often called bad credit at the bank (Riyadi, 2016). In Islamic Commercial Banksis called Non-Performing Financing (NPF) by Sharia principles. The definition of NPF itself is financing that has the potential not to return, or in other words, customers have the potential to be unable to return financing based on mutually determined terms (Djohanputro & Kountur, 2007). If the credit risk figure increases, it indicates an increase in debtors who fail to pay credit, the income earned by the bank will decrease. Credit that is unable to pay by the debtor is known as bad credit. This non-performing loan will result in the loss of opportunities for banks to obtain income from loans, thereby reducing the acquisition of profitability (Dendawijaya, 2009).

H1: Credit risk has a negative effect on the profitability of Conventional commercial banks and Islamic commercial banks

Liquidity Risk

According to the Regulation of Financial Services Authority, liquidity risk is the risk due to the inability of a bank to meet its maturing obligations from cash flow funding sources and/or from high quality collateralized liquid assets, without disturbing the activities and financial condition of the bank. The variable that can represent liquidity risk is the Loan to Deposit Ratio (LDR) for Conventional Commercial Banks (Lasta et al., 2014), while for Islamic Commercial Banks is the Financing to Deposit Ratio (FDR), which is following Sharia principles. The regulation also states that the higher the liquidity risk, the bank in a condition unable to provide cash to third parties at the agreed time, the bank will experience liquidation and decrease bank performance and may even experience termination of bank operations (sudden death).

H2: Liquidity risk has a negative effect on the profitability of Conventional commercial banks and Islamic commercial banks

Earnings

Earnings compare the company'sprofit with assets or capital owned and used to generate this profit (Riyanto, 2011). The variables used to measure profitabilities are Net Interest Margin (NIM) for Conventional commercial banks and Net Operating Margin (NOM) for Islamic commercial banks. According to theCircular Letter of Bank of Indonesia, Nimcompares net interest income and assets used to generate interest. Meanwhile, according to the Circular Letter of Financial Services Authority in Indonesia, NOMis the ratio between income distribution after profit sharing is reduced by operating expenses and the average earning assets. Based on this definition, the higher the profitability, the higher the bank's profitability.

H3: Earnings has a positive effect on the profitability of Conventional commercial banks and Islamic commercial banks

Capital

Bank capital is a fund that the owner invests in establishing a business entity intended to finance bank business activities andcomply with stipulated regulations (Dahlan, 2009). The appropriate variable to measure bank capital is the Capital Adequacy Ratio (CAR). CAR ratio is the ratio of bank performance to measure the bank's adequacy to support assets that contain or generate risk (Kasmir, 2009). Capital serves to measure a bank's ability to absorb unavoidable losses and can also measure the size of the bank's wealth (Kusumo, 2008).

H4: Capital has a positive effect on the profitability of Conventional Commercial Banks and Islamic Commercial Banks

Total Assets

Bank size is the size of a bank, as seen from total assets at the end of the year (Menicucci & Paolucci, 2016). According to the Regulation of Financial Services Authority, assets consist of productive assets and non-productive assets. Banks withsignificant total assets will be more profitable than banks with small total assets because banks withsignificant assets have a high-efficiency level in achieving profitability (Kosmidou, 2008).

H5: Total Assets has a positive effect on the profitability of Conventional Commercial Banks and Islamic Commercial Banks

Inflation

Inflation is a condition where prices continue to increase, exceeding the general price level (Nopirin, 2014). Types of inflation according to the origin of inflation are divided into inflation originating from within the country, which is caused by too much money supply or too high demand for goods; and inflation arising from abroad caused by the economic turmoil that occurred in the global/ external economy (Boediono; 2013). The price increase due to inflation causes a decrease in purchasing power, which causes a reduction in producer income, resulting in a reduction of bank loan repayments made by the producer, which reduces bank income (Taswan, 2010).

H6: Inflation has a negative effect on the profitability of Conventional commercial banks and Islamic commercial banks

Exchange Rate

The exchange rate is the price of domestic currency against foreign currencies (Hady, 2016). According to Bank Indonesia, the exchange rate is divided into three types: the selling rate, the buying rate, and the middle rate. When the exchange rate appreciates, imported goods will be cheaper than domestic goods and reduce exports and more imports. Meanwhile, when the exchange rate depreciates, imported goods will tend to be expensive. The price of raw materials that come from outside (imports) also increases prices, which causes an increase in production costs. This will decrease the ability of producers to repay loans, especially in the form of US$, which in turn causes bank profitability to decline (Mankiw, 2012).

H7: Exchange Rate has a negative effect on the profitability of Conventional commercial banks and Islamic commercial banks

Economic Growth

Economic growth is the process of increasing per capita output in the long run (Syahputra, 2017). The emphasis is on three aspects, namely: process, per capita output, and long term. In essence, economic growth is a process over time, not seen at a certain point in time. According to Statistics Indonesia, constant price (real) Gross Domestic Product can show the economic growth rate as a whole or each sector from year to year. The economic growth of a country is closely related to the level of welfare of its population. The slower economic growth indicates that the welfare level of the population is decreasing, which results in quiet economic transactions. Due to the lack of economic transactions, producers will experience a decline in profitability, reducing their ability to repay loans, especially loans from banks. This decline in the ability to repay loans risks causing bad credit, which reduces bank profitability (Ahmad et al., 2013).

H8: Economic growth has a positive effect on the profitability of Conventional commercial banks and Islamic commercial banks

Difference between Conventional Commercial Bank and Islamic Commercial Bank

Islamic commercial banks have differences compared to Conventional commercial banks. Conventional commercial banks use an interest rate system, while Islamic commercial banks use a profit-sharing system (Mukti &Noven, 2019). Islamic commercial banks do not adhere to an interesting system because they contain elements of usury thatIslam prohibits. According to the Islamic view, there is an element of injustice in the interest system because the borrowing party must pay more than the loan without paying attention to the borrower's profit/loss. In contrast, the profit-sharing system used by Islamic commercial banks is a system where debtors and creditors share the risks and benefits, of course by agreement. From this statement, it can be concluded that there are differences between the two banks in obtaining profit. Many studies have found differences in profitability in Conventional commercial banks and Islamic commercial banks (Deliman et al., 2019; Gunartin, 2015; Muchlis & Umardani, 2016; Qian & Velayutham, 2017). However, some studies provide different results where there is no difference in profitability in the two types of banks (Nathan et al., 2014) (Figure 1).

Analysis method

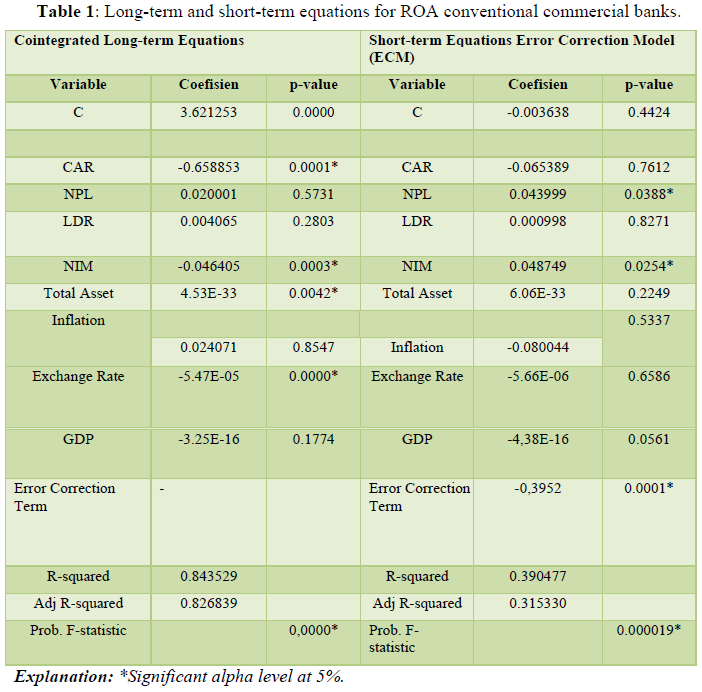

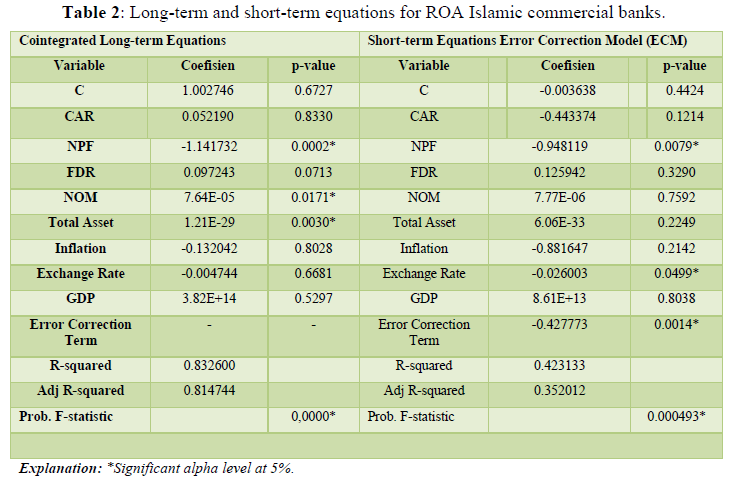

This study uses quantitative methods with secondary data obtained from Indonesian Banking Statistics, Sharia Banking Statistics from The Financial Services Authority of Indonesia, and middle exchange rate data from Bank of Indonesia. Data for real Gross Domestic Product and inflation are taken from data released by Statistics Indonesia. The data taken is monthly aggregate data where the actual Gross Domestic Product data is interpolated from quarterly data to monthly data. The research period was taken from 2013-2019. The independent variables used are credit risk, liquidity risk, earnings, capital, total assets, inflation, exchange rates (middle exchange rate Rp/US$), and economic growth (real Gross Domestic Product). The dependent variable is the Return on Assets (ROA) of Conventional commercial banks and Islamic commercial banks (Table 1). The analytical method used is the time series analysis method with the Error Correction Model (ECM) and difference test. ECM analysis was chosen because this analysis accommodates research that uses time series analysis and can interpret the model in the long and short term. Meanwhile, the difference test can statistically show the difference between the conventional commercial bank and the Islamic commercial bank.

Analysis method

This study uses quantitative methods with secondary data obtained from Indonesian Banking Statistics, Sharia Banking Statistics from The Financial Services Authority of Indonesia, and middle exchange rate data from Bank of Indonesia. Data for real Gross Domestic Product and inflation are taken from data released by Statistics Indonesia. The data taken is monthly aggregate data where the actual Gross Domestic Product data is interpolated from quarterly data to monthly data. The research period was taken from 2013-2019. The independent variables used are credit risk, liquidity risk, earnings, capital, total assets, inflation, exchange rates (middle exchange rate Rp/US$), and economic growth (real Gross Domestic Product). The dependent variable is the Return on Assets (ROA) of Conventional commercial banks and Islamic commercial banks (Table 1). The analytical method used is the time series analysis method with the Error Correction Model (ECM) and difference test. ECM analysis was chosen because this analysis accommodates research that uses time series analysis and can interpret the model in the long and short term. Meanwhile, the difference test can statistically show the difference between the conventional commercial bank and the Islamic commercial bank.

RESULTS AND DISCUSSION

Conventional Commercial Banks

Based on the table above, the long-term and short-term equations show that the F test is significant, which means that simultaneously the independent variable affects the dependent variable significantly. This is evidenced by the significance value of the F test is less than the alpha value (0.05). This is supported by research conducted by (Gunartin 2015); (Almaqtari et al., 2019); (Tan& Floros, 2012); (Jaber & Al-khawaldeh, 2012); (Purnamasari & Mudakir, 2019); (Riwayati & Anggraeni, 2013); and (Sorongan, 2017) where simultaneously the internal factors and external factors significantly affect the ROA of Conventional Commercial Banks. The significant variables in the long-term equation are the Capital Adequacy Ratio (CAR), Net Interest Margin (NIM), total assets, and middle exchange rate. A negative NIM constant sign indicates that in the long run, the NIM variable will adversely affect ROA growth, or in other words, when NIM increases, ROA growth will decrease. This is, of course contrary to hypothesis 3. The results of the study, which showed a negative relationship between ROA and NIM, were supported by (Rahmat & Musnadi, 2014) the results showed that NIM had a negative or significant impact on ROA. This phenomenon occurs when the increased NIM is caused by the growth of net interest income faster than the growth of productive assets. Still, with the increase/growth of productive assets, it is also followed by an increase in Risk-Weighted Assets (RWA). With the rise in RWA, there is a risk that encourages banks to make reserves to add Allowance for Impairment Losses (CKPN), which means that the bank will pay a fee for CKPN. The issuance of fees for this CKPN will reduce the bank's profitability/return. The significant variable in the following long-run equation is the CAR variable. The negative CAR constant sign means that the relationship between CAR and ROA of Conventional Commercial Banks is opposite, which means that when CAR increases, ROA will slow down/decrease. Of course, this is contrary to hypothesis 4. However, this negative relationship is supported by research conducted by (Stevani & Sudirgo, 2019), which in his study, CAR growth and ROA growth had a negative and significant relationship. CAR relationship that negatively affects ROA can occur when CAR increases in conditions where capital growth is faster than RWA growth. With the increase in RWA, even though it is lower than the capital increase, banks experience an increase in risk, wherein banks need to add CKPN to deal with these risks. Increasing the allowance for impairment losses means that the bank incurs costs, which cause a decrease in profitability/return. However, after correcting the imbalance of the CAR variable in this long-term equation, the short-term equation for the CAR variable becomes insignificant. The following variable, which is significant, is the total variable assets. A positive total asset constant sign indicates that Conventional Commercial Banks' total assets and ROA growth have a unidirectional relationship. In other words, when the total asset value increases, the growth in ROA value also increases. This result follows hypothesis 5.Banks with significant total assets have larger economies of scale than banks with small total assets; with larger economies of scale, the banks will operate efficiently, resulting in better profitability (Kosmidou, 2008). This result is supported by research (Abduh & Issa, 2018). The following significant variable is the middle exchange rate (Rp/US$). A constant negative sign means that the relationship between the exchange rate and the ROA growth of Conventional Commercial Banks is opposite. In other words, when the middle exchange rate depreciates, the ROA growth will decrease. This result consistent with hypothesis 7.This phenomenon occurs when the depreciation of the rupiah impacts the increase in the price of imported goods which can cause an increase in production costs. This increase in costs impacts decreasing the ability of customers to repay loans/credits, which in turn affects the decline in bank profitability (Hidayati, 2014). This statement is supported by (Almaqtari et al., 2019) where the exchange rate will quantitatively affect the profitability of Conventional Commercial Banks.

There are two significant variables in the short-term equation: Non-Performing Loan (NPL) dan Net Interest Margin (NIM). A positive NPL constant sign means that the relationship between changes in ROA and NPL has aunidirectional relationship, meaning that when NPL increases, ROA for Conventional Commercial Banks will increase. This negative NPL constant sign is contrary to hypothesis 1. This may occur because when the NPL is high, the bank does not add reserves in Allowance for Impairment Losses (CKPN), which means that the bank does not incur costs for CKPN. The bank does not reduce the profitability obtained for provisioning costs. This result is also supported by research conducted by (Fajari & Sunarto, 2017) which states that NPL will positively and significantly affect the ROA of Conventional Commercial Banks. The last variable that is significant is Net Interest Margin (NIM). A constant positive sign means that the relationship between NIM and the ROA growth of Conventional Commercial Banks is unidirectional. In other words, when NIMdecreases, the ROA growth will decline. This result is following hypothesis 3. The positive NIM constant sign isalsoby the opinion expressed by (Riyanto, 2011) where profitability is the ratio between net interest and assets or capital used to generate this interest and is expressed as a percentage. With the higher net interest earned, the profitability obtained by Conventional Commercial Bank will also be higher (Table 2). This statement is supported by (Riwayati & Anggraeni, 2013; Sorongan, 2017),which in research, NIM and ROA had a positive and significant relationship.

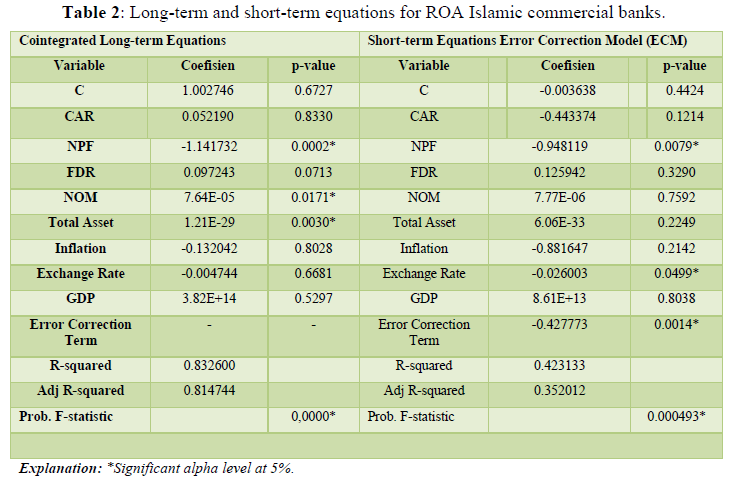

Islamic Commercial Banks

The meaning of the error correction term (ECT), which is significant and has a value of -0.3952, indicates the speed of adjustment towards equilibrium of 0.3952. This coefficient also means that 39.52% of the long-term imbalance that occurs as a result of changes in the ROA value of Conventional Commercial Banks in the previous period (t-1) will be corrected by 39.52% in the first period after the research period and the rest will be corrected in the next period. With a significance value of the error correction term of 0.0001 or below the alpha limit level of 0.05, it indicates that ECT is significant, which means that the ECM equation is valid to use.

Based on the table above, both the long-term and short-term equations show significant results on the F test, which means that simultaneously the independent variable affects the dependent variable significantly. This result is evidenced by the significance value of the F test for both long and short-term equations less than the alpha value (0.05). The results of this study are supported by research conducted by (Aziz 2017; Gunartin, 2015; Supiyadi & Purnomo., 2019; Zarrouk et al., 2016), which proves that simultaneously internal factors and external factors significantly affect the ROA of Islamic Commercial Banks. The first significant variable is Non Performing Financing. A negative NPF growth constant sign indicates that the growth of NPF affects the ROA of Islamic Commercial Banks in the opposite direction. In other words,when the growth of NPF increases, the ROA of Islamic Commercial Banks decreases. The negative NPF constant sign is following hypothesis 1.

NPF, which affects ROA negatively/oppositely can also occur if the NPF is high, the bank will add reserves in the form of Allowance for Impairment Losses (CKPN), which means the bank incurs additional costs for CKPN so that the bank will reduce profitability This negative NPF constant sign is also supported by research conducted by (Sari & Haryanto, 2017)which states that NPF will negatively and significantly affect the ROA of Islamic Commercial Banks. The next significant variable is FDR. The FDR constant sign is positive, indicating that the relationship between FDR and ROA of Islamic Commercial Banks is unidirectional. In other words, when FDR increases, the ROA of Islamic Commercial Banks also increases. This is consistent with hypothesis 2. This is in accordance with the opinion that when the FDR increases, it indicates that the bank is expanding its fund financing to customers, both in productive and consumptive financing. With the expansion of financing channeled carefully, automatically, the profitability or return obtained by the bank will also be higher. However, it must be remembered that if the expansion of financing is not carried out carefully, it will cause the bank to experience two risks, namely: credit risk and liquidity risk, which will result in a decrease in bank profitability. Credit risk can arise when a bank carries out a credit expansion that is not careful; the RWA will increase, which causes the bank to make a reservation in the form of CKPN, which is an additional fee for the bank. By issuing this fee, the bank's profitability/return will decrease.

Meanwhile, liquidity risk can occur if a bank extends credit beyond the upper limit specified in Regulation of Bank of Indonesia on"Peraturan Bank Indonesia No. 15/16/PBI/2013", 94%. If this liquidity risk occurs, the bank will find it difficult to pay cash to third parties to be liquidated because the bank cannot fulfill its short-term obligations. This situation will make it difficult for the bank to continue its business, even if it is not running or shut down. This result is also supported by research conducted by (Ardana, 2018), which shows that FDR has a positive effect on the ROA of Islamic Commercial Banks in the long run. The following significant variable affecting the ROA of Islamic Commercial Banks is total assets. A constant positive sign indicates that total assets affect the ROA of Islamic Commercial Banks in the same direction. In other words, when total assets increase, ROA growth will also increase. This result is following hypothesis 5.Banks with significant total assets have larger economies of scale than banks that have small total assets; with larger economies of scale, the banks will operate more efficiently, resulting in better profitability (Kosmidou, 2008). This is supported by (Abduh & Issa, 2018), who prove quantitatively that total assets will affect the profitability of Islamic Commercial Banks.

There are two significant variables in the short-term equation: the NPF and the middle exchange rate. A negative NPF constant sign means that the relationship between changes in ROA and NPF has the opposite relationship, meaning that when the NPF value increases, the ROA of Islamic Commercial Banks will decrease. This negative NPF constant sign is following hypothesis 1. NPF, which affects ROA negatively/oppositely, can also occur if the NPF is high. The bank will add reserves in Allowance for Impairment Losses (CKPN), which means that the bank incurs additional costs for CKPN to reduce profitability obtained for financing provision. The negative NPF constant sign is also supported by research conducted by (Sari & Haryanto, 2017) which states that NPF will negatively and significantly affect the ROA of Islamic Commercial Banks. The last variable that substantially affects the ROA of Islamic Commercial Banks in the short term is the middle exchange rate (Rp/US$). This middle exchange rate is not significant in the long-run equation but significant in the short-term equation, meaning that when the middle rate variable has been corrected for its imbalance, this variable is important. A constant negative sign means that the relationship between changes in the value of the middle exchange rate and ROA of Islamic Commercial Banks is opposite. In other words, when the middle exchange rate depreciates, ROA will decrease. The constant negative sign is still consistentwith hypothesis 7. This result is supported by research conducted by (Swandayani 2012). This phenomenon occurs when depreciation of the rupiah exchange rate will impact an increase in the price of imported goods. This condition can cause an increase in production costs which can have an impact on decreasing the ability of customers to repay loans/credits, which in turn affects the decline in bank profitability (Hidayati, 2014).

For the meaning of the error correction term (ECT), which is significant and has a value of -0.427773, it shows an indication of the speed of adjustment to balance/equilibrium of 0.427773. This coefficient also means that the 42.77% long-term imbalance that occurs due to changes in the ROA value of Islamic Commercial Banks in the previous period (t-1) will be corrected by 42.77% in the first period after the research period. An ECT significance value of 0.0014 or below the alpha limit level of 0.05 indicates that ECT is significant, which means that the ECM equation is valid to use.

Differences in the Profitability of Conventional Commercial Banks and Islamic Commercial Banks

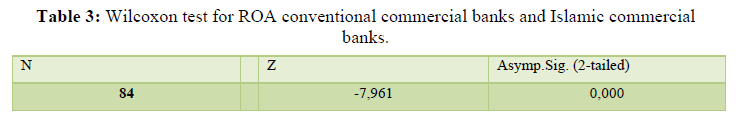

Before carrying out the difference test, the first step is to test the correlation between ROA conventional commercial banks and Islamic commercial banks. This test is intended to decide whether the different tests applied to the model use paired or independent sample tests. Based on the Pearson correlation test, it was found that the level of significance was 0.001, which means it is smaller than alpha (0.05); the conclusion is to reject H0, which means that there is a relationship between ROA conventional commercial banks and Islamic commercial banks. Based on these results, in this study, the paired test was used.

The next step is to test the normality of ROA conventional commercial banks and Islamic commercial banks data. This test aims to determine whether the difference test is carried out by parametric or non-parametric. The test was carried out with two tests, namely the Kolmogorov-Smirnov test and the Shapiro-Wilk test. Based on the normality test, it was found that the significance value of the two variables was below the alpha value (0.05) in both the Kolmogorov-Smirnov test and the Shapiro Wilk test. Then the decision is taken to reject H0, or the data is not normally distributed, which means that non-parametric methods carry out the different tests (Table 3).

Based on the Pearson test and normality test, the test taken is the Wilcoxon test. This difference test aims to find differences between two data samples or several data samples with a relationship using non-parametric methods.

Based on the Wilcoxon test above, it can be concluded that there is a difference between the average value of Return on Assets for Conventional Commercial Banks and Islamic Commercial Banks. This result consistentwith research conducted by previous studies (Deliman et al., 2019); (Muchlis & Umardani, 2016); and (Qian & Velayutham, 2017). In theory, the difference between Conventional Commercial Banks and Islamic Commercial Banks is the interest system adopted by Conventional Commercial Banks, namely the interest rate system, while Islamic Commercial Banks adhere to the profit-sharing system. Or in other words, there are different ways of obtaining profitability, one of which is that Conventional Commercial Banks rely more on interest and Sharia Commercial Banks rely more on profit sharing (Mukti &Noven, 2019). In addition to the differences above, there are still differences in principles applied by Commercial Banks Sharia in profitability that conventional commercial banks do not apply. First, it is free of interest. What is meant by free of interest is that the customer does not need to pay additional loans other than the principal loan provided by the bank. Second, free from non-productive speculative activities. What is meant here is that Islamic Commercial Banks do not place their funds in non-productive speculative activities such as playing on stocks. Third, Free from things that are unclear and doubtful. What is meant here is that Sharia Commercial Banks are prohibited from conducting transactions that are unclear or dubious, such as sales not yet in the hands of the seller, such as houses that the developer has not built. Forth, Free from illegal things. What is meant by being free from illegal things is the owner of the funds, the bank, obliging the borrower to pay more than what is borrowed (interest) regardless of whether the borrower gets a profit or experiences a loss.

Based on the results of the inferential analysis, the difference is shown in the results of the short-term equation where NPL and NPF significantly affect ROA in each equation but have different effects. The difference in this effect is that NPL affects the ROA of Conventional Commercial Banks positively, while NPF negatively affects the ROA of Islamic Commercial Banks. The meaning of NPL has a positive effect on the ROA of Conventional Commercial Banks because when NPL increases, Conventional Commercial Banks do not incur costs for reserves in the form of CKPN. Because the bank does not incur these costs, the profitability/return of conventional commercial banks does not decrease. However, not making a provision is that the CAR will reduce, or the Conventional Commercial Bank must increase its capital. The increase in wealth by Conventional Commercial Banks is possible due to profitability that does not decrease due to not making reserves. However, in the coming year, Conventional Commercial Banks will still have NPL expenses (bad credit), affecting the sustainability of financing activities of Conventional Commercial Banks in generating profitability. What Islamic Commercial Banks do is different from Conventional Commercial Banks, where Islamic Commercial Banks prefer to make provision when the NPF increases in the form of CKPN. Islamic Commercial Banks carry out provisionto keep RWA low by issuing non-performing financing by a reserve in the form of CKPN. The bank can write off the bad financing, which in the end, the CAR value is maintained. The NPF financing burden in the coming year becomes lighter so that the continuity/sustainability of Islamic Commercial Banks is more secure compared to Conventional Commercial Banks. By making a provision, Islamic Commercial Banks incur costs, which reduces profitability/return so that NPF will negatively affect ROA.

Conclusion

Based on the test results simultaneously, both long-term and short-term equations, the variables CAR, NPL, LDR, NIM, total assets, inflation, middle exchange rates, and GDP significantly affect the ROA of Conventional Commercial Banks. However, if seen partially in the long-term equation, the variable CAR, middle exchange rate, NIM, and total assets significantly affect the ROA of Conventional Commercial Banks. The variables that significantly affect the ROA of Conventional Commercial Banks are NIM, NPL, and error correction term in the short-term equation. With the results of this study, there is indeed an influence of internal and external factors on ROA of Conventional Commercial Banks both simultaneously and partially. When the management manager does not consider these external and internal influences, it will make the profitability of Conventional Commercial Banks decrease. In particular, the management of Conventional Commercial Banks needs to pay attention to variables that have a significant influence, namely: CAR, NIM, NPL, and total assets for internal factors and middle exchange rates for external factors.

For testing both the long and short-term equations, the variables CAR, NPF, FDR, NOM, total assets, inflation, middle exchange rates, and GDP simultaneously significantly affect the ROA of Islamic Commercial Banks. However, if seen partially in the long-term equation, the variable FDR, NPF, and total assets significantly affect the ROA of Islamic Commercial Banks. In the short-term equation, the variables that significantly affect the ROA of Islamic Commercial Banks are the middle exchange rate, NPF, and error correction. These results answer that there is an influence of internal and external factors on the ROA of Islamic Commercial Banks both simultaneously and partially. Considering the significance of internal and external factors shows that the management of Islamic Commercial Banks needs to pay attention and make the right decisions regarding the internal and external factors in this study. The objective is to maintain profitability, especially for variables that partially significantly affect the ROA variable of Islamic Commercial Banks: FDR, NPF, and total assets and exchange rates for external variables.

Moreover, the study found that the average value between ROA of Conventional Commercial Banks and Islamic Commercial Banks is different. The different test results are supported by the results of this study where Conventional Commercial Banks and Islamic Commercial Banks differ in managing profitability. Conventional Commercial Banks tend not to make provisions in the form of CKPN so that profitability remains high. However, it will impact lowering CAR, and there will still be a burden on NPL financing (bad credit) in the coming year. Meanwhile, Islamic Commercial Banks will make a provision in the form of CKPN to reduce the profitability obtained by Islamic Commercial Banks. Still, Islamic Commercial Banks have a lighter NPF financing burden and stable capital, which affects the continuity/sustainability of Islamic Commercial Banks.

This study has limitations; however, the results can contribute to further research. First, the use of a substitute variable that is partially insignificant between the two banks, namely GDP, may be replaced by per capita income or inflation replaced by the Consumer Price Index or creates a new composite index. Second, a sample of Conventional Commercial Bank and Islamic Commercial Bank will capture the phenomenon of profitability between Conventional Commercial Banks and Islamic Commercial Banks more clearly.

- Abduh & Issa, M. S. (2018). Financial Crisis and Determinants of Profitability in Islamic and Conventional Banks: The Study of Kuwait Banking Industry. Jurnal Kajian Ekonomi Dan Bisnis Islam Iqtishadia 1(1), 1-26.

- Ahmad, F., Abbas, Z., & Bashir, T. (2013). The explanatory power of macroeconomic variables as determinants of non-performing loans: Evidence from Pakistan. World Applied Sciences Journal 22(2), 243-255.

- Almaqtari, F. A., Al-Homaidi, E. A., Tabash, M. I., & Farhan, N. H. (2019). The determinants of profitability of Indian commercial banks: A panel data approach. International Journal of Finance and Economics 24(1), 168-185.

- Ardana, Y. (2018). Faktor Eksternal dan Internal yang Mempengaruhi Profitabilitas Bank Syariah di Indonesia. Cakrawala 13(1), 51.

- Aziz, N. I. M. (2017). Islamic Banking Profitability: Roles Played By Internal and External Banking Factor. The Journal of Muamalat and Islamic Finance Research 14(1), 23-38.

- Boediono. (2013). Ekonomi Makro. Yogyakarta: BPFE.

- Boyd, J. H., & Champ, B. (2006). Inflation, Banking, and Economic Growth. Federal Reserve Bank of Claveland. Claveland.

- Siamat, D. (2009). Manajemen Lembaga Keuangan “KebijakanMoneter danPerbankan”, Jakarta: Fakultas EkonomiUniversitas Indonesia.

- Daly, S., and Frikha, M. (2017). Determinants of bank Performance: Comparative Study Between Conventional and Islamic Banking in Bahrain. Journal of the Knowledge Economy, 8(2), 471–488. https://doi.org/10.1007/s13132-015-0261-8

- Deliman, L., Arifin, S., & Wahyono, R. (2019). Analisisperbandingankinerjakeuanganantara bank umumsyariah dan bank umumkonvensional. Journal of Banking and Finance 1(1), 24-40.

- Dendawijaya, L. (2009). Manajemen Perbankan (Edisi Kedua). Jakarta: Ghalia Indonesia.

- Djohanputro, B., and Kountur, R. (2007). Non-Performing Loan (NPL) Bank Perkreditan Rakyat (BPR). Jakarta.

- Fajari, Sunarto, S.D. (2017). Pengaruh CAR, LDR, NPL, BOPO Terhadap Profitabilitas Bank (Studi Kasus Perusahaan Perbankan Yang Tercatat di Bursa Efek Indonesia Periode Tahun 2011 Sampai 2015). Prosiding Seminar Nasional Multi DisiplinIlmu& Call for Papers UnisbankKe 3, 853-862.

- Gunartin. (2015). Pengaruh Faktor Internal dan Eksternal Terhadap Profitabilitas Perbankan Syariah dan Konvensional di Indonesia Periode Juni 2010-2013. Jurnal Akuntansi Aktual 3(1), 91-102.

- Hady, H. (2016). Manajemen Keuangan Internasional (Forth). Jakarta: Mitra Wacana Media.

- Hidayati, & Nuril., A. (2014). Pengaruh Inflasi, BI Rate dan Kurs Terhadap Profitabilitas Bank Syariah di Indonesia. Jurnal Ekonomi Syariah An-Nisbah 1(1), 72-97.

- Irma, Hadiwidjaja, R. D., & Widiastuti, Y. (2016). Assessing the Effect Performance on Profit Growth Using RGEC Approach. Review of Integrative Business and Economics Research 5(3), 87-101.

- Jaber, J. J., & Al-khawaldeh, A. A. (2019). The Impact of Internal and External Factors on Commercial Bank Profitability the Impact of Internal and External Factors on Commercial Bank Profitability in Jordan. March 2014. Available online at: https://doi.org/10.5539/ijbm.v9n4p22

- Jin, J., Yu, Z., & Mi, C. (2012). Commercial bank credit risk management based on grey incidence analysis. Grey Systems: Theory and Application 2(3), 385-394.

- Kasmir. (2009). Pengantar Manajemen Keuangan. Jakarta: Kencana.

- Kosmidou, K. (2008). The Determinants of Banks' Profits in Greece During The Period Of EU Financial Integration. Managerial Finance 34(3), 146-159.

- Kusumo, Y. A. (2008). Analisis Kinerja Keuangan Bank Syariah Mandiri Periode 2002-2007. Jurnal Ekonomi Islam La Riba, 2(1), 109–131. https://doi.org/10.20885/lariba.vol2.iss1.art8

- Lasta, H. A., Arifin, Z., & Nuzula, N. F. (2014). Analisis Tingkat Kesehatan Bank Menggunakan Pendekatan RGEC (Risk Profil, Good Corporate Governance, Earnings, Capital) (Studi pada PT BANK RAKYAT INDONESIA, TbkPeriode 2011-2013). Jurnal Administrasi Bisnis 13(2), 1-10.

- Mankiw, N. G. (2012). Macroeconomics Eight Edition. New York: Worth Publisher.

- Menicucci, E., & Paolucci, G. (2016). The Determinants of Bank Profitability: Empirical Evidence from European Banking Sector. Journal of Financial Reporting and Accounting 14(1), 86-115.

- Muchlis, A., & Umardani, D. (2016). Analisis Perbandingan Kinerja Keuangan Bank Syariah dan Bank Konvensional di Indonesia. Journal Manajemen Dan Pemasaran Jasa 9(1), 129-156.

- Mukti, T. W. & Noven, S (2019). Apakah Bank Syariah Berbeda dengan Bank Konvensional? (Kajian Fenomenologi). Jurnal Ekonomi Syariah Teori dan Terapan 6(6), 1137-1152.

- Nathan ThuraiMuruganEntebang, H., Rafique, Q., & Mansor, S. (2014). Comparison between Islamic and Conventional Banking: Evidence from Malaysia. International Journal of Islamic Banking & Finance March 4(1), 1-14.

- Nopirin. (2014). Ekonomi Moneter (Keempat). Yogyakarta: BPFE.

- Pane, B. Y. (2016). Kegagalan Yunani Memanfaatkan Bailout dalam Upaya Mengatasi Krisis Ekonomi Tahun 2008. Jurnal Online Mahasiswa Fakultas Ilmu Sosial Dan Ilmu Politik, 3(1), 1-12.

- Peraturan Bank Indonesia Nomor 13/1/PBI/2011. Regulation of Bank of Indonesia for Conventional Commercial Banks

- Peraturan Bank Indonesia No. 15/16/PBI/2013 . Regulation of Bank of Indonesia aboutReserve Requirementin Rupiah and Foreign Currency for IslamicCommercial Banks and IslamicBusiness Units.

- Peraturan Otoritas Jasa Keuangan Number 8/POJK.03/2014. Regulation of Financial Services Authority for Islamic Commercial Banks.

- PeraturanOtoritasJasaKeuanganNomor 18/POJK.03/2016. Regulation of Financial Services Authority for Commercial Banks.

- Peraturan Otoritas Jasa Keuangan No. 40/POJK.03/2019. Regulation of Financial Services Authority about Asset Quality Assessment for Commercial Banks.

- Purnamasari, Y., & Mudakir, B. (2019). Determinan Profitabilitas Bank Umum di Indonesia (Studi Kasus : Bank Kategori BUKU 4). Jurnal Dinamika Ekonomi Pembangunan 2(1), 1-14.

- Qian, D. J., & Velayutham, S. (2017). Conventional Banking and Islamic Banking: Do the Different Philosophies Lead to Different Financial Outcomes? Journal of Wealth Management & Financial Planning 4, 3-14.

- Rahmat, M. A., & Musnadi, S. (2014). Pengaruh Capital Adequacy Ratio, Biaya Operasional Pendapatan Operasional, Non-Performing Loan, Net Interest Margin dan Loan to Deposit Ratio Terhadap Profitabilitas Bank (Studi Pada Bank Persero di Indonesia 2002-2013). JurnalAkutansiPascasarjanaUniversitasSyiah 3(2), 85-93.

- Riwayati, H. E., & Anggraeni, D. (2013). Pengaruh Faktor Internal dan Eksternal Bank Terhadap Profitabilitas Bank Persero. E-Jurnal Perbanas 1-16.

- Riyadi, S. (2016). Banking Asset and Liability Manajemen. Depok: Fakultas Ekonomi Universitas Indonesia.

- Riyanto, B. (2011). Dasar-dasar Pembelanjaan Perusahaan. Yogyakarta: BPFE.

- Sari, S. P., & Haryanto, A. M. (2017). Analisis Pengaruh Capital Adequacy Ratio, Net Operating Margin, Financing to Deposit Ratio, Non-Performing Financing dan Pembiayaan Bagi Hasil Terhadap Profitabilitas BUS Di Indonesia (Studi Kasus BUS di Indonesia Tahun 2011-2015. Diponegoro Journal of Management 6(4), 1-15.

- Sartono, A. (2014). Manajemen KeuanganTeori dan Aplikasi.Yogyakarta: BPFE.Sholihin, I. N., Mustafid, &Safitri, D. (2014). Analisis Faktor Konfirmatori Strategi Positioning Pasar Modern Indomaret (StudiKasus Wilayah Tembalang Kota Semarang) AnalisisFaktorKonfirmatoriStrategi Positioning Pasar Modern Indomaret (StudiKasus Wilayah Tembalang Kota Semarang). Jurnal Gaussian 3(3), 431-440.

- Sirait, H., Citarayani, R., Saminem, & Quintania, M. (2019). Pengaruh Tingkat Kesehatan Bank Dengan Metode RGEC Dan Strategi Diversifikasi terhadap Pertumbuhan Laba (Studi Pada Bank Umum Yang Terdaftar Di Bursa Efek Indonesia Periode 2013-2019). Journal of Management Review 4(1), 411-420.

- Sorongan, F. A. (2017). Analisis Pengaruh CAR, LOAN, GDP Dan Inflasi Terhadap Profitabilitas Bank DI Indonesia. Jurnal Akuntansi 10(2), 116-126.

- Stevani, & Sudirgo, T. (2019). Analisis CAR, BOPO, NPL, dan LDR Terhadap ROA Perusahaan Perbankan. Jurnal Multiparadigma Akuntansi 1(3), 863-871.

- Supiyadi, D., & Purnomo., B. S. (2019). Pengaruh Faktor Internal dan Eksternal Terhadap Profitabilitas Pada Bank Syariah di Indonesia. Jurnal Riset Akuntansi Dan Keuangan 7(1), 55-66.

- Surat Edaran Bank Indonesia No. 6/23/DPNP Tahun 2004. Regulation of Bank of Indonesia for Commercial Bank Health Level Assessment System.

- Surat Edaran Otoritas Jasa Keuangan No. 10/SEOJK.03/2014. Regulation of Financial Services Authority for Islamic Commercial Bank Health Level Assessment System.

- Swandayani, D. M., & Kusumaningtias, R. (2012). Pengaruh Inflasi, Nilai Tukar Valas dan Jumlah Uang Beredar Terhadap Profitabilitas pada Perbankan Syariah di Indonesia Periode 2005-2019. Jurnal Akuntansi Akrual 3(2), 147-166.

- Syahputra, Rinaldi. (2017). Analisis Faktor-Faktor Yang Mempengaruhi Pertumbuhan Ekonomi Di Indonesia. Jurnal Samudra Ekonomika 1(2), 183-191.

- Tan, A. Y., & Floros, C. (2012). Bank profitability and inflation the case of China. Journal of Economic Studies 39(6), 675-696.

- Taswan. (2010). Manajemen Perbankan. Yogyakarta: UPP STIM YPKP.

- Wirabrata, A. (2015). Krisis Yunani dan Turbulensi Ekonomi Indonesia. DPR. Jakarta

- Zarrouk, H., Jedidia, K. Ben, & Moualhi, M. (2016). Is Islamic Bank Profitability driven by sama forces as conventional banks? International Journal of Islamic and Middle Eastern Finance and Management 9(1), 46-66.